:max_bytes(150000):strip_icc():format(webp)/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

Returns on a portfolio are a function of two factors

- Risk

- Liquidity

Most people are quite rational when they factor in the risk of an investment but tend to ignore liquidity as a cost. If two products with similar risk are available it’s best to maximize the return for the target maturity of your investment.

Example :

- If 2 bonds of similar risk have significant difference between a 3 month and 6 month maturity and we do not want immediate liquidity we should choose the 6 month bond.

If we structure our portfolio based on our Liquidity and Risk demand we can enhance the portfolio yield with almost similar risk by matching the tenor with our liquidity requirement.

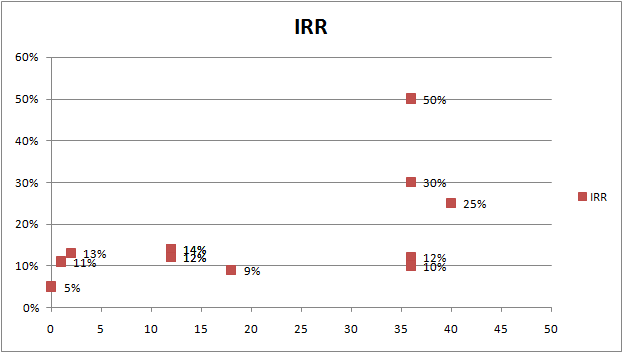

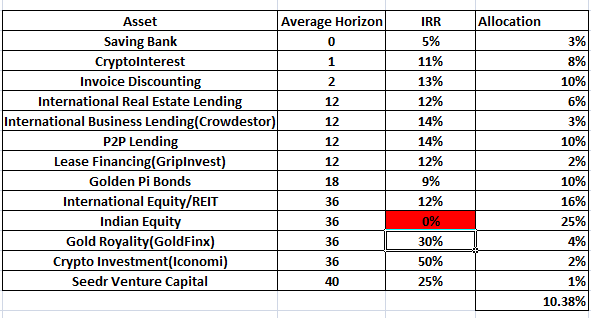

Here is a table of Tenor and Return potential of various Investments:

| Asset | Average Horizon | IRR |

| International Real Estate Lending | 12 | 12% |

| International Business Lending(Crowdestor) | 12 | 14% |

| P2P Lending | 12 | 14% |

| International Equity | 36 | 12% |

| Indian Equity | 36 | 10% |

| Invoice Discounting | 2 | 13% |

| CryptoInterest | 1 | 11% |

| Gold Royality(GoldFinX) | 36 | 30% |

| Crypto Investment(Iconomi) | 36 | 50% |

| Golden Pi Bonds | 18 | 9% |

| Saving Bank | 0 | 5% |

| Seedr Venture Capital | 40 | 25% |

| Lease Financing | 12 | 12% |

For Investment where we have long holding period like venture capital(Seedrs ),crypto (Iconomi Platform) and Gold mines(GoldFinX) we expect higher IRR compared to short duration investment like Crypto Interest account(Celsius Network,BlockFi,Youholder) or Invoice Discounting(TradeCred ).

We have 2 goals to achieve:

- Maintain Sufficient Liquidity

- Maximize Long Term Returns

To ensure our portfolio has enough liquidity we segregate the portfolio based on bucket. In a hypothetical scenario say we try to create a portfolio with atleast 25% of assets within 18 Months Liquidity.

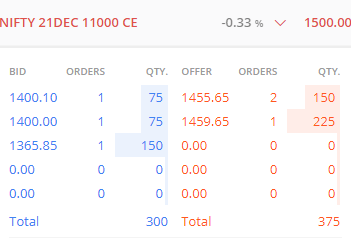

| Asset | Average Horizon | IRR | Allocation |

| Saving Bank | 0 | 5% | 3% |

| CryptoInterest | 1 | 11% | 8% |

| Invoice Discounting | 2 | 13% | 10% |

| International Real Estate Lending | 12 | 12% | 6% |

| International Business Lending(Crowdestor) | 12 | 14% | 3% |

| P2P Lending | 12 | 14% | 10% |

| Lease Financing | 12 | 12% | 2% |

| Golden Pi Bonds | 18 | 9% | 10% |

| International Equity/REIT | 36 | 12% | 16% |

| Indian Equity | 36 | 10% | 25% |

| Gold Royality(GoldFinX) | 36 | 30% | 4% |

| Crypto Investment(Iconomi) | 36 | 50% | 2% |

| Seedr Venture Capital | 40 | 25% | 1% |

| Net Return | 12.88% |

The total portfolio return is close to 13% with almost 40% portfolio available in the 12 Month period. Can we reduce the risk of the portfolio without impacting the return?

Let’s assume a situation when equity drops 20% and other asset remain unchanged( just for sake of example ). Now what will the be the total performance of portfolio?

Our portfolio lost 7% because of equity under performance . Can we restructure our portfolio to have same return with lower risk.

I will show you 2 ways in which we can do it!

- Taking Long Position in the market synthetically.

As of now we have 25% allocation to Indian Equity .Equity is a long term investment. Most people do not realise that they are paying a cost to hold equity. Think of it like owning a house. You expect the house price to go up in the long term but what if you do not keep any tenants? Theoretically you are losing the money which you would have earned maybe in a FD of that amount. It applies to equity as well.

Eg If we have a 1 Crore portfolio and 25 Lakh is equity then in 3 years we earn zero Interest on Equity( some dividend).

Let’s do some calculation:

Initial Investment in Equity = INR 25 Lakh

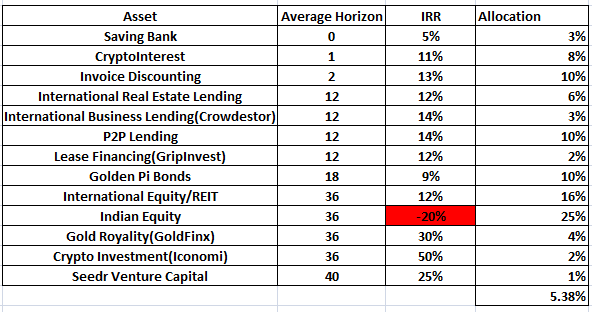

Interest on 25 Lakh in high rated Bond = 9%~

Golden PI bond list has few bonds in our criteria:

You can achieve higher return if you add Loan against collateral etc

So in 1.5 year with 25 lakh capital you earn = 25* 1.5 *9 =INR 3.33 Lakh

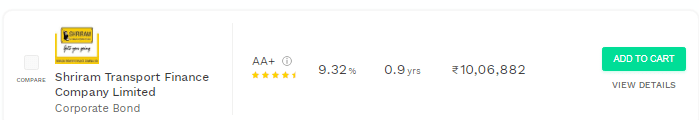

Now instead of buying 25 Lakh stock you buy Dec 21 11000 Nifty option :

You can buy in Zerodha or Upstox

1 lot is 75 nifty so for 25 Lakh you buy = 25Lakh/11000 = 225 =~3 Lots

Cost =225 * 1425 = 3.2 Lakh.

Now I can replace my stocks with bond + 1.5 year call option at zero cost.

Advantage is now you have zero downside risk of Equity volatility.

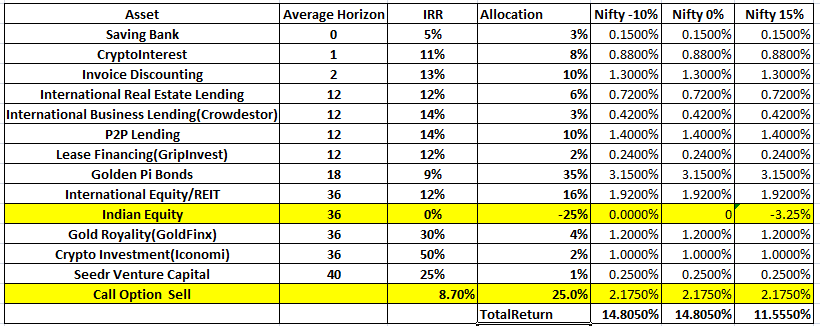

- Making Portfolio Market Neutral using Options

Lot of people in the current market are reluctant buyer.i.e they are holding on to the portfolio because they don’t want to keep lot of money in liquid fund but don’t expect much returns for the next 2 years and secondly there are people reeling under losses in the past equity investment and hoping the rally continues but also expect market to fall instead or are uncertain. If you are in these category you can structure the portfolio to make money even in flat to slightly bullish and bearish market also.

Instead of Buying the Call Option we can sell the Call option (As option are expensive these days):

Price is 1425 per lot for Dec 21 Nifty 11000 Call , we can sell 3 lots ,for margin we can use our ETF/Liquid Fund.

Now we buy the bond which will give us INR 3.3 Lakh and Sell the option which will give us INR 3.2 Lakh = INR 6.5 Lakh

so In 18 Months total return = 6.5/25 =26%

Portfolio Performance under various scenraio will look like this:

The Money we saved in stocks were used to buy bonds at 9% IRR and we got 8.7% IRR by selling the call(almost 17% IRR added). This is a good investment if market crashes or even goes up till 15-18% up in 1.5 year. You can further enhance yield by additionally selling shorter dated options deep out of the money on this portfolio

If people are interested in longer maturity options(18 Months+ ) and if its not available I can help provide liquidity for the same

Conclusion: This is a good investment strategy for people with large stock portfolio and who wish to reduce impact of any sharp equity correction in next few months or for people who want to generate yield in falling or volatile market.