Introduction

Bonds are an important part of any well-diversified investment portfolio. They provide stable returns in the form of regular interest payments. However, not all bonds are the same. In this article, we will explore the key differences between listed and unlisted bonds and how you can evaluate these investment options based on your goals and risk appetite.

What are Listed and Unlisted Bonds?

Let’s start with understanding the basic definitions:

Listed bonds are debt securities issued by corporations or governments that are traded on a stock exchange. Examples include NSE and BSE in India. These bonds have higher liquidity as investors can buy and sell them easily through stockbrokers.

Unlisted bonds are not traded on any stock exchange. They are privately placed with institutional investors like banks, mutual funds, insurance companies, high net-worth individuals, etc. directly by the issuer. Liquidity is relatively lower for unlisted bonds.

However, unlisted bonds do not automatically equate to higher risk. Many companies choose to issue bonds privately because it’s cost-effective, especially for smaller issuance sizes. By avoiding the listing process, companies can save on fees and regulatory compliance costs. This can offer investors unique opportunities to access debt from reputable companies that simply opt for a more streamlined funding route.

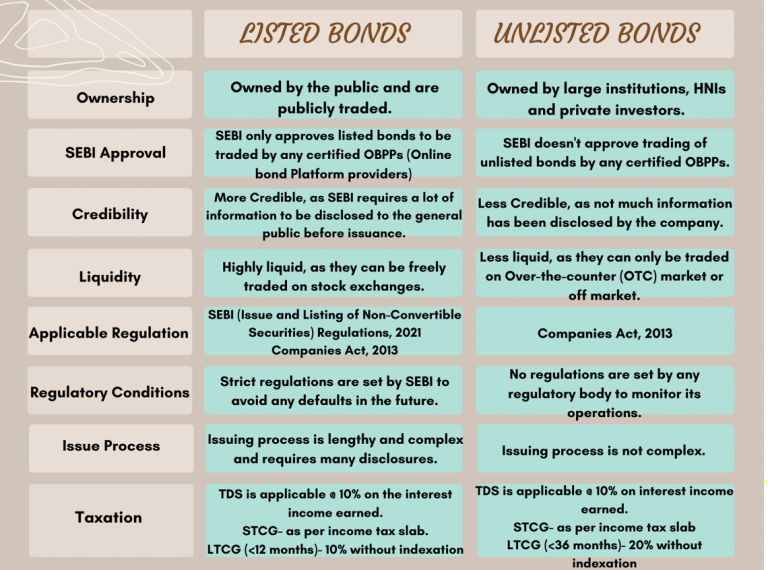

Key Differences Between Listed and Unlisted Bonds

The major differences between listed and unlisted bonds are:

Liquidity

Listed bonds have higher liquidity as they are freely traded on stock exchanges. This allows investors to buy or sell bonds based on their needs easily. In comparison, unlisted bonds have lower liquidity since they are not exchange-traded and investors may find it difficult to find buyers or sellers. Though listed bonds are available on exchange liquidity is poor and most transaction are generally bilateral between known parties.

Transparency

Listed bond prices are publicly available on stock exchange platforms, providing higher transparency. However, pricing for unlisted bonds is not publicly available since they are traded over-the-counter (OTC).

Minimum Investment Size

The minimum investment size for listed bonds is usually lower, making them more accessible for retail investors. Unlisted bonds have a higher minimum investment threshold, usually above ₹10 lakhs, limiting them to institutional or high-net-worth investors however now you can invest as low as INR 1 lakh in unlisted bonds.

Yield

Unlisted bonds typically offer higher yields than listed bonds to compensate investors for lower liquidity and transparency. The issuers have more flexibility to design yield features for unlisted bond investors.

Regulations

Listed bonds need to comply with strict regulatory guidelines of SEBI or other exchanges. Unlisted bonds have relatively fewer regulatory requirements since they are privately placed.

Costs

These bonds have lower issuance costs for companies since they do not have listing fees or intermediary commissions applicable to listed bonds. This benefit is passed on to investors via better yields.

Credit Risk

Unlisted bonds may have higher credit risk as the issuers have lower disclosure requirements. Investors need to diligently assess the credit quality of unlisted bond issuers. However, it is important to note that many issuers of unlisted bonds are established companies with strong financial health, and their decision to go for unlisted bonds is often related to minimizing administrative overhead, not necessarily a reflection of weaker credit standing.

Benefits of Investing in Unlisted Bonds

While unlisted bonds have some disadvantages compared to listed ones, they also offer certain benefits that make them attractive for specific investor requirements:

Higher Yields

Due to lower liquidity and fewer regulatory hurdles, unlisted bonds typically offer 0.25-3% higher yields than similar listed corporate bonds. This makes them suitable for investors seeking higher returns.

Flexibility

These bonds offer more flexible terms customized to investors’ needs, such as tailored maturity dates, unique security structures, preferential early redemption options, etc.

Low Correlation

Unlisted bonds tend to have low correlation with equity markets, making them an excellent diversification tool for risk-averse investors. Their returns are less volatile compared to equities.

Direct Access

Investors get direct access to companies raising funds without relying on brokers or stock exchanges. This allows for building long-term issuer relationships.

In summary, though lower liquidity is a concern, unlisted bonds can enhance portfolio yields when suitable issuers with strong credit profiles are identified after thorough due diligence.

Steps to Invest in Bonds

Here are the steps to invest in bonds:

- Decide if you want to invest in listed or unlisted bonds based on your risk tolerance, liquidity needs, investment horizon, and diversification strategy.

- If you choose listed bonds, you can buy them through a broker. Brokers offer access to a wide range of listed government and corporate bonds.

- If you choose unlisted bonds, you can purchase them directly from the issuer, through a broker who deals in unlisted bonds, or via a bond aggregator platform.

- Evaluate factors like credit quality and risk, yield, tax treatment, and transparency of issuer for the specific bond you want to invest in.

- Make sure the bond matches your investment objectives and risk appetite. Investment in any bond involves credit risk which should be understood.

- Once you have selected the bond, submit the application form along with payment of application money to purchase bonds depending on the minimum investment requirement.

- The allotment of bonds will be done, and you will receive the bonds in demat or physical form based on your preference. Now the bond will start providing regular interest income till maturity.

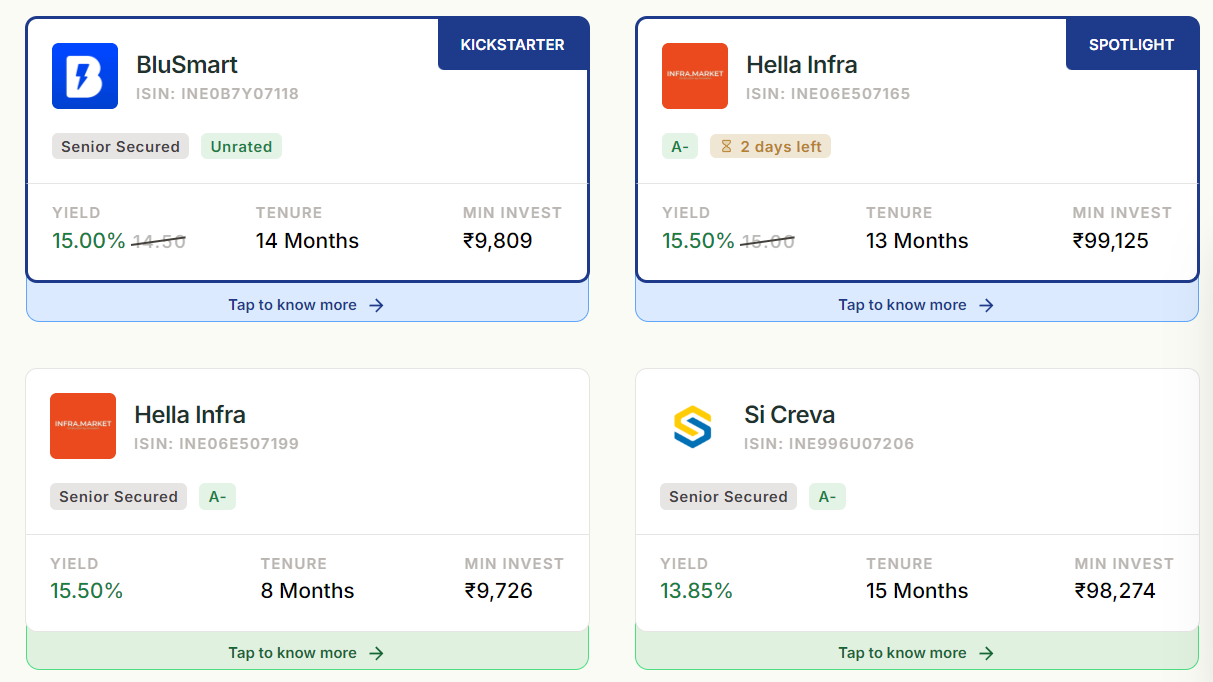

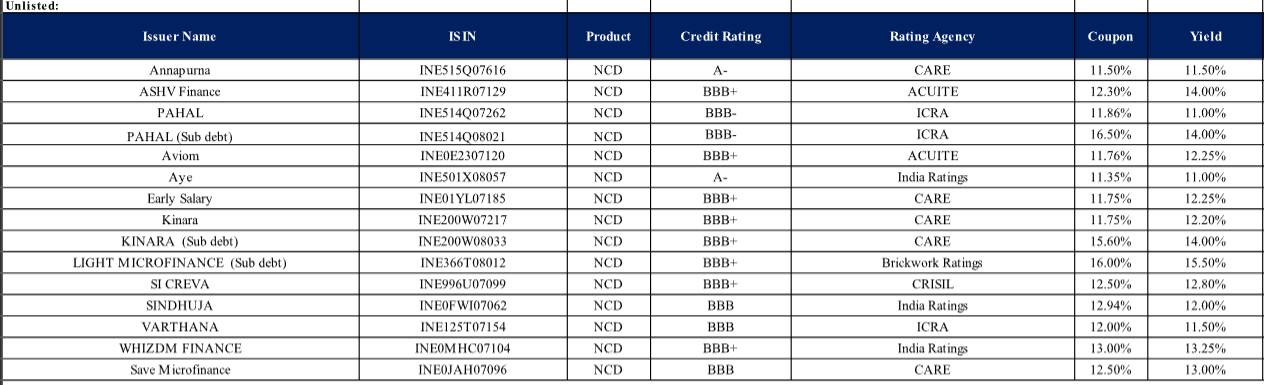

Top Platforms to Invest in Unlisted Bonds in India

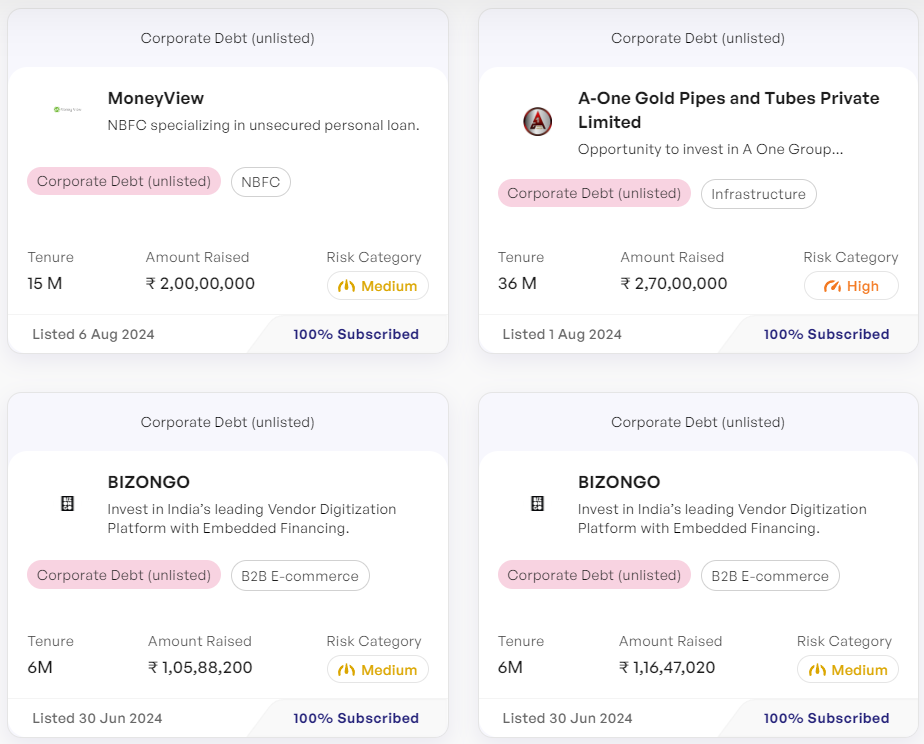

With the growth in direct investment platforms, accessing unlisted bonds has become much simpler. Below is a list of top platforms offering unlisted bonds.

One of India’s largest unlisted bond platforms, TapInvest allows investors to directly invest in unlisted debt opportunities across tenors and industries. Its tech-enabled platform provides seamless investment. Some of the opportunities are unique on this platform.

Operated by Northern Arc, AltFi is a leading alternate investment platform facilitating access to unlisted and listed fixed-income instruments. To buy Unlisted bonds on Altifi you need to connect with the relationship manager as these transactions have to be done through the Northern Arc website.

AltGraaf is another popular platform for investing in unlisted bonds, asset leasing, invoice discounting, and real estate bonds in India. It works with some of the leading issuers and offers multiple products from a single portal.

Do thorough research on platforms, fee structures, and past track records before deciding. Paperwork for KYC and account opening is generally smooth. Minimum investment starts from ₹1 lakh in most cases.

Performing Due Diligence on Unlisted Bonds

As unlisted bonds have lower transparency, it is critical for investors to perform rigorous due diligence on issuers and offered instruments. Some aspects to diligently evaluate include:

- Management background and experience

- Financials – past 3-5 years of audited financial statements

- Purpose of raising funds and its utilization plan

- Repayment/servicing track record of existing debts

- Collateral/security being offered, if any

- Covenants and restrictions in offer documents

- Macroeconomic factors impacting the issuer’s industry/sector

- Credit ratings from top agencies, if available

- Peer comparison and competitive analysis

Investors must understand business and credit risks fully before parking long-term capital in unlisted bonds. Consulting advisors can help in such evaluation.

Key Takeaways

To conclude, both listed and unlisted bonds have merit as investment options. While listed bonds offer greater liquidity and transparency, unlisted bonds can enhance yields when due diligence is given the highest priority. Investors need to evaluate their specific needs around returns, holding period, liquidity, regulation, etc., and choose the most appropriate option or a combination cautiously. With access through technology platforms growing, unlisted bonds are turning attractive for retail exposure too within defined limits.