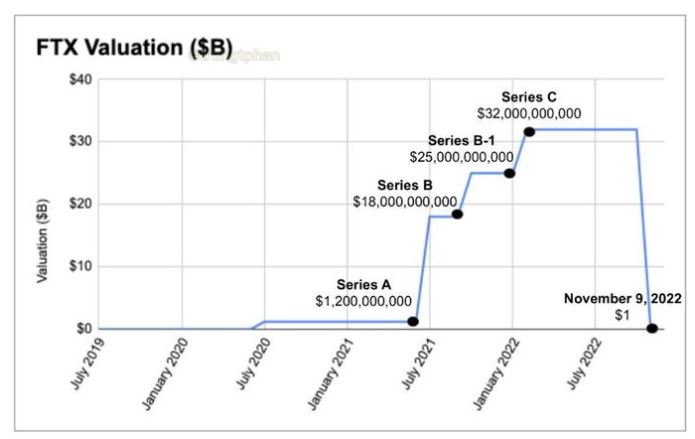

November was a month of contrasting performance. While the conventional equity market and alternative investment did well, crypto had one of the worst months, thanks to the FTX Fiasco. Sam Bankman, the owner of FTX and apparently a fraud went on to become from the JP Morgan of crypto to the Bernie Madoff of crypto. Some of the most popular VCs like Sequoia were invested in the company which was valued at 32 Billion USD in January 2022.

FTX would mint FTT cryptocurrency and then sell it/Loan it to Alameda. Alameda would then borrow actual money and other cryptocurrencies using the free FTT as collateral. In this way, Bankman-Fried would allegedly print his own cryptocurrency and then exchange it for real money, earning billions.

Such is the scale of the FTX crash that many large trading institutions have been left with empty bags as FTX was the go-to trading platform for most training companies.

Alternative Investment Portfolio Performance

This Month I reinvested capital across Bonds and other alternatives. I have also been exploring unlisted equity. Would be adding NSE shares this month to the portfolio. The long process of acquiring NSE Shares has caused procrastination.

Would be buying NSE Shared through Unlistedzone

| Platform | Returns | NPA |

| Grip Invest | 11-12%(Post-Tax) | 0% |

| Klubworks | 15-17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post-Tax) | 0% |

| Growpital | 14%(Tax-Free) | Blended Yield across Plans |

| Leafround | 18% | New (7 Payments) |

| Altifi | 12.50% | 0% |

- Received payment from Growpital on time

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are as per schedule.

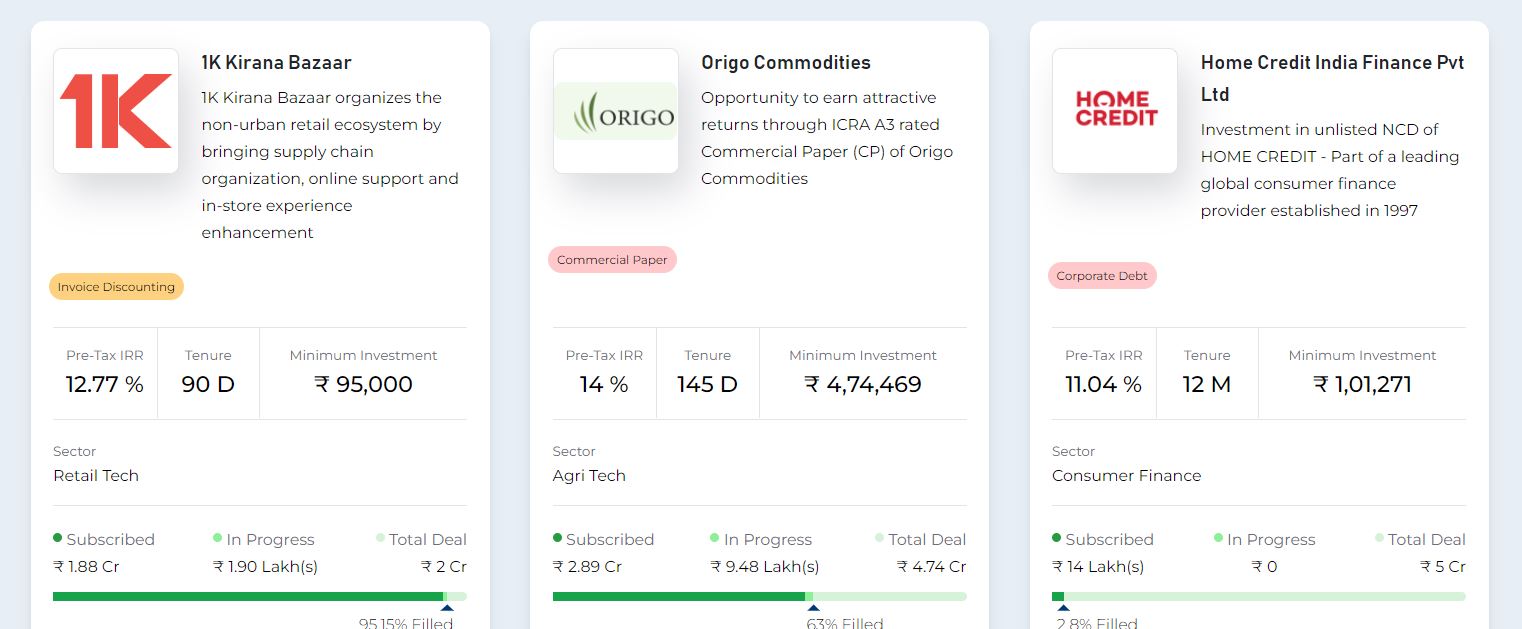

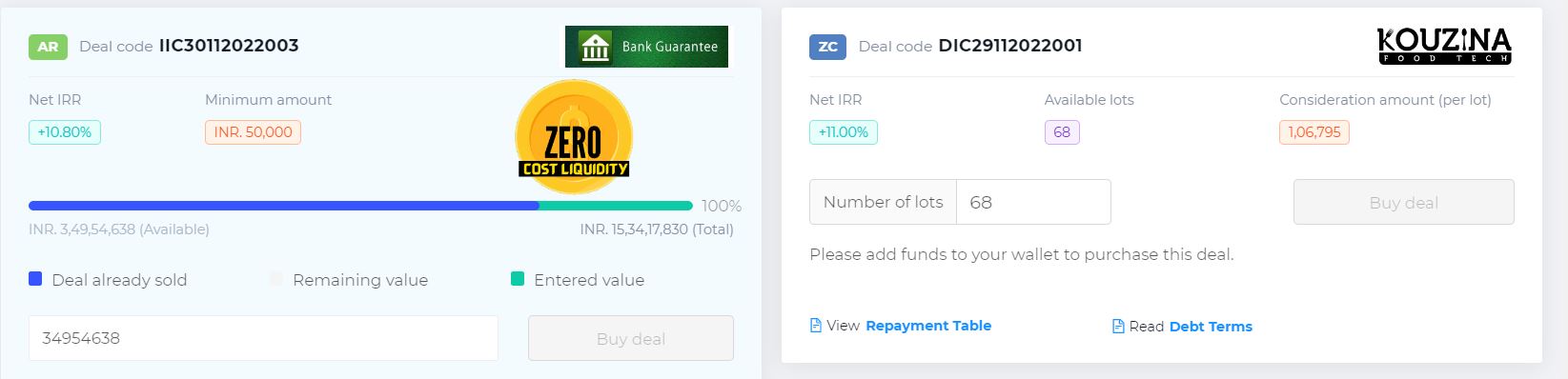

- Added 2 invoice discounting deals on Jiraaf.

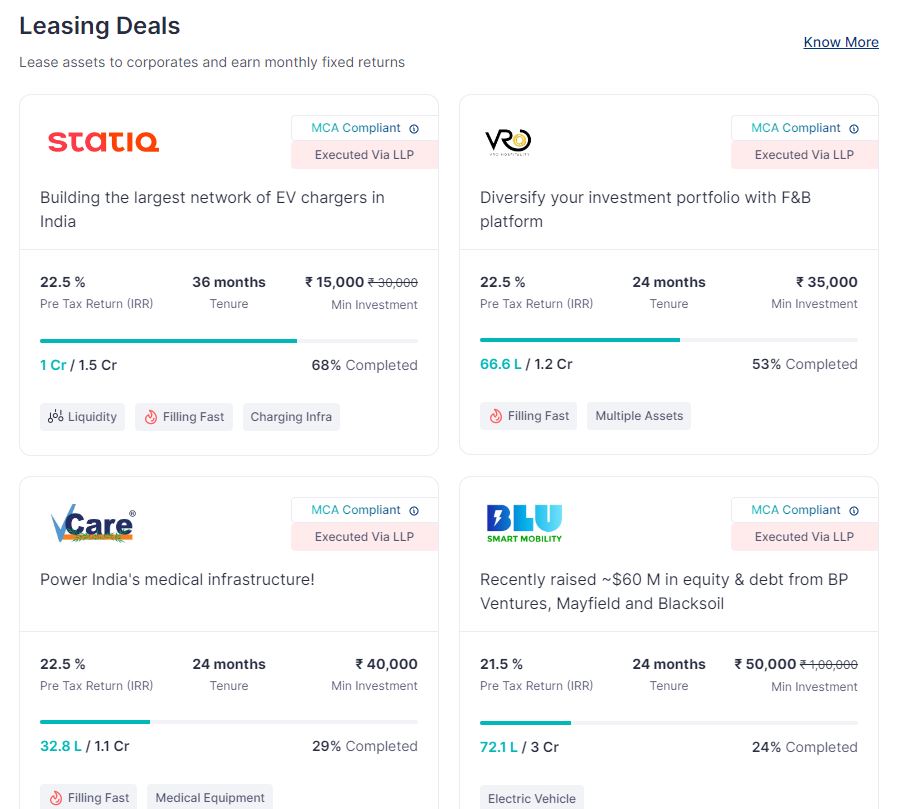

- Invested in 2 more Leasing deals on Gripinvest at 22% PreTax and 1 Deal on Leafround

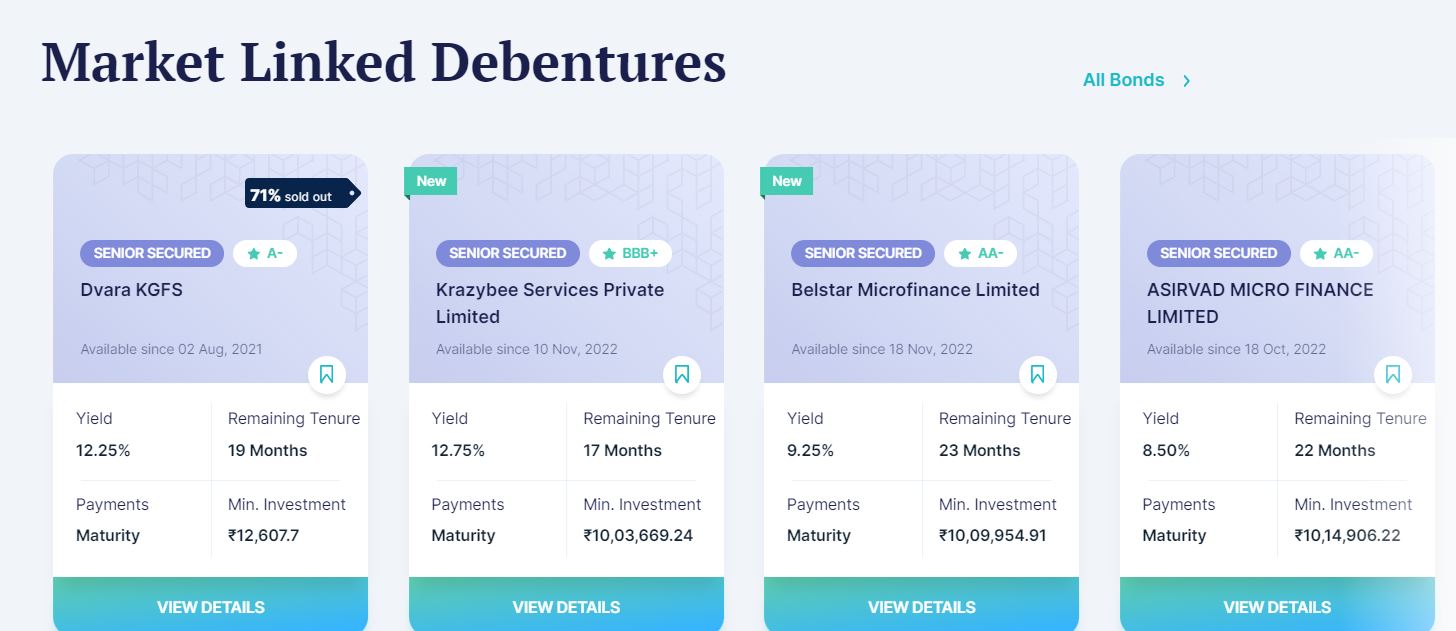

- Adding one MLD in Altifi as they have better tax benefit than bonds

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations.

- Using Liquiloans to park short term capital

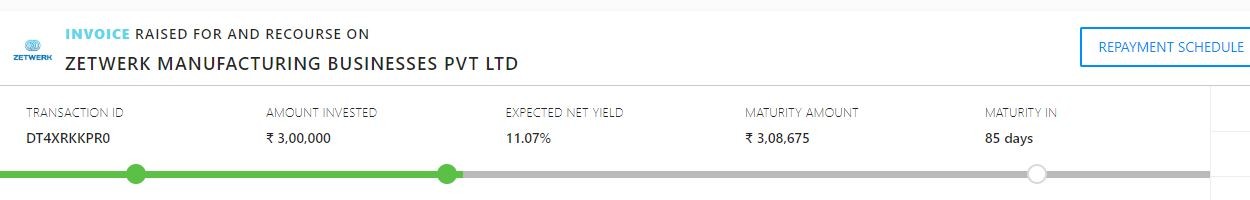

- Zetwork Deal matured on KredX. Have reinvested in Zetwork again at 12.5% IRR.Have another outstanding Zetwerk deal on Tradecred

Crypto Investing

We had shared FTX issue just before withdrawal when rumors were running around. I was able to take out most of the capital. A small amount still got stuck as I got careless and delayed my KYC.

Now Binance is the only large crypto exchange left globally. To avoid this kind of mess I am thinking of keeping 90% of my crypto assets in a Cold Wallet. Will be doing a post once I buy a hardware wallet

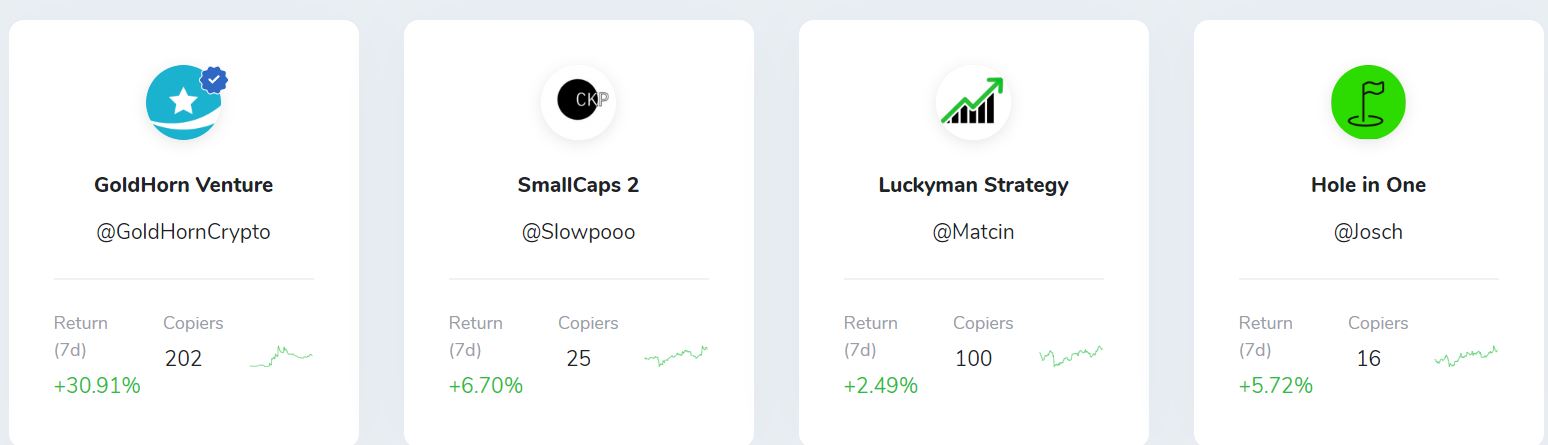

Crypto is definitely at an attractive level but the bigger challenge is to find an exchange that doesn’t go bust. I am keeping a small amount in Iconomi on some active strategies and for the rest of my planned passive investment, I will move to cold wallets. Though ICONOMI was one of the first crypto firms to be registered with the UK Financial Conduct Authority (FCA) and keeps an audited Crypto asset proof on the chain, the black swan events in the crypto market have made me decide to risk only a minimum capital on any platform.

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -15% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 5% |

| Bitcoin Trading(Binance/CoinDCX) | 15% |

P2P Investment

Current allocation:

- India P2P – 40%

- 12Club – 5%

- I2IFunding- 35%

- Finzy-20%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.85% |

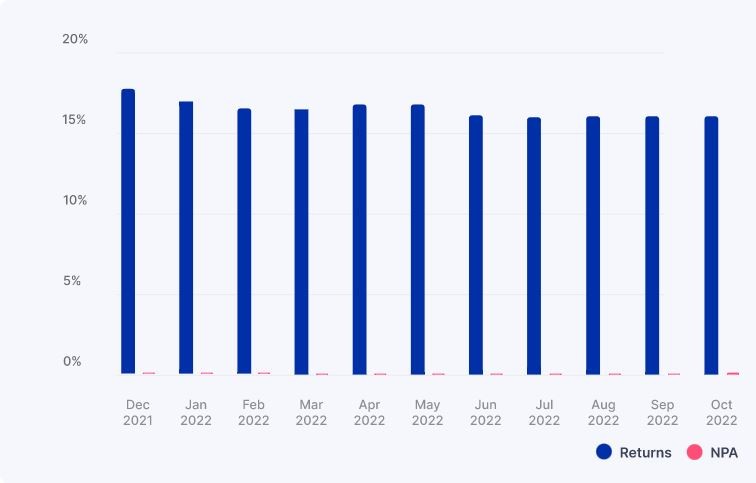

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistently positive till now with negligible NPA. Have increased allocation and will continue to monitor

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 11.5% | 1% |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1.5% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- With the current crisis going on in Europe I feel its best to not increase allocation to Europe-based platforms

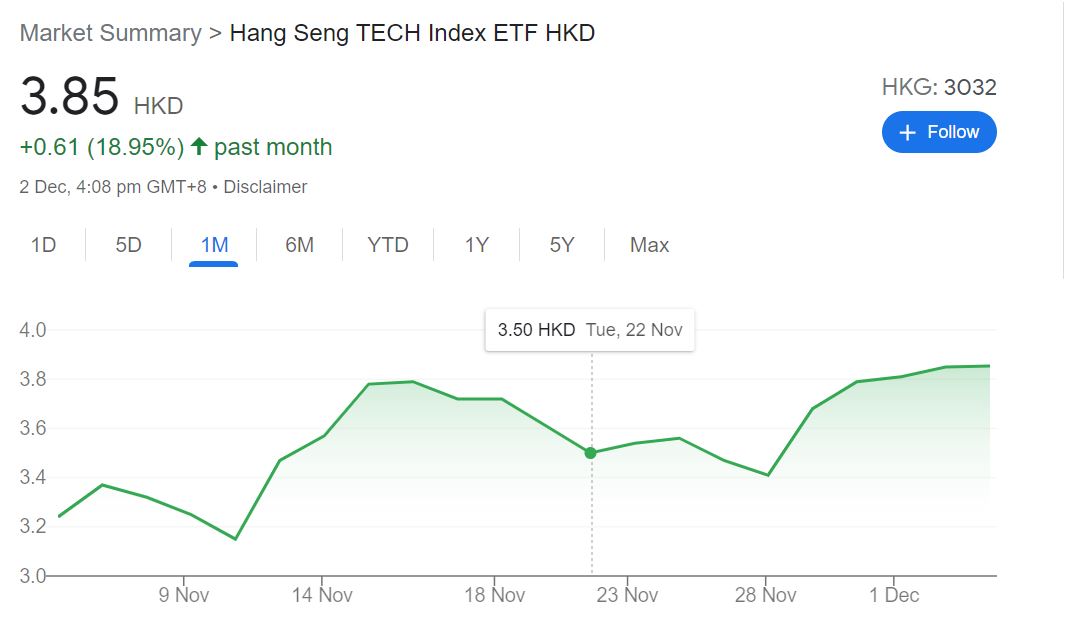

Equity Market

Last few months I had invested in the US and China as highlighted in the October review. Both countries have done extremely well in a month timeframe. However, it is too early to say. I will add more in dips.

- Invested in Nasdaq 100 FOF operated by Navi Mutual fund

- Invested in China and Hangeng Tech ETF through Stockal and Mirae Mutual Fund.

Indian market looks very strong at the moment but valuations do not allow me to add in large quantities. Will add small quantities to avoid feeling FOMO in case the market doesn’t correct 🙂

Other Alternative Investment Assets and Platform Updates

Growpital Investment – Based on my latest conversation with the Growpital Founder below are some of the updates he provided:

Growpital(Promo code GROWRDIMES)

- Listed first ever NCDs on Tyke Invest, it got fully subscribed within 6 hours of listing and by end of the campaign it was subscribed

737.85%. - Got a Contract from McCain for Potato seed multiplication. Currently, the project is going in full swing at Barmer, Rajasthan.

Media Coverage:

https://www.amarujala.com/photo-gallery/rajasthan/big-deal- with-multinational-food-compan y-potato-farming-first-time- in-bamer-will-make-farmers- rich

https://hindi.news18.com/news/rajasthan/barmer-big-deal-with -multinational-food-company- potato-farming-first-time-in- bamer-will-make-farmers-rich- 4931655.html

https://www.dainiklokmat.com/Barmer-agriculture-rajasthan-po tato-agro-farming-tenanat-cont ractfarming-taratra-vilaage- india - Recently listed assets on Leafround to restrict blockage of our capital in one place. Now the cost is distributed across 12 months for the same asset, it helps to get technological advancement faster.

- In the final discussion to add Tea and coffee plantations to farm portfolios as well. Also exploring farm projects across Europe and Africa.

- Latest number, AUM:15 Cr+, Users 2000+, Farmlands- 2000+ acre

Sustvest Investment – Have invested in the latest Lodha opportunity on Sustvest. The payout has been consistent till now for my other investment.

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 9 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest(you need to invest INR 25 lakh over 5 years )

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 10.00 |

Do you and if yes, what tool or app do you use to keep track of all your investments & stats like invested amount, total returns so far, xirr etc?

Hey, I use Excel to track everything. Will share an updated version soon which can help to put everything in one place.

hello sir, I have been following you since couple of months and have invested in some alternative investment schemes Like GRIP, JIRAAF. Now starting investment in Growpital and Leafround. However, I have a doubt that why these schemes are paying such lucrative interest to us when they can eaisly borrower money from bank/FI at a very reasonable ROI. All are in profits and doing well still they are not approaching Banks etc.

Is there is any thing which I am missing or our funds are at stake as they will stop monthly payouts any time as per their comforts.

Maybe I sound little confused but these questions comes when I discuss with my firends also w.r.t to such alternative schemes.

Please highlight

Hi Tarun,

I think there is some misconception in your understanding of these platforms. Jiraaf and Grip are not raising funds for themselves, They are just marketplace which facilitate the borrower and investor transactions. The financial creditworthiness of platform does not have any bearing on deal performance.

Each deal has it own specific risk.

Most companies that raise money are not blue-chip companies. Most Bank do not provide such companies leasing finance. Secondly, NBFC also lease out at high-interest rate.

Another factor is the quantum of investment which is required. Most banks etc would only indulge if the transaction is above a threshold . Also they would be wiling to provide minimum flexibility in product.

Hence it makes better sense for such companies to tap capital through these platforms.

Sir, by writing alternative investments like GRIP etc I meant deals only on this platforms with such high returns.

Ok Sir, thanks for the reply. Your monthly updates are very useful and helps to decide our investment strategies also. Though we may not be investing big corpus like you.

Also, your other regular articles help to update knowledge and understand what’s is happening around.

Request you to share your excel to manage the portfolio/returns etc.

Also, please add me in your personal whatsapp/telegram group for regular updates, if possible. As I regularly investing in these platforms and will get regular guidance from you. (its a personal request).

My mail ID- tarungoel1908@gmail.com

HI Tarun, You can added you to email list.

You can follow the telegram channel here

https://t.me/randomdimes09