In India Real Estate Investment has traditionally been a source of wealth generation. The new generation has started investing in other asset classes too but still lot of people buy Flats as an investments.

Flats are good for living but as an investment they are risky because of:

- The sheer amount of money and leverage we have to take to invest in them

- We take a very concentrated bet on a specific locality and apartment which is a two way sword.

- Another problem which most people do not realise that they invest all their income in India which makes it highly susceptible to country risk(Political issues,economy problems etc)

What are the options for people who want to add real estate to their portfolio with lower risk and lower asset allocation and also want to diversify the country Risk?

The answer is International REIT !

What is a REIT?

A real estate investment trust, or REIT is a type of company that allows investors to pool their money to invest in real estate assets. Some REITs simply buy properties and rent them to tenants, others develop properties from the ground up, and some don’t even own properties at all, choosing to focus on the mortgage and financial side of real estate.

You can think of a REIT like a mutual fund for real estate. Hundreds or thousands of investors buy shares and contribute money to a pool, and professional managers decide how to invest it.

Why do companies launch REIT?

- To monetize cash yielding assets which provides capital for investment

- Because REITs are required to pay out most of their income(90%), they are treated as pass-through entities and are only taxable at the individual level thus saves tax for corporates.

Advantage of REIT buyer

- REITs can be a source of reliable, growing income. Because most property-owning REITs lease their properties on a long-term basis, REITs can be nicely set up for steady income, quarter after quarter. There’s definitely far less variance in the quarter-to-quarter profits of well-run REITs than there is for most other companies, including those that are generally thought of as “stable.”

- REITs can be a smart way to add diversification to your investment portfolio. They’re technically stocks, but they represent real estate assets, and real estate is generally considered a separate asset class that isn’t closely coordinated with the stock market.

- If you want to invest in real estate, REITs can be a very easy way to get started. There’s excellent return potential in owning investment properties outright, but lot of effort is involved with direct real estate investments ,and you have to pay for lot of additional charges for brokerage,maintenance etc.You can buy shares of any publicly traded REIT with the simple click of a button, and without any ongoing maintenance worries.

- As REIT distribute most of the earning as dividend you get high dividend and also access to long term growth of underlying real estate!

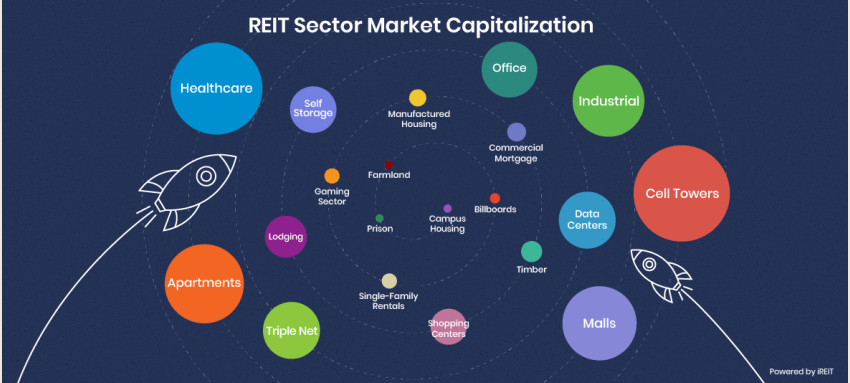

Types of REIT:

There are multiple type of REITs (more than 300) depending on what kind of underlying property, and each can explored in depth .Some of the types are

- Mortgage REIT

- Office REIT

- Residential REIT

- Healthcare REIT

- Datacentre REIT etc

Most REIT are equity REIT while few are Mortgage( i.e they don’t own underlying asset but invest in Mortgage Backed Securities or originate mortgages )

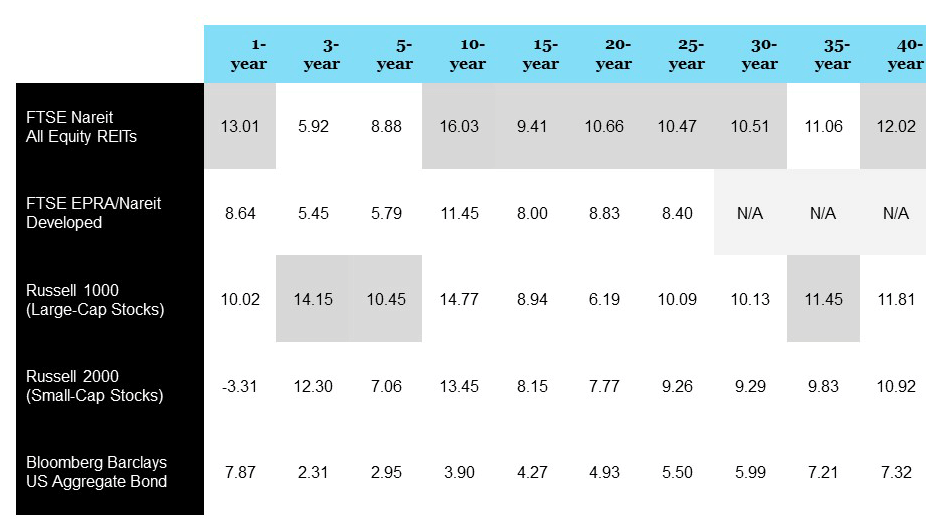

REIT Historical Performance

REITs have historically outperformed stocks in the long run .It does not mean people stop investing in stocks but they should allocate a part of their investment in Real estate through REITs

Performance in the Indian Context:

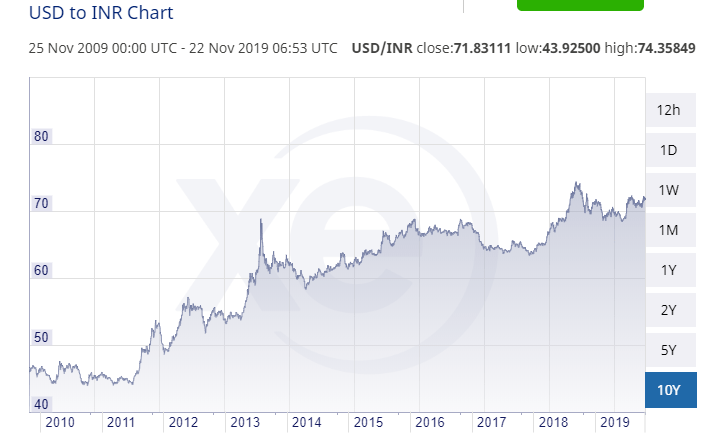

Interesting international REIT investment has couple of more advantage to the Indians

- It isolate us from an Indian specific risk ie. political or economic

- We make money on dollar appreciation

As we all know India has higher inflation than dollar and historically rupee depreciates around 3-4% annually against dollar. This depreciation will be added to our returns which can take our total returns more than 15% annually!!

In the last 10 years INR has 4.5% annual depreciation which means if I add it to total market REIT return of 16% we would have made 20%+ .

Obviously what happened in past might not happen in future but we can take it as benchmark to evaluate future returns,

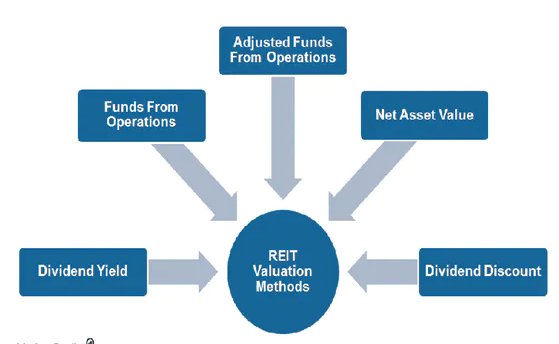

REIT Valuation:

Here are some valuation parameters which we should understand if we wish to buy individual REITs

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs purchase properties based on estimated cash inflows from that property over its life term, not on earnings or historical book values. In this case, the assets are more important. REITs are valued based on three main techniques namely FFO (funds from operations), AFFO (adjusted funds from operations), and NAV (net asset value)

Fund From Operation (FFO):

FFO is a measure used by REITs to evaluate the cash generated from their operations. The formula is:

FFO = net income + depreciation and amortization + impairment charges + losses from sale of property – gains from sale of property

Adjusted Fund From Operation(AFFO):

FFO doesn’t deduct the capital expenditures required to maintain the existing portfolio of properties that’s required to sustain properties’ economic income. In other words, FFO tends to overstate a REIT’s profitability. In order to correct this anomaly, some adjustments need to be made to FFO to arrive at a REIT’s cash flow.

AFFO = FFO – recurring capital expenditures +/- adjustments for straight-lining of rents.

Recurring capital expenditures in the above formula are those that are necessary to maintain properties and income streams like new carpet and drapes, appliances, leasing expenses, and tenant improvement allowances.

NAV: One of the most important valuation metrics for REITs is NAV. It tries to determine the underlying value of a REIT. NAV is the market value of all the assets, including cash and indirect property assets, net of liabilities and deliberated dividends or distributions.

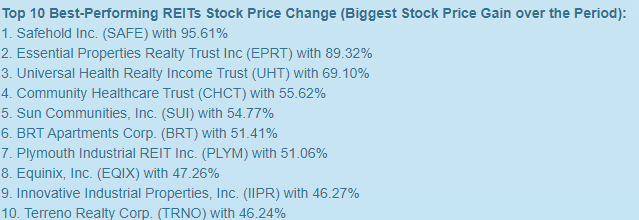

Top REIT returns(1 year) :

REIT ETF:

Lot of people do not have bandwidth to learn about each REIT and then analyze it. REIT ETF gives us an opportunity to invest passively in an Index which has market weighted pool of REIT.

The biggest benefit of REIT ETFs is that they let you get diversified exposure to just about every different type of REIT there is. It’s true that REITs are already diversified because of their extensive real estate holdings, but it’s rare for REITs to invest in more than one or two different types of properties. Investors are used to REITs being tied to a specific property class, and so a REIT that sought to be a jack of all trades in the real estate market wouldn’t get the positive reception that you might expect.

In addition, REIT ETFs save you from the complexity of having to put together your own portfolio of individual real estate investment trusts.

There are two main downsides to REIT ETFs. First, using an ETF won’t give you as good returns as you’d get if you made a successful bet on a specific, particularly well-managed REIT. In other words, diversification can work against you if you accept average returns for the sector rather than concentrating on the best players in the industry. In addition, ETFs impose an extra layer of fees, and although those costs aren’t generally very high, they still represent a reduction in the amount of income you’ll receive from your REIT investment.

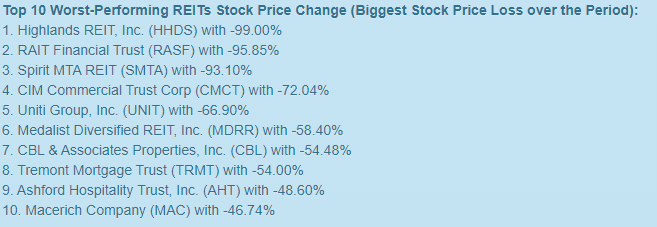

In USA more than 50 REIT ETF are publicly listed. Here is a snapshot of the top performer !

REIT ETF return( YTD)

How to buy REIT ETF?

Until now the only way was to set up an account in a foreign broker which was both cumber some and expense but recently STOCKAL has made it very easy for Indians to invest overseas ( Annual limit for Indians to invest overseas in a year is 250000 USD).

The platform is pretty easy to use and also provides various performance charts and matrices.

You can set up the account using the given link

https://www.stockal.com/signup

Then you can choose the plan :basic , silver or gold membership depending on how much you wish to trade.

After payment you need to add : “Randomdimes” in partner id to avail offers and discounts in various features platform will be launching and also getting better rates in renewing.

(The account is held in a foreign brokerage firm “Drivewealth” and is insured upto 500000 USD.

The benefits of setting up an International Investment account are numerous:

- No home country bias: You reduce the risk of local economy shocks which have become quite probable now

- . You can gain from rupee depreciation.

- Unlike Indian mutual funds, ETF globally have very low fees (.2-.5% range)

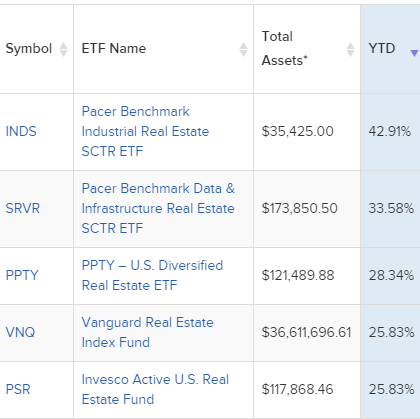

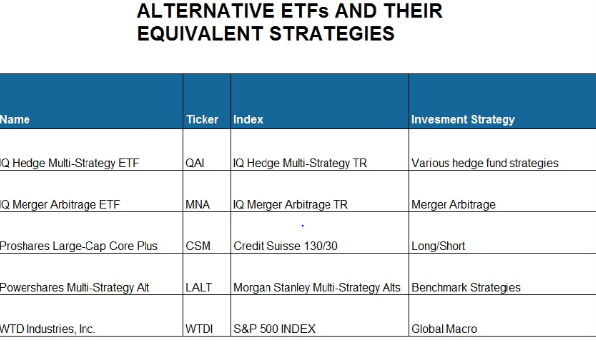

- You get exposure to unique assets of developed Markets after from stocks. Some of them would be

- REITs

- Event Driven Funds

- Private Equity ETF

- Long Short strategies

You can check out some of the interesting ETF

I will be covering all these products in the future and will soon start sharing my overall portfolio allocation and best performing assets across the globe!

People who want specific details of how I invest in REIT and International stocks can also drop me an email

Footnotes:

To invest in global assets register here

https://www.stockal.com/signup

under partner ID use “Randomdimes” to get additional future benefits and renewal discounts

For buying zero cost MF and lowest Derivative Trading

For alternate investment you can use these links

Finzy Referral Code:

https://finzy.com/invest?partner=MAN635

or you can apply the code : MAN635

(First Use the link to register then add the Code “discount50@i2i” while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com