With the growing size of the book finding volume becomes important and I will have to look for more platforms which can provide good risk adjusted returns. Any suggestions are welcome!

I have compiled my latest portfolio performance with NPA

Initially for the first 7-8 Months realising NPA and delinquency was a challenge .If you act too conservative and book all the delinquency as NPA it will become lot compared to the Interest earned because you are booking losses upfront while the good loans will be giving interest gradually over a period of time.

Once the portfolio has matured you have enough closed loans and NPA to get an exact picture and the returns start becoming consistent due to the vintage.

A shortcut method for a new portfolio to guage performance is to see if the Interest earning growth is faster than NPA amount after 3 -4 months of Lending. Basically if the gap between the 2 is increasing positively it will continue to increase and if your NPA are growing faster than your Earning then you need assess the strategy.

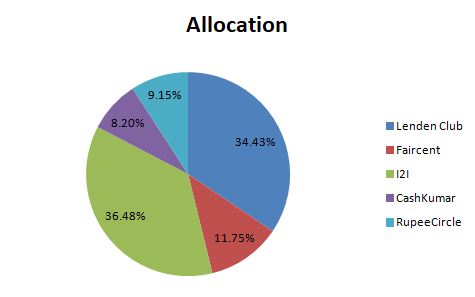

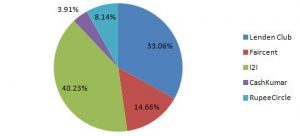

Portfolio Composition

March Allocation

February Allocation

Portfolio Changes:

- Still withdrawing EMI from Faircent and putting them in Lenden

- No changes in I2I except the EMI are reinvested

- Fresh Inflows to Cashkumar and RupeeCircle.

- Plan to have almost 30%-35% exposure in RupeeCircle + Cashkumar in the next few months

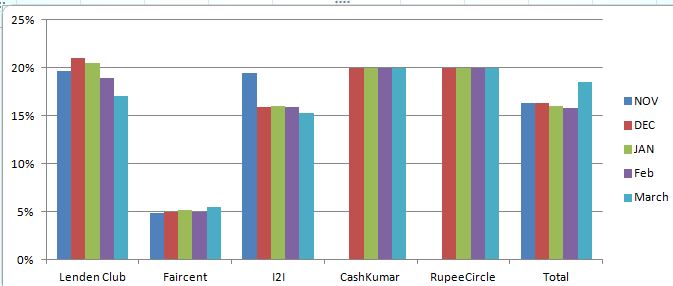

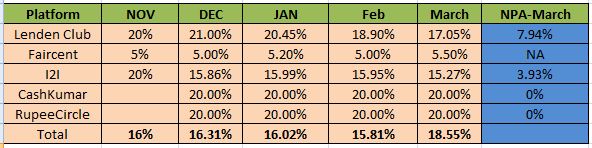

Portfolio Performance:

- March ROI seems higher than other months. Main reason for that is I have increased exposure in RupeeCircle and Cashkumar while reduced in Faircent and they have zero NPA till now

- NPA for Lenden is twice of I2I but the average ROI is also almost 2X of I2I which makes them almost at par.

- In Lenden I have put everything in auto disbursement and almost 85% exposure is in “Unidentified Category”. Basically here I am not trying to do my own evaluation but randomly lending with very small ticket size(500). Maybe if someone evaluate the loans they might be able to generate slightly higher return but it would be a pain evaluating each 500 Rs loan

- 50% of my I2I NPA is because of one loan which I had disbursed when I was new to the platform. I made a mistake of disbursing 10000 in one go. This highlights how important diversification is in P2P . For platform like I2I where ticket size is 5000 you should stick to that size and not disburse more than that to one loan.

- RupeeCircle surprisingly has shown no delinquency till now. I expect some delinquency in the future. Till then I can enjoy my returns.

- Cashkumar , I have observed few delays but no defaults till now.

1 Year Review of The P2P platforms:

LendenClub:

Pros:

- Lot of Loans, idle cash is not a problem.

- High ROI, relatively low fees.

- Auto disbursal which makes the process almost automated

- Small ticket size of 500 makes diversification easy

Cons:

- Collection process is not very transparent.Status of Defaulted loans not available on platform.

- Customer service is not very good. Have to send multiple mails to resolve queries

Advise: Use it for short term ,hassle free lending with 500 ticket size. Expect returns between 13-16% without doing any analysis of the borrower.

I2I Funding:

Pros:

- Detailed analysis of listed borrowers ,easy to evaluate

- Good collection activity,Many delinquent loans end up as active loans again due to collection follow up.

- New category of X rated Loans with small minimum ticket of 1000 and short duration available now to help diversify.

- Good customer service

Cons:

- less number of loans available at a given time. Need to proactively find loans on the platform to lend

- As minimum ticket is 5000 need more capital to diversify effectively. With the new X category loans this might get sorted to an extent

Advise: Use this platform for good quality loans . Can put 20-25% in short dated loans as they are new and their performance history unavailable. Preference order should be Government employees ,Salaried people and then genuine business men whose details are available on social media platforms too.( D and E Category Loans)

RupeeCircle:

Pros:

- High ROI loans available (24-30%)

- Wide range of tenors available and abundant loans

- No Defaults till Now(still a new portfolio)

Cons:

- As minimum ticket is 5000 need more capital to diversify effectively.

- Loan charges(50 Rs) for any loan makes it better for loans more than 15 months

Advise: Use this platform in compliment with I2I as ticket size and tenors are similar. With the high ROI,availability of loans and less NPA this may become a good performer in the coming months

CashKumar:

Pros:

- Very High ROI (42%)

- Very low Fees (0.75%)

- All salaried Borrower

- Minimum Ticket is 2500

Cons:

- Available Loans frequency on platform changes periodically

Advise: Good platform for short dated( <12 Months) loans. Can be used with Lenden as a money parking vehicle because of high liquidity due to short nature of loans.

.

I have been evaluating few other platforms .The major issue is that most don’t have enough volume to put substantial amount of money.

Footnote:

I2I Account Referral Link(Use Code I2I50%DISCOUNT while paying to get 50% off,Mail me after registering to get further benefits)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

Mail me to get Cashkumar Referral

Hi sir, i am srinivas from bangalore. Please share the Cashkumar Referral code. Currently i am using I2I funding P2P platform, After i went through you articles, i wanted open an account in cashkumar to park my money on short term basis.

Thanks Srinivas