Peer to Peer lending is a mechanism where people can invest or borrow money from other people through an online platform. These companies provide a market place for loans like Amazon and Flipkart provide for buyers and sellers. It has been very successful in US and UK.Basic Features of P2P lending are:

- Unsecured Lending for a tenor from 6 months to 3 years.

- Regulated under RBI policy

- Invested money is returned in the form of EMI (Prinicipal + Interest)

- Interest Rate vary from 12% to 36% depending on credit risk of the borrower

- Each platform has its own credit risk analysis report for borrower which is available for Lender to read.

Three important questions to consider in P2P lending

- Why P2P lending?

- Which Platform to Invest?

- How to Invest?

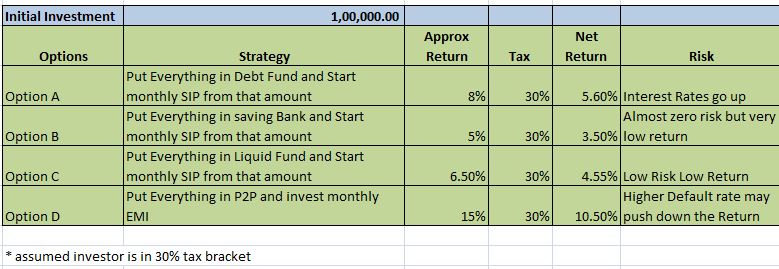

Why P2P Lending: How do people generally invest for SIP ? They keep their money in either saving bank or RD,some put in Liquid Fund and rest put lumpsum in Mutual Funds( either Equity or Debt) .We have already discussed SIP has better risk return reward compared to lumpsum. Comparative Analysis of parking money in different assets for SIP:

These figures are for putting money for 3 years.beyond that we can utilize indexing benefit to put some money in Debt funds

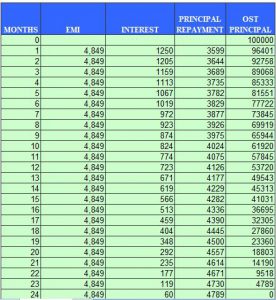

How does P2P lending EMI return look like? If the Return is 15% and Tenor is 2 years

We can either invest the SIP in equity mutual fund or we can reinvest to more borrower:

Which Platform to Invest?

There are many P2P lending platform available in the market .I have tried quite a few and then finally choosen 3.Things to look before choosing a platform

- Credibility:Should be known and trusted name

- Minimum amount to invest should be less.

- Large number of borrowers.

- Good borrower analysis and data available.

- I suggest to atleast invest in 3 different platforms.

The platforms which I have chosen are:

- I2I Funding (https://www.i2ifunding.com/referral/ud8cwng83a/invest)

- Faircent

- lendenClub

Comparison

I have chosen these 3 as they are established names and also provide decent minimum investment .

How to Invest ?

Investing in P2P is like betting on a borrower that he wont default. So if we know approximate default rate we can calculate the risk adjusted return .P2P sites have historical default rate for various risk categories

This approach in investing is based on the Kelly formula which is employed by gamblers in casinos. It is an optimization strategy which maximizes long term returns.In simple terms it says that you increase your bet size when chances are favorable and reduce when chances are not so favorable.

Kelly Formula is basically

x = ( Expected net payoff ) / (Payoff on Success )

=( Probability of success* (Amount you get in success) – (Probability of failure* loss in Failure))/ (Amount you get in success)

Lets see some example:

A)

So lets say a loan in Category F has 5% historical default rate and you get 25% interest.

So your bet size according to Kelly is :

Probabilty of success = 95%

Probability of default = 5%

(25%*95% – 100%* 5%)/25% =75%

It means you can put 75% of your bank roll in this bet

B)

loan in Category C has 1% historical default rate and you get 20% interest.

So your bet size according to Kelly is : (20*99% – 1%* 100%)/20% =94%

It means you can put 94% of your bank roll in this bet

Basically you are better off in second .So you should put higher money in second bet.

Now with Principal Protection: Max loss is zero

Company pays 15% Interest ,default percentage is 5%

Kelly Ratio = (95%* 15% – 5%* 0)/ 15%

= 95%

It is common sense that principal protection lower our max risk and thus bulk of our earning should be in it!

Important thing is expected payoff works when we have many outcomes. How do we get many outcome.We place small but multiple bets.

Let Say Somebody has 100000 to invest .How should he invest.

- Diversification 1 : Choose multiple platform to avoid risk of bad credit risk model in any one platform

- Diversification 2: Place small multiple investment based on expected payoff.

- Diversification 3: Use principal protection as it has high expected payoff.

So how will 100,000 invested look like:

Put around 70% in I2I under principal protection.For some very safe creditor you can choose 75% protection instead of 100%.

so Now 70% of 100000 invested means : 70000

Average return :15%

Default Rate : lets take a stressed figure of 10%

net Return = 13.5% = 9450 Rs

Invest the remaining in Faircent and Lenden Club across borrower.Try to invest minimum bet size as you can place multiple bets:

Average Return 30%

Default Rate 10%

Net Return = 30*% 90% – 10% loss on Principal = 17%

So you get 17% of 30000 = 5100

In total you made= 5100+9450 = 15500 rs on an Investment of 100000.

Things to consider:

- keep Reinvesting the EMI you get in lending or use it as SIP for Mutual Fund.

- Use P2P as a replacement for you short term(less than 3 years) money parking strategy if you are in 30% tax slab.

- For tenor higher than 3 year Bond funds give better risk adjusted return if you in 30% slab.

- Try to use at least 2-3 Lakh INR to be able to be diversified across decent number of borrower.

- Remember P2P is substitute for money kept in FD or short term debt not for Equity SIP

- Its a great way of diversifying in asset class not highly correlated with Equity

i2i has stopped providing capital protection. thus the article needs to be modified. Is there any other platform that provides capital protection?

Yes you are right !I2I has stopped providing Capital protection for sometime.

No platform is allowed to provide capital protection anymore as RBI does not allow platforms to make any promise of principal guarantee .

Hopefully in future RBI might start allowing P2P to offer protection again