People keep asking me which is the best mutual fund?

Which is the best stock in long term?

Will Crypto make it big?

Is Real Estate better than Stock ? Is P2P lending good?

I should be honest about it that I dont know the exact answers of these questions ! I can only predict based on the historical data I have .Maybe If we do a million simulation of the future in some simulation you make a killing in crypto and in other its a dud.

The point is there are some controllable variable and some uncontrollable. We focus too much on the uncontrollable and too less on controllable.

For instance we want to buy the best MF! what is the best MF ? Its a function of the fund manager ,what if the Fund manager leaves. How good is our strategy now.!

The aim of investment should be to take exposure of the uncontrollable to the extent we can tolerate. Do not bite more than you can chew.While on other hand controllable variable should be exploited to it fullest potential .

So how should the strategy look like.

The 3 very important tenets of investment are

- Saving

- Asset Allocation

- Liquidity

Each can make or break the investment goal. I have prepared a simple excel tool to optimise these three aspects.

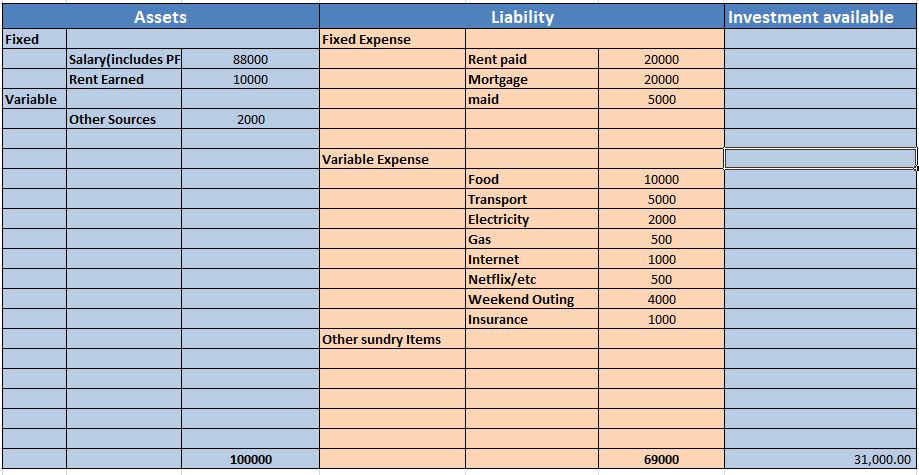

Lets take an example of a 30 year old guy. He is able to make 100,000 per month ( which includes salary,PF, rent etc)

STEP 1: Before even starting to invest he needs to be cognisant of the assets and liabilities. Its paramount that you calculate all your monthly fixed and variable expense .You should be able to predict 95% of your expenses.

How you save will have more impact than your choice of MF investment on the end corpus. I will demonstrate that shortly.

One thing which is very important is Insurance: health and Life . You do not want any health emergency to jeopardise your retirement corpus.

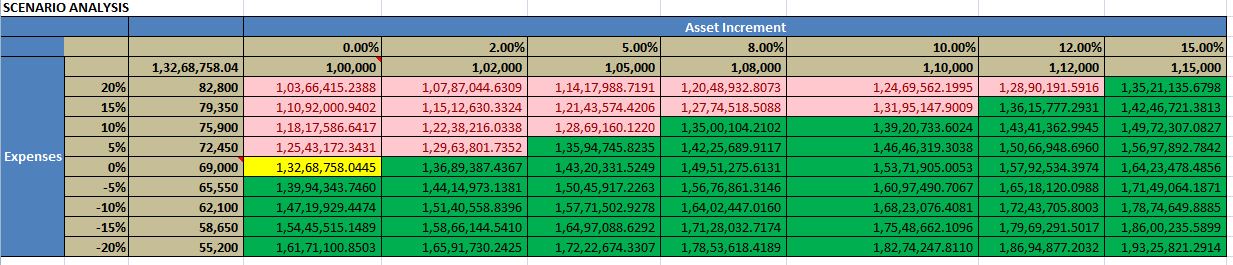

Lets see the sensitivity analysis of impact of small change in saving and small hike in assets on the end corpus considering same investments.

Here my portfolio is giving 11% IRR approx for 10 years.I have calculated end Copus at various expense and salary levels

It is evident that by reducing 20% expenses and increasing earning by 15% I end up 50% higher corpus in a period of 10 years!!

This is very much in my control .How to do it .Very simple Have 2 different account

- Salary

- Investment

As soon as you get salary transfer everything except your monthly expense to a different account. Use the other account for transferring SIPs etc.

If you think you are making some unnecessary expenses ,cut them, Instead of splurging money on fine dine every week do it alternate or monthly etc. Everybody has their vices and their priority and they can cut expense based on them.

I used to spend lot of money on gym supplements. I realised only after wasting lot of money and time that most were marketing gimmicks and I perform better even after not using 99% of them.Worst part was I used the same account for investment and expenditure and every month used to fall short of my goal to invest. A disciplined approach will go a long way

If you do not track your expenditure you will never realise that you overspend! Take ownership of both : your assets and your Liability.

In my next post I will demonstrate how I can optimise my investment and liquidity.