Deribit provides derivatives hedging for Bitcoin Risk Management which has become essential as we have reached a stage of mainstream participation in the asset class causing lot of volatility.

Just over 10 years old, Bitcoin might already be the best-performing investment of all time. It might also be the most volatile, and volatility has a way of luring people into ill-timed and costly investing choices

Bitcoin is the original and most widely known cryptocurrency. The

leading digital asset has a first mover advantage and over ten

years of performance history dating back to 2010 when the first

trade on an exchange took place. I have covered crypto currency investment: Best Platform to Trade/Invest in Crypto in India using INR

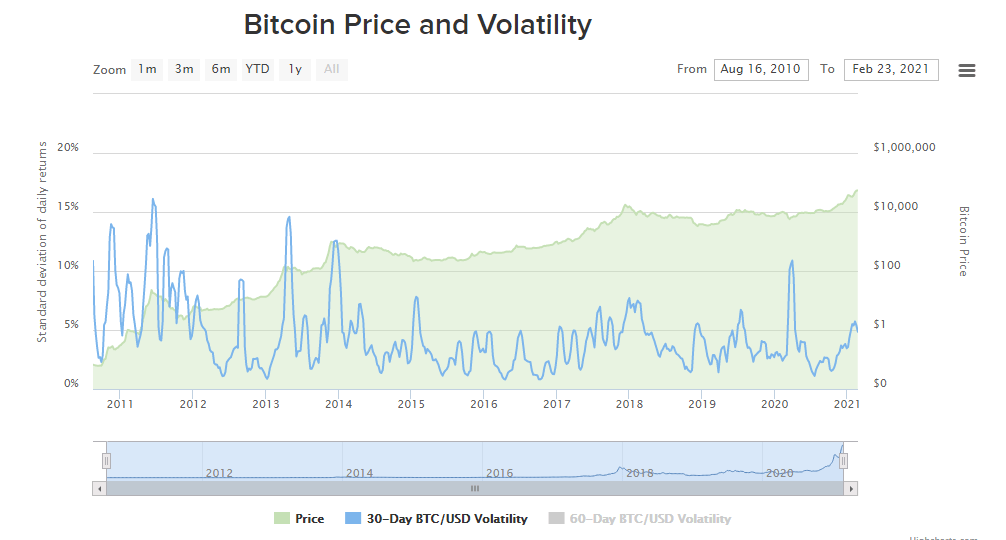

Bitcoin Risk and Volatility

There’s no denying Bitcoin’s astonishing success. Its price has grown a stupefying 796,933 times since 2010. For perspective, the Dow Jones Industrial Average has grown 869 times since its inception in 1896. That means Bitcoin’s price appreciation has been 917 times that of the Dow in less than a tenth of the time.

With a surge like that, it doesn’t take a big investment to make a pile of money. A measly $100 bet on Bitcoin on Day One, or close to it, would have blossomed into close to $80 million. Moreover, investors didn’t have to be there from the beginning to rack up big gains. They just had to hop on somewhere along the line and hang on to their coins.

The trouble is, Bitcoin’s wild swings don’t make it easy to hold on. Its volatility, as measured by annualized standard deviation, has clocked more than 200% since 2010, or close to 15 times that of the S&P 500 Index during the same period. Which implies, Investors who were in and out of Bitcoin had as much opportunity to lose a fortune as make one.

To get some perspective you can compare that with S&P volatility

Bitcoin Hedging using Deribit

Deribit is world’s largest Crypto derivative exchange and will provide us the tool for hedging our bitcoin price risk.

The rationale behind hedge is to have upside performance while restricting the downside risk.

We will employ a covered call strategy which is the sale of

an out-of-the-money call option secured by a long position in the

underlying. In other words ,the returns are capped at the value of strike

price of the call option (approximately 20% per calendar month)

but the premium received can be used to cover the cost of the put

A major benefit of this strategy in crypto is that calls are much more expensive than puts due to bullish market demand hence if we sell a 20% Out of Money call we can use the money to buy put.

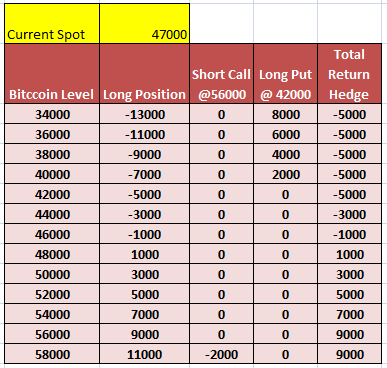

Example of Hedging Strategy

Investor has USD 10,000 exposure to Bitcoin.In normal scenario he is susceptible to the volatility of bitcoin which can make him nervous and he might book profit completely.

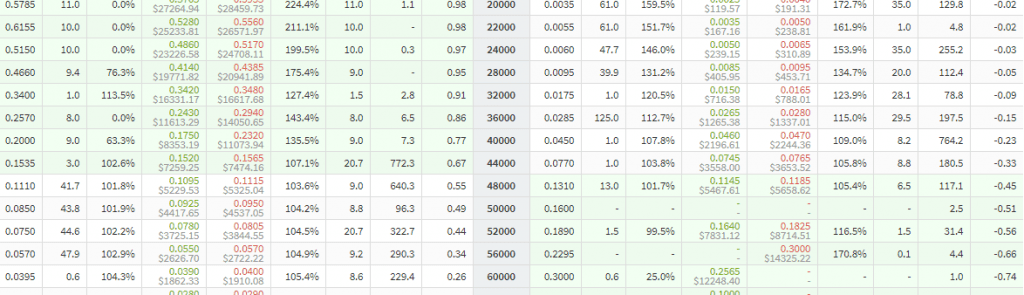

Creating the hedge

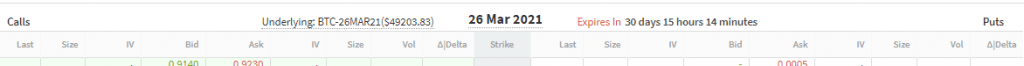

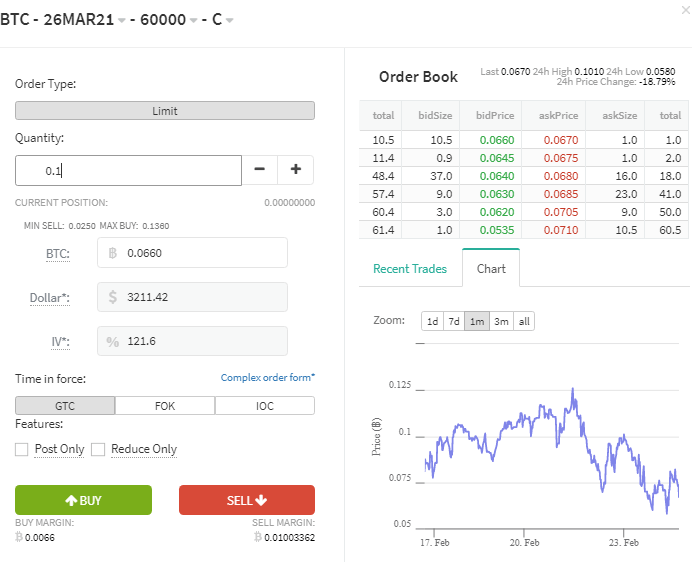

1)Check price of Calls and puts for 1 month expiry

- Current spot price of BTC = 47000

- 10% downside = 42000

- 20% Upside =56000 Approx

Call Option Price 56000 Strike March 21 = USD 2600

Put Option Price 40000 Strike March 21= USD 2100

Buy Selling the 56000 Strike call you can buy atleast 80%worth of 44000 strike Put or 100% using combination of 40000 and 44000 Put.

This strategy will restrict your downside loss to only 10% per month but you have a 20% upside every month which is reasonable.

Margin Requirement for Deribit Hedging

Deribit allows 10x leverage for option which means you can take 1 BTC exposure by putting only 0.1 BTC as margin. You can transfer the required margin from your BTC wallet and execute the trade.

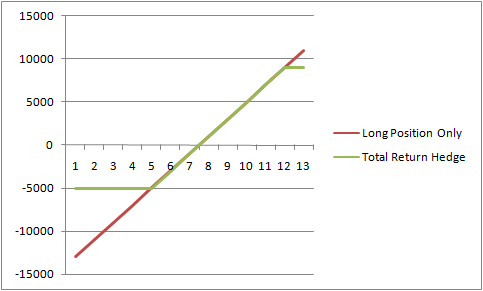

Scenario Analysis Deribit Hedging

Comparison of Hedged Portfolio vs Naked Long Position

Someone with naked position would have got annihalted

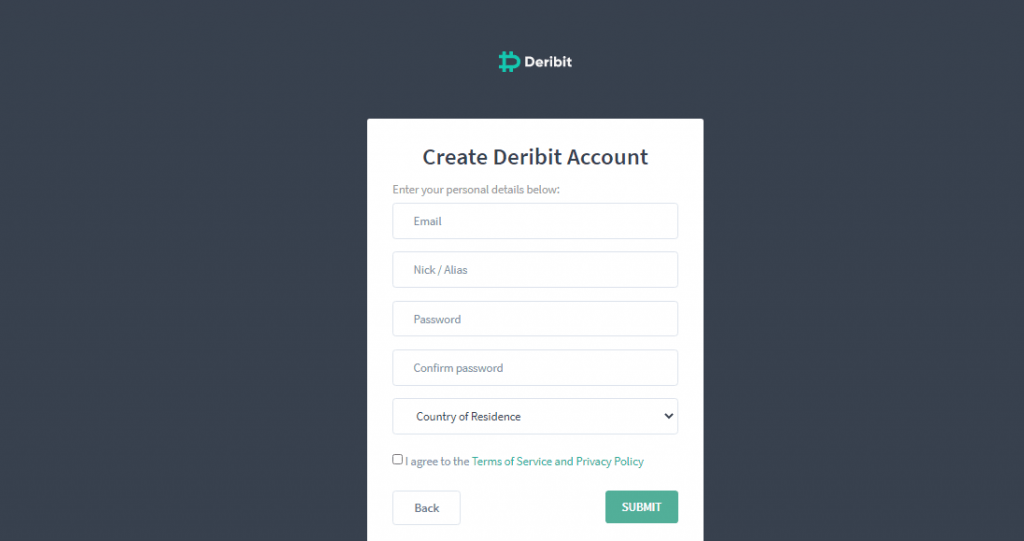

How to get started On Deribit

Step 1) Register on Deribit using link. The process is super easy

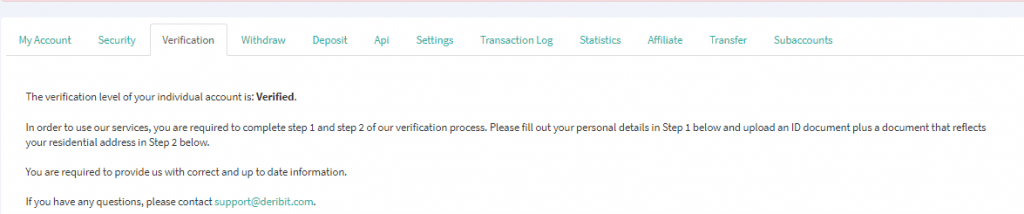

Step 2 ) Complete KYC. You need to upload Identification documents

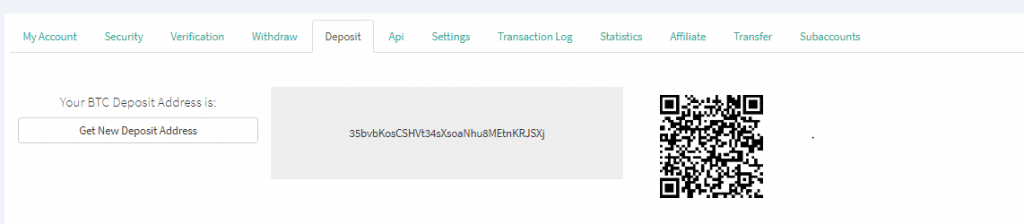

Step 3) Transfer BTC to the adress provided in your account

Step 4) Buy BTC options

You can put the price in BTC or Dollar. It is recommended to put price between bid ask level to get favorable execution rate.

You should take exposure equivalent to your underlying BTC exposure across all wallets to get complete hedge over your portfolio.

You can change the hedge ratio/strike selection based on market scenario and your view .