Introduction

MarketsMojo is a fintech company based in Mumbai, India, founded in 2015 by Joyson Thomas and Mohit Batra. It operates as an algorithm-based research platform focused on publicly traded stocks, aiming to simplify investment decisions for retail investors, financial advisors, and brokerage firms. The company has developed a unique system that analyzes vast amounts of data to provide insights into stock performance, helping users make informed choices in a complex market environment. With a valuation of $9.89 million and $445,000 raised in seed funding, MarketsMojo has carved a niche in India’s growing financial technology sector. It competes with firms like Pico, Two Sigma Investments, and Trendlyne, offering tools to analyze stocks across various parameters such as quality, valuation, and financial trends.

This article provides an in-depth review of MarketsMojo, exploring its features, business model, strengths, and areas for improvement. It examines how the platform serves retail investors and institutions, its competitive landscape, and its potential impact on the investment ecosystem. By analyzing its offerings objectively, this review aims to help readers understand whether MarketsMojo aligns with their investment needs.

Company Background

MarketsMojo was established by Joyson Thomas and Mohit Batra, both seasoned professionals with extensive experience in financial services. Joyson Thomas, a co-founder, previously served as CEO of Moneycontrol.com for 17 years, bringing deep expertise in financial data and investor behavior. Mohit Batra, the current CEO, holds an MBA and a PhD in FinTech, with a career spanning over 25 years, including roles at Moneycontrol, ABN AMRO Bank, Motilal Oswal, and Alchemy Capital Management. Their combined experience led to the creation of MarketsMojo, with a mission to democratize stock market research by making it accessible and understandable for retail investors.

The company started with an initial funding of ₹4 crore and later raised ₹2 crore in 2016, diluting a 3% stake at a $10 million valuation. Today, the founders hold a 70% stake in the company. MarketsMojo employs a team of 12 as of May 2025, with key members including Karan Batra (Chief Product Officer), Rohan Thale (Chief Technology Officer), and Rageesh M (Head of Technology), many of whom previously worked with the founders at Moneycontrol. The platform has grown to serve 1.2 million registered users, with around 100,000 paid subscribers, and manages portfolios worth ₹65,000 crore, including ₹6,000 crore under direct advisory services.

Core Offerings and Features of Marketsmojo

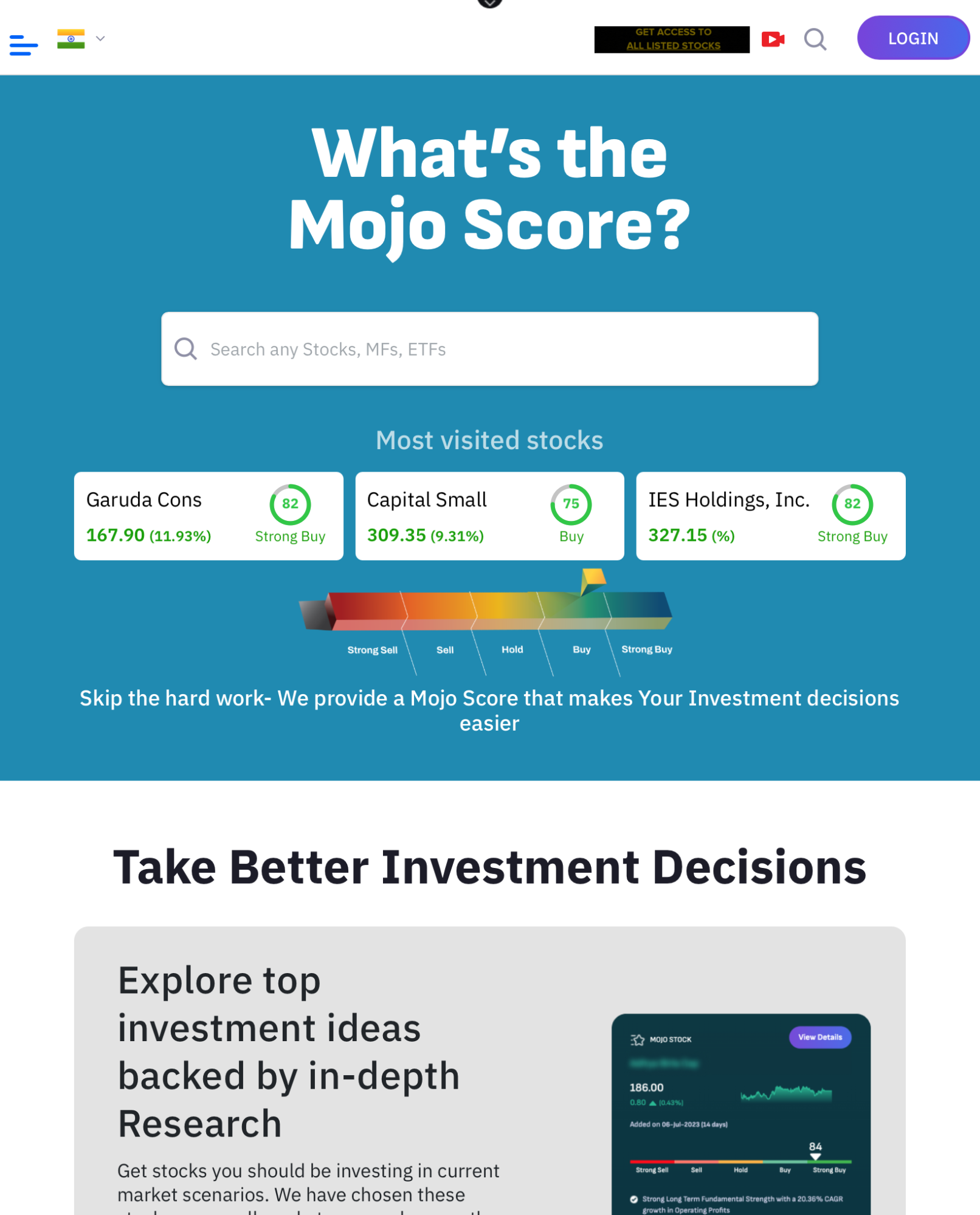

MarketsMojo’s primary offering is its algorithm-based research platform, which analyzes over 4,000 listed companies in India and 20 global markets, covering approximately 60% of global market capitalization. The platform processes millions of data points daily, using over 550 parameters to evaluate stocks. These parameters are grouped into four key categories: Quality (long-term performance within the industry), Valuation (assessment of the current stock price), Financial Trends (latest quarterly performance), and Technical Analysis (market movement indicators). The result is a proprietary “Mojo Score,” a simplified metric that rates stocks as Buy, Sell, or Hold, helping users make quick yet informed decisions.

Key Features

-

Mojo Score and Stock Analysis

The Mojo Score is the cornerstone of MarketsMojo’s platform. It consolidates complex financial data into a single rating, making it easier for users to assess a stock’s potential. For example, stocks like Sharda Cropchem (Mojo Score: 87, Strong Buy) and Garuda Cons (Mojo Score: 75, Buy) are highlighted for their performance. The platform provides detailed scorecards for each stock, covering fundamentals, peer comparisons, balance sheets, cash flows, and industry trends. This allows users to dive deeper into the reasoning behind a stock’s rating.

-

Portfolio Tracking and Optimization

MarketsMojo offers a Portfolio Optimizer tool that analyzes users’ existing investments and suggests modifications to improve returns, reduce risk, and enhance diversification. Users can upload their portfolios in under two minutes and receive recommendations on which stocks to buy, sell, or hold. The platform monitors portfolios 24/7, providing real-time alerts on market changes or stock performance.

-

Top-Rated Stocks and Model Portfolios

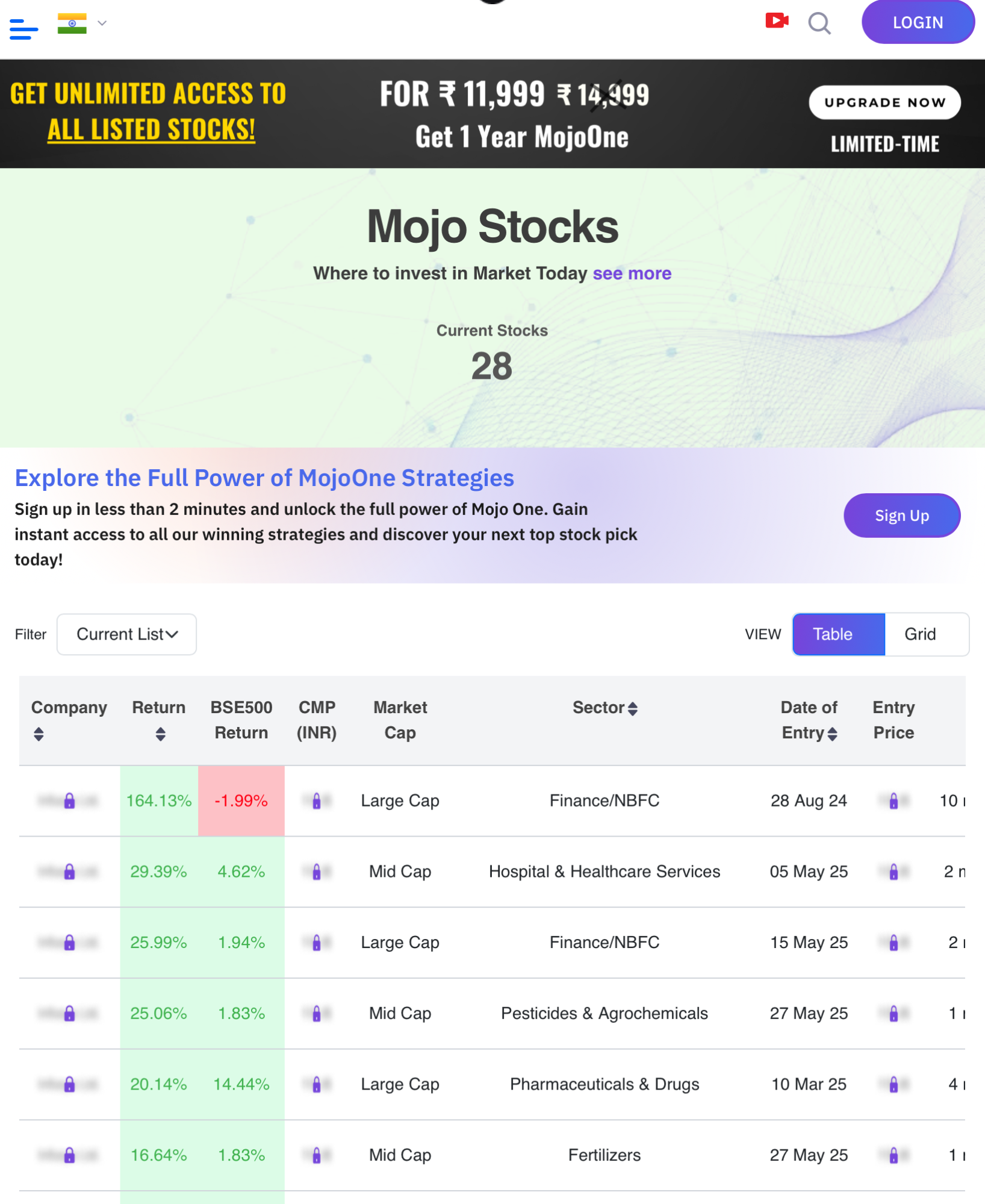

The “Mojo Stocks” section features 3–5 high-conviction picks monthly, screened from over 4,000 listed companies across all market caps. One notable pick reportedly delivered a 165% return in eight months, showcasing the platform’s ability to identify high-potential stocks. MarketsMojo also offers up to five model portfolios tailored to different investment styles, helping users align their strategies with market conditions.

-

Stock of the Month and Verdict Reports

Each month, the Chief Investment Officer selects a top stock based on rigorous evaluation criteria, complete with sector insights and future potential. The Verdict feature provides real-time research reports with an 82% success rate, covering all aspects of a stock’s performance. These tools aim to simplify decision-making for users who lack time for in-depth research.

-

SwitchER and Screeners

The SwitchER tool suggests better stock options when users want to replace underperforming assets in their portfolio. Additionally, MarketsMojo’s stock screener allows users to filter stocks based on their preferred criteria, such as market cap, sector, or performance metrics, enabling personalized investment strategies.

-

My Feeds and Market Updates

The My Feeds section consolidates actionable insights, news, and events for users’ selected stocks, ensuring they stay informed about relevant developments. The platform also provides live updates on market indices like Sensex, Nifty, and BSE, along with national and international business news, helping users stay connected to broader market trends.

-

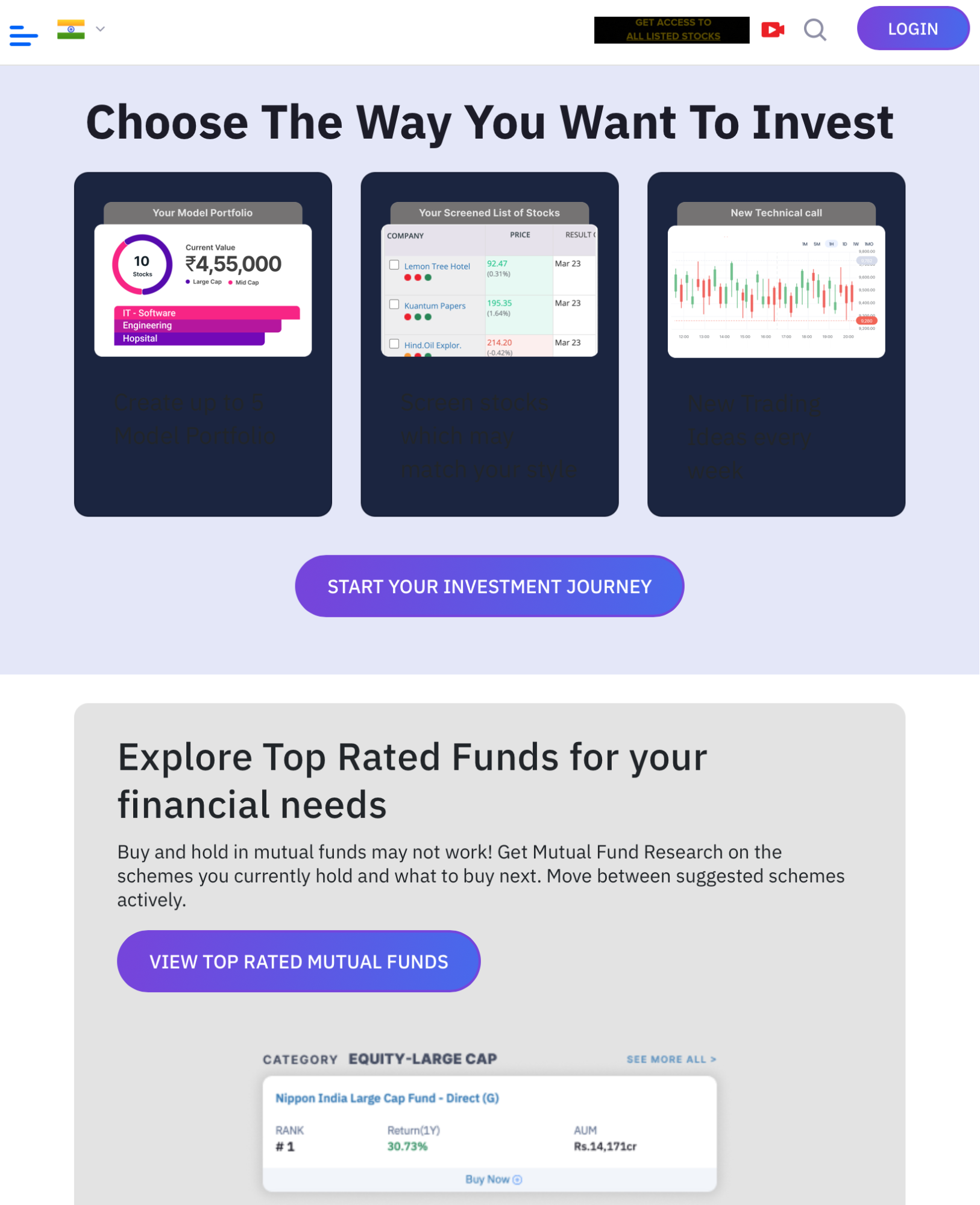

Mutualund Research

Beyond stocks, MarketsMojo offers mutual fund analysis, allowing users to evaluate their current holdings and discover top-rated funds. This feature encourages active management of mutual fund investments, moving away from a passive buy-and-hold approach.

Upcoming Features

MarketsMojo is set to introduce advanced tools to enhance its platform further:

- AI Search: This feature will allow users to search for stocks using natural language, eliminating the need to navigate complex menus. It aims to deliver instant results, saving time and improving accessibility.

- MagicPic: An AI-powered tool that enhances image clarity for part identification, potentially applicable to stock-related visuals or documentation, ensuring precise and quick recognition.

Marketmojo Business Models

MarketsMojo operates through three distinct business models, catering to different user segments:

- B2C Model

This model targets retail investors who can access the platform without logging in. Users search for dealers or brokers by zip code, and orders are routed through a cloud-based admin panel for pricing and fulfillment. This approach simplifies access for individual investors seeking stock recommendations. - B2B Model

Aimed at dealers and financial advisors, this model requires secure login credentials. It integrates with ERP and Dealer Management Systems (DMS) for seamless order tracking and submission. Major brokerage firms like Kotak Securities, Axis Securities, and Angel Broking use MarketsMojo’s research on a white-label basis, covering 30% of India’s retail brokerage industry. - B2B2C Model

This model supports sales executives and retailers placing orders on behalf of clients. It integrates with SAP or other ERP systems for efficient dispatch tracking, bridging the gap between businesses and end consumers.

Marketsmojo Alternative

MarketsMojo operates in a competitive fintech space with 430 active competitors, including 74 funded and 26 that have exited. Its top competitors include:

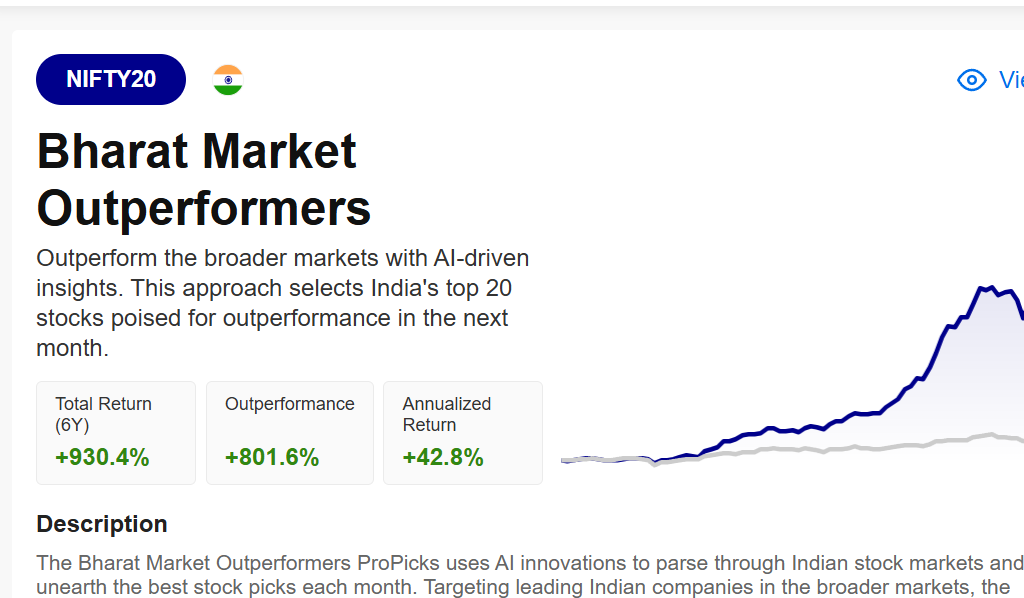

Investing.com (Pro India Version)

Target: Global + Indian traders/investors

Core USP: Real-time global market data, macroeconomic indicators, FII flows

✅ Pros:

-

Great for traders tracking global cues (currencies, commodities, crypto)

-

Free charting with multiple technical indicators

-

Economic calendar, earnings calendar

-

Covers almost every listed Indian stock

-

News aggregator with a global feed

❌ Cons:

-

Weak on fundamental Indian stock analytics

-

No model portfolios or personalized investing tools

-

The mobile app is ad-heavy without Pro

The pro version is pretty good, with some great performance on stock picking. We have done a detailed investing pro review

StockEdge

Target: Active Indian investors and traders

Core USP: Data-driven scanning, FII/DII flows, bulk block deals, insider trading

✅ Pros:

-

Powerful stock and mutual fund screeners

-

Smart investor tracking: who is buying/selling (e.g., Rakesh Jhunjhunwala holdings)

-

Regular data on bulk/block deals, insider activity

-

Sector/industry-based themes

-

Daily research ideas and scans

❌ Cons:

-

The interface can feel technical for new users

-

Limited advanced charting (relies on TradingView for it)

-

Premium pricing for full features

-

Less focus on global markets

Tickertape

Target: Modern investors, particularly millennials

Core USP: Clean UI, stock health score, integration with brokers

✅ Pros:

-

Easy-to-understand stock health metrics (Valuation, Momentum, Risk, etc.)

-

Broker integration (Zerodha, Upstox) for one-click investing

-

ETF & Mutual Fund analysis

-

Good watchlists and forecast tools (analyst ratings)

-

Modern UX with personalized filters

❌ Cons:

-

Limited depth for advanced traders

-

Heavy reliance on analyst consensus — not always reliable

-

Requires subscription for full data access (Pro)

-

No real-time technical charts

Trendlyne

Target: DIY investors, quants, mutual fund investors

Core USP: DVM score, forecasting engine, alert system

✅ Pros:

-

Deep screener tools with customizable filters

-

SWOT analysis, Star Ratings, Forecast score

-

Alerts based on fundamentals and technicals

-

Mutual fund portfolio overlap & SIP tools

❌ Cons:

-

UI is not as polished as Tickertape

-

Too much data can overwhelm casual users

-

Lacks broker integration

-

Some tools are locked behind a paywall

6. Screener. in

Target: Fundamental stock pickers, DIY analysts

Core USP: Custom queries & financial filters

✅ Pros:

-

Extremely customizable financial screeners

-

Great for creating your own valuation templates

-

Clean interface, no ads

-

Free for basic use, very popular with value investors

❌ Cons:

-

No technical indicators

-

No model portfolios or robo-advice

-

Not for traders or non-financially savvy users

-

Limited mobile functionality

Summary Table

| Platform | Best For | Pros | Cons |

|---|---|---|---|

| MarketsMojo | Beginners/intermediate investors | 360° analysis, model portfolios | Lack of transparency in scoring |

| Investing.com | Global investors/traders | Macro data, global coverage | Best Features in Pro Plan |

| StockEdge | Traders, thematic investors | Scanners, FII/DII, insider deals | Interface & price complexity |

| Tickertape | Millennials, passive investors | Clean UI, broker-integrated | Analyst-heavy, less for pro traders |

| Trendlyne | Quants, long-term investors | Alerts, forecasts, mutual fund tools | Overloaded UI |

| Screener.in | Value/fundamental investors | Fully customizable, free | Not beginner-friendly, no tech charts |

Recommendation Based on Use Case:

| Use Case | Suggested Platform(s) |

|---|---|

| Long-term investing (fundamentals) | Screener.in, Trendlyne |

| Short-term trading | StockEdge, Investing.com |

| Passive portfolio building | MarketsMojo, Tickertape |

| Thematic/insider tracking | StockEdge, Trendlyne |

| Global macro tracking | Investing.com pro |

Strengths of MarketsMojo

This section highlights the key advantages that set MarketsMojo apart in the stock research market.

- Comprehensive Coverage

MarketsMojo analyzes all 4,000 listed companies in India, unlike many competitors who cover only 10–15% of the market. This extensive coverage ensures retail investors have access to insights on both large and small-cap stocks. - Unbiased Research

The platform’s algorithm-driven approach minimizes human bias, providing objective Buy/Sell/Hold recommendations. Its lack of a transaction platform further reduces conflicts of interest, appealing to self-directed investors and advisors. - User-Friendly Interface

The Mojo Score simplifies complex financial data into an easy-to-understand metric. Tools like My Feeds and the Portfolio Optimizer make the platform accessible to users with varying levels of expertise. - High Success Rate

MarketsMojo claims an 80–82% success rate for its Buy and Sell calls, with back-tested portfolios yielding over 1,000% returns in five years, significantly outperforming top mutual funds (175% returns). This track record enhances its credibility. - Retail and Institutional Reach

With 1.2 million registered users and partnerships with major brokers, MarketsMojo serves both retail investors and institutions. Its B2B model powers 30% of India’s retail brokerage industry, demonstrating scalability. - Affordable Subscription Plans

Subscription fees range from ₹4,999 for basic access to ₹98,999 for professional packages, with occasional discounts (e.g., 85% off for Mojo Professional). This makes it accessible to a wide range of investors.

Areas for Improvement for MarketsMojo

This section identifies challenges and opportunities for MarketsMojo to enhance its platform and market position.

- Limited Global Presence

While MarketsMojo covers 20 global markets, its primary focus remains India. Competitors like Pico and Two Sigma Investments have a stronger international footprint, which could limit MarketsMojo’s appeal to global investors. - Small Team Size

With only 12 employees as of May 2025, MarketsMojo may face challenges scaling its operations compared to competitors with larger teams. This could impact its ability to innovate quickly or handle increasing user demand. - Competitive Pressure

Competitors like Trendlyne offer similar features at a lower cost (₹1200/year), which could attract price-sensitive retail investors. MarketsMojo needs to differentiate further to maintain its market share. - Perception of Multi-Bagger Identification

Some analysts argue that MarketsMojo struggles to identify multi-bagger stocks consistently. While the company disputes this, citing its back-tested portfolio performance, it must continue proving its ability to spot high-growth opportunities. - Dependency on Subscription Revenue

The platform’s revenue relies heavily on subscriptions and B2B partnerships. Diversifying income streams, such as through new services or markets, could strengthen its financial stability.

User Feedback and Market Perception

User feedback on platforms like X highlights MarketsMojo’s strengths in providing unbiased recommendations and an efficient portfolio optimizer. Retail investors, particularly those lacking technical expertise, appreciate the simplicity of the Mojo Stocks section and the platform’s ability to judge company quality. However, some users suggest adding features like profit/loss booking alerts for recommended stocks to enhance the user experience.

MarketsMojo has garnered recognition, with CEO Mohit Batra receiving the Most Promising Business Leader of Asia Award from Economic Times in 2020–21. The platform’s partnerships with major brokers like Kotak Securities and its operational profitability within three months of launch underscore its market credibility.

Conclusion

MarketsMojo has established itself as a notable player in India’s fintech landscape, offering a robust algorithm-based platform for stock research and portfolio management. Its comprehensive coverage of 4,000 listed companies, user-friendly Mojo Score, and high success rate make it a valuable tool for retail investors and brokers. The platform’s B2C, B2B, and B2B2C models cater to diverse needs, while upcoming features like AI Search and MagicPic signal continued innovation.

However, MarketsMojo faces challenges in scaling its operations, competing with lower-cost alternatives like Trendlyne, and expanding globally. Its small team size and reliance on subscription revenue highlight areas for improvement. With plans for PMS, AMC, and an IPO, MarketsMojo is poised for growth, but it must maintain its focus on unbiased, high-quality research to stand out in a crowded market. For investors seeking a data-driven, accessible platform, MarketsMojo offers significant value, though its long-term success will depend on addressing competitive pressures and executing its expansion strategy effectively.

The “Mojo Stocks” section features 3–5 high-conviction picks monthly, screened from over 4,000 listed companies across all market caps. One notable pick reportedly delivered a 165% return in eight months, showcasing the platform’s ability to identify high-potential stocks. MarketsMojo also offers up to five model portfolios tailored to different investment styles, helping users align their strategies with market conditions.

The “Mojo Stocks” section features 3–5 high-conviction picks monthly, screened from over 4,000 listed companies across all market caps. One notable pick reportedly delivered a 165% return in eight months, showcasing the platform’s ability to identify high-potential stocks. MarketsMojo also offers up to five model portfolios tailored to different investment styles, helping users align their strategies with market conditions.