In recent years, fractional real estate investment has gained traction as a viable alternative for individuals seeking to participate in India’s real estate market without the traditional barriers. While real estate has long been regarded as a stable and appreciating asset class, investing in it typically requires large capital commitments, substantial paperwork, and long holding periods. Platforms like Estates by Per Annum aim to simplify this process by offering fractional ownership in curated properties, starting at lower entry points.

Purchasing real estate also comes with challenges, including liquidity issues and market fluctuations. Fractional investment attempts to address some of these by allowing you to invest smaller amounts across multiple properties, potentially spreading risk and easing management burdens.

This review takes a closer look at Estates by Per Annum, a platform positioned at the intersection of real estate and fintech, and assesses its model, offerings, and the potential it presents, alongside the associated risks and considerations.

What is Per Annum Estates?

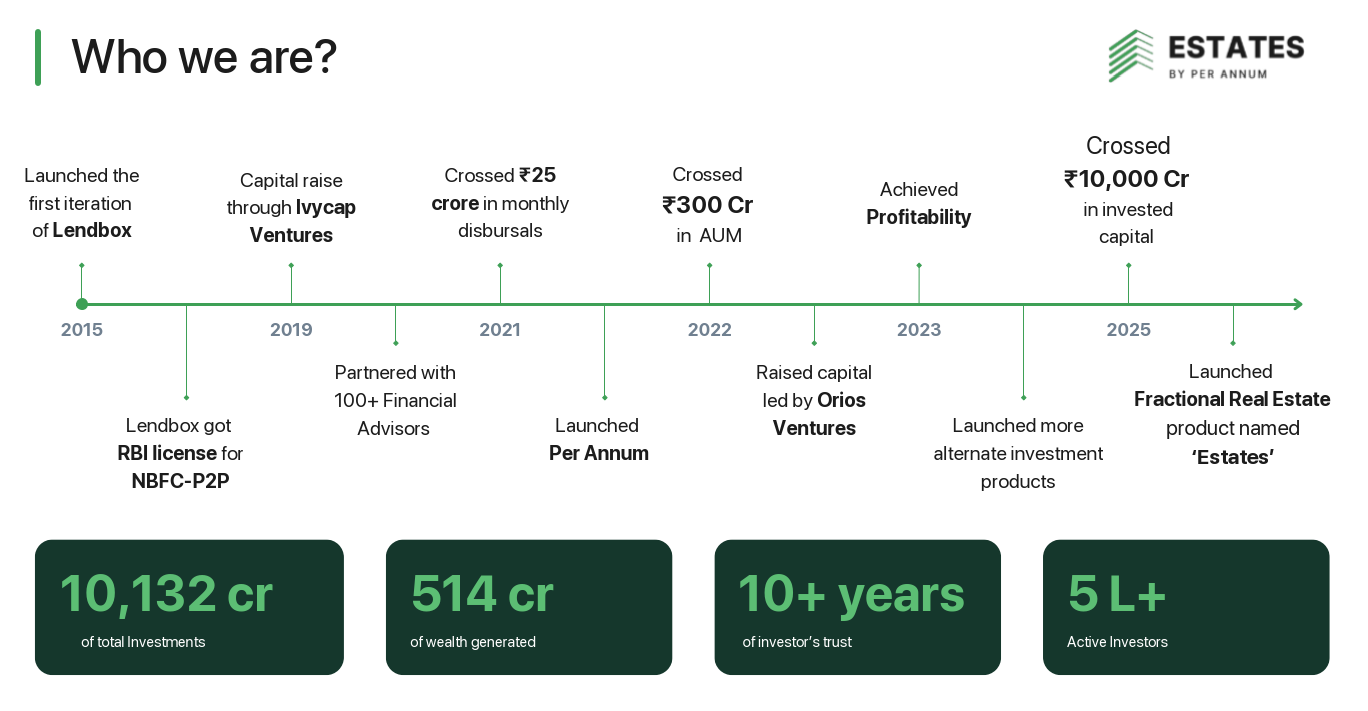

Estates is a fractional real estate product launched by Per Annum, a platform developed by Transactree Services Pvt. Ltd., which has been active in the alternative investment space for over a decade.

It was a pioneer in the P2P lending space through a product called lendbox and managed over ₹10,000 crore in invested capital, has generated ₹514 crore in wealth, and serves a base of more than 5 lakh active investors. These figures indicate substantial reach and activity; however, Estates is a newer addition to the platform’s offerings.

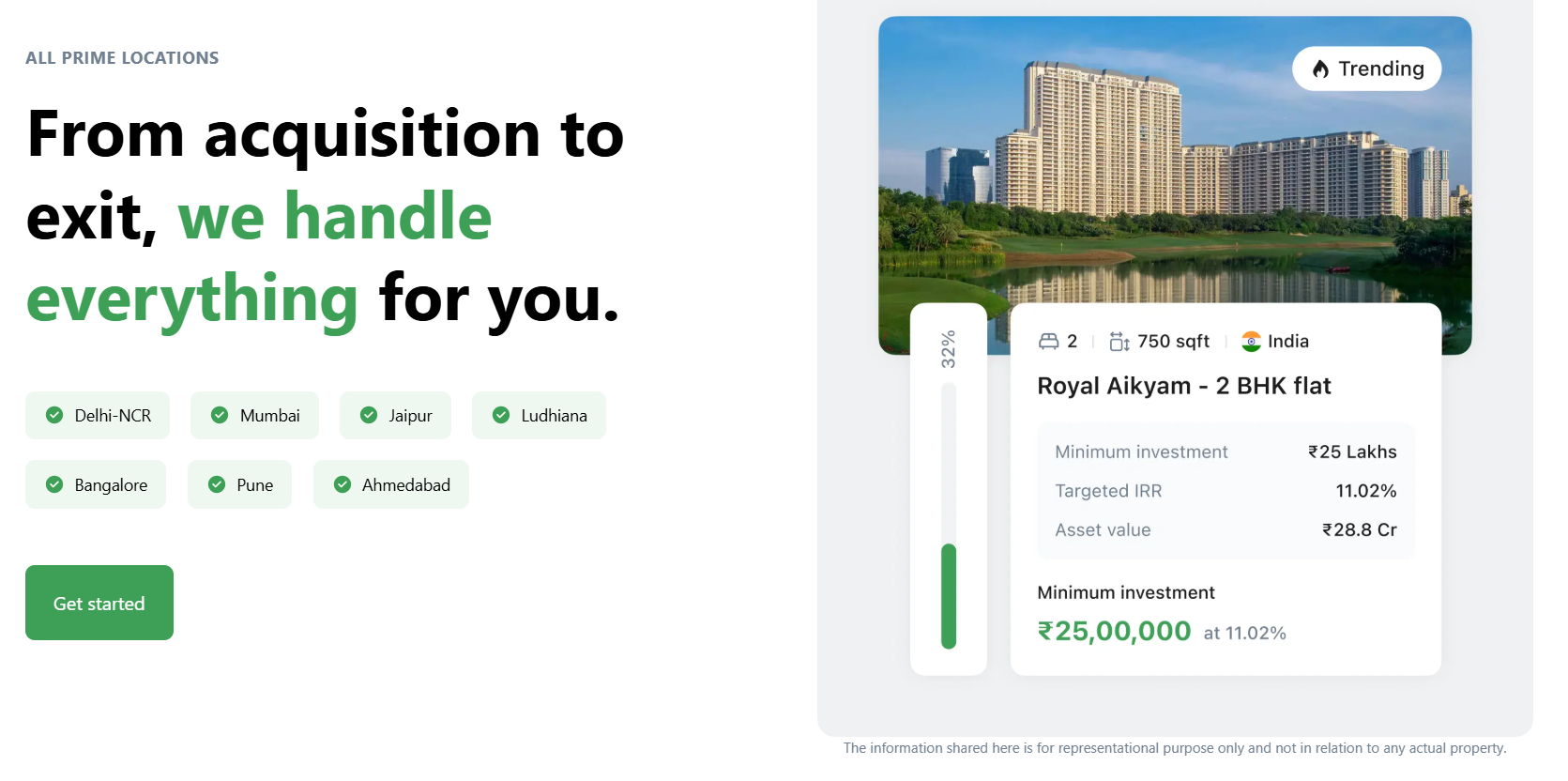

Estates focuses on early-stage fractional opportunities in residential projects, particularly in high-growth micro-markets like Gurgaon. The investment threshold starts at INR 10 Lakhs, and the platform is open to retail investors, HNIs, and NRIs (via NRO accounts).

The Team Behind Per Annum Estates

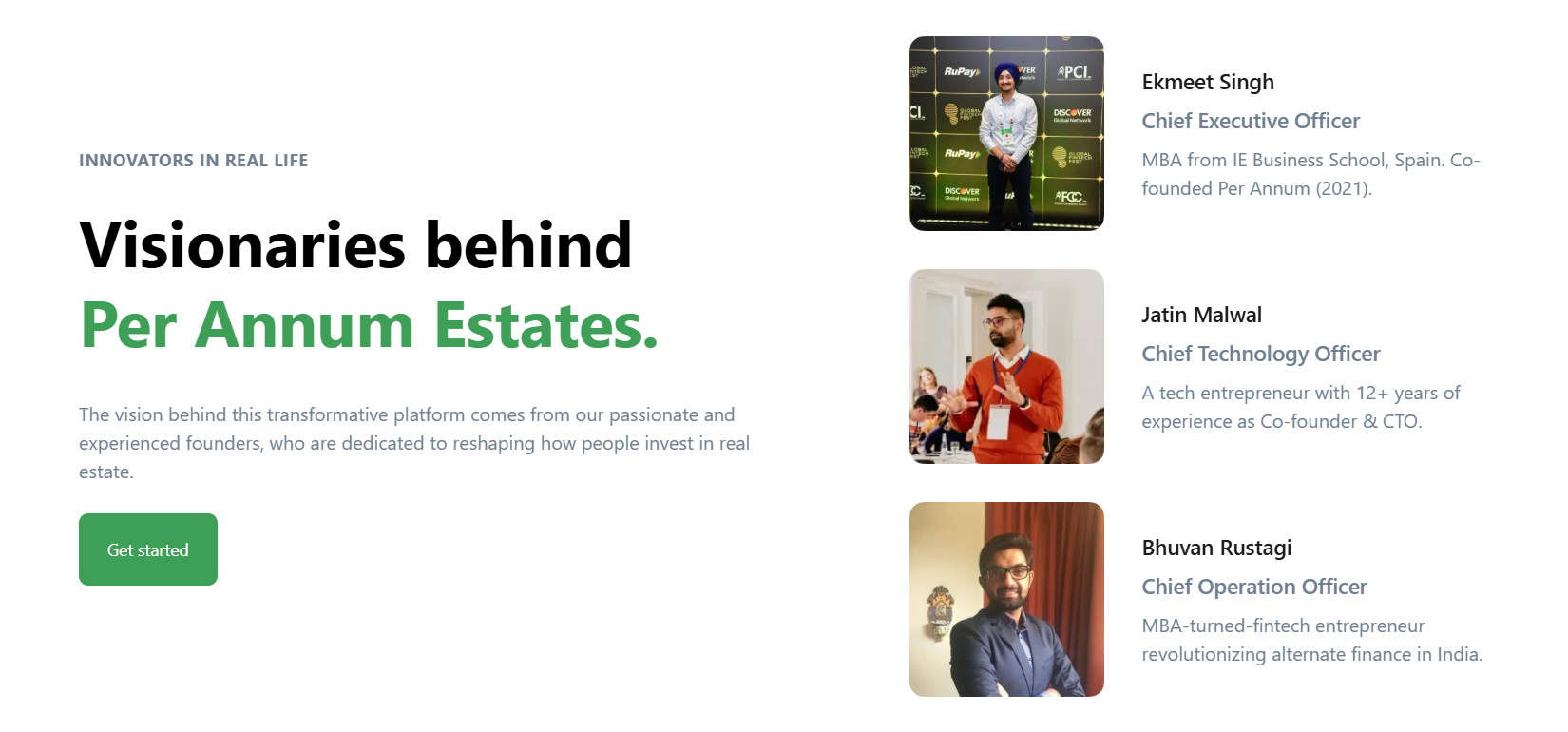

The Estates platform is led by a team with varied experience in finance, real estate, and technology. Ekmeet Singh, Co-Founder and CEO, brings over 17 years of experience in investment strategy and consulting. Bhuvan Rustagi, Co-Founder and COO, is a fintech entrepreneur with a background in investment banking and M&A. His 16+ years of industry experience have shaped Per Annum’s sharp focus on alternative investment innovation.

On the tech side, Jatin Malwal, Co-Founder and CTO, leads product innovation with over 12 years of experience building cutting-edge technology solutions.

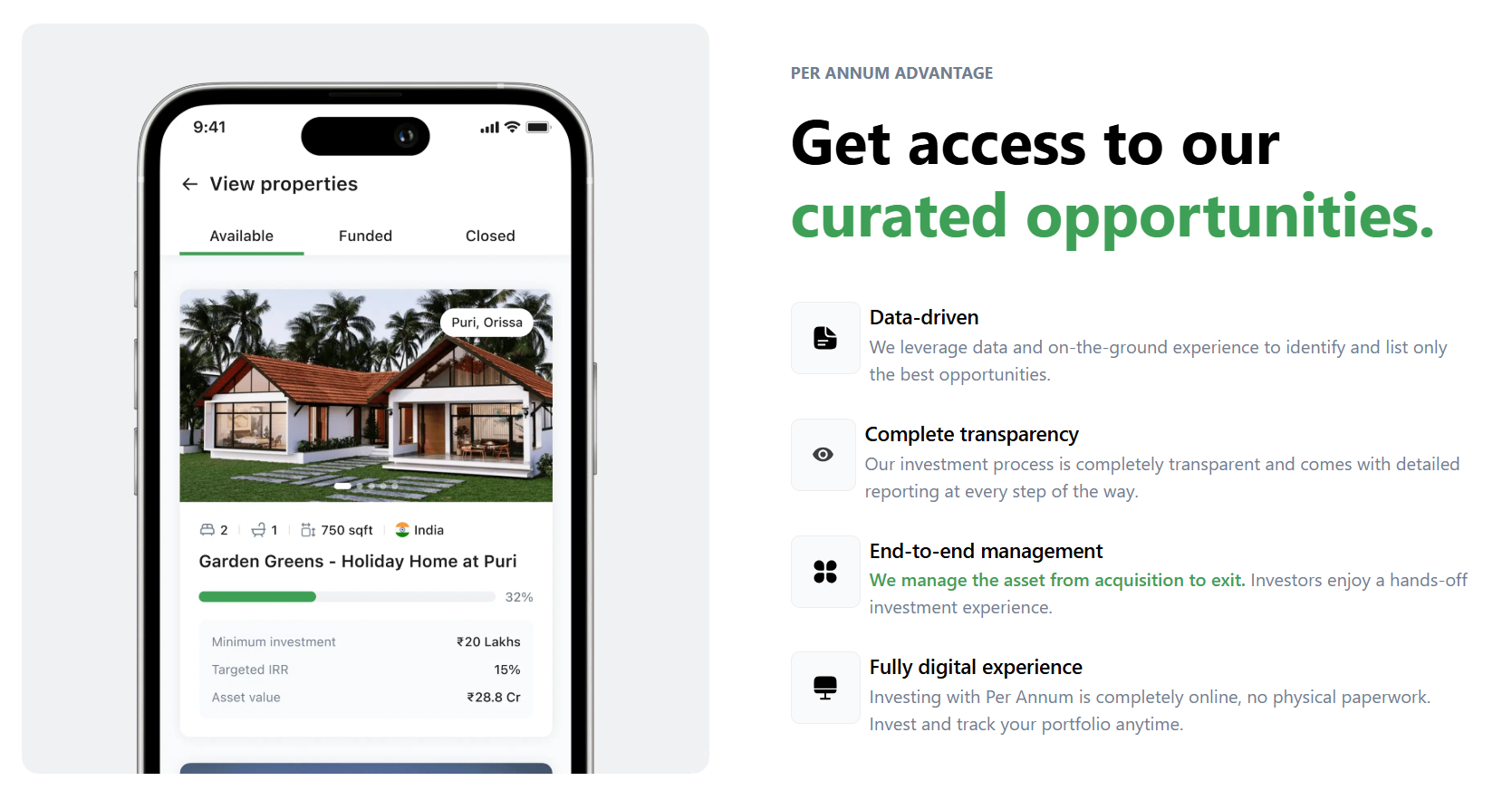

Key Features of Per Annum Estates

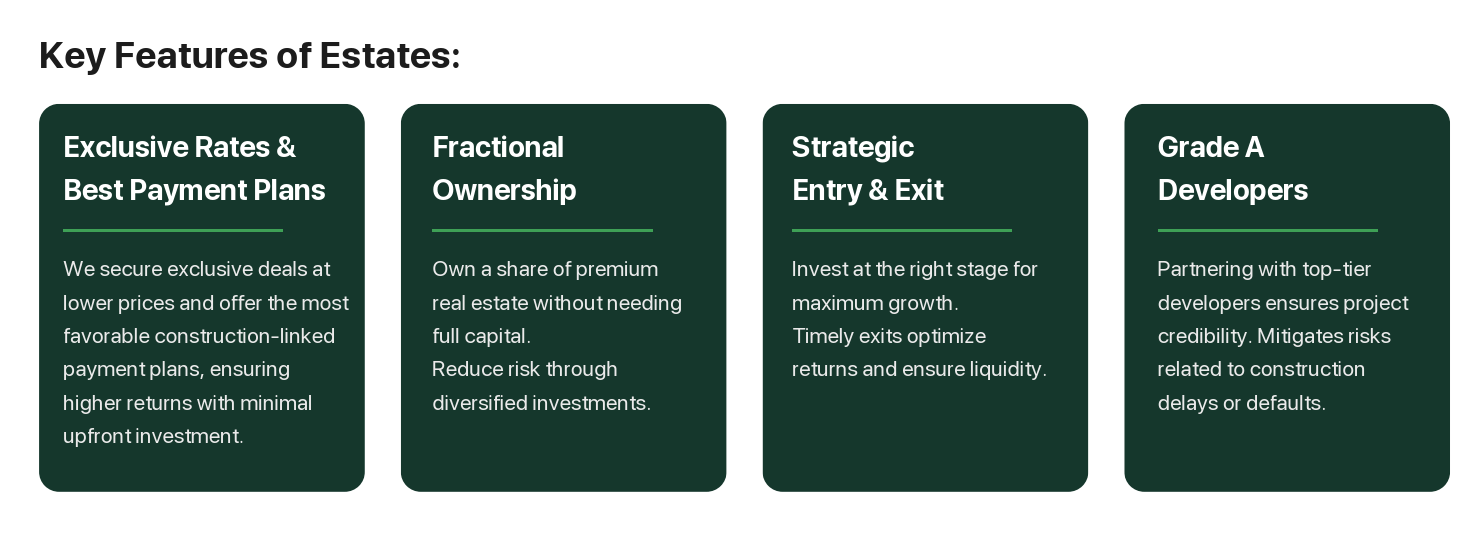

Estates offers several features aimed at simplifying real estate participation. One of the key features is fractional ownership, which allows multiple investors to co-own a property, thereby reducing the required capital commitment per individual.

Another notable feature is early-stage entry into projects. You can buy when the project is still in its launch phase and when prices are lowest. This strategic entry is then paired with a carefully timed exit when the market peaks, helping you extract maximum value from the deal. Estates also emphasise a Construction Linked Plan (CLP), where investors pay in stages as construction progresses. This can ease cash flow and reduce the upfront burden.

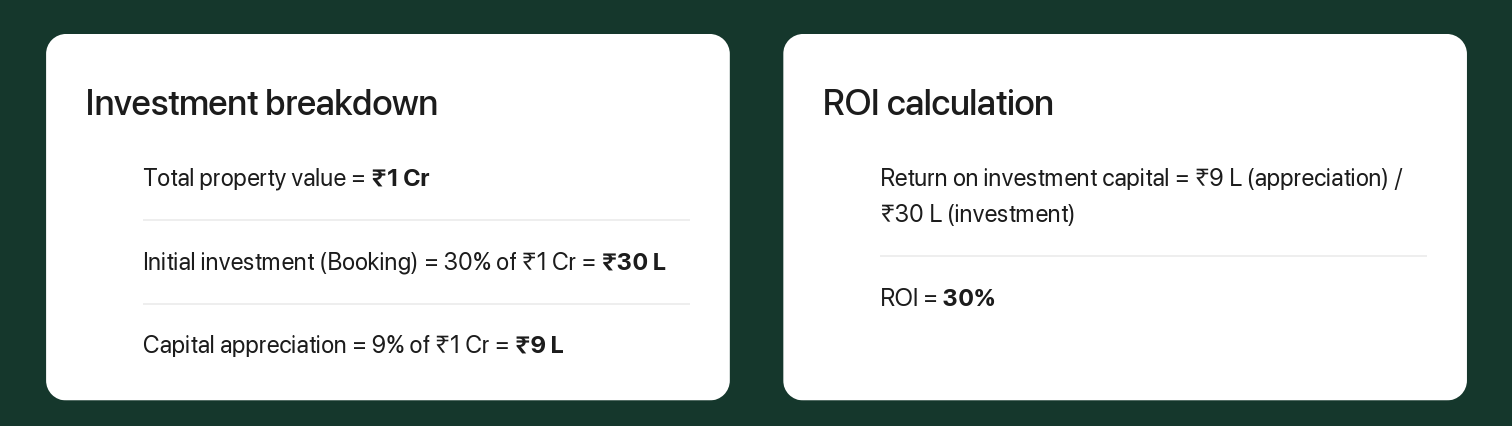

For instance, imagine a property valued at INR 1 Cr. You only invest 30% initially, that is INR 30 Lakhs, under the Construction Linked Plan.

If the overall property appreciates by just 9%, that’s INR 9 Lakhs in gains. But since your investment was just INR 30 Lakhs, your effective return on capital is 30%.

That’s the math behind such deals, you are effectively leveraging without putting in complete capital

How Estates Work?

Contribution Model

At the heart of Estates’ structure lies a Special Purpose Vehicle (SPV) model. When you choose to contribute to a project, a dedicated SPV is created specifically for that asset. The SPV purchases the property, handles legal and financial paperwork, and manages the asset throughout the lifecycle. When the property appreciates to a target valuation, the SPV exits and distributes capital among all fractional owners.

Contribution Process

Getting started with Estates is easy. First, you need to sign up on the Per Annum platform using link below. From there, you can explore a curated list of properties with detailed information about developers, location, financials, and growth potential.

Once you’ve selected a property, you become a co-owner in the respective SPV by signing the investment agreement. Your capital is securely transferred through encrypted payment gateways. After the contribution t is made, the SPV oversees the asset while you monitor everything in real time via your dashboard.

When the property hits its target valuation, the SPV sells the asset, and gains are distributed to you and other investors.

How Per Annum Estates Make Money

Estates uses a performance-based fee model. If the SPV generates returns of 15% or less, the platform charges no fees. For returns above 15%, it takes 25% of the excess returns.

For example, if a property appreciates by 30%, you keep the first 15% fully. From the remaining 15%, you retain 75% (11.25%), and the platform takes 25% (3.75%). This would leave you with a net return of 26.25%.

Onboarding & Technology

Estates promotes a digital-first experience, offering paperless onboarding, AI-assisted property selection, real-time dashboards, and automated documentation. Payments are encrypted, and updates are delivered through the investor portal. You’ll receive regular updates, performance reports, and exit alerts via the dashboard.

Due Diligence Process

Estates by Per Annum outlines a four-tier due diligence process:

- Market Analysis: Focused on areas with strong infrastructure and growth potential.

- Developer Screening: Prioritising developers with RERA compliance and proven delivery records.

- Legal Review: Involving experienced legal partners to vet project documentation.

- Risk Assessment: Evaluating demand-supply dynamics and project feasibility.

While this approach appears comprehensive, it’s worth noting that all real estate investments carry inherent risks, and you should do your own due diligence before investing in a project.

Exit Strategy & Liquidity

Estates aims to offer liquidity by timing exits based on market demand and price appreciation. The platform relies on a network of over 1000 channel partners to assist in finding buyers and is also working toward launching its own secondary marketplace for resale.

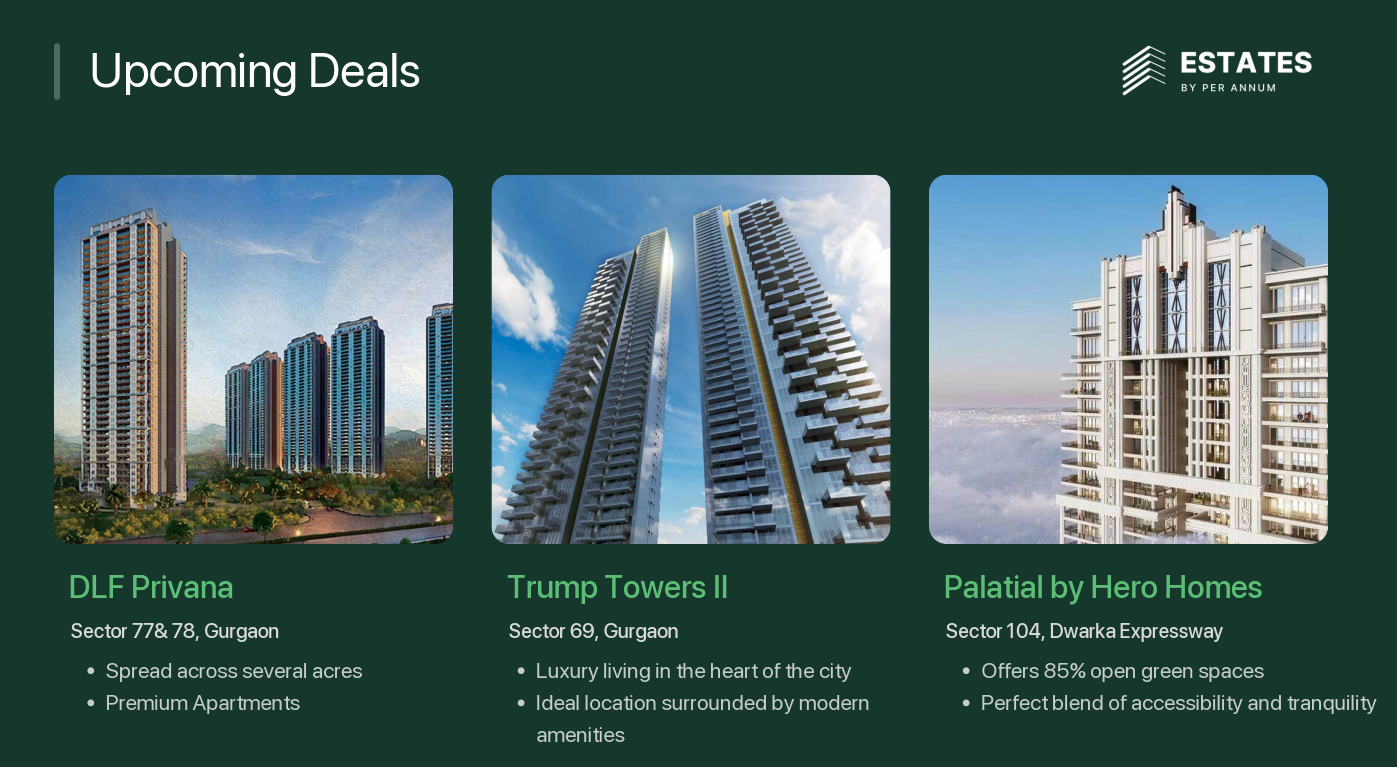

Upcoming Opportunities on Estates

Estates is currently offering early access to a curated selection of high-potential residential projects in Gurgaon. Notable among these are DLF Privana in Sectors 77 & 78, known for its expansive layout and premium construction; Trump Towers II in Sector 69, a luxury address with brand value appeal; and Palatial by Hero Homes in Sector 104, offering 85% open green space and excellent connectivity via Dwarka Expressway. These projects are positioned in rapidly developing micro-markets and are being marketed for their strong appreciation potential and strategic entry pricing.

Godrej Astra Opportunity

One of the most anticipated listings on Estates is Godrej Astra, a boutique luxury development located in Sector 54, Golf Course Road, Gurgaon. The project comprises 151 exclusive residences and offers a meticulously crafted lifestyle featuring a 4-level Club Celestial, curated landscaping, and design by international consultants such as UHA London and Gensler.

From an investment perspective, Astra offers a target gross appreciation of 58.25% over an estimated 18-24-month holding period. The deal amount stands at INR 11.91 Cr, with a minimum investment of INR 10 Lakhs, and contributions are structured under a 25 x 4 milestone-based payment plan. The projected sale value is INR 13.64 Cr, with expected gross gains of INR 1.73 Cr.

Backed by the legacy and credibility of Godrej Properties, this opportunity combines luxury, location, and strategic capital structuring, appealing to investors looking for short- to mid-term appreciation in a premium segment.

Risks Involved

Every investment carries risk, and fractional real estate is no exception. Some of the potential risks include:

- Market Volatility: Economic downturns, interest rate hikes, or policy shifts can impact property values.

- Liquidity Challenges: Exiting may take time and depend on market demand.

- Construction Delays: Regulatory or financial issues can extend timelines, especially for under-construction projects.

- Platform Reliance: Investors depend on Estates for asset management and resale execution.

- Regulatory Risks: Tax changes or real estate regulations may affect returns.

Conclusion

Estates by Per Annum presents a structured approach to fractional real estate investing, offering lower entry points, curated assets, and professional management. For investors looking to diversify their portfolios into real estate without the burden of full ownership, it may offer an accessible path. However, like any investment, it comes with its own set of risks and assumptions, particularly around market timing and liquidity. As with all financial decisions, you should conduct your own due diligence and consider consulting a financial advisor before proceeding.