CLOs originated in the late 1980s, similar to other types of securitizations, as a way for banks to package leveraged loans together to provide investors with an investment vehicle with varied degrees of risk and return to best suit their investment objectives.

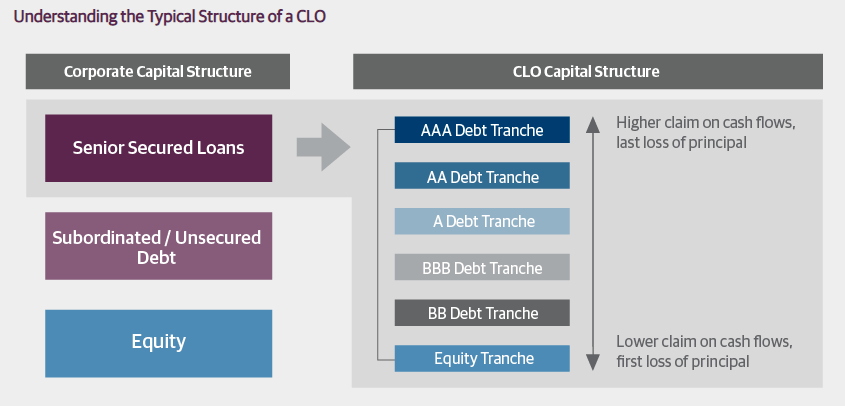

A CLO is a type of structured credit. Structured credit is a fixed-income sector that also includes asset-backed securities (ABS), residential mortgage-backed securities (RMBS), and commercial mortgage-backed securities (CMBS). CLOs purchase a diverse pool of senior secured bank loans made to businesses that are rated below investment grade. The bulk of CLOs’ underlying collateral pool is comprised of first-lien senior-secured bank loans, which rank first in priority of payment in the borrower’s capital structure in the event of bankruptcy, ahead of unsecured debt. In addition to first lien bank loans, the underlying CLO portfolio may include a small allowance for second lien and unsecured debt.

Standard & Poor’s defines leveraged loans as senior secured bank loans rated BB+ or lower (i.e., below investment grade) or yielding at least 125 basis points above a benchmark interest rate (typically LIBOR or EURIBOR) and secured by a first or second lien. Several characteristics make leveraged loans particularly suitable for securitizations. They:

- Pay interest on a consistent monthly or quarterly basis;

- Trade in a highly liquid secondary market;

- Have a historically high recovery rate in the event of default; and

- Originate from a large, diversified group of issuers.

Understanding CLO Structures

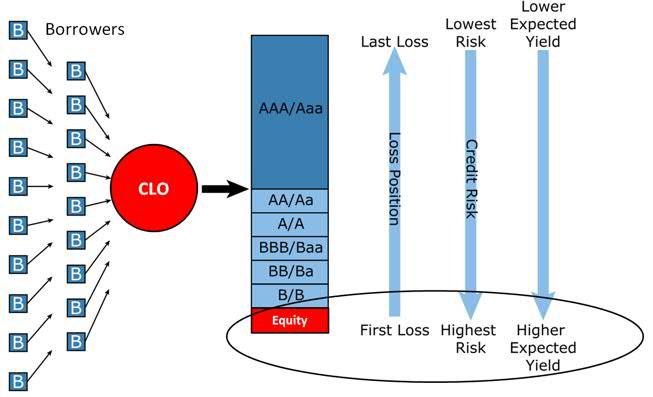

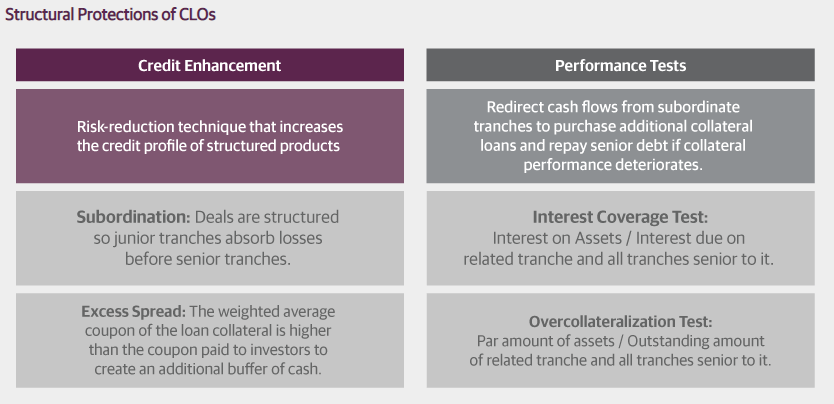

To purchase the portfolio of loans, the CLO raises money by selling debt and equity securities. The debt and equity securities are sold in tranches, where each CLO tranche has a different priority of claim on cash-flow distributions and exposure to risk of loss from the underlying collateral pool. Cash-flow distributions begin with the senior-most debt tranches of the CLO capital structure and flow down to the bottom equity tranche, a distribution methodology that is referred to as a waterfall.

CLO waterfall

To make it Simple

A CLO management company buy senior Loans(secured senior debt) of mid market or less investment grade issuance. They pool them together.

Now the interest received is first provided to top tranches and then lower,what’s left is passed on to equity tranche.

So in a way top tranche is safe even at 20-30% default, while equity tranche is susceptible to any losses on the portfolio.

When these tranches are priced, certain assumption are taken like every year 2% loan will default, and recovery of say 60% will take place etc.

The yield of a equity or debt tranche is based on those numbers. Now if people perceive risk in economy etc the equity tranche start trading in discount which means if Default stay at 2-3% per year you will make 20% plus yield.

The equity tranche: the highest risk could mean the highest return

The equity tranche occupies a unique place in the CLO structure. It’s essentially a highly leveraged play on the strength of the underlying collateral. Because the equity tranche’s success depends on the success of the loan tranches – it’s last in line to receive cash flows and first to realize loan losses – its owners take the most risk of any CLO investors. Their goal, then, is to maximize the value of the equity.

As compensation for assuming a higher share of risk, the majority equity-tranche holder is given potential control over the entire CLO in the form of options to call or refinance the CLO after the non-call period (usually the first two years of a transaction) expires.

- The call typically is exercised if the equity-tranche holders consider the underlying loans at or near the top of their market value – which is when the equity is most valuable. Exercising the call in this scenario results in the liquidation of the entire portfolio and, in the process, the equity-tranche holders reap the fullest possible benefit of the equity’s leverage.

- Refinancing can happen if CLO tranche spreads fall enough so the CLO capital stack can be replaced at lower spreads, which reduces equity-tranche holders’ cost of leverage and thus increases their return. The portfolio can be refinanced either partially or in full.

How to buy CLO?

Most senior tranche are available to institutional or High Networth people but retail people have access to public listed company which invest in equity tranche of multiple companies.

You can use Stockal to buy these:

Global Investing Platform Stockal Discount Link

CLO funds offer a high ‘immediate income’ to investors. These, when added to more conservative investments, offer a way to get a high yield that is time-tested in combination with a higher degree of safety. CLOs typically offer little capital appreciation and trade in a tight band – almost all their returns come from the income they generate. By adding a small position of CLOs to your portfolio, you can boost your overall income significantly.For example, if you own a portfolio with an overall yield of 7.0%, by allocating only 10% of your portfolio to a CLO investment yielding 15%, you can boost your ‘total income’ by 11% for an overall yield of 7.8%.

This means your “more conservative investments” can see dividend growth or capital appreciation while your CLO investments provide the necessary living dividends. Many retirees will enjoy the regular high immediate income thrown off by these investments that make retiring on a lower saved income a greater possibility. Younger investors can take the income and turn around and use it to make opportunistic investments with the money as it comes in.

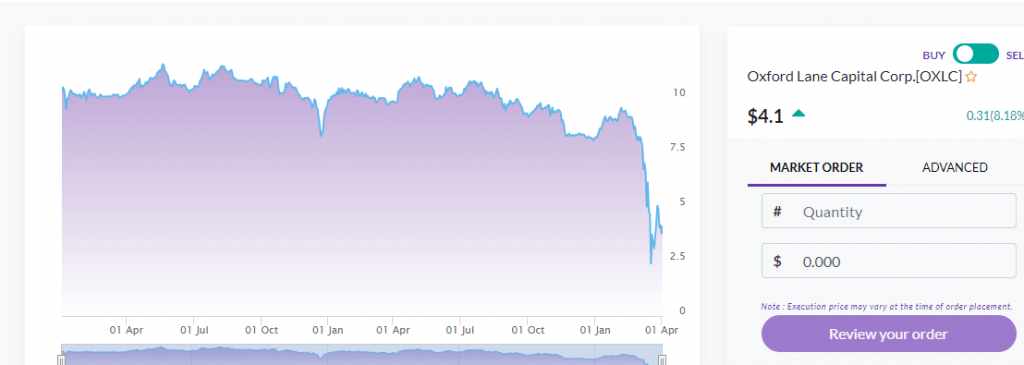

Currently, there are three publicly traded CLO funds. All invest over 90% in equity tranches of the available CLO in the market, and they are:

- Oxford Lane Capital (OXLC) current Yield 40%

- Eagle Point Credit Company (ECC) – current Yield 37%

- OFS Credit (OCCI) – current Yield 25%

They are available on Stockal.

More about the company here:

https://www.oxfordlanecapital.com/

http://www.eaglepointcreditcompany.com/

Conclusion

Contrary to popular believe most CLO performed better than other asset classes during 2008 crisis. The real problem was CDO backed by mortgage and synthetic CDO which were priced on performance of MBS without actual assets.The housing market collapsed and all MBS too as they had very high correlation among themselves

CLO funds, senior secured loans and many Business Development Companies all have one thing in common. They are priced for some serious turbulence in the economy. We like CLO funds simply as they are mismatched and the cheaper asset class versus the S&P 500 and even vs. high-yield bonds. Could they go down from here? Sure they can. Could the premiums go lower? Of course they can. But they do represent to a good way of playing the equity markets as we are buying the asset that is pricing in difficulties versus one that is far more sanguine. OXLC and ECC are very attractive with the current price, and make great additions for investors who are seeking high income but keep it to small percentage of total portfolio.

Though the drawback is that expense ratio is high and most people do not understand the risk return profile.People should do their research before investing. I am not holding any CLO Fund at the moment but may strategically hold a small amount in future.

Footnotes:

Global Investing Platform Stockal Discount Link

For global Investing through Vested

Use this to register and get 5$ in your account (https://app.vested.co.in/referrals?code=RORA74993 )

For buying zero cost MF and lowest Derivative Trading

For alternate investment you can use these links

Finzy Referral Code:

https://finzy.com/invest?partner=MAN635

or you can apply the code : MAN635

(First Use the link to register then add the Code “discount50@i2i” while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For specific queries ping me on 9967974993 or mail me on rohanrautela9@gmail.com