Real estate investing is becoming increasingly popular in India. Amidst increasing volatility in stock markets and decreasing FD rates, retail investors are now looking for lucrative alternative investments to diversify their portfolios. However, unlike online stock brokers like Zerodha or Groww, real estate investment platforms are yet to evolve. As a result, it becomes challenging for retail investors to find the perfect real estate investment platform that checks all the right boxes.

This article will cover a list of the best real estate investment platforms in India and their key features.

This list is created based on our experience investing through these platforms or interacting with other investors

A good investment platform needs to fulfill a few basic requirements of investors, which include multiple investment options, access to information, secure transactions, credibility, reliability, and a praiseworthy support system. A real estate investing platform must provide investors with all the necessary information to make an informed investment choice. These include legal and financial information related to the property, rental yield, etc.

Before I cover the list of best real estate investment platforms in India, let’s look at what you should look for in a platform or a real estate investment app.

Things to Look for in a Real Estate Investment Platform

Real estate investment is nothing new. Land ownership is fundamental to the evolution of the idea of property rights. Land being a limited resource, the benefits of land ownership and investing in land are known to everyone. However, traditionally, real estate as an investment avenue has been limited to High Net Worth Individuals (HNIs) with minimum investments going as high as crores. This is especially true for commercial real estate, which offers higher returns than residential properties.

But with Fintech startups mushrooming in India, now even retail investors can invest in commercial real estate properties. Fractional ownership and real estate investment instruments such as Real Estate Investment Trusts (REITs) have made it easier to invest in commercial real estate.

Now since most of these real estate investment platforms are less than a decade old, and can be classified as Fintech Startups, you must look at a few things before you invest through them.

-

Promoters and Investors

One way to gauge the credibility of an investment platform is to research its founders. People sitting in key managerial positions can tell you a lot about the company’s reliability, its likeliness to survive and thrive, and its vision. Real estate investment is typically a long-term commitment, and the investment platform must survive for such long periods!

Having industry leaders and well-known firms from the finance sector as investors can tell you a lot about the company’s trustworthiness.

-

Licensing/ Registration and Regulatory Clearance

The regulatory landscape surrounding fractional ownership platforms or FOPs in India is fairly new. On May 12, 2023, SEBI issued a consultation paper titled ‘Regulatory Framework For Micro, Small & Medium REITs (MSM REITs)’ laying down a proposed regulatory framework for Small and Medium Real Estate Investment Trusts or SM REITs which would make real estate investment more accessible and facilitate fractional ownership platforms to be governed under the ambit of SEBI (Real Estate Investment Trusts) Regulations, 2014. Based on this, the REITs Regulations of 2014 were amended and the amendments were notified on March 08, 2024, vide the SEBI (Real Estate Investment Trusts) (Amendment) Regulations, 2024.

In line with these amended regulations, few fractional ownership platforms are regulated by SEBI and are required to be registered with the regulatory body.

However, if a platform incorporates the SM REIT guidelines it cannot do residential real estate, land investment, or debt hence only a few platforms would come under these currently. Hence many platforms have SPV or NCD structure.

-

Secured Transactions

Fintech companies and online payment gateways have facilitated effortless online transactions. However, online banking frauds are still on the rise! Thus it is important to be extra cautious while transacting online. Make sure your real estate platform enables safe and secure transactions.

Ensure they have an independent Trustee and escrow mechanisms to avoid any leakage of cash flow or mismanagement. It is important to ascertain that the legal documents are sound.

-

Availability of Information

Real estate investing can be grueling and confusing for someone with little or no prior knowledge about how real estate investments work. At the same time, aspects such as rental yield, projected capital appreciation, and exit formalities need to be specified.

This is why your investment platform must have all the information you need to make informed investment choices.

Furthermore, these days Fintech companies are spending tons of money on marketing and educational content to educate investors about their products and services. Make sure your platform has an extensive knowledge base to help you learn more about the platform as well as real estate investing.

-

Customer Support

Make sure your investment platform has a good customer support system in place. It is important as periodic queries or issues on your investment can happen and you should have a dedicated point of contact to resolve.

Finance and investing are best experienced with professional advice and guidance. Most Fintech platforms these days provide investors with consultation and advisory calls, as well as live customer support. These are basic features that you should know about, before using an online investment platform in India.

The above points are some of the basic features that you need to look for in a real estate investment platform. However, there can be several other aspects besides these. Before you invest in a platform, make sure you check the track record and ratings of the platform to understand how it has worked for other investors.

Now let’s have a look at the list of the best real estate investment platforms in India and understand their key features in brief.

Best Real Estate Platforms in India

We have created the list based on below real estate products that are generally available in the market.

- Commercial Real Estate

- Residential and Land Ownership

- Agricultural Land

- Real Estate Debt

The following are some of the best online real estate investment platforms in India in these categories(in no particular order of preference):

-

Commercial Real Estate

When it comes to fractional real estate some of the platforms that we found good are below

The platform offers investment opportunities over four asset categories and thirty investor geographies. The company has over 350 crores of rupees in assets under management (AUM) and has delivered an average internal rate of return (IRR) of 14 to 24%.

The platform has listed some interesting projects in fractional ownership with a focus on Bangalore and Hyderabad. The platform has different variety of CRE opportunities such as the “Co-Living” project near Hyderabad airport.

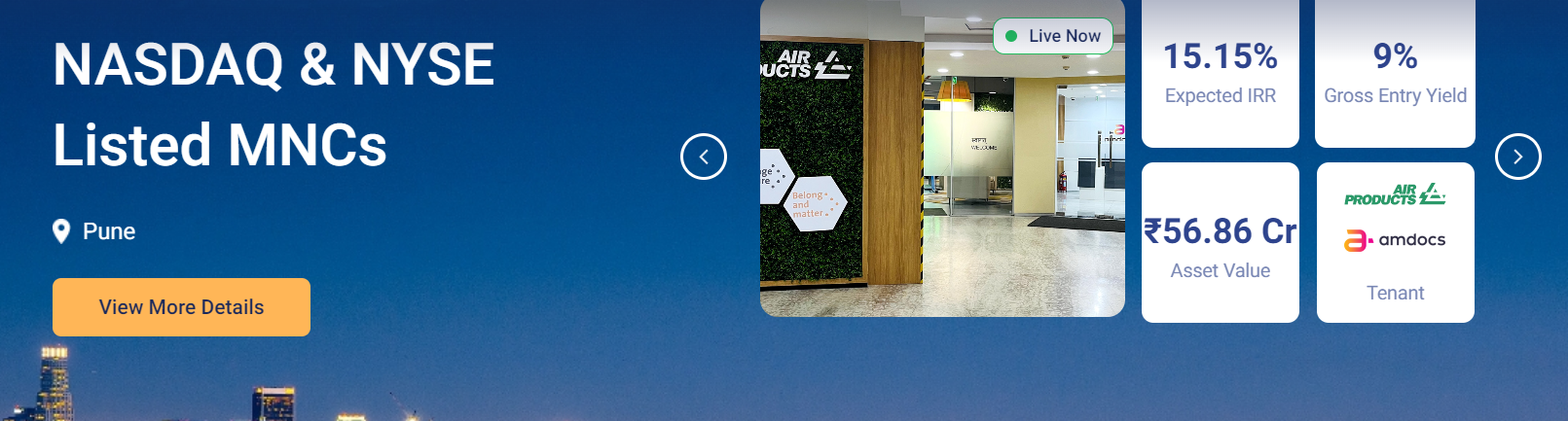

WiseX (formerly, MYRE Capital) is a proptech platform that provides easy access, transparency, and liquidity to a curated selection of rent-yielding commercial real estate assets. The platform offers high-yield institutional-grade investment opportunities in the real estate sector.

The platform offers real estate investment opportunities for a minimum investment amount of INR 25 lakhs and offers an IRR of 14-20%. As an investor, you can benefit from both regular rental yield, as well as capital appreciation with time. With over 60,000 users, WiseX has facilitated investments of over INR 400 crores.

We had invested in the Mumbai Time Centre property via Wisex. Our experience has been good so far. They have done some large projects in Pune and Bangalore.

-

Hbits

hBits is a fractional ownership platform that was started in 2018 and aims to democratize real estate investment in India. The platform offers multiple investment opportunities for specific commercial real estate projects across major cities in India, such as Mumbai, Pune, Bengaluru, etc. The platform offers real estate opportunities for a minimum ticket size of INR 30 lakhs and offers up to 18% IRR and up to 10% rental yield.

With over 1,00,000 registered users, hBits has around INR 365 crore in Assets under management (AUM) today. The company boasts a record of exiting its first property with an Internal Rate of Return or IRR of 17.54%

The platform also runs Alternate Investment Funds (AIF) for investors looking to invest large capital.

Residential and Land Ownership

There is currently only one platform, Alt DRX, where residential land investment is possible. Alt DRX

Short for Alt Digital Real Estate Exchange, claims to be the world’s first digital real estate exchange. Alt DRX operates on the principle of fractional ownership, breaking down real estate assets into smaller, digital tradable units known as ALT.SQFT. This approach allows investors to buy and sell fractions of real estate, making investing in as little as 1 square foot of property possible.

The platform leverages advanced technology, including a proprietary machine learning algorithm, to determine real-time Net Asset Value (NAV) and facilitate peer-to-peer trading in ALT.SQFT.

Alt DRX is unique in terms of its approach towards real estate investing. Its innovative approach, leveraging technology and a digital marketplace, brings liquidity and accessibility to an asset class traditionally known for its illiquidity.

We have invested in multiple land projects on the platform and were able to partially exit it on the exchange with decent returns.

Agricultural Land

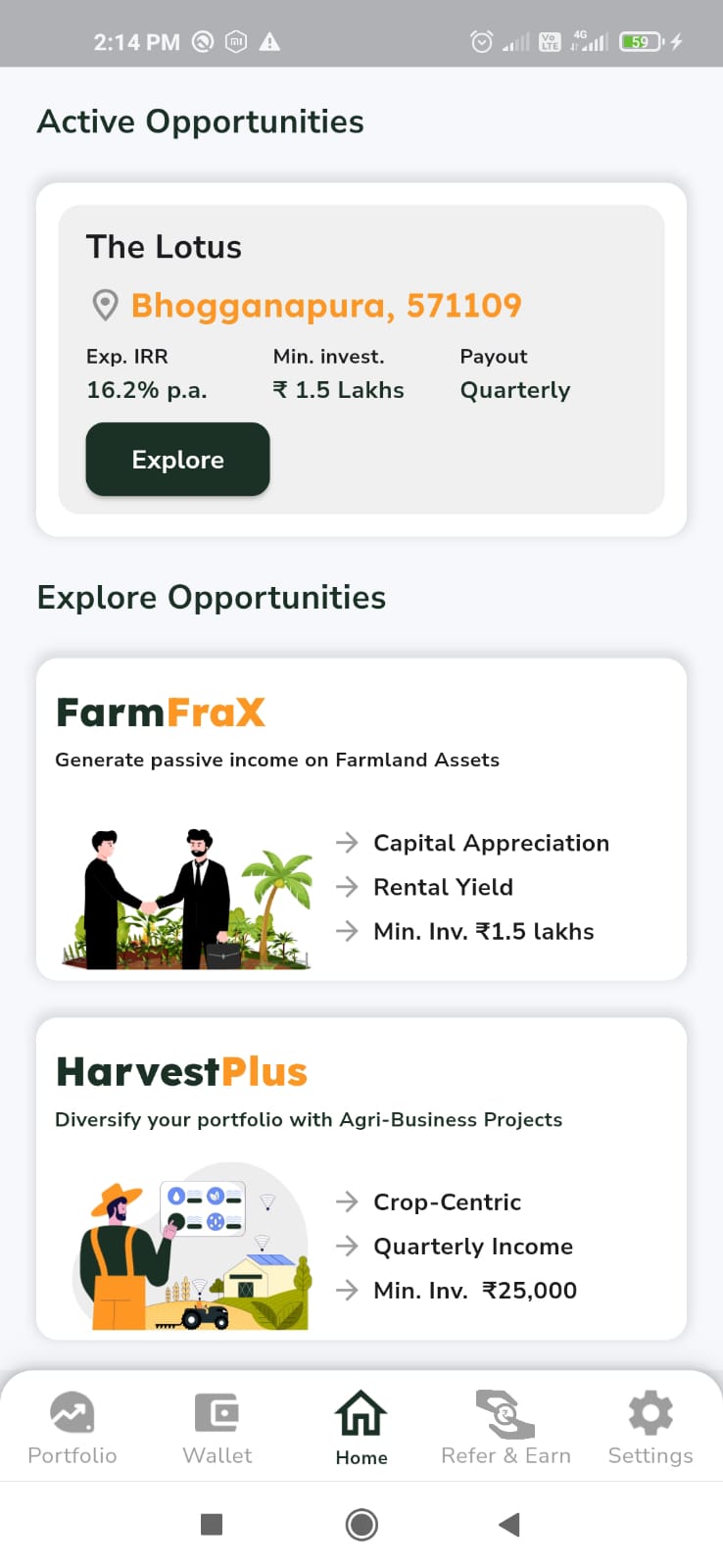

Farmfrax is run by Faab platform which specializes in agriculture. This platform allows you to purchase agricultural land which they lease and develop and then is sold after a few years with capital appreciation.

Real Estate Debt

Below are the top real estate platforms in order of our comfort with them.

-

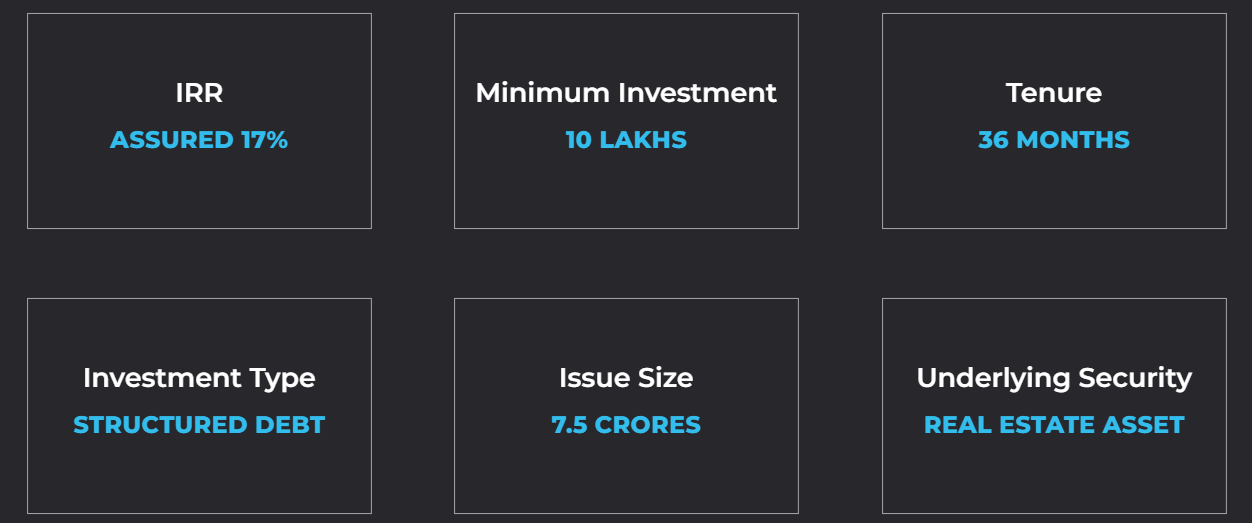

Assetmonk

Assetmonk has generally the highest return in its debt products with some products giving 18-19% return. The performance has been good with zero defaults even during the Covid period.

-

Earnnest. me

This is another of our favorite platforms for real estate debt in India. The platform boasts of a very experienced team that also manages real estate fund. The deals are generally very well structured.

Earnnest. me was launched in February 2022 by Certus Capital, which has been offering real estate capital solutions and investment opportunities since July 2018. Earnnest lists curated investment opportunities that offer fixed annual returns secured by real estate projects.

The platform lists curated opportunities that are secured, regular paying investments, and can generate 5% – 10% more than fixed deposits or debt mutual funds, but without the volatility of equity markets.

With a gross commitment of INR 385 crores, Earnnest has over 700+ investors on the platform, with 70% showing repeat investment interest. Earnnest is a venture of Certus Capital, which has its group entities licensed as NBFCs and AIFs, regulated respectively by the Reserve Bank of India and the Securities and Exchange Board of India.

Though this is not an exclusive real estate platform as it has many other products like invoice discounting etc, it sometimes lists interesting real estate opportunities with short tenors and high yield. The platform has done more than INR 1,000 Crore of deals and has a strong team.

-

Wisex

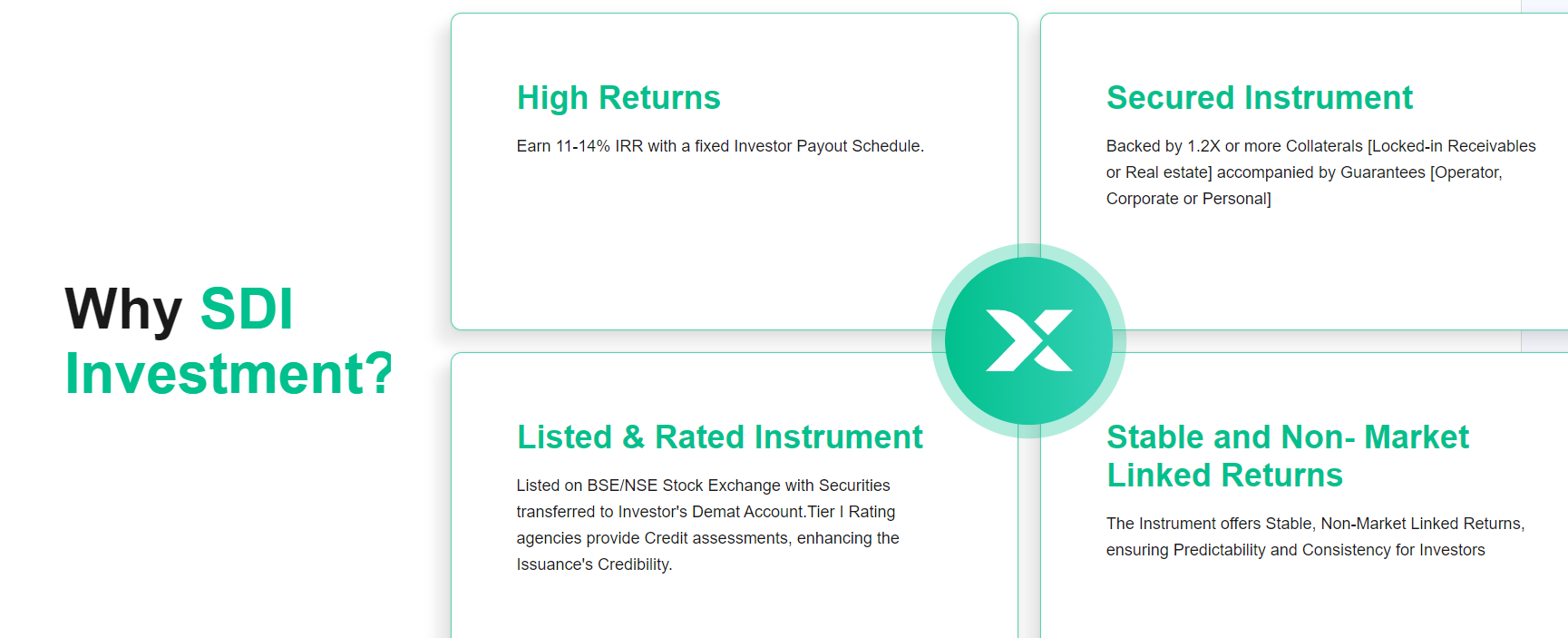

Apart from fractional real estate, Wisex offers high-yield debt products like Securitized debt investments with yields up to 15%. The good part about SDI is that these are listed, rated and regulated by SEBI. This adds more comfort to investors.

Conclusion

Several online real estate investment platforms now offer fractional investment opportunities in India. However, for an investor, choosing a real estate platform wisely is important based on some of the key features discussed in this article and not just the rate of returns offered. These factors include regulatory clearance or registration/licensing, opportunities offered, exit process, information availability, etc.

In this article, we have covered the factors to look into before choosing an online real estate platform, and a list of the best investment platforms available in India that you can choose from.

We provide monthly reviews of deals and the performance of these platforms on our website.