Nifty touched a milestone of 19,000 in June.

Beginning of the year, the index had slipped to sub-17000 levels in March’23 but has since rallied ~11% following risk-on sentiments. Indian equities are experiencing PE re-rating and have been supported by strength in global markets as well. FPI flows into Indian equities have turned positive with the change in the macro narrative.

Alternative Investment Portfolio Performance

This month I have tried a new platform Lendpartnerz. As a start, I have invested only in one deal. Would be closely monitoring the performance before deploying more capital.

A lot of people have been sharing many new platforms offering alternative investments but I urge everyone to be very conservative while investing in new platforms as most of these new platforms seem to be run by unknown people and do not even provide basic details about deals. Hence it is paramount to avoid taking risks.

The idea is to start Forum on Randomdimes for discussing investment opportunities, trading, and other finance-related stuff to help create a community that can share their experience on different asset classes and platforms

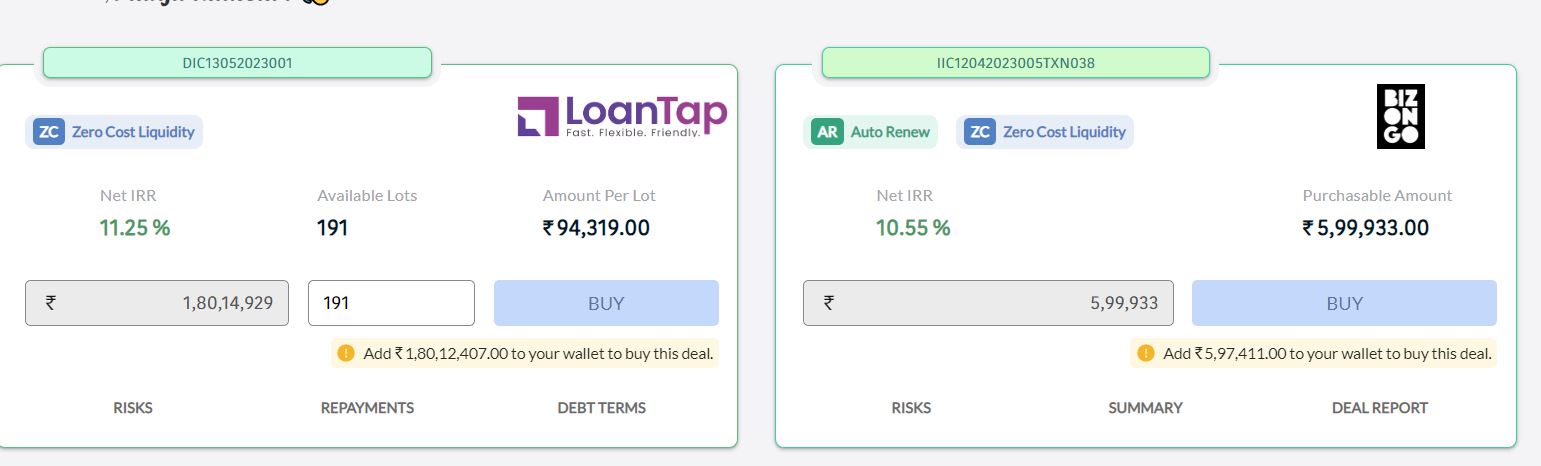

Lending Investment

| Platform | Returns | NPA |

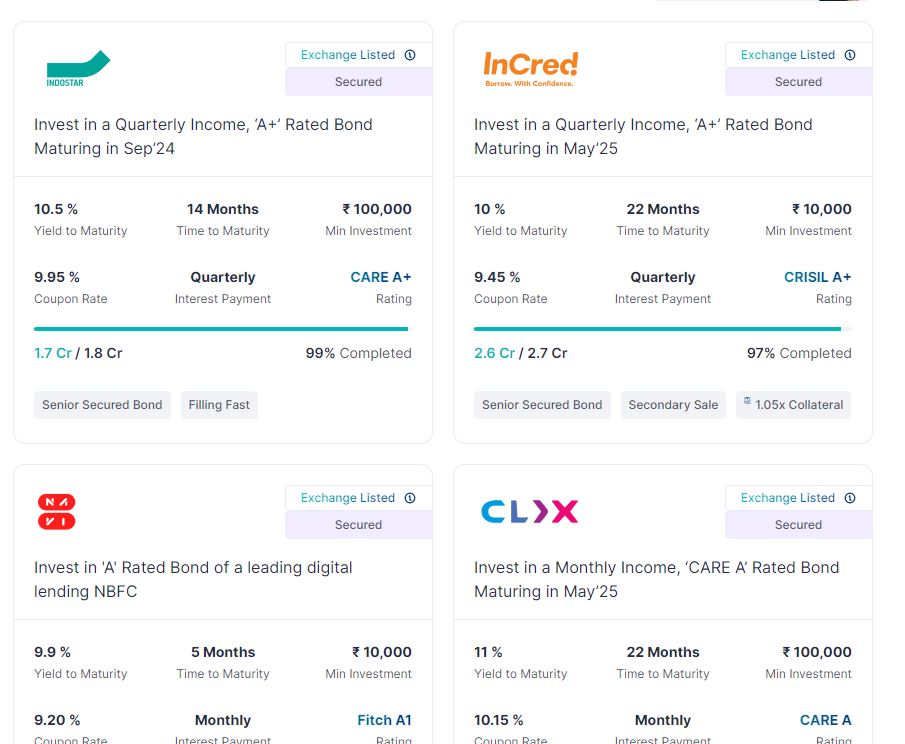

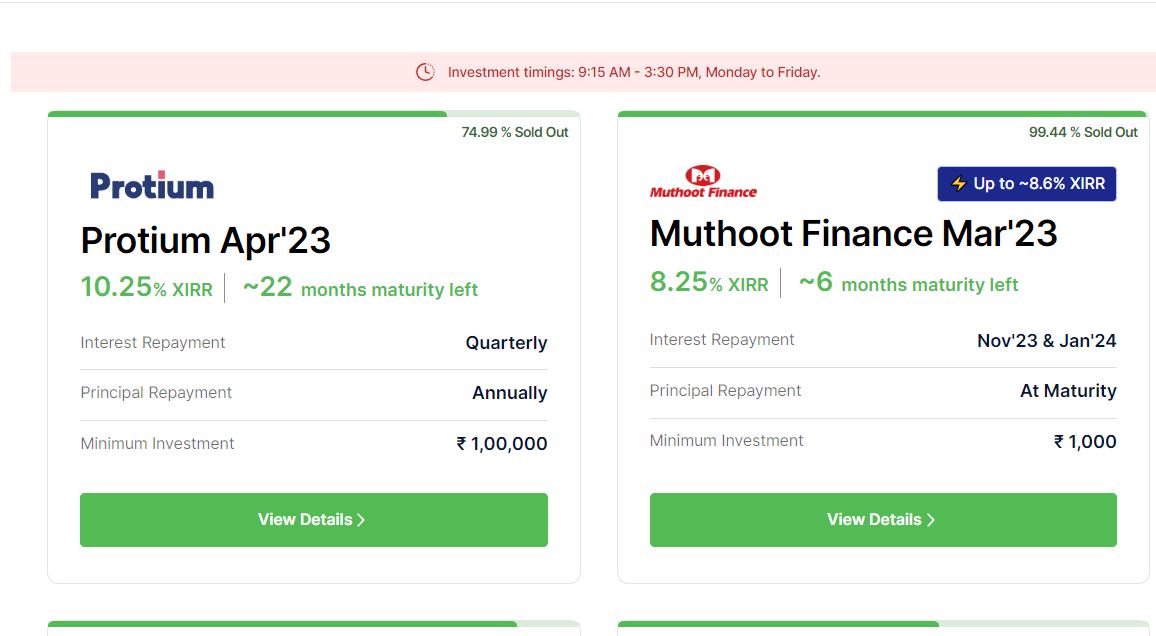

| Grip Invest | 13% | 0% |

| Klubworks | 15-17% | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post Tax) | 0% |

| Growpital | 16%(Tax Free) | Blended Yield |

| Leafround | 15-18% | 0% |

| Altifi | 12.50% | 0% |

| Better Invest | 16-18.00% | 0% |

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are per schedule.

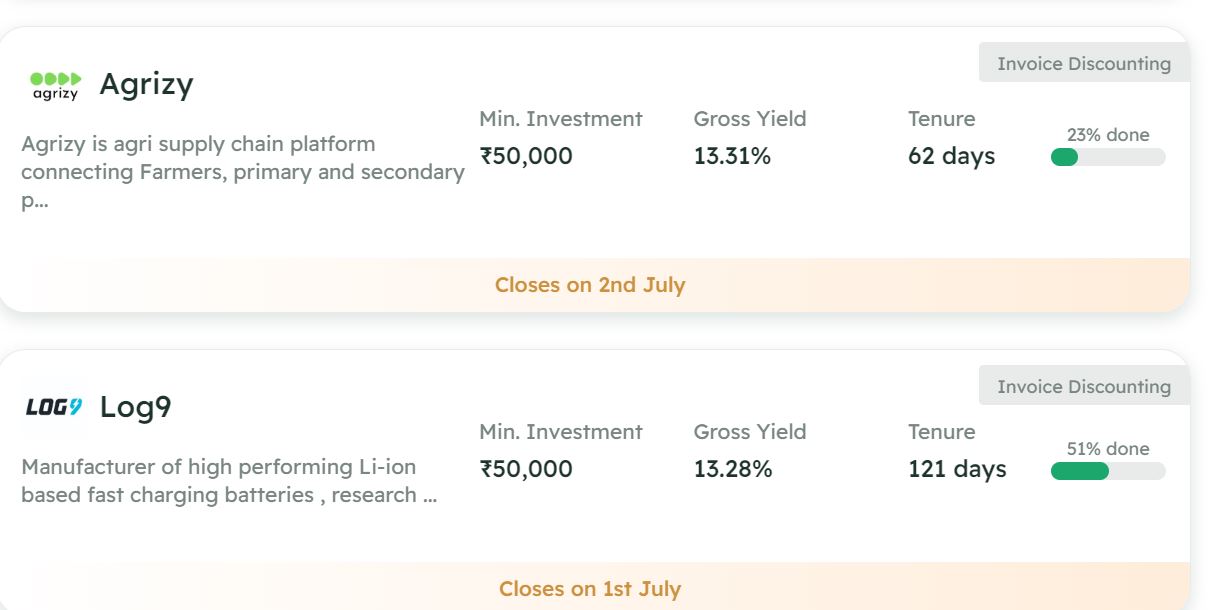

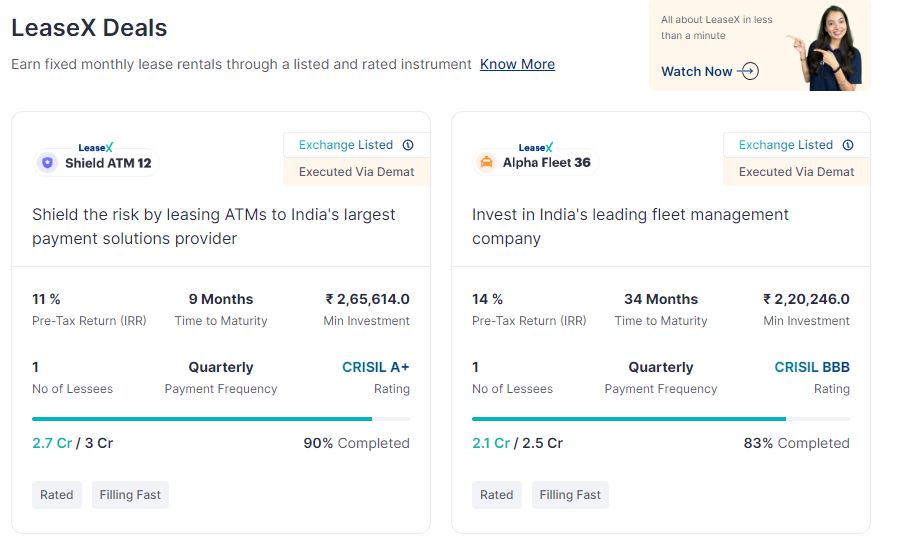

- Invested in Leasex Everest fleet deal on Grip offering 14%. We will soon have listed invoice discounting on Grip.

- Invested in 2 invoices on Leafround Round

- Participated in Earthern Hues at 16.07% on Jiraaf

- 2 Betterinvest deals are lined up this month

- All my Jiraaf Bonds: KNR Infra, Clayworks, Home credit, Bhanix, etc are repaying on time.

- Betterinvest deal offering 18% IRR Is live.

Update on Klubworks

Many investors have complained that they can’t access deals on the Klub portal. The primary reason is that they might not have registered through the randomdimes referral link as currently, Klub is only showing deals to investors who have been referred through randomdimes or other seasoned investors.

Telegram channel for details on new deals

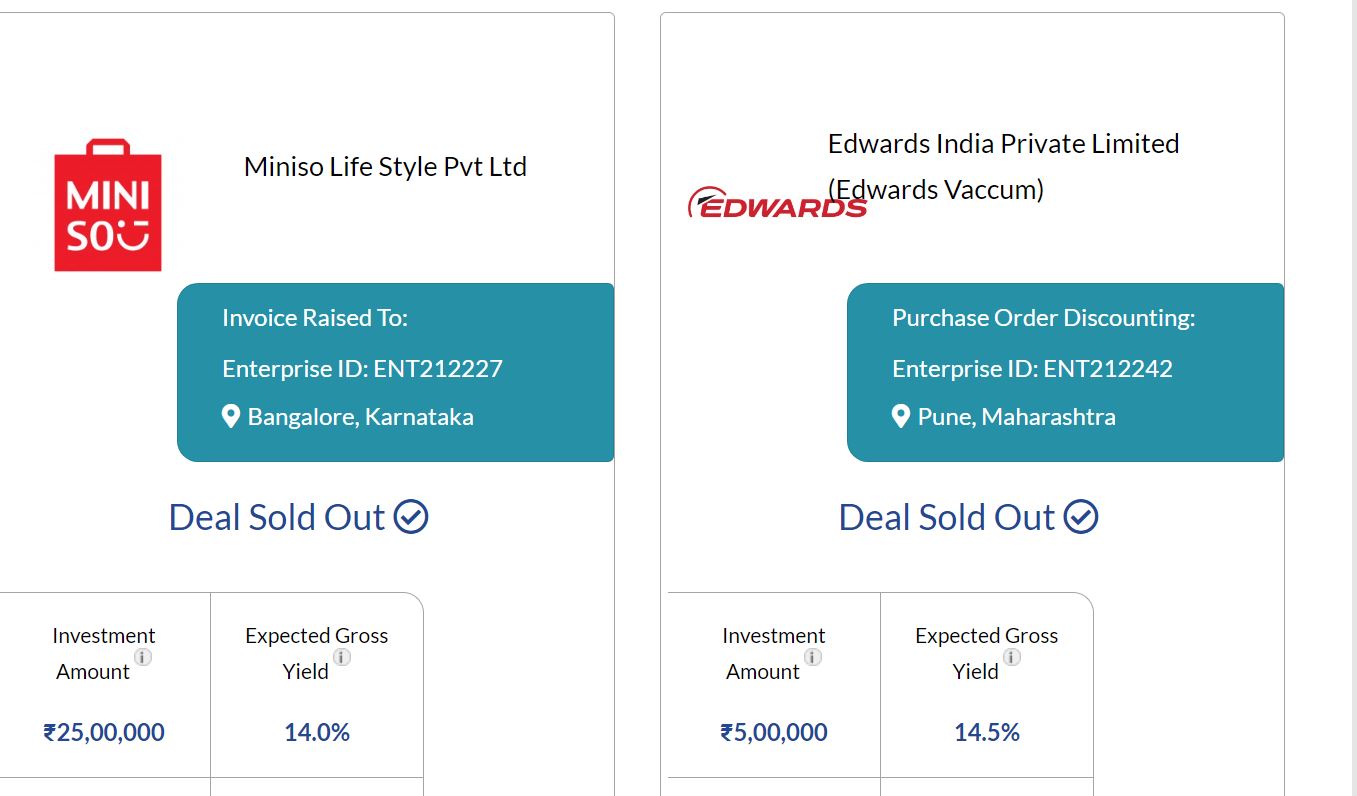

New Deals

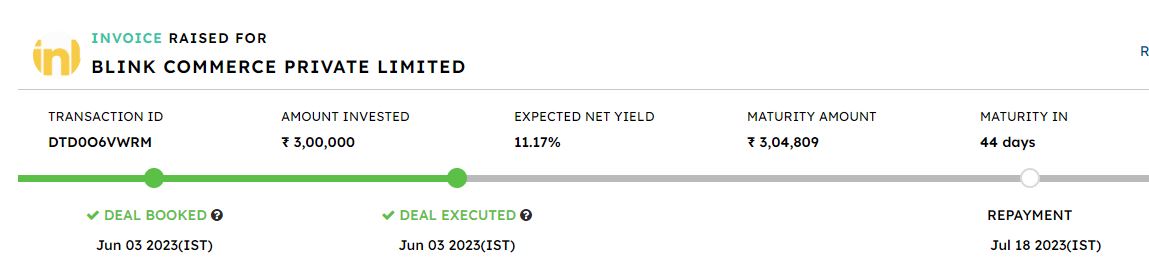

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | paused | Paused |

| KredX | 12% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity.

- Using Liquiloans/Per Annum to Park Short term capital

- Have invested in Kredx Blinkit last month. Maturity is expected this month. It is important to choose deals wisely on Kredx and not go by Kredx Score as some deals with high scores have not performed well in the past.

- Have stopped Cashkumar for the moment as no deal flow and visibility.

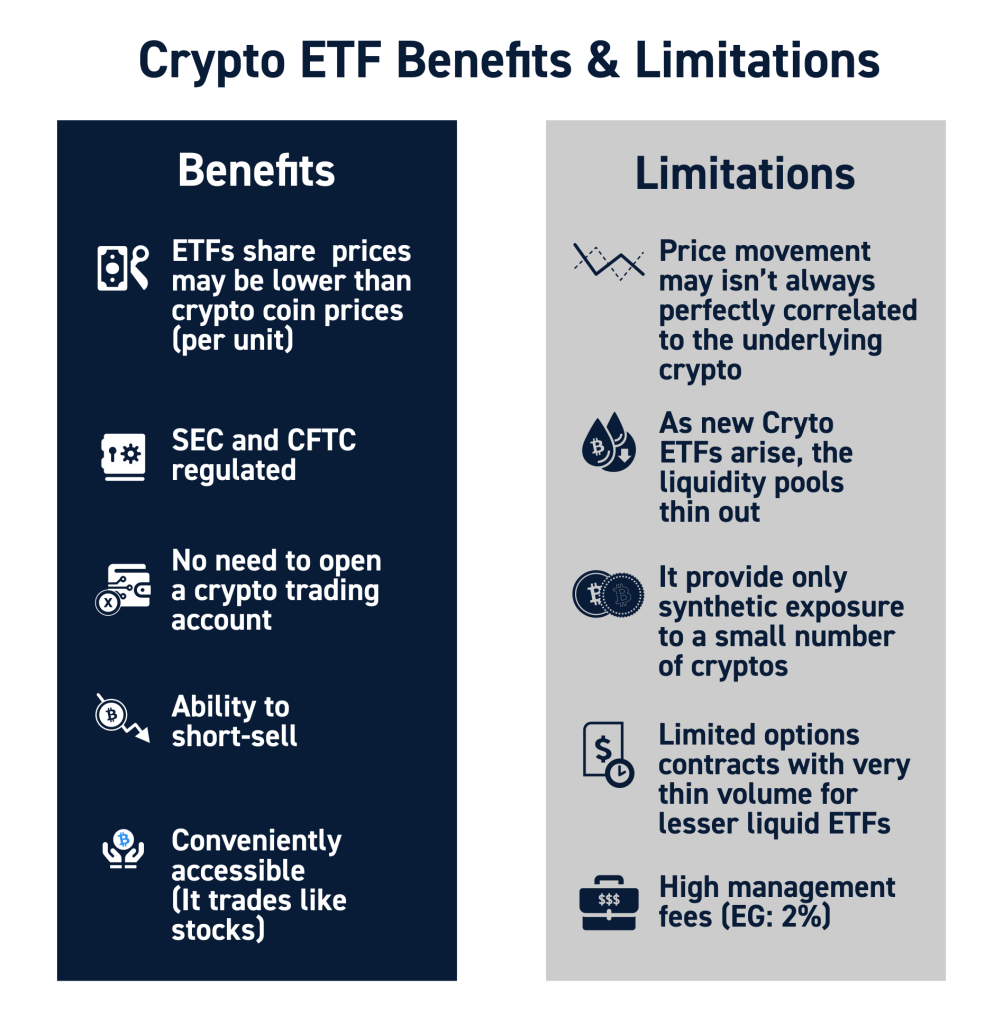

Crypto Investing

BlackRock’s filing for the first spot in Bitcoin Exchange-Traded Fund (ETF) marks a groundbreaking moment for virtual assets. Blackrock is a financial giant with more than USD 10 trillion in assets under management. This has led to optimism in the crypto industry and can push crypto prices as there would be increased demand from Institutional investors also.

You can buy Hardware Wallets on Etherbit as it is highly advised not to keep large amounts on exchanges.

P2P Investment

Current allocation:

- India P2P – 50%

- 12Club – 5%

- I2IFunding- 25%

- Finzy-10%

- Faircent Pool Loan -10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Paused) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.75% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- I have completed 1 year of using IndiaP2P with good performance. Will be adding more capital this month.

- I2Ifunding and Finzy have a very low volume of loans

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

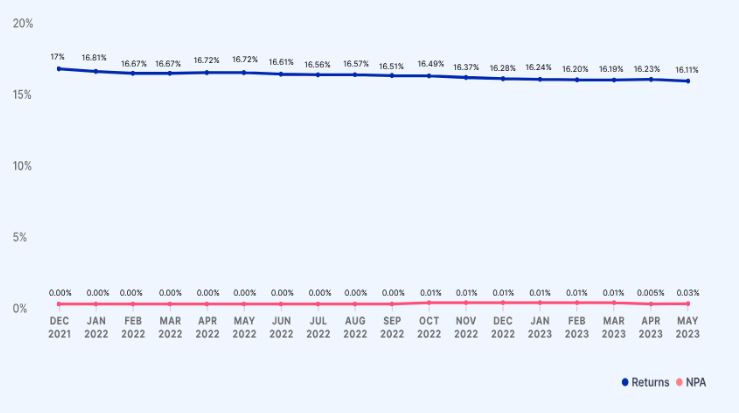

IndiaP2P Performance

Equity Market

PreIPO Stocks

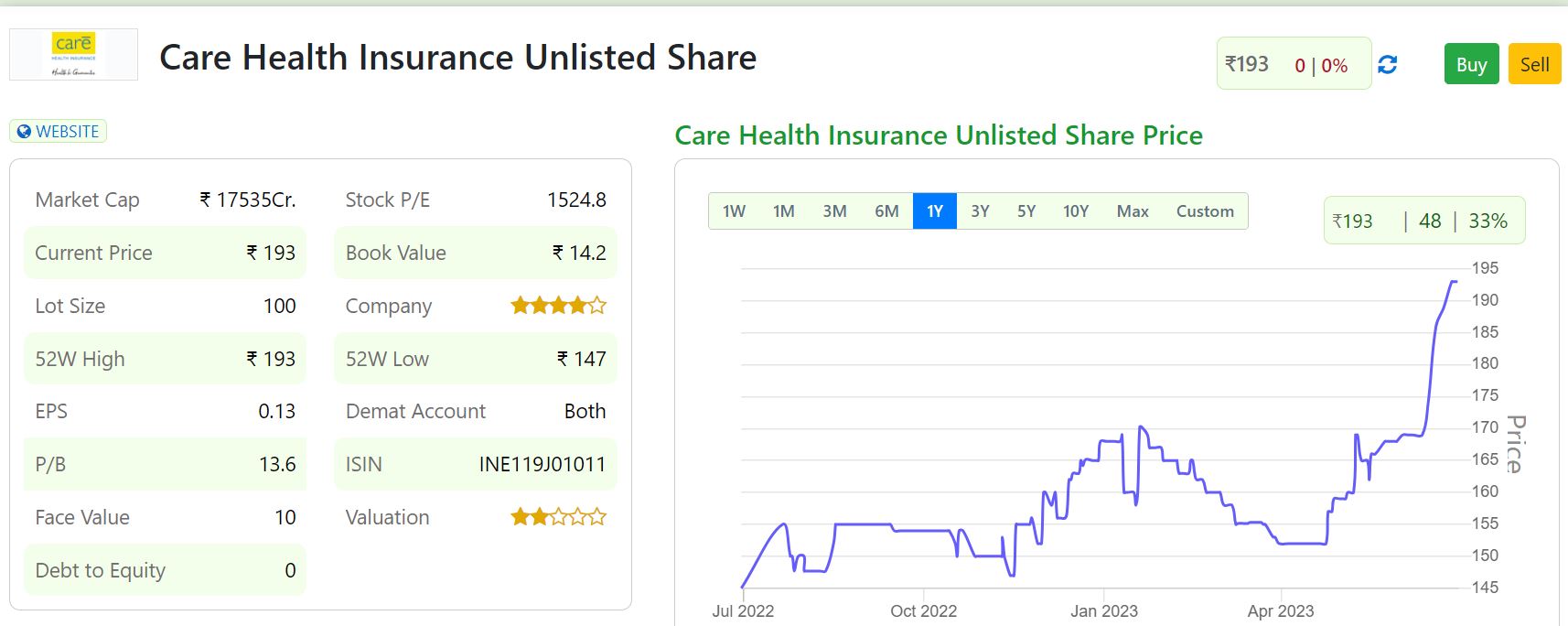

In the Preipo market lot of interest can be seen in 2 stocks

- Care Healthcare

- NSE

The primary reason for that is both companies are profitable with strong performance compared to peers. It is also expected by next year both will have an IPO.

The current price for NSE has gone over INR 3500 after a stellar performance in the last quarter. Unlisted Zone and Altius are offering the best prices. For a lot higher than 500 we can connect with some large brokers. You may drop a query to us.

Listed Stocks

The Equity market has hit an all-time high but valuation wise it’s still below 2021 levels. While some analysts are predicting 21000 by year-end investors should allocate based on their risk appetite.

Other Alternative Investment Assets and Platform Updates

Growpital Investment – The performance of the platform has been satisfactory till now. The latest webinar’s recording is available here

Growpital(Promo code GROWRDIMES)

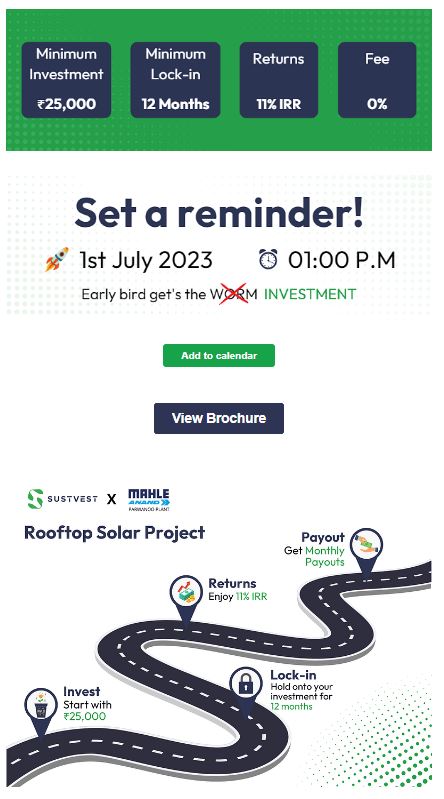

Sustvest Investment – My Sustvest Portfolio has been doing fine. There is a new deal live offering 11%

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. It is now called Yiedlwisex. They have recently closed a Lease rental discounting opportunity backed by real estate.