What is settlement Finance and how does it fit in my asset allocation?What’s the difference between Invoice Discounting and Settlement Finance?

I have covered Invoice Discounting in my earlier post:

What is Invoice discounting?

Invoice discounting is the practice of using company’s unpaid invoices to raise working capital & fulfil its financial needs. Traditionally, financial institutions including banks and NBFCs have been discounting invoices for MSMEs. Invoice discounting involves transfer of rights on an asset (invoice) from the seller (i.e. business) to the financier (i.e. investor) at an agreed value

The process is a simple method used by companies to generate working Capital. Let’s say company A provide some services to company B.

Company A : mid sized enterprise(SME)

Company B: Blue chip company.

Now B has to pay A money for the services. A raise invoice for the payment. B being a big company takes 2-3 months for the payment.

Now A does not want to wait for the money as it needs immediate cash which can be deployed in business. Here comes invoice discounting.

- The firm A borrows money from an investor keeping the invoice as collateral

- The investor does not pay the full face value of the invoices; instead it pays the firm a percentage, 80-90%

- As the investor now owns the unpaid invoices money , the money due from the end customers is credited to the investor

- When the end customers pay the invoices, all the money goes to the investor

- Thus investor had put in 90 bucks and got 100 end of 3 months which is the interest he earned.

The advantage over corporate FD is that this funding is backed by invoice as collateral and is thus a secured funding.

The companies which are going to pay are blue chip thus unlikely to default.

Company A is legally liable to pay you even if company B does not honour the invoice.

All transaction take place in escrow account thus is reasonable safe.

What’s Settlement Finance?

Settlement Financing is a unique product that addresses a specific trade credit use case in India. When a consumer swipes a credit/debit/atm card, the amount is deducted from his/her account immediately. However, the merchant (receiver) has to wait 1 day for these funds to reach their account from the bank. This 1-day capital gap causes cash flow issues in businesses. Settlement financing provides 1-day loans to business that want to reduce their cash flow impact while waiting for transactions to settle from the day prior

The Platform works with registered payment intermediaries/aggregators who gives real time cash receivables to merchants/ATMs post which the money is received by Platform in an escrow account the following day. Post settlement of lenders cash settlement amount, remaining money is passed to the payment intermediary/aggregator

What risks are involved?

In terms of actual empirical data on risks, TradeCred has facilitated over 350 crores of Settlement Financing till date with ZERO default and ZERO delays till date.

To mitigate these risks:

- TradeCred does not fund any transaction more than INR 10,000.

- TradeCred funds only maximum 90% of the total transaction volumes. Just to get a sense, overall fraud risk in the card payments system in India is less than 0.10%.

How It is regulated?

It is a platform, and not the beneficiary of the funds nor the owner of funds.

Type of Deals available on TradeCred?

TradeCred has both type of deals:

- Invoice Discounting ( Min 3 Lakh)

- Settlement Financing (Min 50 Thousand)

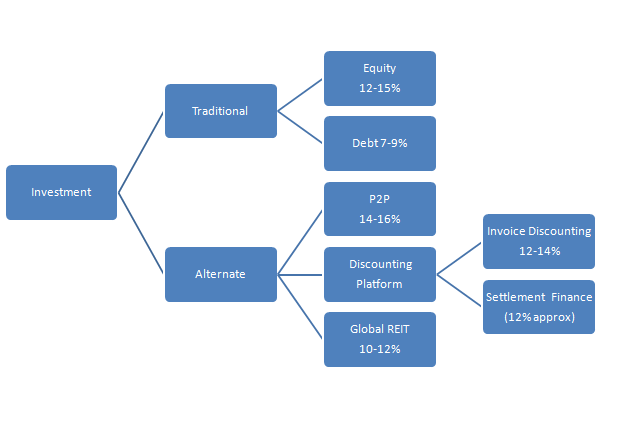

Flowchart of expected Return and allocation in various available alternate

To register on TradeCred use the link :

https://buy.tradecred.com/onboarding/apply-now/TC0152

For Invoice Discounting on other platforms mail me on rohanrautela9@gmail.com or ping me on 9967974993

Footnote:

Note: For alternate investment you can use these links

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993

Great article! I had never heard about Invoice discounting before, but after reading this and later other articles available, I got a good understanding, associated risks and returns. Then after, I also spoke to both TradeCred and Kredx. I’ve actively started with TradeCred Sep 2020 and so far invested into Coca-Cola, RentoMojo and Godrej deals.

Though the net IRR has come down to ~11.5 to 12%, it is better than fixed deposits, with some additional risks.

Great ! do keep us updated with your experience