Wish you all a very Happy New Year!

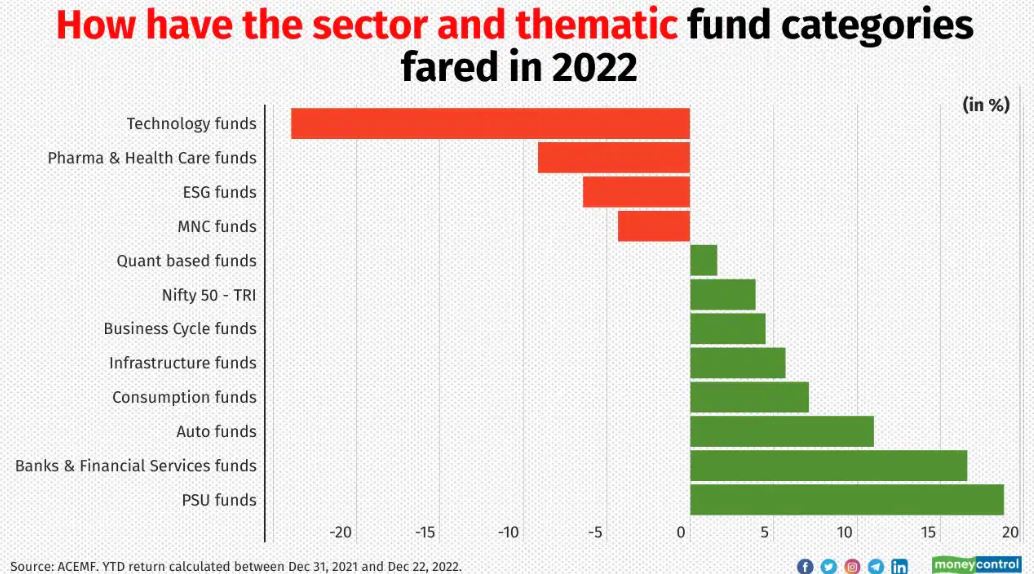

2022 was not the best year for most of the asset classes. Cryptocurrency and VC funds were the worst-performing assets in 2022 with a steep fall in valuation. Indian equities bucked the trend and have been an outlier this year, with the benchmark indices Nifty delivering positive returns, compared to a double-digit decline of its counterparts in many global markets. This was despite a very unfavorable macroeconomic environment with high inflation, rising interest rates, currency swings, and geopolitical uncertainties.

For the Alternative Investments, the ride was smoother as this year most of my investment performance was as per expectations. We added a few platforms and opted out of a few which seemed risky. Trading strategies had some great months (both directional and Volatility strategies)

Alternative Investment Portfolio Performance

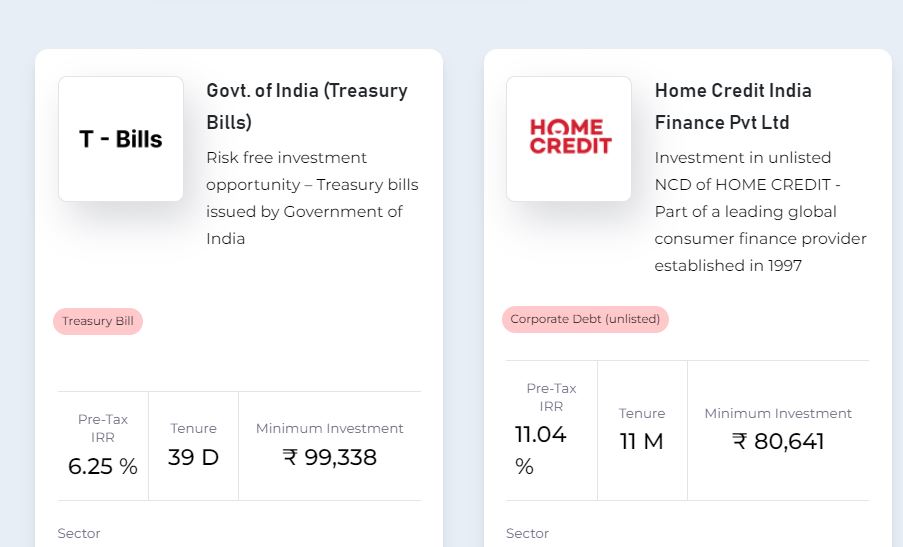

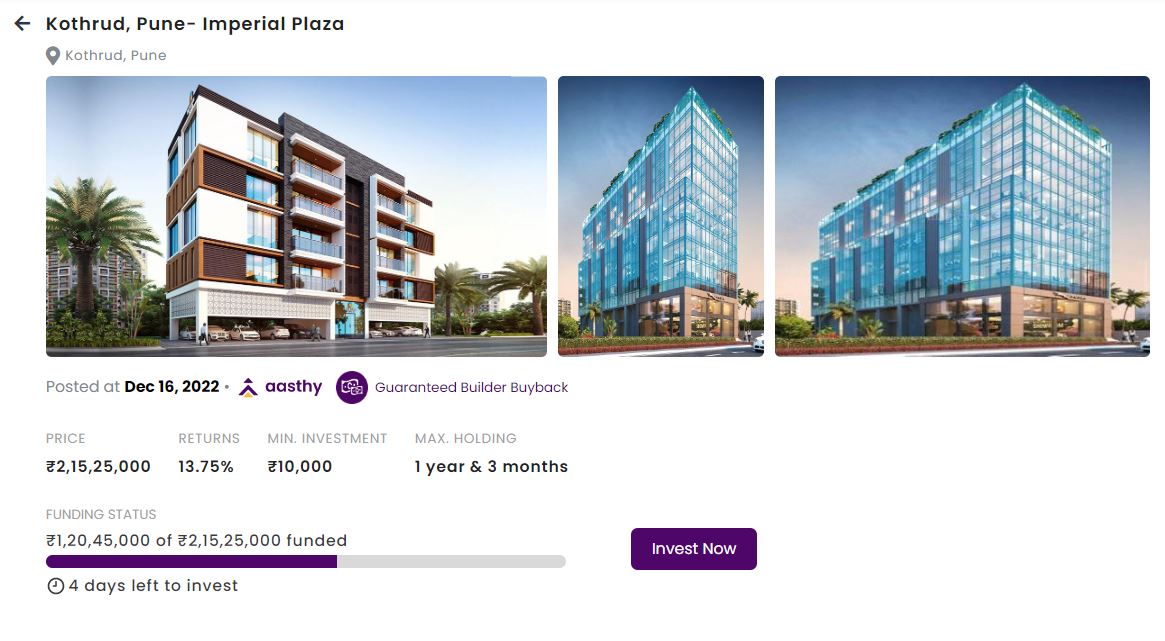

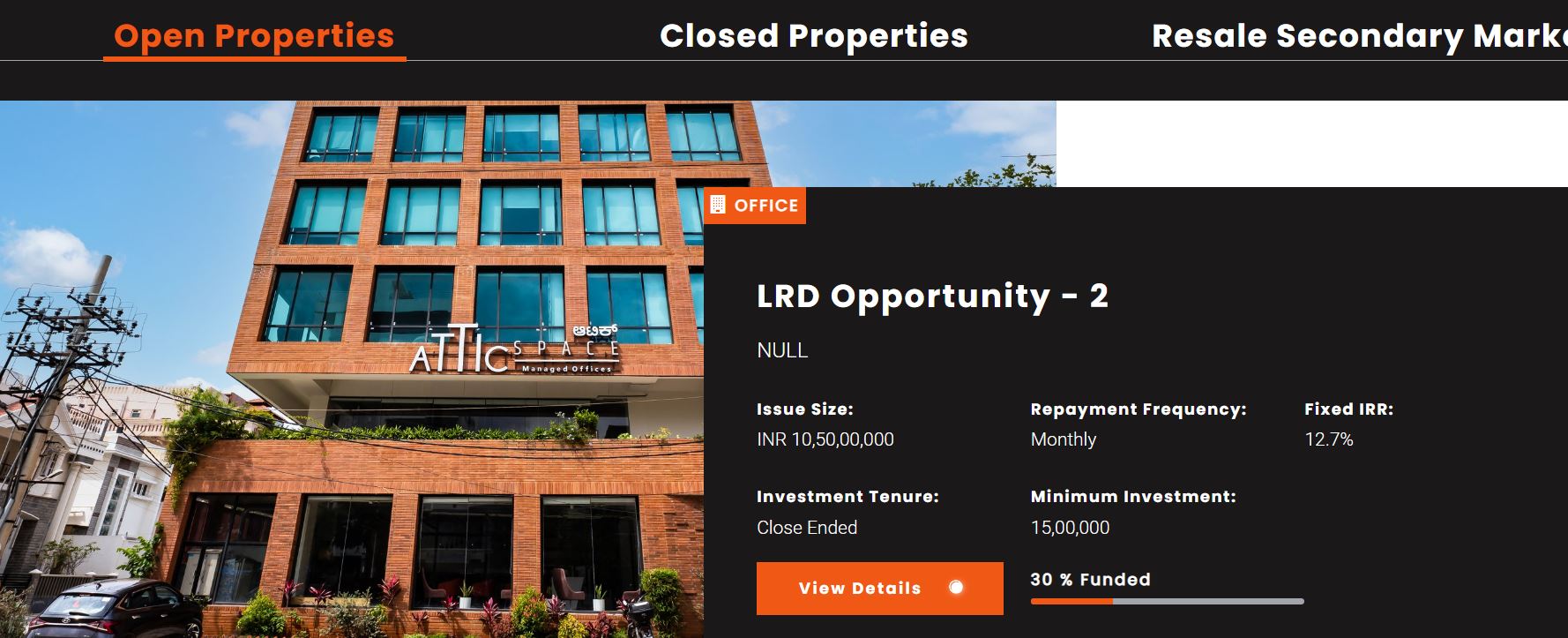

For most of December, I have added invoice discounting and Leasing deals and focussed on short-term deals while adding some unlisted shares. Have been adding some US and China Equity also. We are also focused on scaling up our trading portfolio by increasing allocation to a few more strategies. There is a new 2-year opportunity on Myre

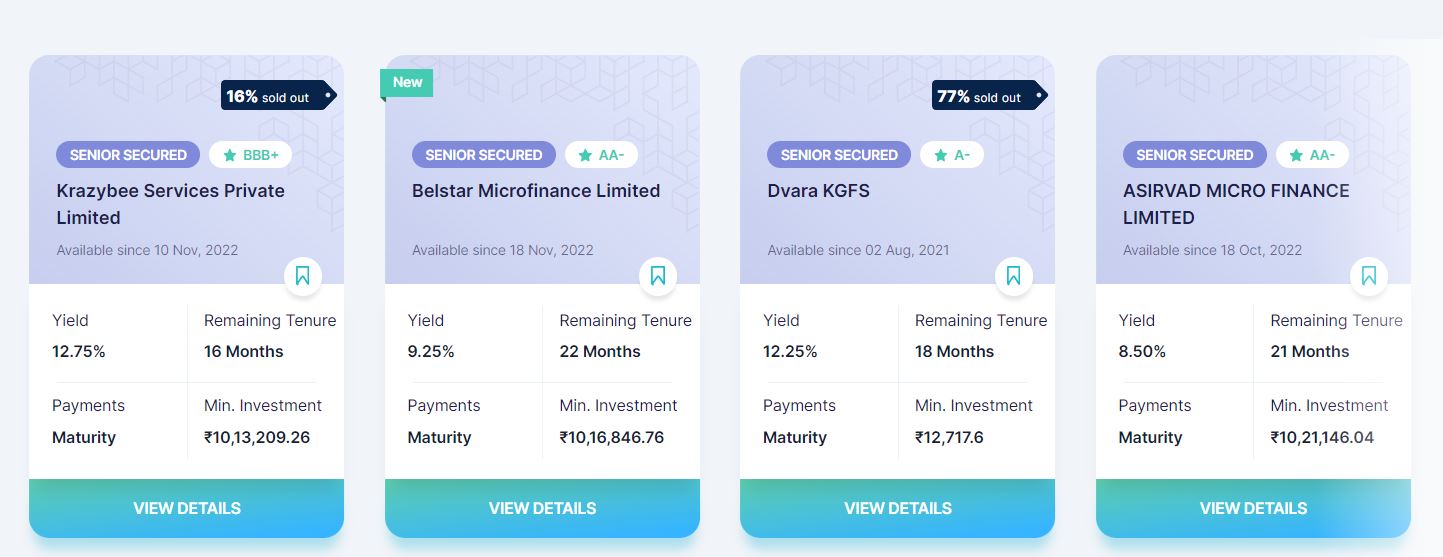

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 12%(Post-Tax) | 0% |

| Klubworks | 15-17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12.5-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post-Tax) | 0% |

| Growpital | 14.5%(Tax-Free) | Blended Yield across Plans |

| Leafround | 18% | New (8 Payments) |

| Altifi | 12.50% | 0% |

- Growpital has been doing well currently.

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are as per schedule.

- Added 3 invoice discounting deals on Jiraaf.

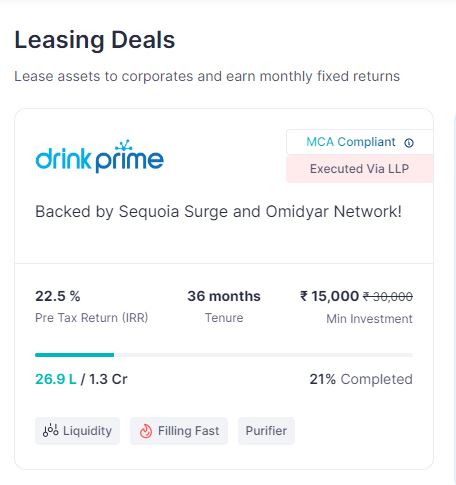

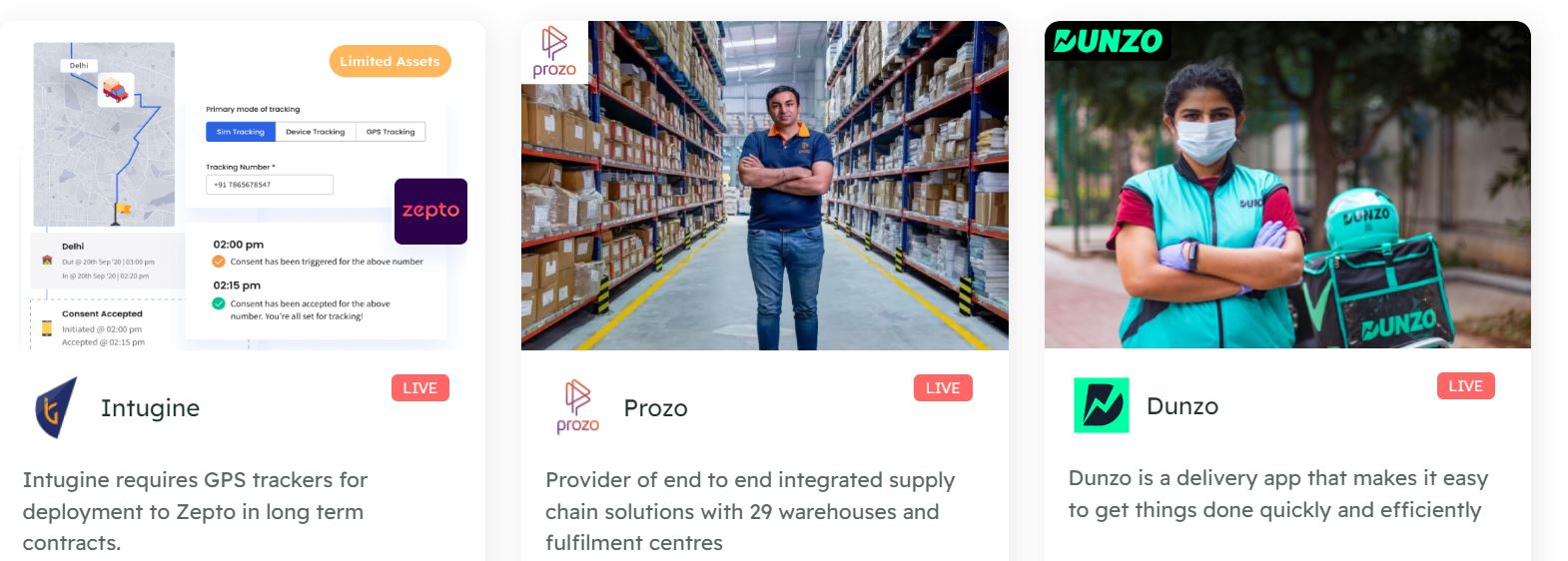

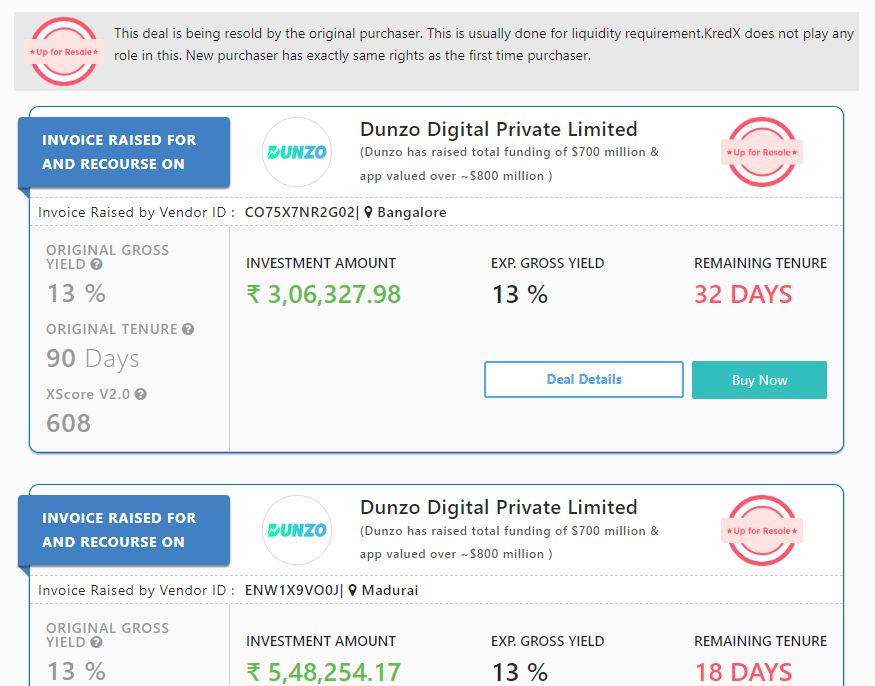

- Invested in1 more Leasing deals on Gripinvest at 22% PreTax and 1 Dunzo Laptop Deal on Leafround

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations.

- Using Liquiloans to park short term capital

- Have done a Dunzo Deal on Kredx this month

Crypto Investing

2022 was a nightmare year for crypto with multiple frauds, crashes, and overall pessimism. It seems that crypto winter will last for a good part of 2023 too! Historically best years of crypto came after such long winter and for long-term investors, these are attractive levels. However, the bigger risk right now is some crypto exchanges going bust. Having a cold wallet can be the best decision now( Post coming soon)

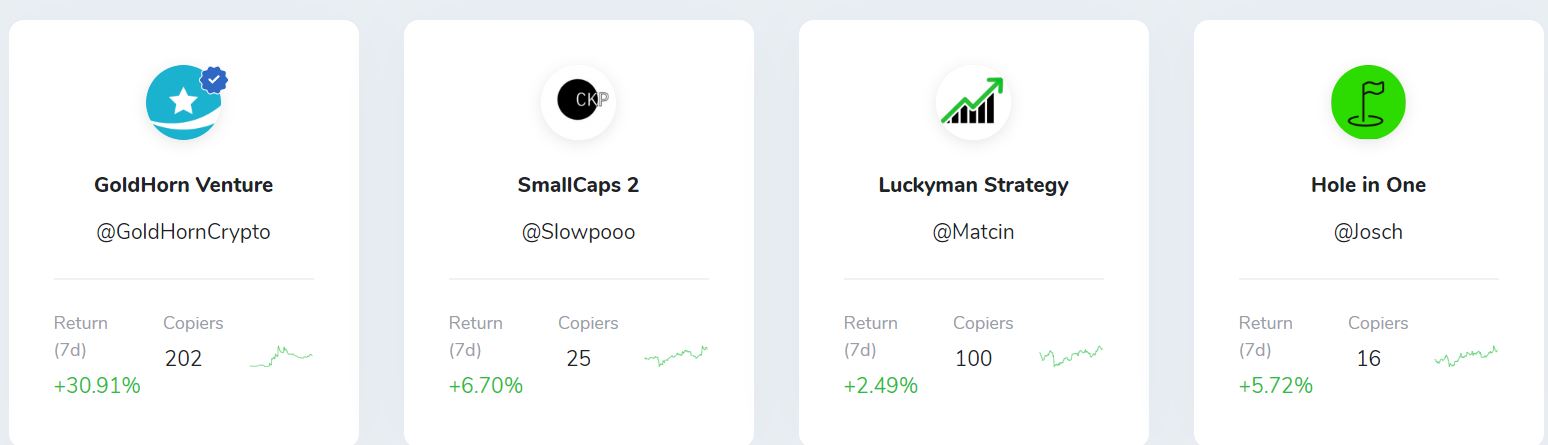

I am adding a small exposure to Iconomi and Binance and will move the rest to cold wallets

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -15% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 8% |

| Binance/CoinDCX Exposure | -15% |

P2P Investment

Current allocation:

- India P2P – 45%

- 12Club – 5%

- I2IFunding- 30%

- Finzy-15%

- Faircent Pool Loan -5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.75% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistent for more than 6 months now. I have added capital in the aggressive plan only

- Have been investing in Urban Clap Loans on I2IFunding but volumes have been low

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

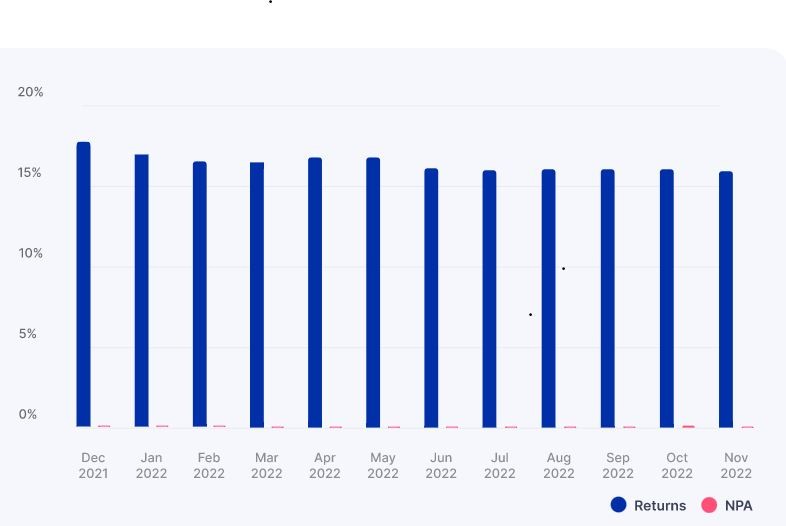

IndiaP2P Performance

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 11.5% | 1% |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1.5% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- With the current crisis going on in Europe I feel it’s best to not increase allocation to Europe-based platforms.New Investment Paused

Equity Market

PreIPO Stocks

A few PreIPO stocks are popular in the unlisted market. NSE is on top of my buy list but the allocation process is really long

Listed Stocks

I will be adding a few sector-based ETFs – IT and Pharma and a small amount in Small Cap in the Indian Market while keep adding to Nasdaq for every 3% dip from the current level.

Other Alternative Investment Assets and Platform Updates

Growpital Investment – Growpital has been making good progress. If the performance stays consistent I will add more capital in 2023.

Growpital(Promo code GROWRDIMES)

Sustvest Investment – Have invested in the latest Lodha opportunity on Sustvest. The payout has been consistent till now for my other investment.

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 10 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest(you need to invest INR 25 lakh over 5 years ). The current Lease rental opportunity looks interesting for people who want monthly income

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 10.00 |

Hi

Can you pls help with how you calculate returns in lease rental deals on gripinvest/leafround. They show IRR which is quite misleading. For example, in Dunzo deal on leafround, on 1L investment, they are giving 5700 per month for 17 months and 10k in 18th month. How to calculate returns in this case.

Also on Indiap2p, i tried investing but didnt like how they were charging for fund addition on their portal.

You have mentioned about faircent sip loans, but when I am clicking on given hyperlink, it is taking me to standard faircent page, can you pls share more information about it.

XIRR is correct when cashflow is paid intermittently. Think about it this way,you need to calculate interest on the cashflow you get to make it comparable with a bullet payment.!

to calculate XIRR you should use excel by adding the cashflow or use the below link

https://vindeep.com/Calculators/XIRRCalculator.aspx

Regarding Indiap2p

As an investor you do not need to pay any upfront fee. A nominal percentage of the interest you earn every month is deducted as IndiaP2P’s fee from your earnings along with ₹250 + taxes at the end of 12 months of investment.

Hi

Thanks for your response.

XIRR assumes that the cash inflow recd back still earns at that same rate for rest of the duration also which is obviously not correct.

Take leafround dunzo deal for example which shows an IRR of 18%, if we tweak EMI formula, that the last payout, instead of taking zero, we take the extra amount over monthly rental

See my calculation below:

Investment in M0 = -1L

Rental for 18 months (M1 – M18) = 5771

Return in 19th month (M19) = 10,635 which can be written as 5771+4864, so extra amount is 4864

Now using EMI formula

4864 = 1L×(1+r)^19 – 5771×((1+r)^19 – 1)/r

Solving for r, we get only 5.91% even though deal is showing IRR of 18%. So in reality, this deal has a CAGR of 5.91% even though IRR is advertised as 18% !

Hi Saurabh

1) XIRR is correct. It basically calculates the single rate which will give the PV given the outcome and is perfectly fine to use it for instruments with periodic cash flow. You can solve it for a discounted rate which will get the net present value of the investment and get similar results

2) Regarding your formula,it assumes that in the final EMI everything becomes zero which is not the case.!

Here is the derivation:

B(0)=P

B(1)=(1+i)P−I

B(2)=(1+i)((1+i)P−I)−I=(1+i)2P−(1+i)I−I

B(j)=(1+i)jP−(1+i)(j−1)I−(1+i)j−2I−…I=(1+i)jP−(1+i)j−1iI

0=(1+i)nP−(1+i)n−1iI