Commercial real estate investment has always been known as a low-risk, high-value investment with steady returns. However, due to the high value of commercial properties, real estate has traditionally been a very restricted investment avenue, accessible and affordable only to a few. With the advent of technology-driven online investment platforms, investing in commercial real estate is now easier and more affordable than ever before. Online investment platforms have facilitated fractional ownership of high-value real estate properties, thus enabling average investors to hold a share in prime commercial properties for comparatively lower investment amounts.

This article will look at a thorough review of one such fractional ownership platform in India that has been democratizing access to real estate. hBits is a fractional ownership platform that started in 2018 and works at the intersection of real estate and technology. The post will look at what hBits is, what it does, the team behind hBits, its investment products, and its alternatives.

What is hBits?

hBits is a fractional ownership platform that was started in 2018 and aims to democratize real estate investment in India. Real estate has traditionally been accessible to high-net-worth individual investors or institutional investors. hBits started with the goal of democratizing access to real estate and bringing this lucrative asset class to the everyday average investor.

With over 1,00,000 registered users, today, hBits has around INR 365 crore in Assets under management (AUM). The company boasts a record of exiting its first property with an Internal Rate of Return or IRR of 17.54%.

The parent group of hBits, Raycon, is a German joint venture engaged in property investment, land development, real estate development and providing end-to-end real estate development services in India, Germany & UAE. hBits also operates a co-working business by the name of “WorkLoft” and operates four co-working spaces in Mumbai, with more in the pipeline across major cities in India.

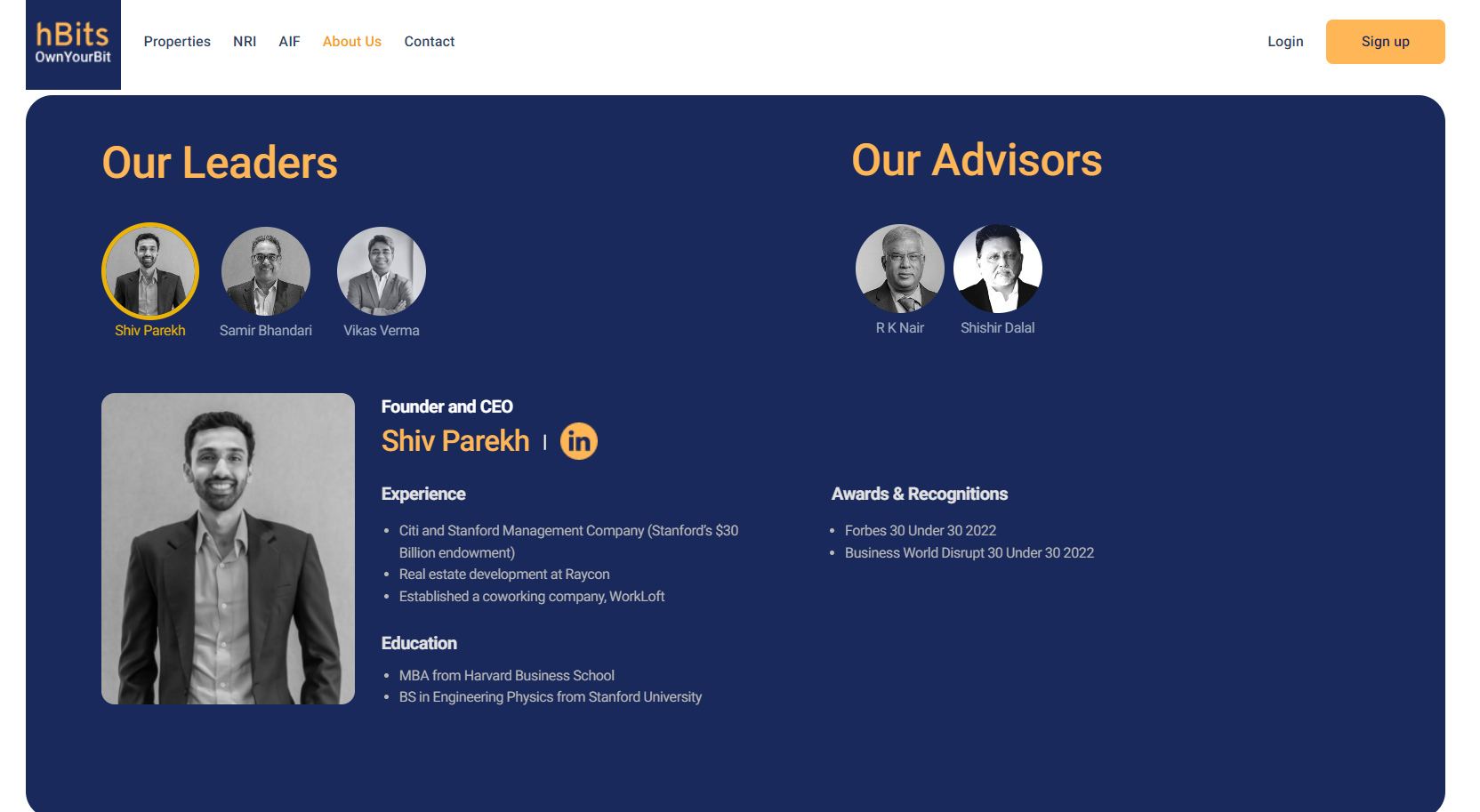

Team Behind hBits

The team behind hBits has a combined experience in real estate spanning over 200 years. hBits is headed by its Founder and CEO, Shiv Parekh, who holds an MBA from the prestigious Harvard Business School and has previously worked with global institutions like Citi and Stanford Management Company. Shiv has been recognized in the 2022 list of Forbes Asia 30 under 30. Besides Shiv, the company’s Co-founder and CFO, Samir Bhandari, is a Chartered Accountant and holds an MBA from the Indian Institute of Management, Ahmedabad. Samir has previously worked with prominent organizations like Nomura, JP Morgan, UBS, and Bank of America.

How hBits Works?

Register here to get 1% cashback

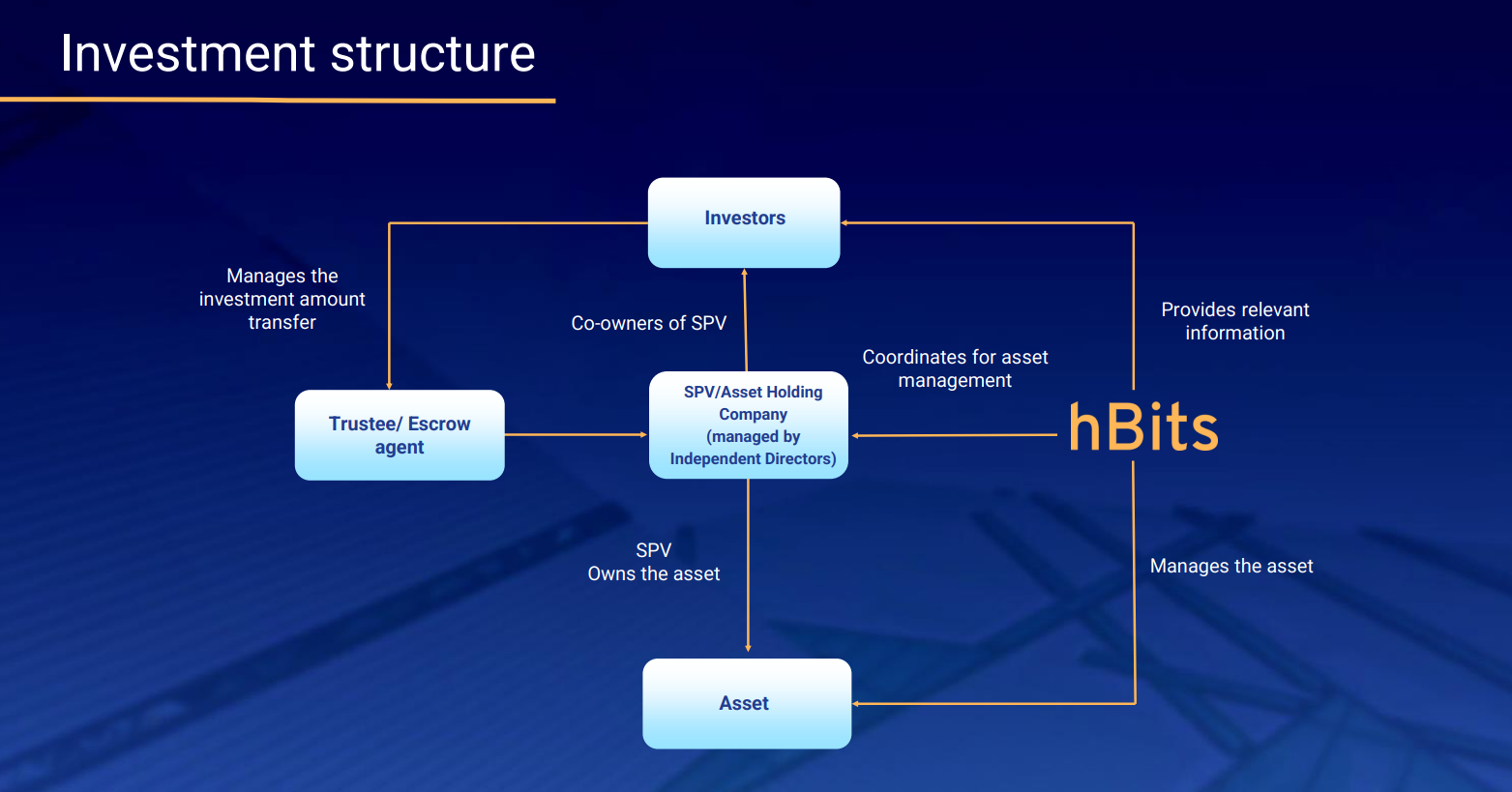

hBits offers multiple investment opportunities for specific commercial real estate projects across major cities in India, such as Mumbai, Pune, Bengaluru, etc. As a prospective investor, you will have to create an account with hBits.co and choose a project to invest in based on its range of live opportunities. hBits offers detailed information about a real estate project to its registered users to enable them to make an informed investment decision. Once you have chosen an investment opportunity, you will be required to digitally sign the EOI document for the property and pay the initial token amount through the hBits platform. You will be required to update your Know-Your-Customer (KYC) information on hBits’ dashboard along with details of your demat account. Once all details are updated and verified on the dashboard, you can digitally sign the ownership agreement for the project chosen and pay the remaining investment amount.

Once you have invested in a commercial real estate property on the hBits platform, you can earn a return on your investment in two ways. First, you will start earning rental income from your property and the same will be credited to your registered bank account every month. Other than rental income, you will be able to benefit from the capital appreciation of the property in the long run. Once the property is sold after a period of 4 to 6 years, you will be able to earn lucrative capital appreciation on your investment amount. Besides, you can also sell your share in investment at any point in time during this period on hBits’ dashboard.

hBits’ investment dashboard offers all the key details about your investments and tracks the performance of your portfolio. Besides portfolio overview, the dashboard also offers analytics into the performance of each project invested in, along with key documents relating to the properties and investments made therein.

Opportunities on hBits

Register here to get 1% cashback

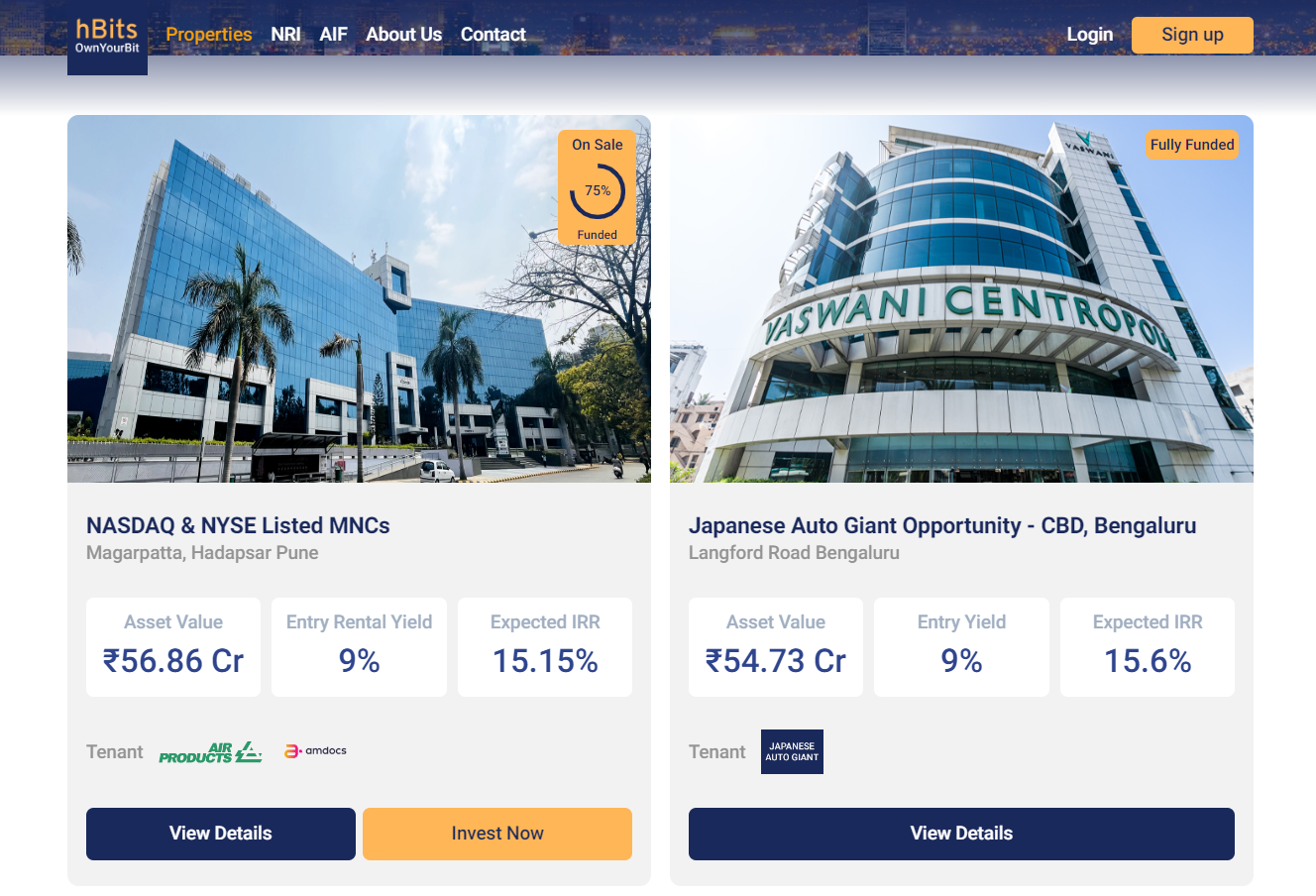

hBits offers interesting commercial real estate properties across major cities in India. The company evaluates assets of over INR 3000 crores every month to curate promising investment opportunities.

At present, the platform is offering opportunities for commercial properties located in prime commercial hubs in Mumbai, Pune, and Bengaluru. For instance, its “NASDAQ & NYSE Listed MNCs” project in Cybercity-Magarpatta, Pune, has an expected IRR of 15.15% with a minimum investment amount of INR 25 lakhs and a 3-year lock-in period. The two tenants for the property are MNCs listed in stock exchanges in the United States. Similarly, in Bengaluru, the platform is offering an opportunity in Langford Road Bengaluru, with a Japanese auto giant as a tenant. With an asset value of INR 54.73 crores, this opportunity has an expected IRR of 15.6%. In Mumbai, hBits has multiple opportunities from which to choose. For instance, the “Times Square Andheri Opportunity” lets you invest in a prime commercial property located in Andheri East, Mumbai. The property has an asset value of INR 21.89 crores and is expected to give an IRR of 13.1% and an average rental yield of 10.35%. Its tenants are companies like Persistent and Smartworks.

hBits Alternative

Register here to get 1% cashback

The following are some of the platforms that investors can explore for similar fractional ownership investing:

- Alt DRX

Alt DRX, short for Alt Digital Real Estate Exchange, is a fractional ownership platform that offers investment opportunities in fractional real estate by breaking down real estate assets into smaller, tradable units known as ALT.SQFT. The platform claims to be the world’s first digital real estate exchange. Read in detail about Altdrx

- Assetmonk

Assetmonk is a new-age alternative real estate investment platform that offers strategically curated high-potential real estate investment opportunities with small ticket sizes via fractional ownership. The company has over INR 350 crores in AUM and has delivered an average IRR of 14 to 24% and an average yield of 9%.Read in detail about Assetmonk

- MYRE Capital (wiseX)

Wisex is another fractional real estate platform that provides easy access, transparency, and liquidity to a curated selection of rent-yielding commercial real estate properties.Read in detail about Wisex

Conclusion

Tech-driven fractional real estate investing has truly democratized commercial real estate investments and made them accessible and affordable to a new group of investors. In this review article, we have seen what hBits is, how it works, the type of opportunities it offers, the team behind the platform, and alternatives to hBits. With over INR 365 crore in AUM, hBits is one of the most prominent fractional ownership platforms in India and has been offering lucrative assets in key cities like Mumbai, Pune, and Bengaluru. If you are looking to invest in commercial real estate, you can explore the opportunities on hBits. However, make sure you go through all the details about an asset before investing. Your financial goals, planning, and aspirations must guide your investment decisions.