In a world where technology is continually reshaping our lives, mobile applications have become indispensable tools. They’re not just for communication and entertainment; they’ve also infiltrated the world of personal finance. Among the several fintech apps, one brings to you a unique and engaging way to save, invest, and even have fun while doing so – Fello. In this Review, we’ll explore what the Fello app is, how it works, its key features, and how to get started. So, let’s dive into this exciting journey of saving, earning, and gaming, all within the Fello app.

What is Fello App?

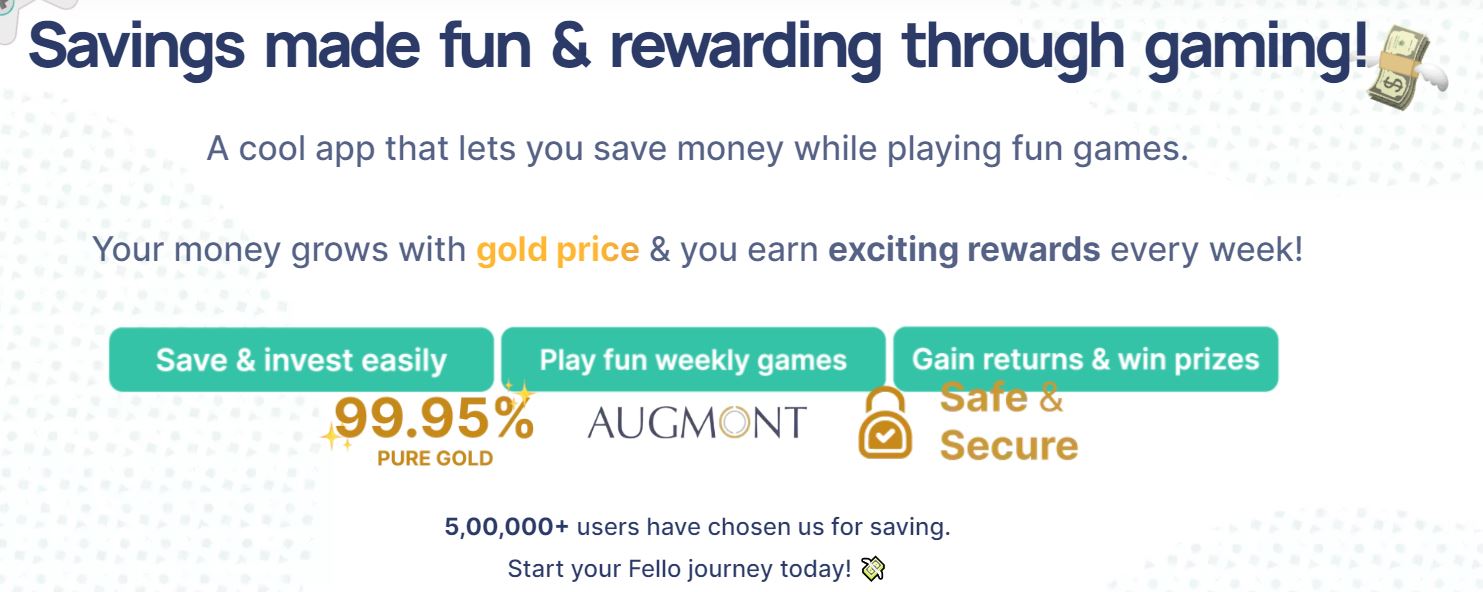

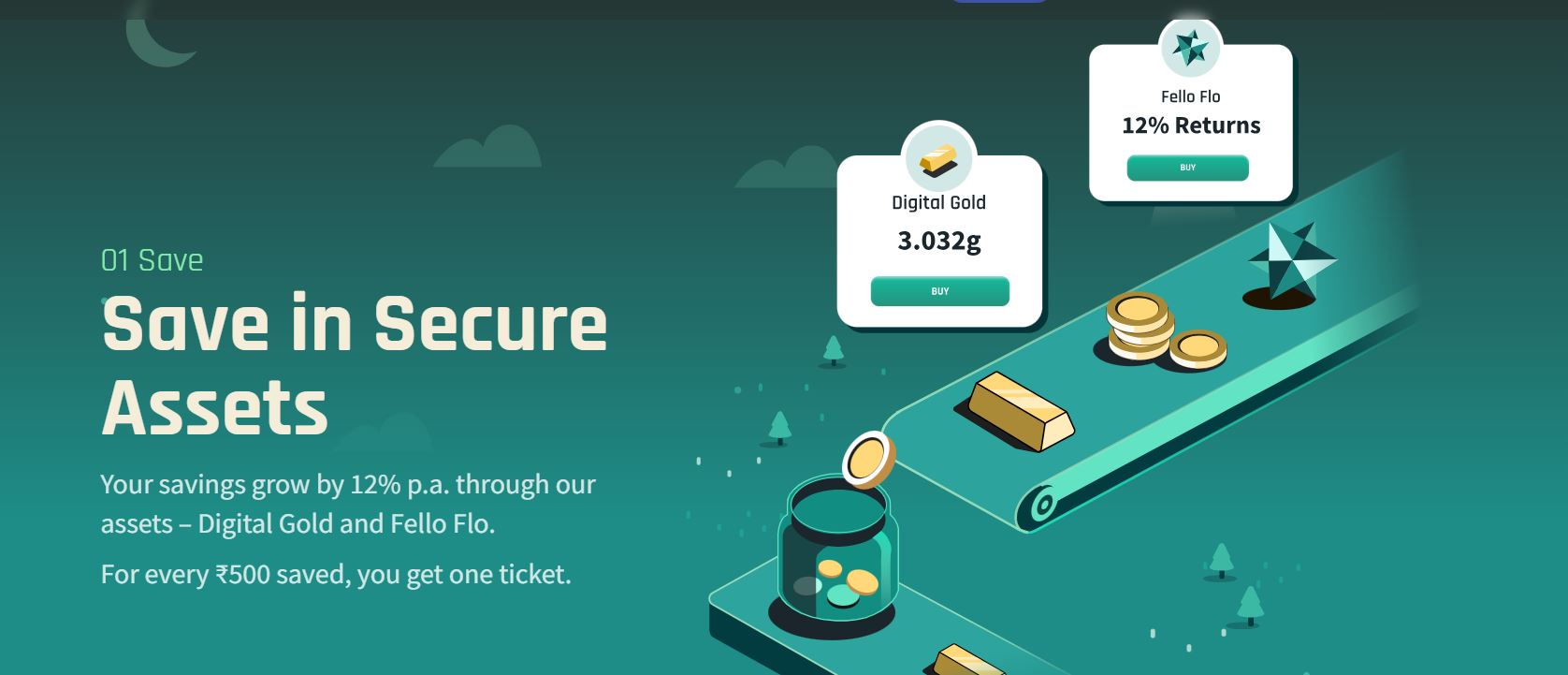

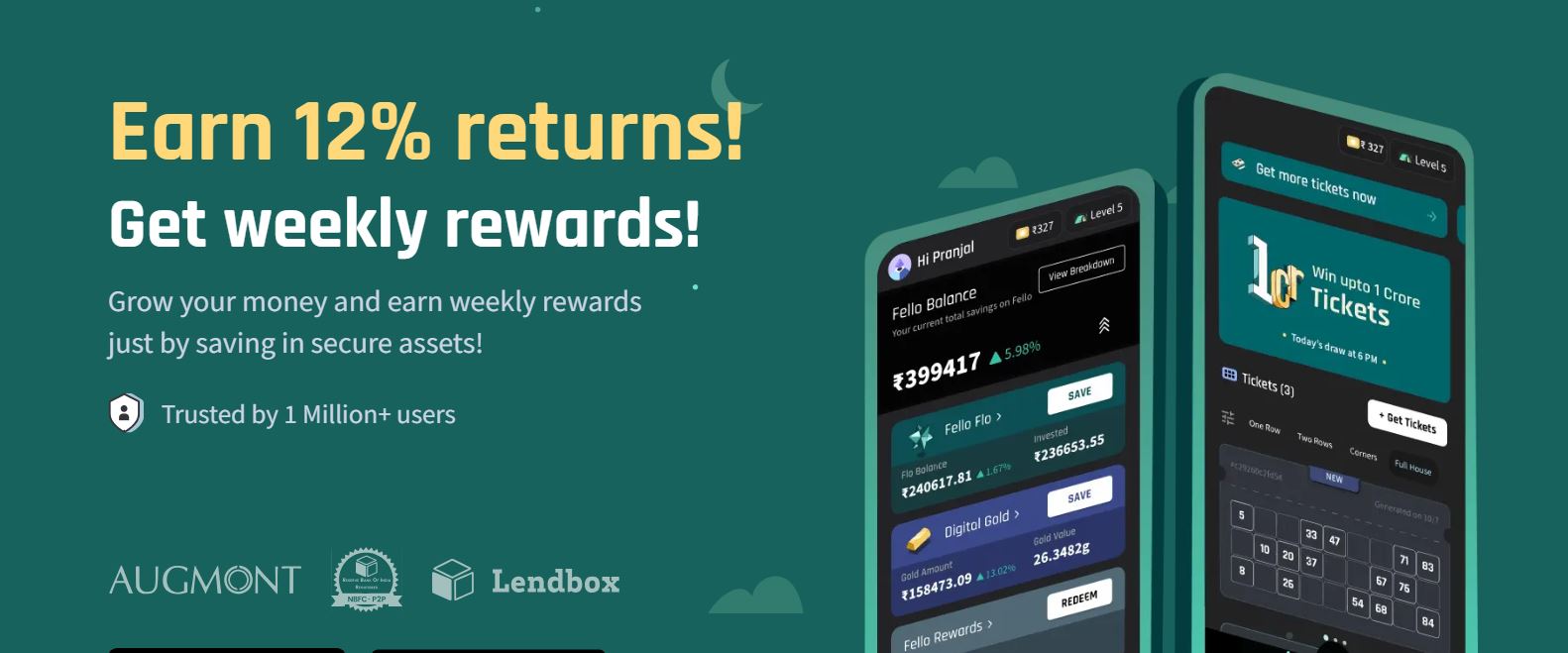

The Fello app is a game-based savings application designed to help users save and grow their money while having the chance to earn weekly rewards. It’s a fusion of traditional savings and modern gaming elements. The app’s goal is to make saving money more engaging and rewarding, encouraging users to build their financial reserves in a fun way. The app claims to help you grow your savings by up to 12% returns by investing in assets like digital gold and Fello Flo (a P2P lending product in association with an NBFC partner). The mobile app is available on Android and iOS Play Store and has millions of downloads.

How does Fello App Work?

Fello operates on a simple yet ingenious premise: save to earn. When you save in secure assets using the application, you receive Fello tickets. These tickets can be used to play games within the app and win rewards. Additionally, for every Rs. 500 saved, you earn a weekly ticket, opening the door to even more rewards.

One of the exciting ways Fello rewards its users is through “Fello scratch cards.” These cards are awarded when users achieve milestones, refer friends, or win weekly rewards. These scratch cards contain enticing rewards, adding an element of surprise and delight to the saving process.

Fello also offers an exclusive investment opportunity called “Fello Flo.” This is a P2P asset provided by their asset partner, LendBox, which is a registered NBFC entity under the RBI. With Fello Flo, you can enjoy attractive returns of up to 12% per annum.

The app allows users to invest in Digital Gold (in partnership with Augmont), making wealth accumulation more accessible and diversified. You can simply buy digital gold (like other platforms) OR invest in the ‘Gold Pro’ plan which allows you to save in digital gold and get additional interest on it too.

In essence,it is more than just a savings app; it’s a financial playground where users can grow their money while having fun.

Fello Founders

Fello is founded by Shourya Lala and Manish Maryada, as part of the Y-combinator. They have received INR 4 Million USD in its latest funding round led by US-based Courtside Ventures along with Entrepreneur First, Ycombinator, Kube Venture, and Upsparks.

Angel investors Kunal Shah, Founder of Cred, Lalit Kishore, co-founder of Groww, Charlie Songhurst, Dafeng, and Alan Rutledge also participated in this round.

Fello App Features

The Fello app is packed with features that make it a one-of-a-kind financial platform. Here are some of the key features that make it stand out:

- Game-Based Savings:

Fello transforms the mundane act of saving into an exciting game. Users are rewarded with FELLO tickets, which can be used to play games and win rewards, making the process of saving more engaging.

- Weekly Rewards:

Every Rs. 500 saved on the app earns you a weekly ticket, providing the opportunity to win attractive rewards.

- Fello Scratch Cards:

Milestones, referrals, and weekly rewards earn you scratch cards with various rewards, adding an element of surprise to your savings journey.

- Fello Flo:

An exclusive RBI-certified P2P fund partnership with LendBox offers users the potential to earn attractive returns, beating traditional savings options.

- Digital Gold Investment:

Users can invest in Digital Gold through the app, diversifying their investment portfolio and increasing wealth.

Fello Flo

[maxbutton id=”1″ url=”https://fello.in/app/referral/MyT2″ text=”Download Fell

Fello Flo is the app’s P2P investment product offered in partnership with their NBFC partner- Lendbox. There are essentially 3 plans- using which you can get up to 12% returns. There are as follows:

| Flo Name | Min Investment | Returns | Tenure |

| 12% Flo | Rs.10000 | up to 12% | 6 Months |

| 10% Flo | Rs.1000 | up to 12% | 3 Months |

| 8% Flo | Rs.100 | up to 12% | 1 Week |

Alternatives to Fello Flo

Investors can check out the below platforms to diversify their investment across other similar platforms. Some of the platforms investors can consider are :

It is a similar platform to Fello but can offer up to 13% yield. Another benefit of 13Karat is that it is backed by Cashe and uses its underwriting skills which makes it a more robust platform.

Lendbox is one of the oldest P2P platforms in India and has partnered with the top fintech companies in India and thus has a pool of diversified borrowers. It offers plans with instant liquidity also.

IndiaP2P is the only platform in India that has physical branches for borrower verification and thus has a more mature model of lending than other fintech p2p platforms that rely solely on digital analytics

How to Register and Start Using Fello App

[maxbutton id=”1″ url=”https://fello.in/app/referral/MyT2″ text=”Download Fell

Getting started with Fello is a breeze. Follow these simple steps to embark on your journey of saving, earning, and gaming:

Step 1: Download the App

Fello is available on both the Android Play Store and iOS App Store. Use the link to download app and get additional benefits or use code MyT2 while registering on the app

Step 2: Registration

Once the app is installed, open it and follow the registration process. You’ll need to provide basic information and set up your account. Use Code https://fello.in/app/referral/MyT2

Step 3: Link Your Account

Link your bank account to the app for seamless fund transfers and savings. The app provides a secure platform for your financial transactions.

Step 4: Start Saving

Begin your saving journey by transferring funds into the Fello app. For every rupee saved in secure assets, you’ll earn FELLO tokens, which you can use to play games and win rewards.

Step 5: Explore Fello Flo and Digital Gold

Explore investment opportunities within the app. Consider Fello Flo for attractive returns or diversify your portfolio with Digital Gold investments.

Congratulations, you’re now ready to save, earn, and play with Fello!

Conclusion

[maxbutton id=”1″ url=”https://fello.in/app/referral/MyT2″ text=”Download Fell

In this Review, we’ve delved into the unique features and offerings of the app. While the products it offers for investment- P2P investments through Lendbox & digital gold through Augmont- are available to invest through several other apps & directly through the partners as well- Fello provides a unique and engaging solution to your financial needs by the way of gamification. The fusion of gaming and finance is a fresh take on traditional savings methods, providing users with new incentives to build their financial futures.

As our lives become increasingly digital, financial apps like Fello exemplify the potential for technology to revolutionize the way we manage our finances. The concept of “saving while gaming” is a testament to the creative solutions emerging in the fintech industry. In conclusion, Fello offers a unique and exciting way to secure your financial future, one rupee at a time. One can sign up and give it a try if digital gold and P2P investments need to occupy a chunk of your portfolio.

Frequently Asked Questions (FAQs) on Fello

- Is Fello a secure platform for saving and investing?

Yes, Fello takes security seriously. Your bank account details and transactions are protected using robust encryption and security measures.

- How can I earn FELLO tokens?

You can earn FELLO tokens by saving money in secure assets through the app. For every rupee saved, you receive FELLO tokens, which can be used to play games and win rewards.

- What are the benefits of Fello Flo?

Fello Flo is a 10% P2P fund that offers attractive returns, potentially up to 12% per annum, surpassing traditional savings methods like Fixed Deposits.

- How can I invest in Digital Gold through Fello?

It provides an option to invest in Digital Gold through the app, allowing you to diversify your investment portfolio easily.

- Are there any fees associated with using Fello?

Fello is committed to making savings and investing accessible. It doesn’t charge any fees for using the app, allowing you to grow your money without additional costs.

- How are Fello reviews from other customers?

The Fello app has 1 million + downloads and an average rating of 4.3 among 3000+ reviews at the time of writing the article. Looking at the Fello Reviews online from customer, the app seems to be quite popular among users.

Have you started saving through using this app?

I have invested a small amount only in Fello till now to test the app.