Mr X want to invest 1,000,000 INR in equity Mutual Fund. We will assume he is making a lumpsum investment .He wants to stay diversified so he picks these 3 mutual funds:

- Kotak Select Focus(60%)

- Reliance Large Cap Fund(20%)

- Reliance Small Cap Fund(20%)

What does the combine portfolio of all three mutual fund look like:

- Total Portfolio had 216 Securities

- Adding up common securities we get 190.(26 securities were common)

- List of top holding in consolidated portfolio

| No | Name.of.the.Instrument | Weight(%) |

|---|---|---|

| 1 | Cash | 8.53 |

| 2 | HDFC Bank | 5.60 |

| 3 | HDFC | 3.53 |

| 4 | ICICI Bank | 3.37 |

| 5 | Larsen | 3.31 |

| 6 | Reliance | 3.03 |

| 7 | Infosys | 2.14 |

| 8 | SBI | 2.03 |

| 9 | IndusInd Bank | 1.98 |

| 10 | Hero Motocorp | 1.96 |

| 11 | Maruti Suzuki | 1.96 |

Few things are evident.

- Its not as diversified as he thinks.Quite a few overlapping securities

- More than 30% is put in 10 securities out of 190

- Around 8% portfolio(80000 INR) is in cash.

Now I segregate the portfolio based on market cap size.I have created 5 categories(Mega Cap Stocks> 50000Cr,Large Cap 30000>&<50000,MidCap>10000&30000,Small Caps<10000).

- Mega Cap Stocks:37.316 %

- Large Cap Stocks: 5.756%

- Mid Cap Stocks: 9.098%

- Small Cap Stocks:39.296%

- Cash: 8.534%

Now I check the cheapest ETF and Index Funds available in the market in various market cap categories(liquidity in ETF is important).I choose the 2 products:

- ICICI Pru Nifty ETF

- Reliance Junior Bees( Index Fund Tracking Nifty Next 50)

*As of now no liquid ETF tracking Nifty Next 50 so we use Index Fund.In future we may get good ETF substitute

Performing the same segregation for ETF and Index Funds I get :

- Nifty 50 :Mega cap 95.62%Large Cap 4.14% Mid Cap 0%,Small Cap 0%

- Nifty Next 50:Mega cap 40.65%Large Cap 37.40% Mid Cap 20.57%,Small Cap 1.14%

I want to add a small cap fund to get exposure to small caps

- Portfolio allocation for Reliance Small Cap:Mega cap 1.89%Large Cap 1.80% Mid Cap 3.30%,Small Cap 83.28%,cash 10.73%

Now If i wish to replicate my MF portfolio I will need to find the weights to put in ETF and Funds to achieve portfolio level allocation :

if w1 weight in Nifty 50

w2 weight in Nifty Next 50

w3 weight in Small Cap Fund then

Let Matrix A be the matrix of Allocation in my funds

| Nifty 50(%) | Nifty Next 50(%) | Small Cap Fund(%) | |

|---|---|---|---|

| Mega Cap | 95.62 | 40.65 | 1.89 |

| Large Cap | 4.14 | 37.40 | 1.80 |

| Mid Cap | 0.00 | 20.57 | 3.30 |

| Small Cap | 0.00 | 1.14 | 83.28 |

B Matrix is the output Matrix:

| MF Portfolio | |

|---|---|

| Mega Cap | 37.32 |

| Large Cap | 5.76 |

| Mid Cap | 9.10 |

| Small Cap | 39.30 |

This is an over determined Matrix. We can solve this using ordinary Least Square or linear programming.Simple solver in excel can also solve this.

Solving overdetermined matrix i get :

| Allocation | |

|---|---|

| Nifty 50 | 31% |

| Nifty next 50 | 16% |

| Small Cap Fund | 47% |

So If I put the given amount in these 3 funds I will be able to replicate the MF.I still have 6% left. I put that in Nifty Next 50

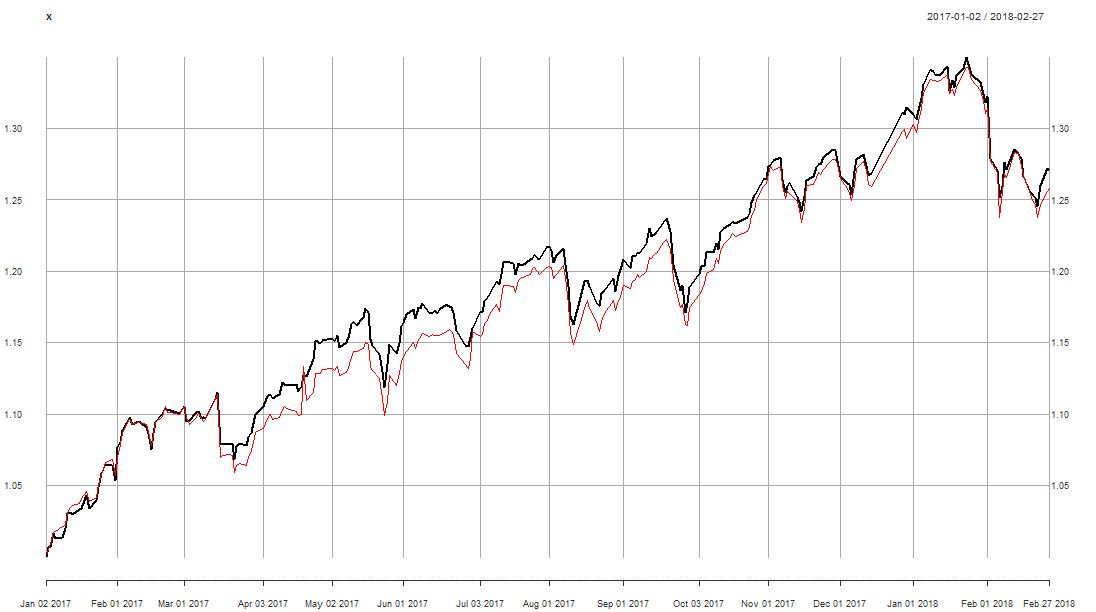

How does this portfolio performs in comparison to MF portfolio .Almost Similar Performance!

lets Compare Volatility:

MF Portfolio Volatility:12.27%

Replicating Portfolio:11.5%

Why did our portfolio show Lower Volatility.One reason is because we are more diversified than MF portfolio though allocation wise we are similar( remember we have all top 100 Securities,making us more diversified stock wise). Secondly in active management Fund manager is not only churning the stocks but also cash.Being overweight cash in a fall and then under weighing in rally can have a leverage like effect.

The advantages of having a large part of portfolio in ETF and Index and some in small cap fund has lot of positives apart from obvious lower cost

- You dont run the risk of a fund managers under performance .Picking the right Fund is like picking a stock and ending up with a bad fund can cause lot of damage.The risk of manager’s discretion in fund management is eliminated in ETF

- You actually know allocation of your portfolio

- Using various Index option Strategies to hedge or for gaining yield is very easy as we have direct underlying to Trade.

- During market crash you can just buy the market rather than hoping that fund manager correctly guesses the sector which will bounce back.

- Mutual Fund lack transparency.No clear demarcation in categaorization ,you end up aggregating similar stocks through multiple funds .No realtime tracking of mutual fund portfolio.You have to trust their NAV numbers.

The bottom line is invest in Index ETF and Nifty Next 50 ETF and then choose a small cap fund wisely.You dont have to fret about 100 funds now!!!Happy Investing

Very nice and easily explained.. Thanks!!

Thanks for sharing this information..have shared this link witrh others keep posting such information..

I’ve been following u on quora

Today I need your advice on some of my cash lying idle

Regards

Dr tayal

Hi, you can drop me a mail at rohanrautela9@gmail.com