Last 15-20 days have been quite volatile for the global stocks , currency and commodity market after the onset of the CoronaVirus.

This is a perfect example of a black swan event which no one had imagined. People were debating on the Market valuation , US-China trade ,Middle east tension as factors which could destabilize the market and out of nowhere the virus hit the world and now every body is losing their mind.

Couple of positive things for people who invested in multiple low correlated asset classes rather than “ALL IN EQUITY” portfolio

- Alternative assets performance have been consistent till now thus my overall portfolio is doing fine even with the stocks down 10%.

- This is not the end of the world. Infact it is a good opportunity to start buying more equity underlying. Only those people can buy now who had kept allocation in other assets and can increase equity allocation now my putting money from other assets.

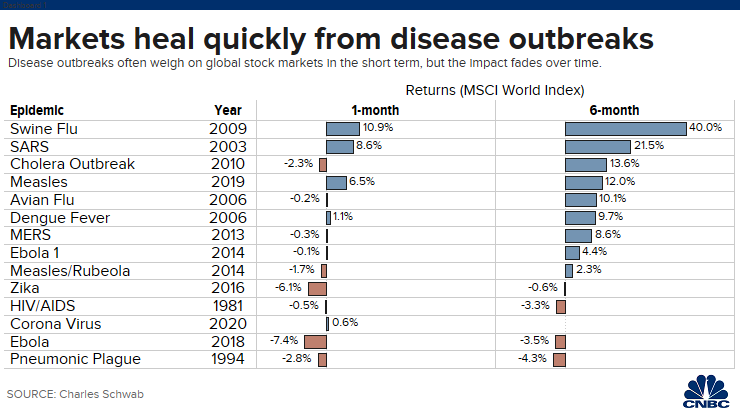

Below is a graph of how equity fared after a disease breakout!

The time to recover can vary and drawdown too but if you systematically keep increasing allocation with drop you will be better off in 3 years or so most likely.

Performance of my Portfolio:

- P2P Portfolio

- Invoice Discounting

- Global Portfolio

- Option Strategies

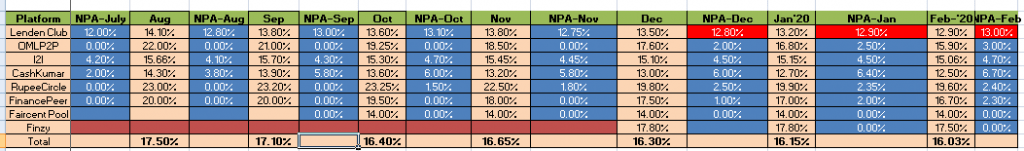

P2P Portfolio current yield and NPA:

I have made I2IFunding, RupeeCircle and Finzy as my core portfolio and others as supplementary as it has becomes too cumbersome to manage a lot of platforms simultaneously.

The returns have been consistent (+/-.5% deviation ).This month I will put some of the money which I had invested in Lenden/Cashkumar into Equity Market!

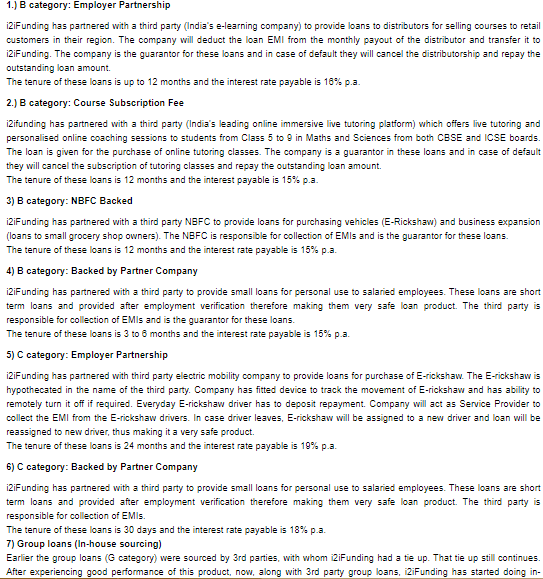

In terms of products I2IFunding has come up with the most versatile products. Here is a summary.

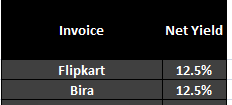

2) Invoice Discounting Performance

Invested in 2 new Invoices this month:

Considering the recent turmoil in Indian Corporate Market( Yesbank etc) it’s important to select only good quality names and not get lured by high yields

Invested in one Faircent pool Loan for Education @ 14%

3) Global Portfolio

Markets around the world got spooked in February. I see it as a good opportunity to start increasing allocation .The question was which market to choose : India or Global.

Considering how Indian had additional economic problems than just the virus fear I choose to invest majority in global. In Indian market I have a few SIPs running already.

Second point is if global market falls means Indian fall

but If Indian Fall does not mean global will fall as Indian market do not have any positive driver in the short term

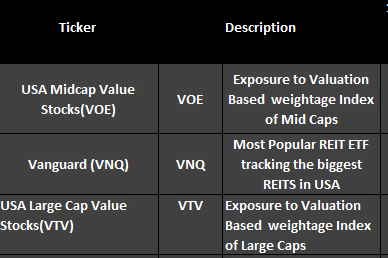

The Funds which I selected were:

The reason to buy these ETF were that I already have some allocation to them and was able to average them. I will again average if market tanks another 5-10% from current level else stay with current portfolio.

I am using stockal to buy ETF and vested for selected stocks( zero commission on stocks)

4) Current Option Strategy :

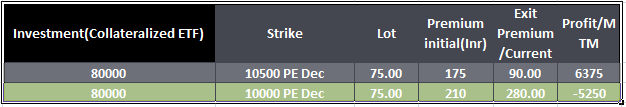

Feb/March Start was a complicated month in terms of trading. I made money in the first half of February but current MTM in my other position has offset the gain

After the budget Jitters market had gone back up and I was able to book profit in my first position.

I initiated a fresh position when market was near 11000 after the coronavirus outbreak. I sold a 10000 Dec put. The reason being :I am comfortable buying Nifty below 10000 for long term (Break even is at 9800).If that doesn’t happen I am happy with pocketing the premium.

The only problem is in short term due to high volatility my MTM losses can shoot up which is ok as the margin is availed through my collateral and does not cost extra money.

If market recovers to 11500 I will book profit else I will hold the put and maybe add some new position to reduce MTM losses.

I prefer selling Options when Implied Volatility is high. A good way to gauge implied volatility is check “India VIX ” ,its available as ticker on zerodha or you can check in the NSE website

Currently its at 25% which means Options are super expensive to buy hence you get good premium selling it.(it was 14% last month!)

Why Options are expensive now? because buying option is like buying insurance , after a catastrophe insurance premium factors in the risk hence become expensive to buy,hence buying options after market crash seldom gives good results.

Footnotes:

Global Investing Platform Stockal Discount Link

For global Investing through Vested

Use this to register and get 5$ in your account (https://app.vested.co.in/referrals?code=RORA74993 )

For buying zero cost MF and lowest Derivative Trading

For alternate investment you can use these links

Finzy Referral Code:

https://finzy.com/invest?partner=MAN635

or you can apply the code : MAN635

(First Use the link to register then add the Code “discount50@i2i” while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For specific queries ping me on 9967974993 or mail me on rohanrautela9@gmail.com