Real estate is a lucrative asset class. However, traditionally it has been limited to High Net Worth Individuals (HNIs), who could invest lakhs and crores of Rupees in real estate properties. But with the Fintech revolution, things are changing for the better!

Now you can invest in real estate properties with as little as Rs. 5,000 and make 12-18% annual returns on your investments.

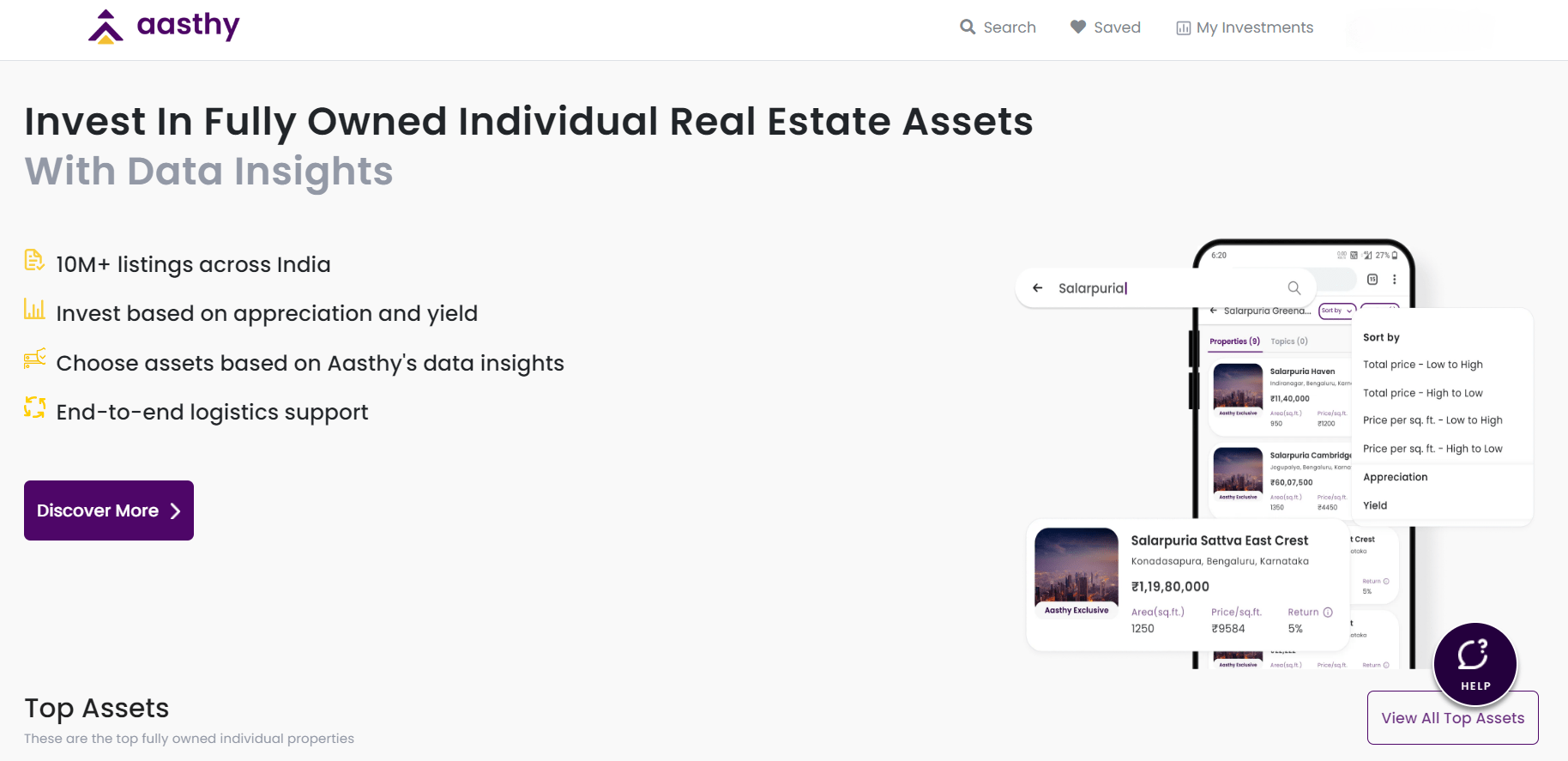

Aasthy is one such real estate investment platform in India, that let’s small retail investors invest in real estate assets with a ridiculously low ticket size. Let’s understand what makes Aasthy one of the best online real estate investment platforms in India.

What is Aasthy?

Real estate investment is known for its low risks and high returns. It has historically created the highest wealth for investors. However, the real estate investment market is known to be fraught with a lack of information, lofty pricing, high ticket size, and low liquidity. All these factors made it impossible for small individual investors to reap the benefit of this lucrative asset class.

Aasthy is a technology-driven real estate investment platform that takes care of all the conventional pitfalls associated with real estate investing. Aasthy is democratizing real estate investment by enabling small individual investors to invest in Grade A real estate assets, for as little as Rs. 5,000.

The platform provides a data-driven approach to real estate investing, by providing investment insights backed by actual data.

At the helm of Aasthy is a team with deep experience in technology and real estate investing.

Let’s have a look at how Aasthy is taking care of the problems associated with real estate investing, one by one.

Features of Aasthy

Aasthy is addressing the pitfalls of conventional real estate investing through its data-driven approach and fractional real estate investment model. Let’s see how.

Small Investment Tickets

Traditionally real estate investing meant buying commercial real estate properties for lakhs and crores from dubious real estate agents and builders.

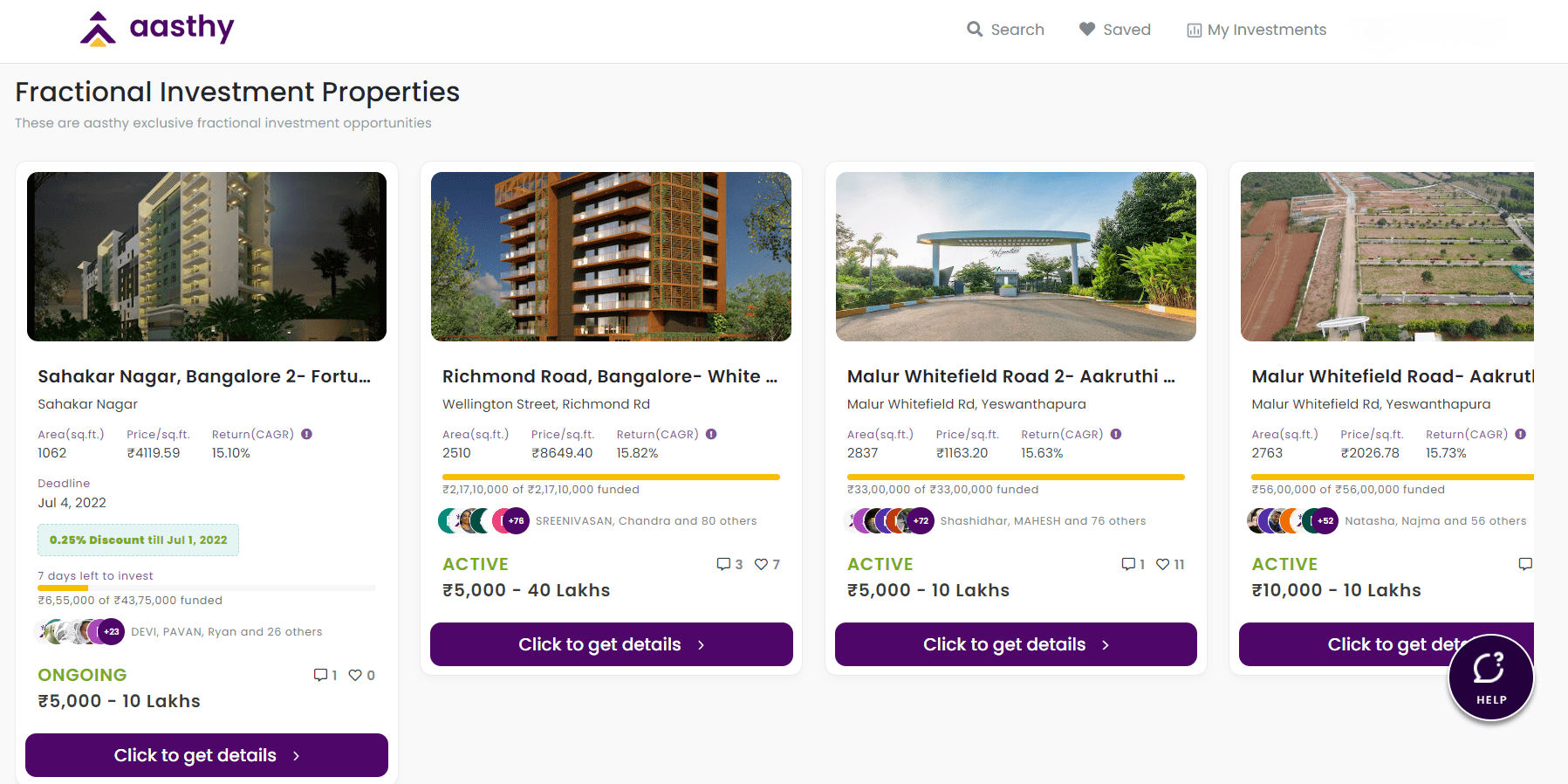

Aasthy facilitates fractional ownership of real estate assets, bringing down the minimum investment amount for individual investors. As a result, the platform provides investment opportunities in Grade A real estate assets for an investment as low as ₹ 5,000. A small ticket size also gives the investor room to diversify his investments among several real estate assets in different flourishing locations. The Investment is pooled into an SPV (Private Limited Company) and the securities issued will be Compulsory Convertible Debentures.

Data-driven Investment Insights

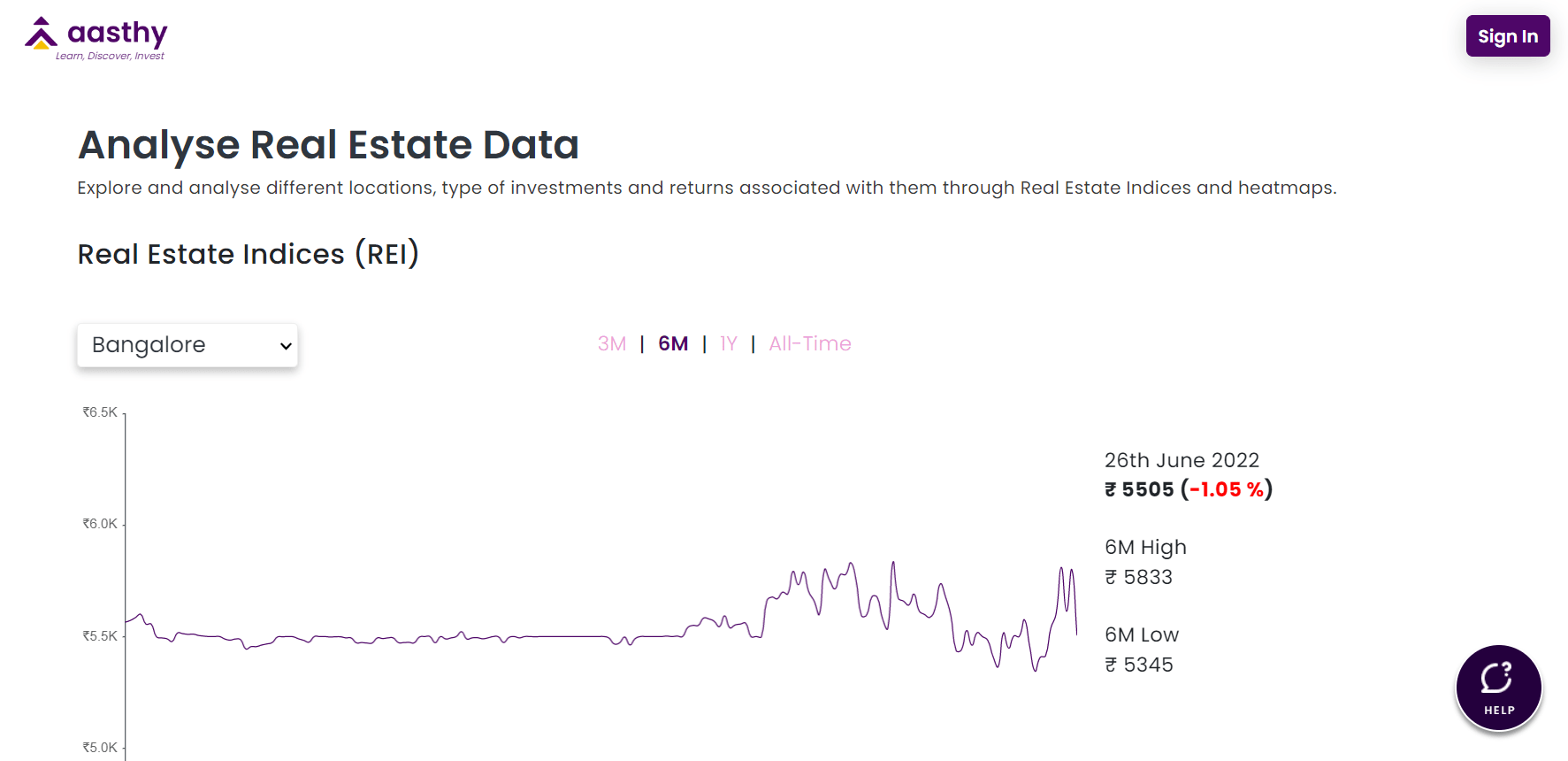

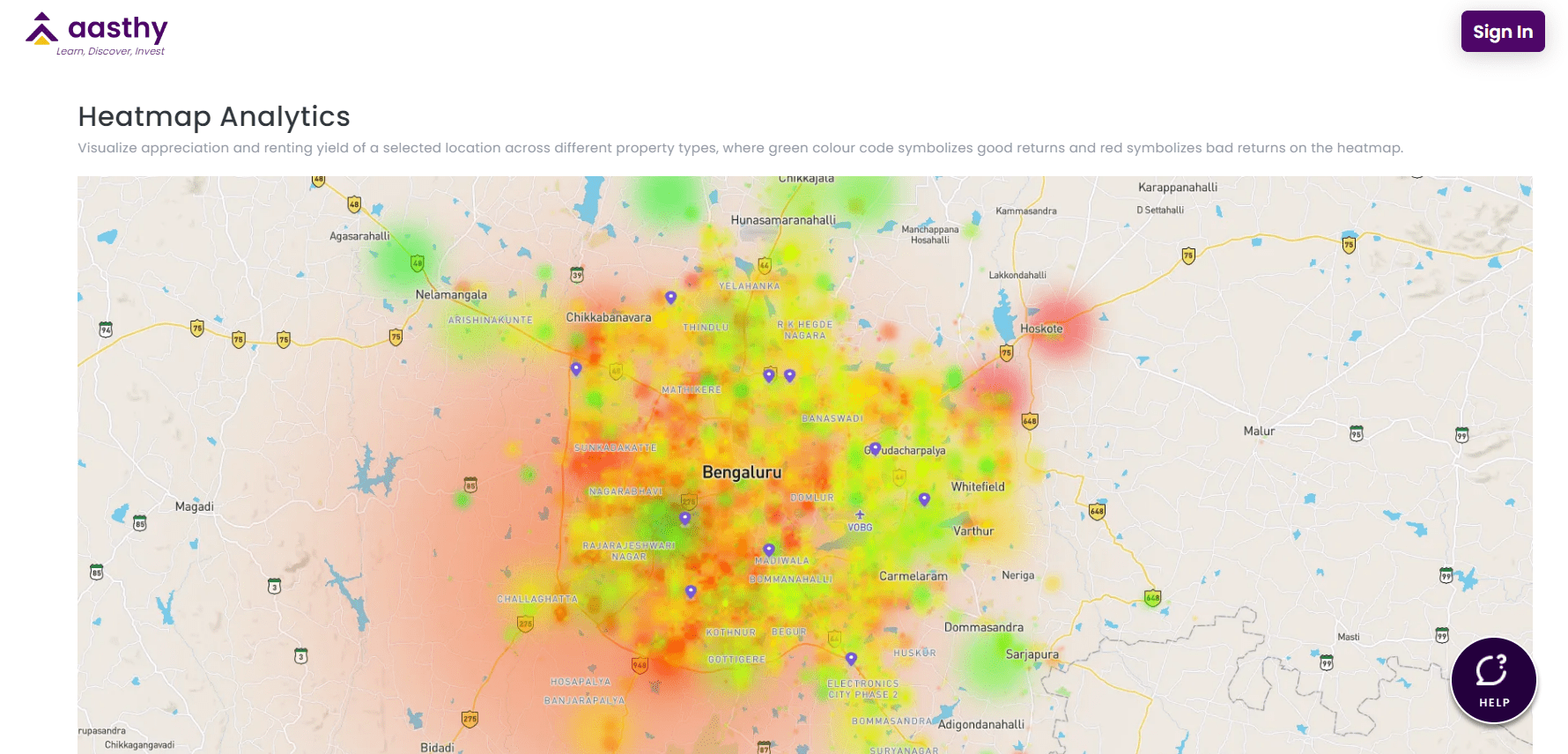

One of the key reasons why small retail investors hesitate from investing in real estate assets is the lack of information. Prices are often decided in the open market, and there is no way to verify them. Real estate agents and builders use this lack of information as an opportunity to cheat the investors by keeping them in the dark. Aasthy provides real-time investment insights to investors that are backed by actual data.

Aasthy’s data-driven approach to real estate investing is what makes it stand out from the crowd. The platform uses over 30 million data points and promises 95% data accuracy. It also gives you key real estate insights like “Heatmap Analytics” to understand the intrinsic value of a particular location. This data-driven approach ensures the efficient presentation of real estate price and appreciation trends.

High Liquidity

Getting out of your real estate investments, when you need the money, can be tricky and cumbersome. This is because the real estate market is known for its low liquidity. Unlike stocks or cryptos, high-ticket real estate assets aren’t traded in real-time. Selling real estate properties needs a lot of paperwork, and at times, you may not even get a seller offering a good price.

Aasthy provides a guaranteed 3-day exit option for up to 5% of the users in a particular asset (on a rolling basis). The platform also provides real estate assets with guaranteed builder buyback. This gives you an assurance of high liquidity and control over your investment. The buyback is for the principal value along with the return on the same. Irrespective of the builder’s sales position, they are bound to honor this based on the legal agreement they get into. The SPVs incur a small charge as ‘Contingency Cost’, which acts as an insurance premium, and by this, Aasthy ensures that the investors are timely repaid even in unforeseen circumstances.

Potential Risk Factors

Like any other investments, investments with Aasthy are also not completely risk-free.

- Aasthy should be able to correctly predict properties that have a good appreciation possibility for investors to make good returns.

- The buyback guarantee has to be honored by the builder. In case the builder lacks the liquidity to provide the principal Aasthy should have sufficient reserves(Insurance fund) to provide the buyback

- There might be platform risk- since Aasthy is an important mediator between the business and the investor, there might be problems getting good exits if Aasthy shuts down.

- Macroeconomic factors affect the demand and supply of real estate and thus influence the returns on your investments.

How to Invest in Real Estate Assets using Aasthy?

Aasthy provides a seamless real estate investment experience. You can start investing in real estate assets once you sign up on the platform and complete your KYC verification process.

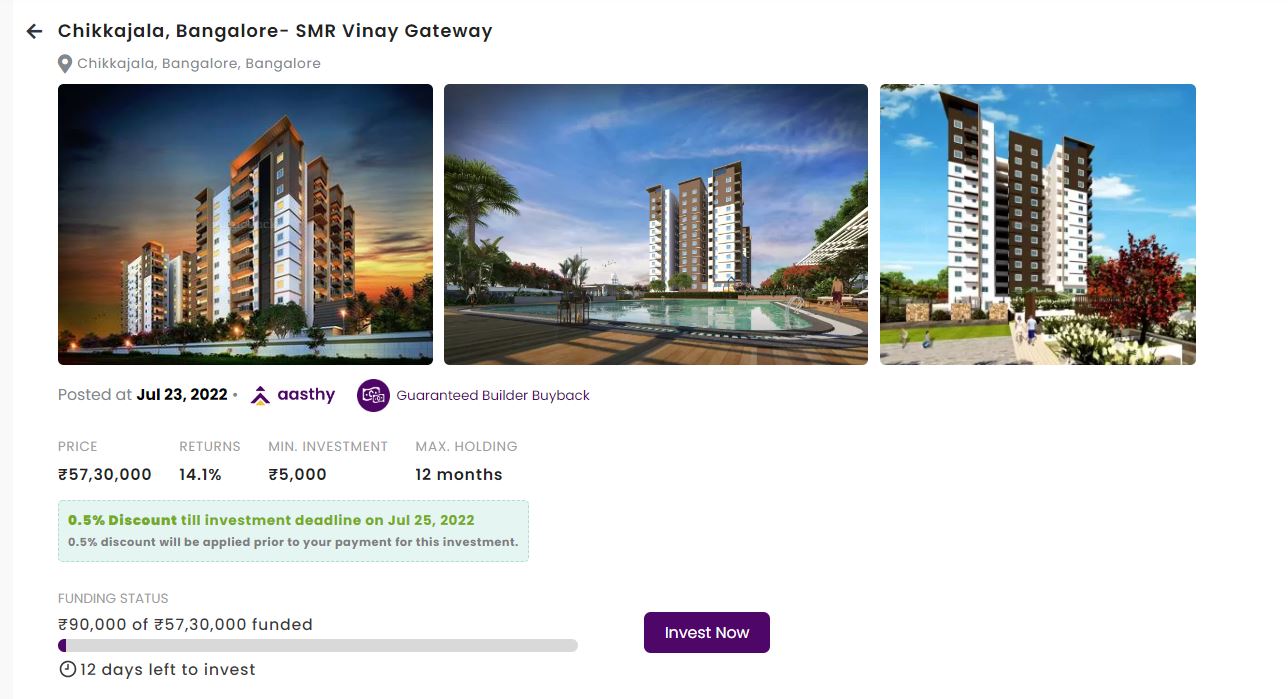

The platform lists several Grade A fractional investment properties, that can be invested in for as low as Rs. 5000.

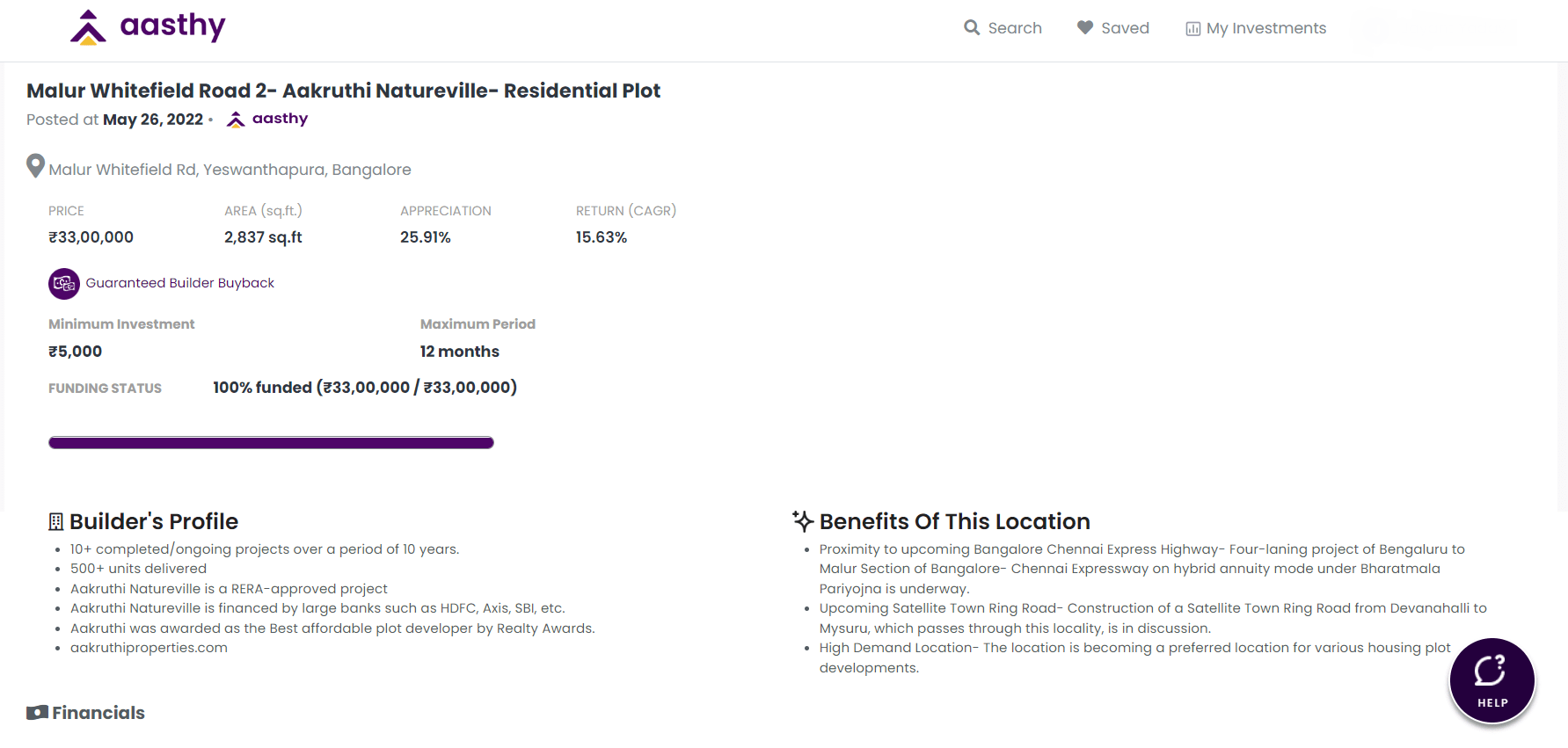

You’ll get all the relevant details about the properties, including location details, pricing, and appreciation trends.

Furthermore, Aasthy provides insights into the builder’s profile that helps understand the credibility and trustworthiness of the builder.

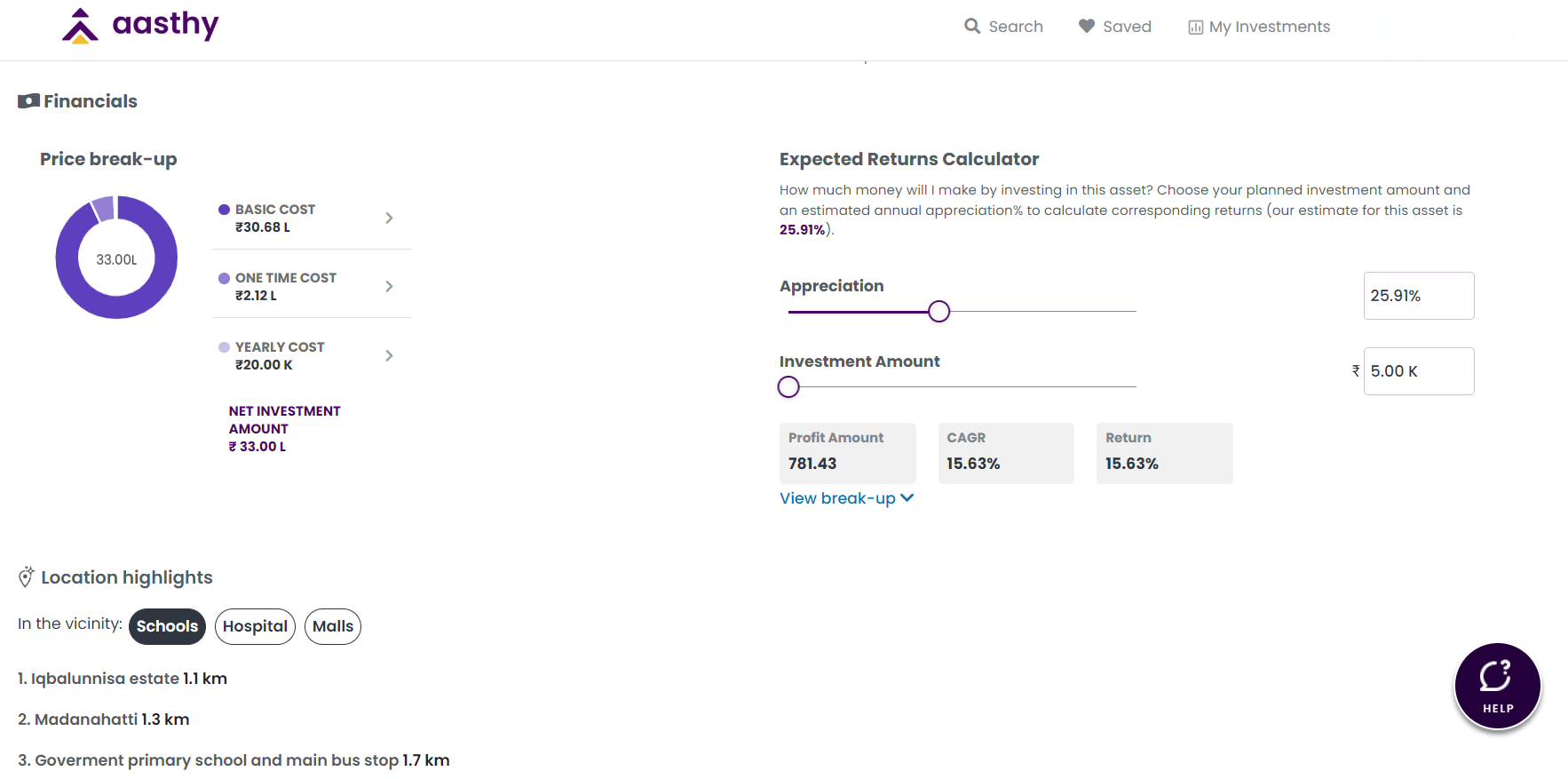

The platform comes with an inbuilt returns calculator, that helps you visualize the performance of your investments.

Also, there is a discussion forum for each listed property where you can consult with experts and fellow investors. The platform also comes with excellent user support, that you can access through call and email.

Aasthy also provides access to fully owned individual real estate assets, that you can invest in on the basis of investment insights provided on the platform.

You can select from a range of grade A properties spread across several booming locations in India. Below are details of the current opportunity.

Now let’s have a look at the benefits of using Aasthy over real estate agents and builders.

Aasthy Founding Team

The core founding team of Aasthy has strong experience in Real Estate and Technology. The current CEO, Nimit Kothari has a background in Wealth and is an ISB alumnus. Details of the founding team are as below:

Srinath Ramanujan is a corporate leader who has built, scaled, and profitably run large internet products in social gaming and agri-tech platforms. He is an engineer at heart who started his career building high-tech coconut extracting robots (featured in BBC). He has always enjoyed leveraging large volumes of data. He has seen Moonfrog Labs (exited at $100M) through ideation and growth, has been the champion behind Tencent’s PUBG becoming the #1 game in the subcontinent, and propelled FarmRise (the most used agri-advisory app in India).

Narayan Lal (Co-Founder) has seen the 9 yards of Real Estate spending the last 10 years in real estate – both with his niche consulting firm Turnip and his prop-tech startup Brongo. He also carries a decade of experience in the finance sector with J P Morgan and Reuters.

Aasthy Alternatives

Aasthy is primarily in the business of fractional real estate investing. There are a few platforms in India that are into this segment- some dedicatedly to this segment whereas others offer different types of alternative investment options. Most of the fractional real estate platforms in India have higher locking periods and high minimum tickets. Some of the alternatives you can consider with similar yields are as follows:

-

Grip Invest

Grip Invest is a platform that lists equipment leasing, inventory-based financing, and commercial real estate investing deals on it. It has a constant flow of new deals and has been one of the pioneers in this space in India. The minimum amount to invest is Rs.10000 and you can get an average IRR of 12-15%+ depending on which deals you invest in.

-

Leafround

Leafround lets you invest in assets that are then leased to Enterprises. They have multiple opportunities available to invest on the platform. The minimum investment is Rs.10000 and you can expect 20-25% IRR.

-

Jiraaf

This is a new but fast-growing alternative investment opportunity listing platform backed by Sequoia and other popular angel investors. Apart from invoice discounting, corporate debt, and other instruments, it also has equipment lease-based investment options on its platform. The minimum investment is slightly higher at Rs.100000 per deal but might vary depending on deals.

There are few international options to explore for Real Estate like Reinvest24 and Lofty.

My Aasthy Investment

I made my first investment a couple of months back. The onboarding process and user experience were smooth. The property has appreciated 2%. I will update the performance in my monthly review

Conclusion

Real estate investing can be complex and bewildering for small individual investors, who do not have the resources and access to information required to make informed investment decisions.

Aasthy is a technology-driven real estate investment platform that is trying to democratize real estate investing in India, opening it up for small investors. Small ticket size, access to investment insights backed by data, and guaranteed liquidity can go a long way in bridging the trillion-dollar gap in real estate investment by individuals in India.

Can you compare it with REIT investments? Security, liquidity and returns approach.

I think comparison with REIT ends with underlying asset being Real Estate:

1) REIT are listed and more liquid and have higher degree of regulation and public data.

2) REIT is an active management of large real estate portfolio with leverage to enhance returns. The underlying properties are very mature meaning less risk and dividend payout

3) REIT are more prone to broad market movement in stocks and interest rate as dividend payout are impacted by borrowing cost etc.

Aasthy investment is akin to buying a property in a neighborhood which has good growth prospects. Risk is higher as it is a fairly new model. The returns are not market linked but more specific to each deal characteristics and risk.

The performance of the platform depends on Aasthy’s capability to use data to find high performing opportunities

I dont see further update on the performance or next review. Can you update on this?

Hi Vardhman, Had invested in one more property. I will update the latest performance in the September review.

Hi, How about new investments in Aasthy and the returns so far?

Hi , Currently my investments are up approx 10% in 6 months or so. They haven’t listed a new opportunity in January. Hopefull Feb will have more opportunities.

their platform seems to have wind down. what happens to the existing ongoing investment?

They have returned the investment along with the interest for all investors