The start of 2022 has turned out to be a rough ride for the global equity and cryptocurrency market. Somehow having a decent chunk of my investment in other alternatives and non-market-linked products has been a savior for me. Else I would have also got sleepless nights like a lot of other investors!

People who started investing late in equity and crypto markets would have got their experience of volatility. People should not get spooked by it. Another learning is for the blind IPO investments people were chasing. Most of the new-age Tech IPO are below the listing price.

My Alternative Investment Portfolio Performance

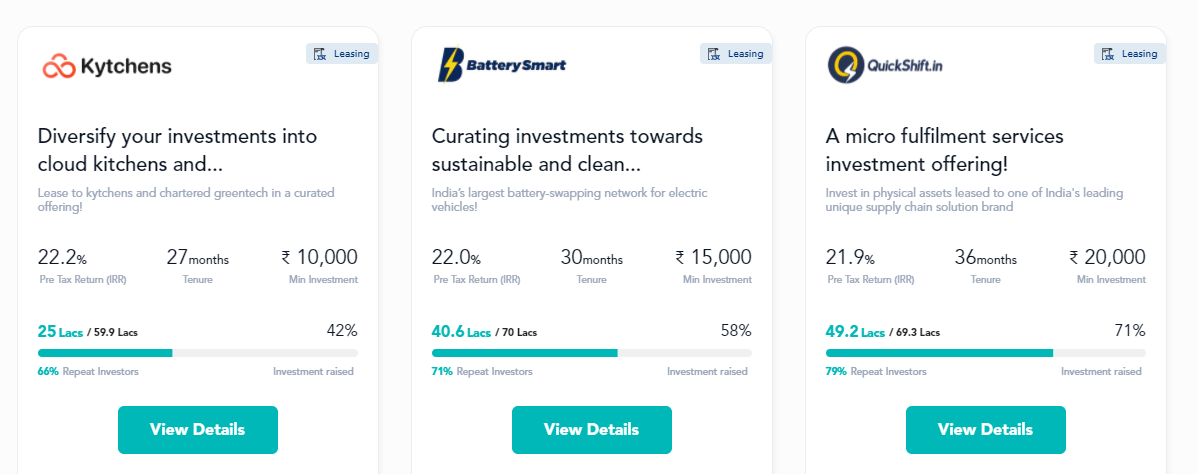

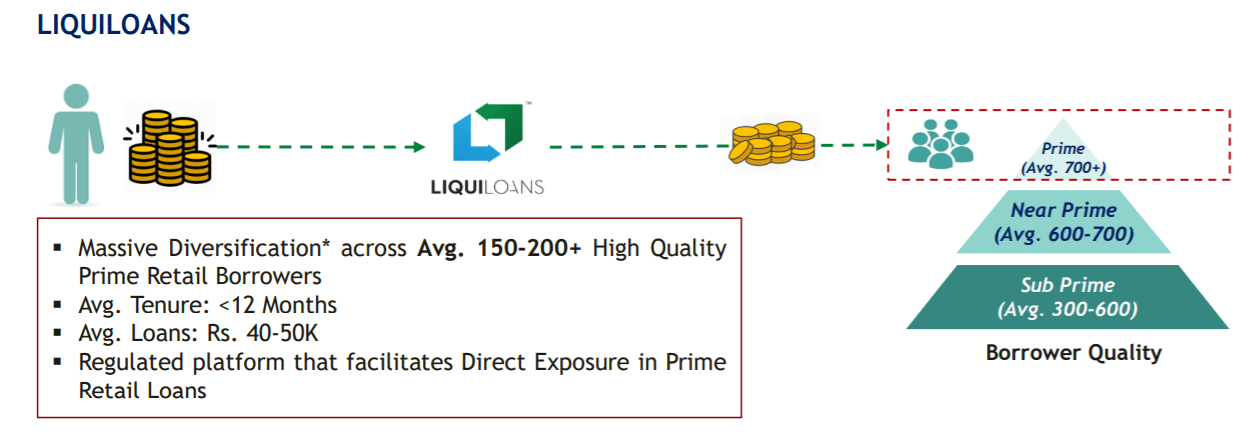

This Year we have added 3 new platforms – Jiraaf, Upcide, and Liquiloans.

Liquiloans is a liquid fund substitute to park emergency corpus while Jiraaf and Upcide are high yield platforms.

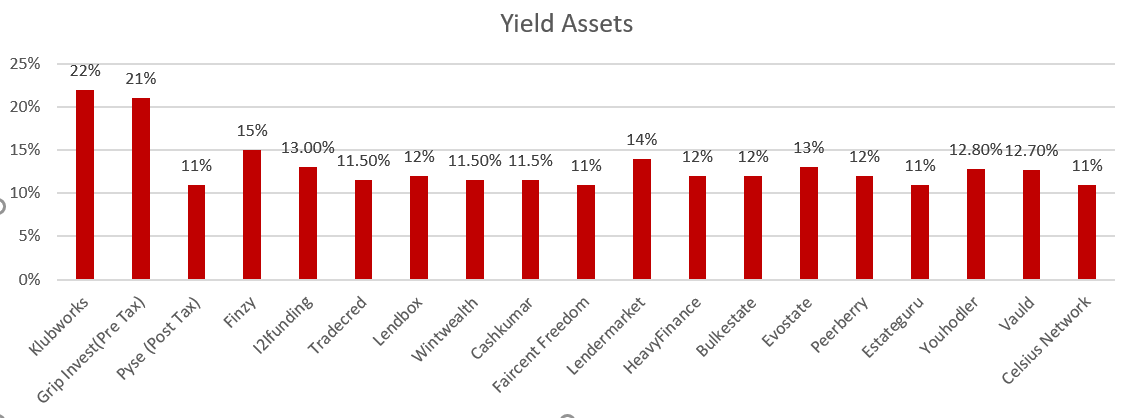

Structured Lending Investment

| Platform | Return | NPA |

| GRIP Invest | 12-13% (post tax) | Nil |

| Klubworks | 20-23% | Nil |

| GrowFix(Wealth Wint) | 10%-11.00% | Nil |

| Pyse | 10%-11%(post tax) | Nil |

- Wealth Wint Issue for Incred bond is live with INR 10k minimum investment

- Have invested in recent Klubworks Moonshine Meadory deal!It was recently on Sharktank and we can expect revenue to go up.

- All my cashflow in Klubworks, WintWealth,Pyse and GripInvest are as per schedule.

New Deals

Invoice Discounting, Settlement Finance,Consumer Loans

| Platform | Returns | NPA |

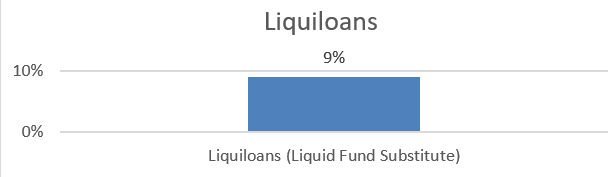

| Liquiloans (Liquid Fund Substitute) | 9% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

- TradeCred listing frequency has increased considerably for investment tickets

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Liquiloans is a great platform to park emergency corpus with instant liquidity

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(Stopped) | 13% | 5.5% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- Use Winvesta multicurrency for managing a global portfolio (now Winvesta has zero maintenance Fees)

- For all investment related remittance please transfer money to IBAN account from your indian bank account and not other remittance services as per RBI FEMA guidelines!

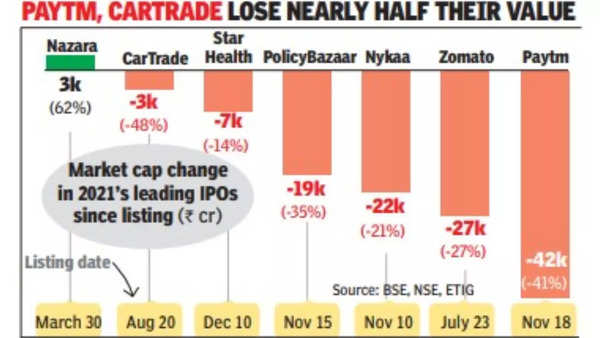

Equity Market

Buying stocks just because they are up doesnt seem to be a good strategy anymore with all tech stocks crashing

- Everyone is aware of the carnage in the equity market this month. While the first half saw continuos rally ,last 2 weeks were complete mayhem!

- I am not increasing allocation yet as risk reward still doesnt look very attractive.

Crypto Lending Investing

| Platform | Return |

| KuCoin | 20%(market dependent 10-60%) |

| Celsius Network | 11.5% |

| BlockFi | 8.6% |

| Youhodler | 12.7% |

| Vauld | 12.6% |

- Coindcx is also offering 14% return on USDT

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Youhodler Paxg (Gold backed coin) offering 8.2% yield over gold returns

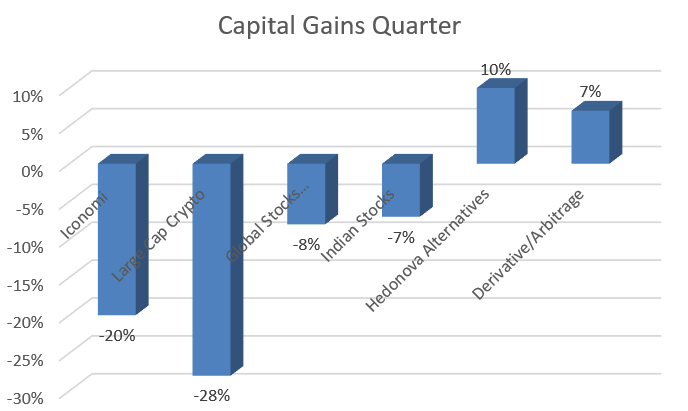

Crypto Investment

Crypto crash makes equity market fall looks like a minor correction. Panic sell off across the spectrum made the portfolio bleed

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -25% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 8% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 4% |

- I have made few more investment in ICONOMI( Diversitas, Carus-AR). Idea is to invest in promising funds.It is highly speculative and I expect more volatility in the next few months!

P2P Investment

Current allocation:

- Rupeecircle- 5%

- I2IFunding- 15%

- Finzy- 20%

- Lendbox-25%

- Faircent-20%

- Cashkumar-15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks backed loans,E-Rickshaw backed loans,education loan,NBFC backed loans(Monedo etc) Group loans | 13.5% | 5% |

| Cashkumar | Elastic Run Product | 11.5% | 0% |

| FINZY | Prime Borrowers,High Salary ,A category | 14.2% | 3.5% |

| Faircent ( Only Pool Loans) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- Have added Cashkumar in my portfolio for Elastic Run Product.

- Systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- Completely stopped RupeeCircle

Other Alternative Assets

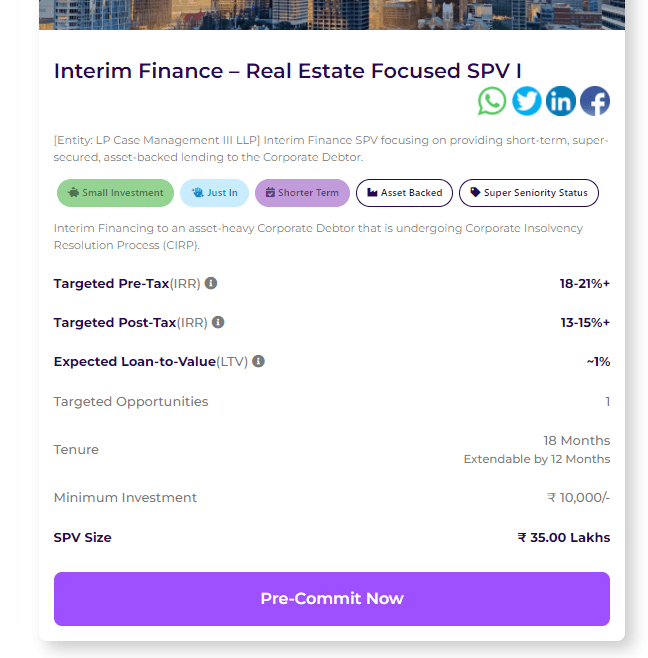

Have Invested in Interim Finance deal issued by LegalPay(Promo code FV48G4 ). Will be updating the performance when cashflow start.Another interim finance deal is going live this month

What is LegalPay’s Interim finance model?

LegalPay’s Interim Finance Model (a short-term, super-secure lending product) is offered to companies under insolvency, where Resolution Professionals need funding solutions to meet exigencies and protect the assets of the company.

9 Reasons why you should diversify your Investments with Interim Finance?

- Super Seniority Status – Interim Financier has the first right to receive repayment of Principal + Interest under S. 53 of IBC

- Short-term investment product – Investors are typically expected to realize returns within 18 months(extendable by 12 months)

- Asset-backed – High asset cover, 50x-100x of the financing amount (LTV < 2%)

- Low ticket size- Start investing with a ticket size as low as INR 10,000

- Lucrative returns – Targeted pre-tax IRRs upwards of 22-25%

- Monthly payments – Payout at regular intervals

- Real-time Monitoring- Transparent investment process allowing investors to track their portfolios on a real-time basis

- Uncorrelated to the market – Legal financing investments do not depend on the capital market.

- Diversification – Invest in Interim Finance to diversify your portfolio as per your risk appetite.

| Platform | Assets |

| Legalpay (Promo code FV48G4) | Litigation Funding |

| Raison | Tokenized Pre IPO stocks |

| METEX | Palladium/Platinum |

| Vinovest | Exotic Wines |

Dear Rohan,

What is your opinion of Orowealth Green Investing option that claims to invest in Clean

and Tax-free assets. I could not find any historical performance data on this.

I reckon Orowealth green is nothing but pyse deal!

you can rather invest directly on pyse here https://app.pyse.in/auth/register?r=RANDOMDIMES01

My pyse review https://randomdimes.com/pyse-review-high-yield-green-investing-tax-efficient/

no defaults till now

Hi Rohan,

I’ve been following you since 2020, you rock dude, on finding such platforms, no one in India has vast alt-inv knowledge currently.

My question is,

I’ve been considering investing in Faircent and I’ve been assured of 12% return, is it safe to invest in Faircent, and what might be their criteria on capital distribution?

If not, is Lendbox per annum or other ‘Alt inv’ safe enough?

and

What happened about your WazirX matter and did you receive your capital back?

Hi Zac,

I only advise Faircent freedom products for investment. It’s a pooled loan product. Personal loans are a big no based on my experience.

Use Lendbox and Cashkumar to invest in pooled loans(like per annum or settlement finance, elastic run). Liquiloans is also a good option for getting a higher yield than your bank account with instant liquidity.

I will suggest splitting capital, this gives less tail risk if some corporate governance issue crop up.

Wazirx money is still stuck, unfortunately!

Hey Rohan – I’ve been following randomdimes for the past 3 months and I really appreciate you for providing insights on all Alternative Investments. Great work and amazing!.

~ Madan Mohan

Thank you Madan for the kind words !