Introduction

Technology has revolutionized how investments work traditionally. Today, anyone from anywhere with an internet connection can access investments that have traditionally been restricted to a select few. With traditional asset classes undergoing increased volatility triggered by macroeconomic events, the average investor is now looking at assets beyond conventional stocks, bonds, and fixed deposits. Alternative investments like fractional real estate and non-convertible debentures offer a lucrative alternative to the volatile financial markets

Fractional real estate allows investors to own a portion of a property, lowering the barrier to entry and providing access to rental income and potential appreciation. NCDs, on the other hand, are debt instruments that typically offer higher interest rates than bank deposits, attracting investors seeking fixed income. While these investments can be lucrative, it’s crucial to acknowledge the associated risks, including illiquidity and potential for default. This is where the role of a technologically robust and transparent investment platform comes in, which offers multiple opportunities while equipping the investor with all the information he needs to make a sound investment decision.

In today’s article, we will review one such alternative investment platform, FundBezzie. We will look at what FundBezzie offers, and the team behind FundBezzie, its parent company, and we will review one of their open investment opportunity.

What is FundBezzie

FundBezzie is an alternative investment platform that offers investment products like Secured NCDs and Fractional Real Estate. It is a technology-driven platform that aggregates curated investment opportunities for its users. FundBezzie is a 100% subsidiary of Pantomath Group and was established in April 2022 with a view to introducing high-quality, new-age investment products. As mentioned above, the platform specializes in secured NCDs backed by real estate collateral and fractional real estate. It offers filtered investment opportunities to authorized channel partners and clients, making them easily accessible.

Fundbezzie by Pantomath Group

Pantomath Group is a financial services conglomerate offering investment solutions to mid-market corporates, family offices, fund houses, and investors. With a track record of over 10 years, the Group has a pan-India network of over 350 franchises and a presence in over 12 countries.

The Group works with a vision to be a leading financial services conglomerate and aims to help businesses scale up while generating optimum wealth for investors. The Group operates across the business verticals of Investment Banking, Asset Management, Stock Broking and Distribution, Wealth Management, Institutional Equities, and Fintech & AI. Pantomath Group holds several key licenses and registrations, including a Stock Broking License, Mutual Fund Distribution License from the Association of Mutual Funds in India (AMFI), AIF Registration from SEBI, PMS registration from SEBI, Depository Participant registration, etc.

Team Behind FundBezzie

FundBezzie’s management team comprises Mahavir Lunwat, Group Founder and Managing Director of the parent company, Pantomath Group. Mr. Lunawat is a CFA Level II (AIMS, US), CFA (ICFAI), FCS (Gold Medalist), and PGDSL and holds over 20 years of experience. He has worked with leading organizations like ITC Ltd., RIL, and PwC. Co-founder and Executive Director of Pantomath Group, CA Madhu Lunawat, is also a part of the management team for FundBezzie and has worked with prominent organizations such as Infosys, ASREC, and Edelweiss. She served as CFO of Edelweiss ARC before joining the Board of Pantomath Group.

Dr Prakash Jain, the Chief Business Officer of Pantomath Group, has held key roles at renowned firms such as Berkshire Hathaway, Orenda India, Anand Rathi, Angel One, Sutherlands Global, Asit C. Mehta Investment Intermediates Ltd., and ICICI Lombard. Lastly, Sitla Thakur, the Chief Business Officer of FundBezzie, holds over 13 years of experience across Banks, Fund Houses, Co-Lending, NBFCs, and Fintech.

Opportunities on FundBezzie

FundBezzie offers investment opportunities across 6 different product baskets:

- Real Estate (FRE and Tokens)

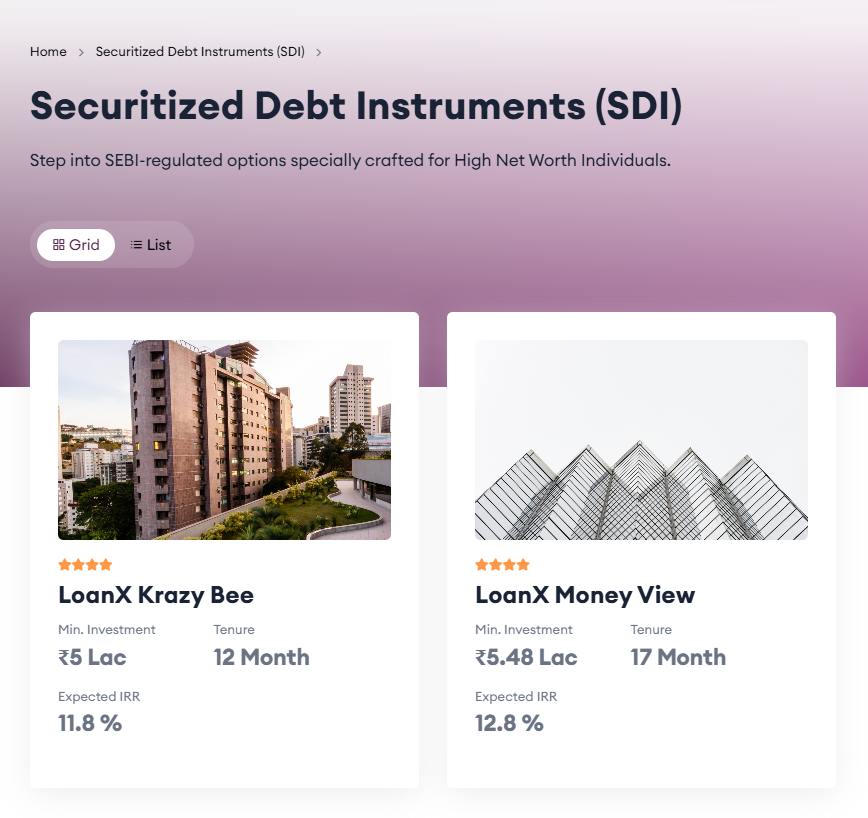

- Securitized Debt Instruments (SDI)

- Alternative Investment Fund (AIF)

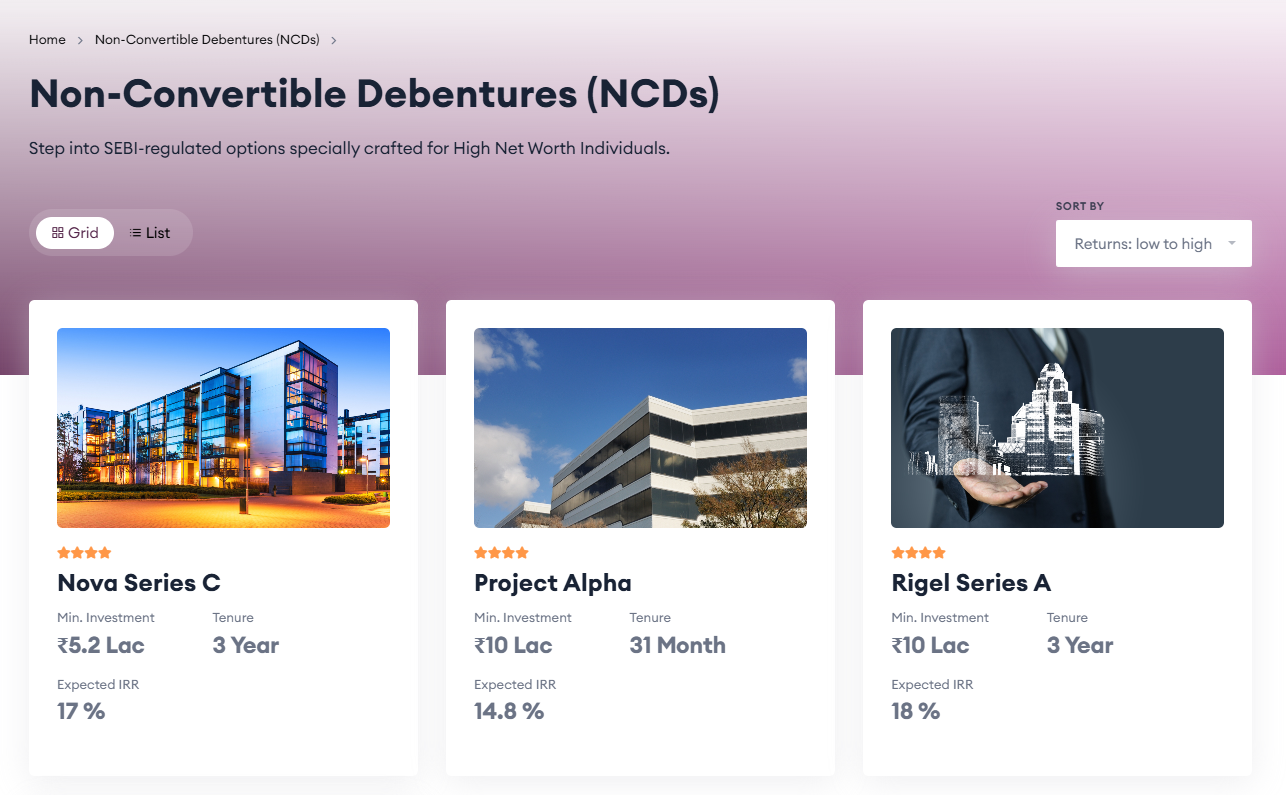

- Non-Convertible Debentures (NCDs)

- Fund Raising

- Green Assets

In the real estate segment, the platform offers fractional real estate opportunities that allow you to own a portion of a commercial property rather than the entire asset, making it accessible and affordable. This investment model is powered by pooling funds from multiple investors, enabling them to invest in high-value properties with a smaller individual commitment collectively. This offers the dual benefit of capital appreciation over the investment horizon and a steady monthly rental income. The platform manages the investment, thus reducing the burden of day-to-day management.

Securitized Debt Instruments convert loans and debts into tradable securities, offering fixed returns to investors. These instruments help banks improve capital flow by pooling various debts into a single product. SDIs combine various loans (like mortgages) into one security and then issue Pass-through Certificates (PTCs) to investors. These securities are divided into different parts (tranches) based on risk and return, giving investors choices based on their preferences. SDIs offer a consistent income in the form of fixed-income payments, with a reduced risk exposure and diversification of your overall portfolio with exposure to low-risk, high-quality securities.

Alternative Investment Funds (AIFs) pool money from multiple investors to invest in high-potential alternative assets, including private equity, venture capital, hedge funds, real estate, and infrastructure. These funds are managed by professional fund managers and are regulated by SEBI under the SEBI (Alternative Investment Funds) Regulations, 2012.

Non-convertible Debts or NCDs are debt instruments issued by companies to raise capital, providing fixed interest payments with no option to convert into equity shares. Investors purchase NCDs to receive regular interest payments at a fixed rate, with the principal amount returned at maturity. NCDs are a stable, low-risk investment, providing predictable returns and offering more security than volatile equity markets.

Key Features of Fundbezzie

The investment opportunities on FundBezzie are tailored to cater to specific objectives and are curated by the platform itself. The platform emphasizes transparency and integrity and focuses on risk management, enhanced due diligence, and long-term value creation. FundBezzie is backed by Pantomath Group, ensuring reliability and expertise while leveraging the Group’s global presence across 12 countries to expand investment horizons.

Let’s look at one of the live investment opportunities on FundBezzie to better understand the features of the platform’s offerings.

Unlike retail platforms Fundbezzie does not allow investors to directly register but they reach out to interested investor on specific opportunities available.

Share your details on the Google form if you are keen to evaluate the Dwarka Opportunity

Dwarka Investment Opportunity on Fundbezzie

The Dwarka Investment Opportunity on FundBezzie is a tokenised real estate investment opportunity with a fund size of INR 9.4 crore and an investment term of over 4 years. The minimum investment amount or ticket size is INR 10 lakhs, with a set-up fee of 1% and a fee of 10% charged on the profit earned at the time of exit. The opportunity carries an expected return of at least 2 times the initial investment amount over the tenure of 4 years and an Internal Rate of Return of 18%+.

Currently, land prices start at just Rs 240/sq.ft in Dwarka and are expected to double within 4 years. Over 75% of the project has been subscribed so far.

Dwarka presents a blend of opportunities in the coming years with its deep-rooted heritage, flourishing tourism, transformative infrastructure, and INR 4,150 crores in government-backed development projects ranging from upcoming airports and thriving industrial hubs to eco-tourism landmarks.

The Gujarat State Government’s Devbhoomu Dwarka Corridor Project aims to revitalize the region’s spiritual and cultural significance by improving tourism. FundBezzie’s Project is located close to key landmarks in the region.

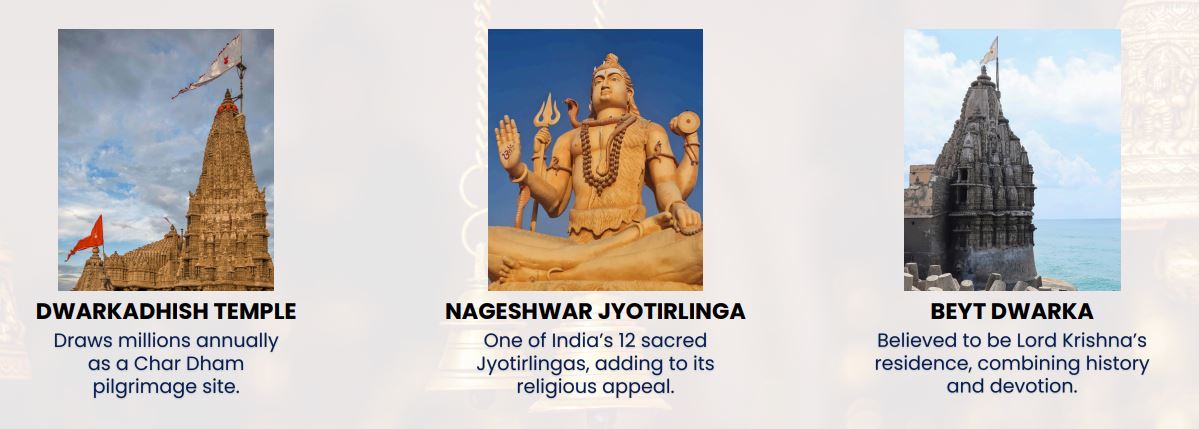

Key Spiritual Places in Dwarka

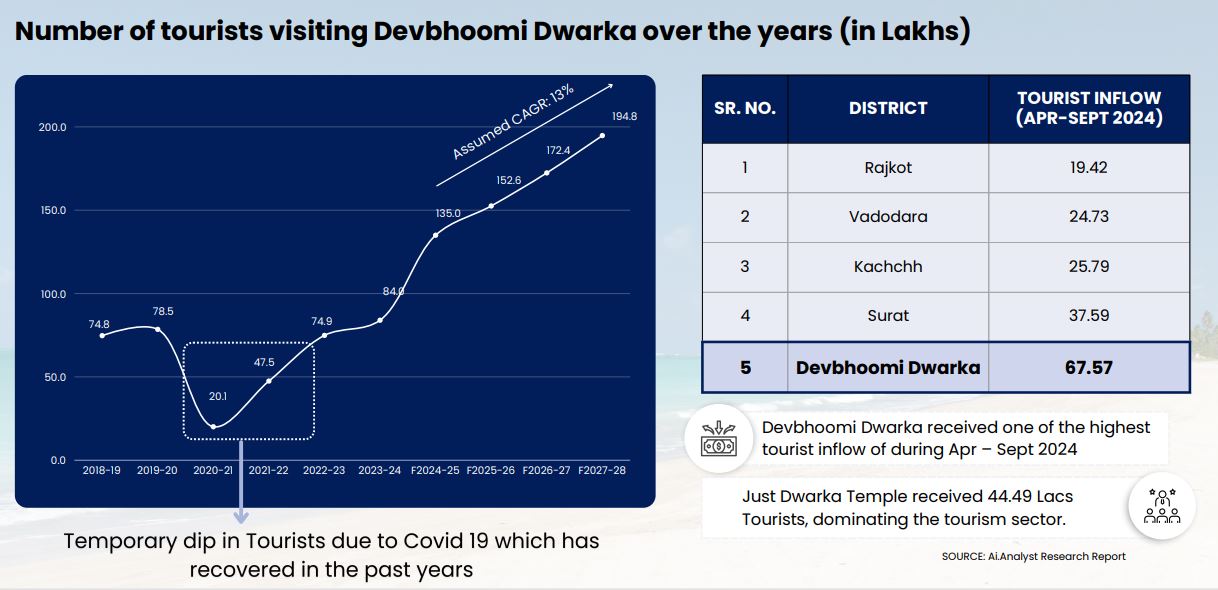

Tourism inflow statistics in Dwarka

Dwarka tourism has been going up steadily over the years and it now surpasses some large cities in Gujrat

The Gujarat Government’s Devbhoomi Dwarka Corridor Project aims to revitalize the region’s spiritual and cultural significance with improved pilgrim infrastructure. Key projects include

- Krishna Statue

- Bhagwad Geeta Zone

Upcoming Key Infra projects in Dwarka

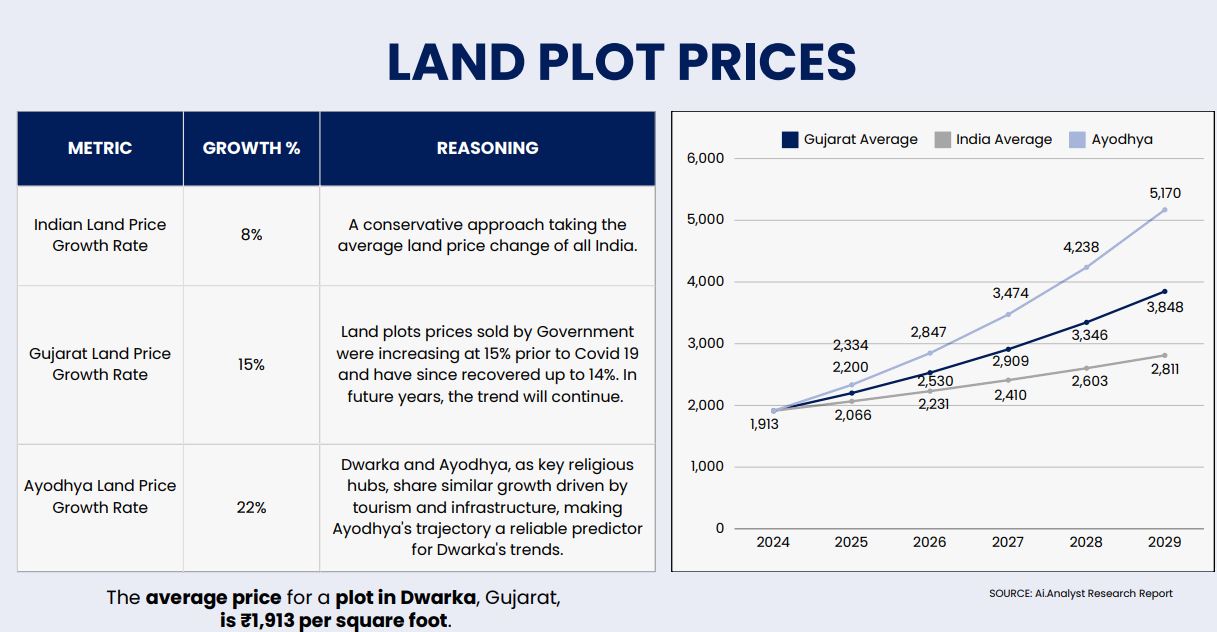

Conservative Estimate of Land Price Growth in Dwarka by Fundbezzie

Fundbezzie Deal Execution

Deal Structuring through Tokenization for better price discovery and transfer

Dwarka Project Exit Strategy

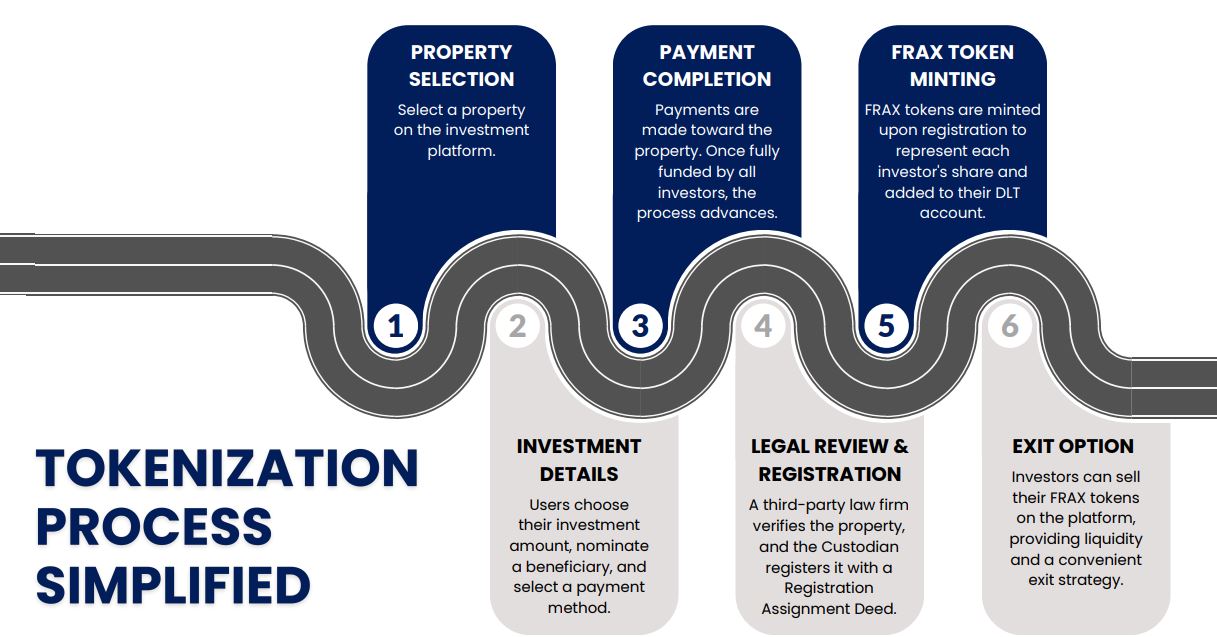

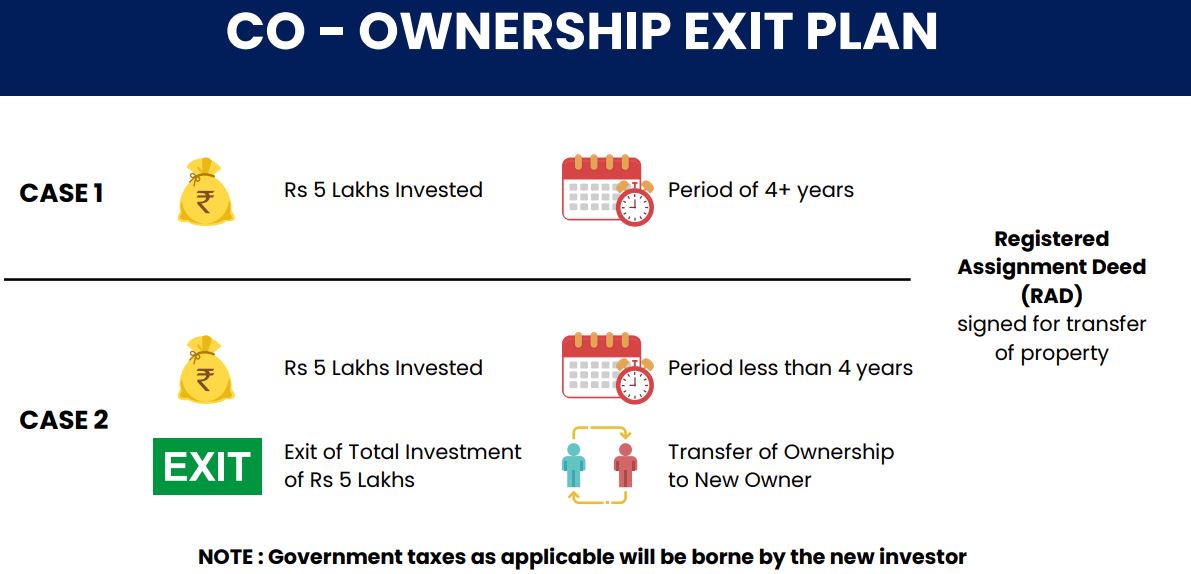

Real estate tokenization converts physical assets into digital tokens on a blockchain, enabling fractional ownership, greater liquidity, and simplified trading. As an investor, you can choose your investment amount on FundBezzie, nominate a beneficiary, and select a payment method. Once fully funded by investors, a third-party law firm will verify the property, and a custodian will register the property with a registration agreement deed. Thereupon, FRAX tokens are minted to represent each investor’s share and are added to their account on a Distributed Ledger. The investors can then exit the investment by selling their FRAX tokens on the platform.

Conclusion

With alternative investments becoming increasingly popular, investors in India now have multiple investment platforms to choose from. It is advisable that before you invest, you go through the key features of an alternative platform and understand how the platform works, what it offers, whether it is reliable, the technology used, the charges involved, etc. FundBezzie offers lucrative investment opportunities across different alternative asset classes and is backed by Pantomath Group, which has a proven track record in the financial landscape. However, before you invest in a particular opportunity, make sure you exercise your own due diligence on the project as well as the platform.