We all know the benefits of doing Systematic Investment Plan(SIP) .It helps to average our buying cost and negate some of the impact of volatility.Many website allow you to calculate return if you do SIP based on average mutual fund performance.

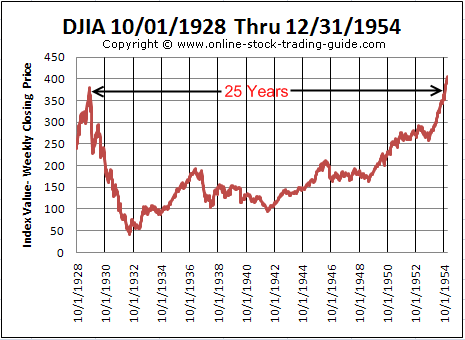

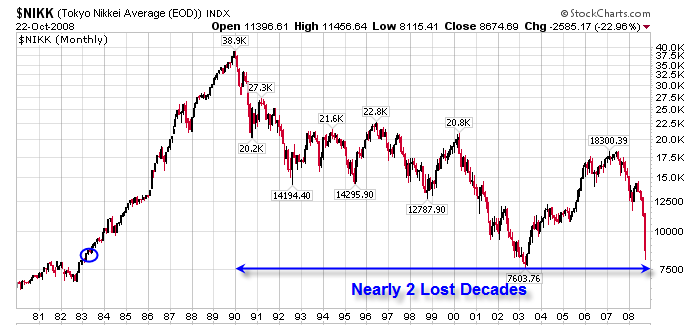

The million dollar question is how would a SIP performance look like in a major market downturn and how effective it is compared to a lumpsum investment. In the past 100 years 2 major market crashes stand out.The great depression of 1929 and the Japanese stock market crash.I dont consider 2008 crash as an issue ,it is pretty obvious the duration of the recession was not much and people who kept on investing made money.

Lets see if those recession happen today what catastrophe we would be dealing with! Look at the charts of the two brutal crashes,both lasted decades.

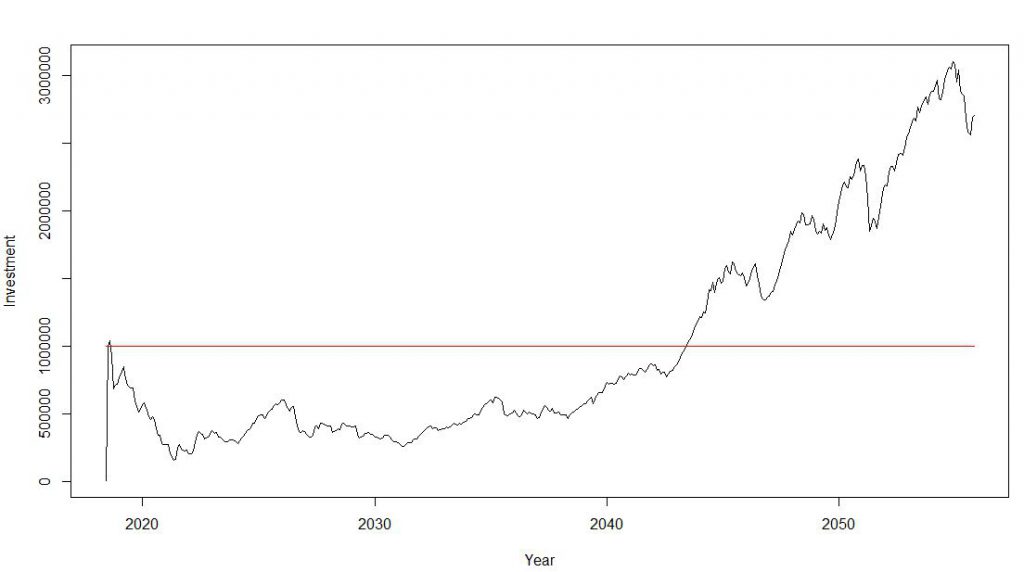

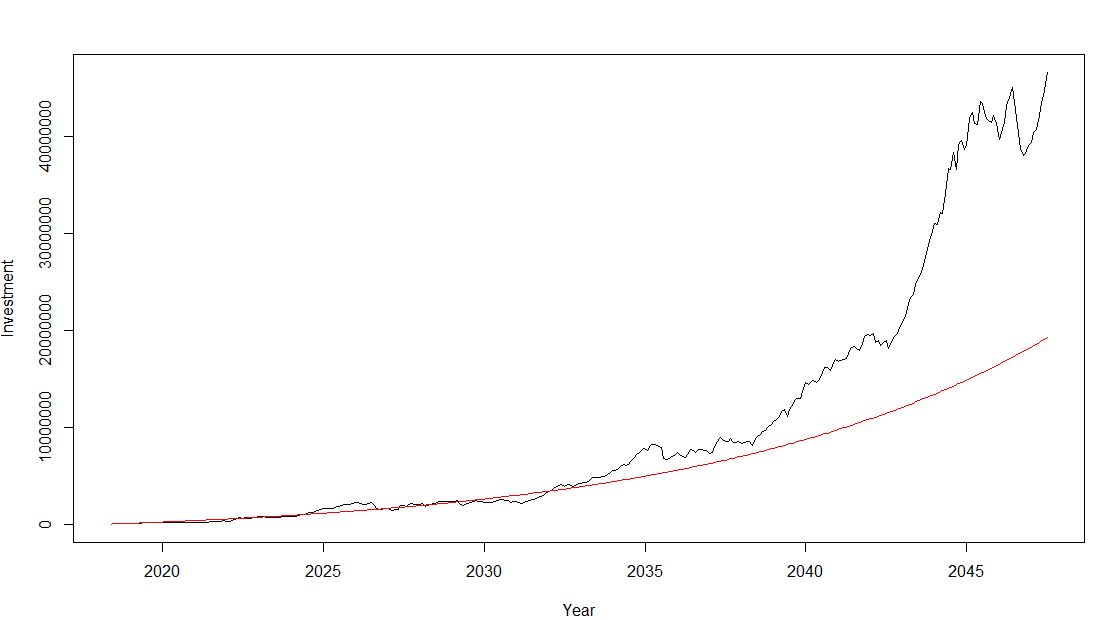

I will superimpose monthly return of S&P levels of 1929 to current Nifty levels. So Lets say Indian market enters a great depression and on top of that our poor investor had just started his systematic Investment Plan.Our investor doesn’t panic and he keeps on investing . Lets see how his wealth and fortune will change.

- Great Recession Super imposed on Nifty (10000 considered as starting point).

- Someone who would have entered lumpsum today would take 25 years just to break even!!!.You can see on the graph the initial level is attained near 2043

- Maximum drawdown would be 85%.For 1000000 invested he would lose 850000!!

.How does SIP payoff perform?

- I have plotted graph of SIP monthly investment vs SIP performance.(black line is the growing SIP contribution,red is the value of assets)So in 2035 (17 years) we would be break even and most of the time our drawdown are not bad. compared to Lumpsum. Worst drawdown is -350000 .We can clearly see our investment are less volatile ! Infact by 2043 our investment would have grown by 80%

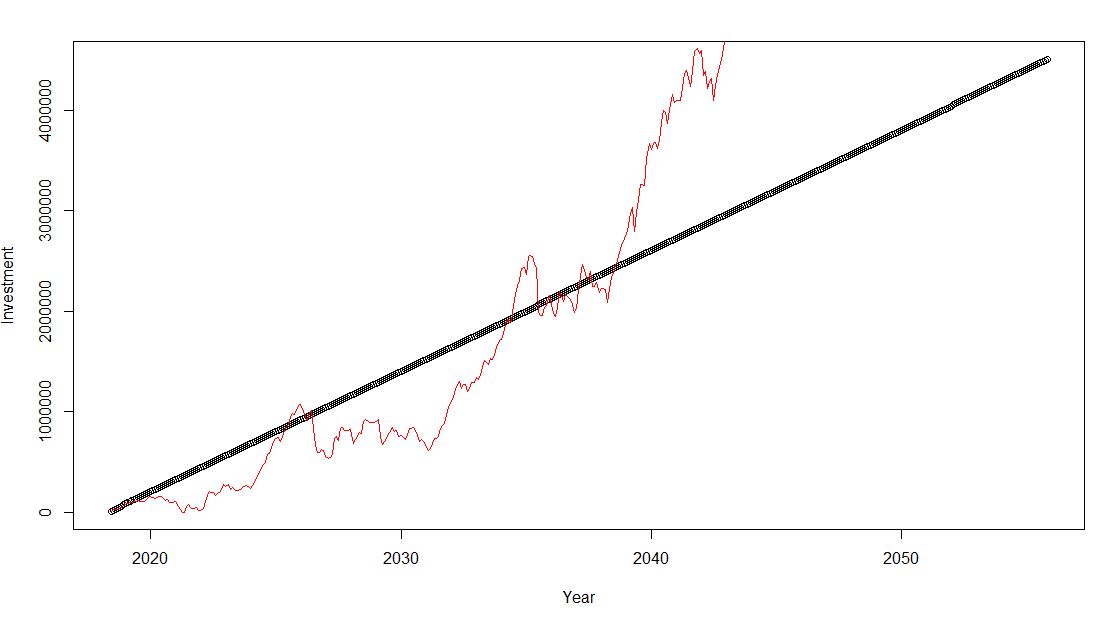

Incremental SIP

Now what happens if I increase SIP .08% every month ( assuming people generally grow salary at 10% a year.Take a monthly percentage which will compound to your annual growth number).

We can see our profit and loss volatility drops further. We are averaging more at a lower level ! In 7 years we are breakeven and beyond 2040 profits are going to rise up exponentially

Comparison Constant SIP vs Incremental SIP:

Lets compare the returns for 25 years( i.e as of 1/07/2043). We use XIRR when we are considering periodic cashflow. Basically XIRR tells us the net return when cashflow are erratic

- XIRR for Regular SIP = 5.77%

- XIRR for Incremental SIP = 7.52%

For the Lumpsum investment we will consider CAGR (Compounded Annual Growth Rate).

- CAGR for lumpsum = .08%

So we see Incremental SIP is the best followed by regular SIP and the Worst is Lumpsum.

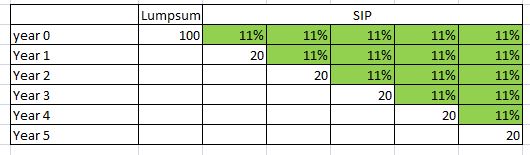

People generally tend to think if they dont put all the money in equity at one go they will miss the rally.Actually difference between SIP and Lumpsum is the incremental return you get for holding the asset till SIP starts.If we can find good money parking method our SIP can beat Lumpsum even in bull market. As we know long term equity average return is around 11% .If we can find an asset to park close to 11%( highlighted in green,20 bucks parked in those assets) we are almost replicating the market with added advantage of very low volatility!

Points to Consider

- Always go for SIP to avoid huge draw downs

- Gradually increase the SIP based on your earning growth even when market is going down.

- One big factor is in a recession people will lose their job or will have lower income so its almost impossible to rely on external cash inflow for continuing SIP.It is therefore very important that people only put a part in SIP and rest in some other assets which they can use to continue there SIP under adverse situations

- As we see if we can find good money parking assets then we do not miss the opportunity cost of not being fully invested in market and also lower the risk of stock market volatility

- I will show in my next post how Peer to Peer lending(P2P) can be used to create an ideal platform to perform SIP.

this is probably the only place where i have come across SIP stress testing. Good effort and idea..

Keen to learn from you..