Finzy review based on my 2 year experience. Recently RBI has increased the investment limit in P2P from 10 Lakh to 50 Lakh. This is a great move for P2P platform which will now attract lot of affluent individuals!

Update: I have done an in depth analysis and covered the covid-19 impact on portfolio

More investors means more crowding to invest ,hence it would be more difficult to find good loans. To prepare myself for this scenario I am exploring Finzy as a platform.

Now people can add other alternative investment along with Finzy such as Tradeced ,GrowFix and Grip Invest

I had opened the account long time back .Though due to the constraint of putting 50 thousand Rupees initially to start I was apprehensive and decided to give the platform a pass.

Some of my followers had invested in Finzy .They shared excel sheets of their performance with me for review . Most of the investors have been able to achieve between 15-18% .This is the amount of return I have been targeting from other P2P platforms. Some people have mentioned disbursal is slightly slower compared to other platform(7 Days time approx).

From next month onwards I will start publishing my Finzy portfolio along with other P2P platforms.The foremost criteria which I follow before investing in P2P is to check if the platform is RBI approved or not, which apparently Finzy is!

Some of the salient features of the platform are:

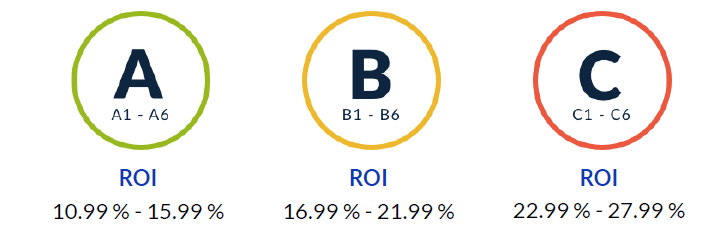

- Type of Loans: The ROI of the loans range from 11% to 28% and is divided into three categories viz A,B and C.

The minimum criteria is that the borrower salary should be more than 25000 per month and for business loan annual income should be more than 5 Lakh.

Finzy Default Rate Review

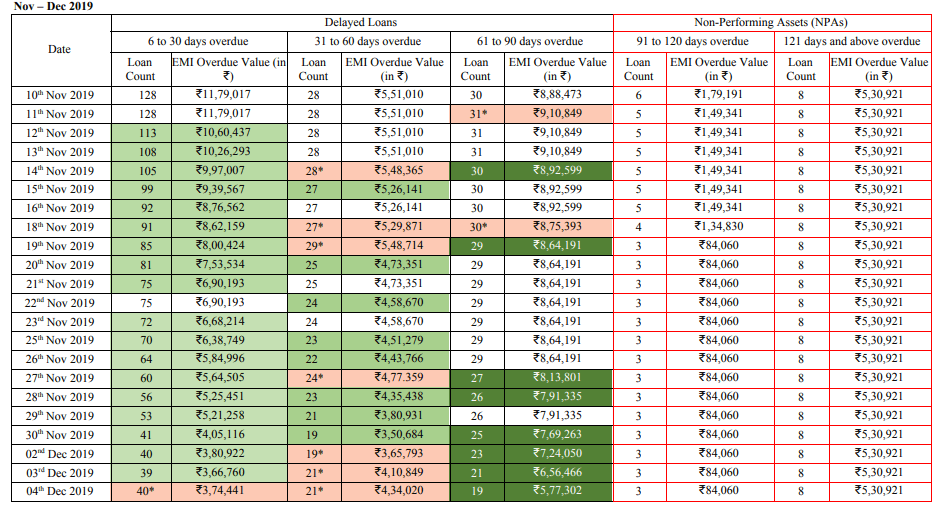

Interestingly Finzy is the most meticulous p2p platform when it comes to publishing data .They update the data on a weekly basis.

Loan disbursed has been more than 50 Cr , thus 5 lakh of default is less than 1%, but we need to note that some of the loans would be disbursed in last few months which may become NPA in future, still the performance seems good if we go by the data published on the website.

Credit Underwriting Review

They have created their own algorithm primarily based on the given factors:

Finzy Team Review

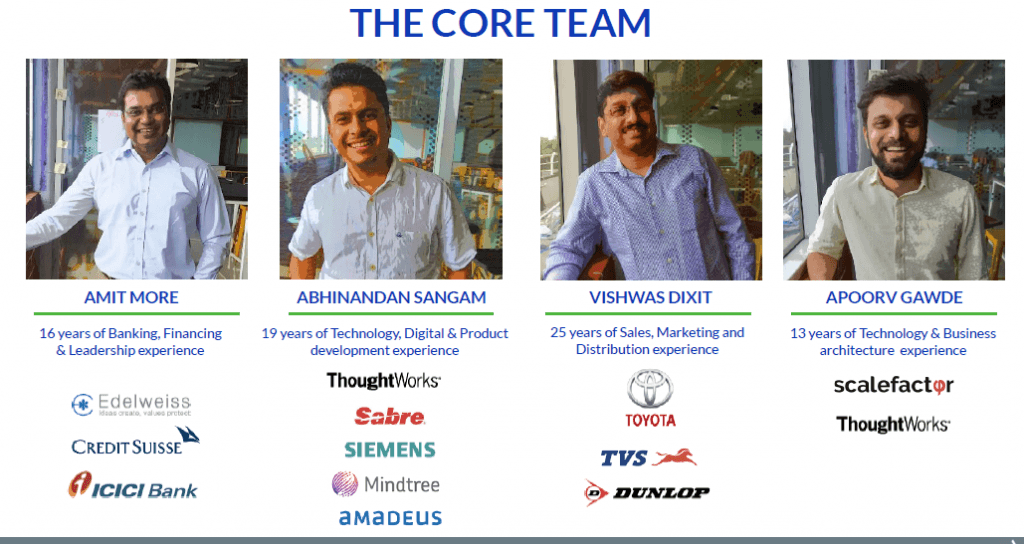

The core team has seasoned professional which is a positive. Off late I have noticed some platform have young entrepreneur.They tend to be really good with the technology part but they lack the experience to create sound underwriting process and marketing process to onboard diverse borrowers.

The Platform raised some 16 Crores from investors last year which will help in scaling up .

Finzy Fees and Charges

They levy a nominal 1% fees plus service tax only when we receive an EMI

.Charging fees with EMI and not at the start of investment put their skin in the game !

Also the fees is one of the lowest as of now among other platforms.

Conclusion

Based on the positive feedback of few followers of my blog and some people in my network and looking at the various attributes I have decided to give this platform a shot. The only bummer is we need to put 50k as the initial amount .

I will publish my experience investing on this platform every month from now onwards

You can register using the Referral code (Registration Free of cost)

https://finzy.com/invest?partner=MAN635

or you can apply the code : MAN635

How has been your experience with finzy so far?

Thanks

Finzy has been really good considering covid was a tough situation. Offcourse yield will be lower than Ruppeecircle