Every quarter investor hopes that Fed would pull the plug on the interest rate uptrend cycle only to disappoint. Markets have been tepid factoring in more rate hikes this year

Many people feel that this rate hike is an unusual behavior from Fed and might be surprised to know that in past we had witnessed sharper rate hikes. The last 10 years had a falling rate scenario which makes people forget the interest rate history.

There is a consensus that a rate hike would somewhat end this year, hence could be a good time to add Target Maturity Debt funds to ride the benefit when rates start going down.

Alternative Investment Portfolio Performance

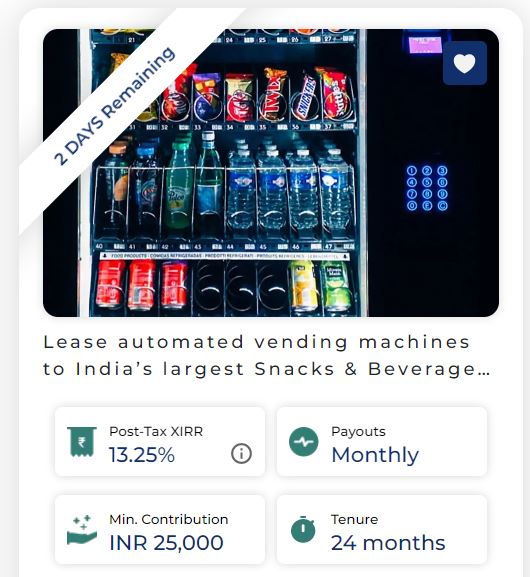

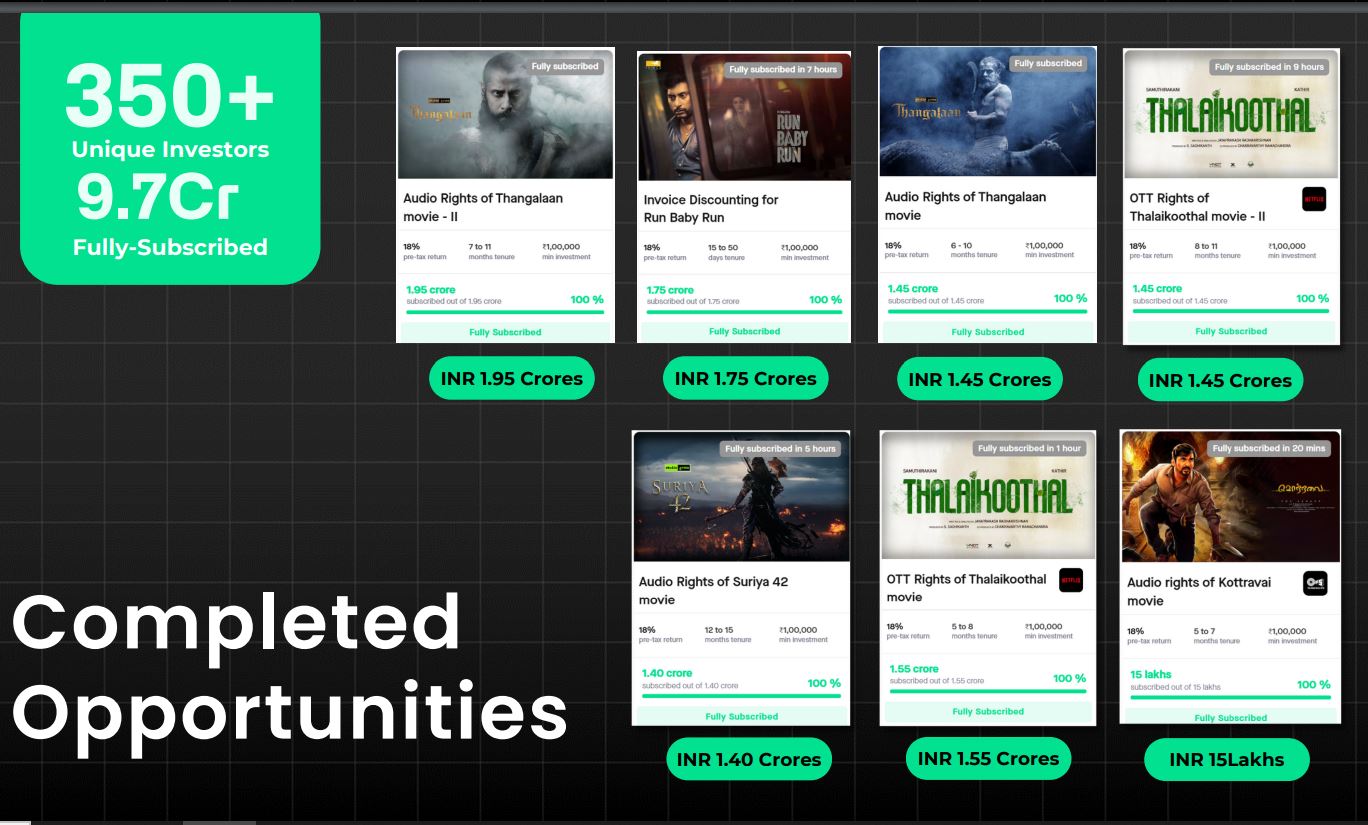

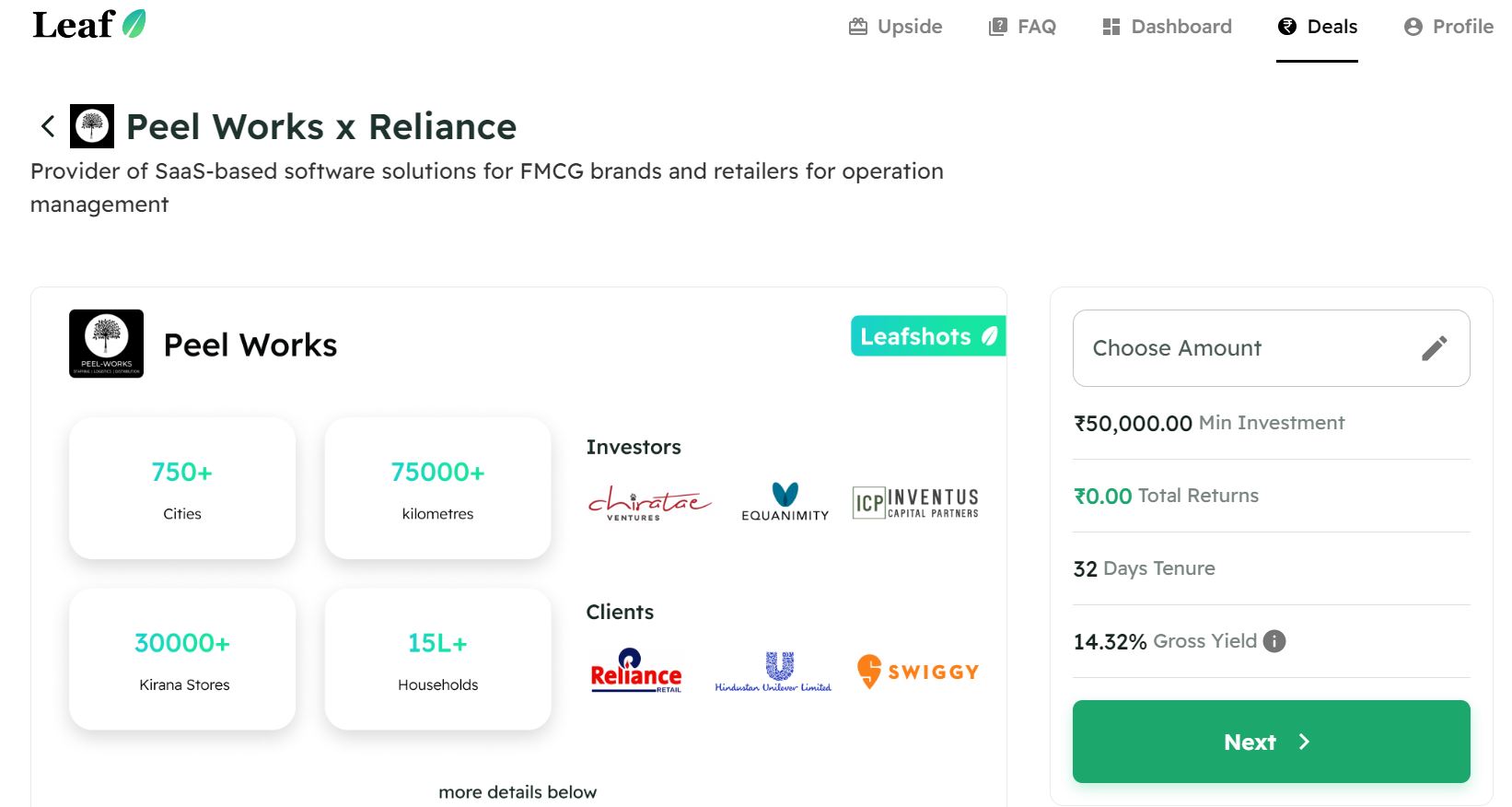

This month I explored 2 new platforms viz: Betterinvest and Altius. To be honest I had made my investment in betterinvest a few months back but wanted to do more research before covering it.

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 15-17% | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post Tax) | 0% |

| Growpital | 16%(Tax Free) | Blended Yield |

| Leafround | 17% | 9 Payments |

| Altifi | 12.50% | 0% |

| Better Invest | 18.00% | 0% |

- Growpital has been doing well currently. There is another upcoming AMA session in March.

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are as per schedule.

- Klubworks had Network 72 Deal this month

- In Jiraaf my investment in Bhanix Finance and Investment Limited (BFIL) corporate debt has started paying

- Invested in 1 Inventory Finance deal on Gripinvest at 22% PreTax and 1 invoice on Leafround

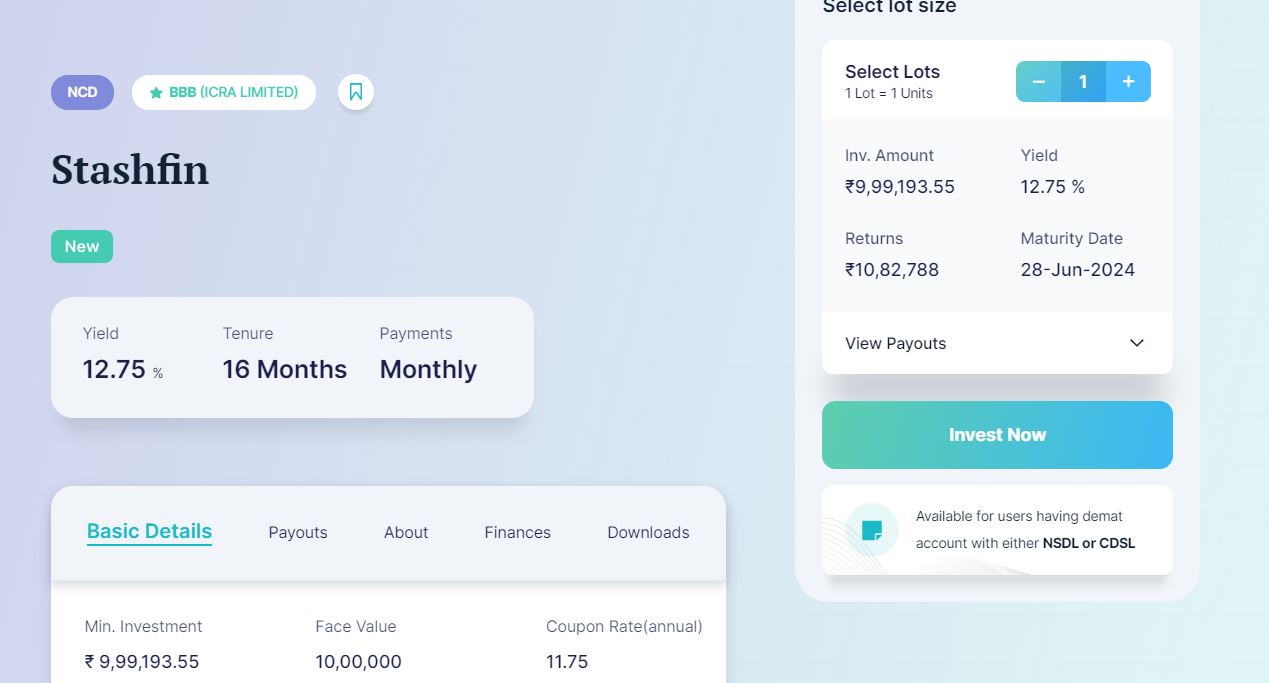

- Have added Dvara and Stashfin on Altifi

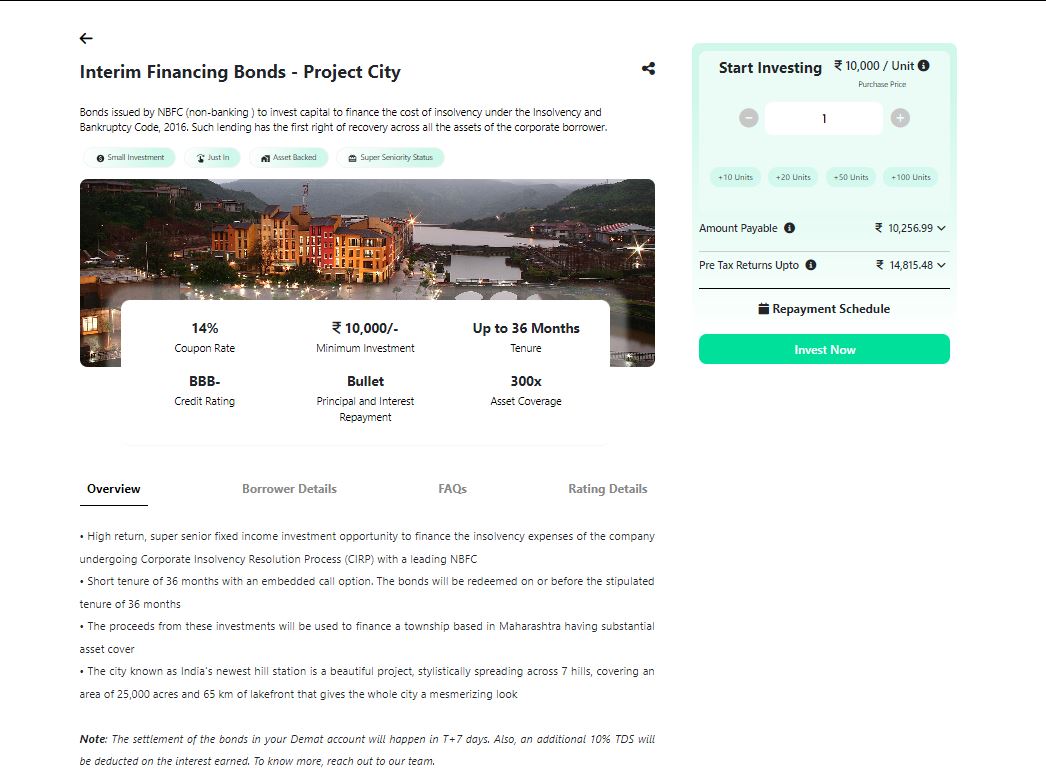

- Investing in Interim finance bond on Legalpay

New Deals

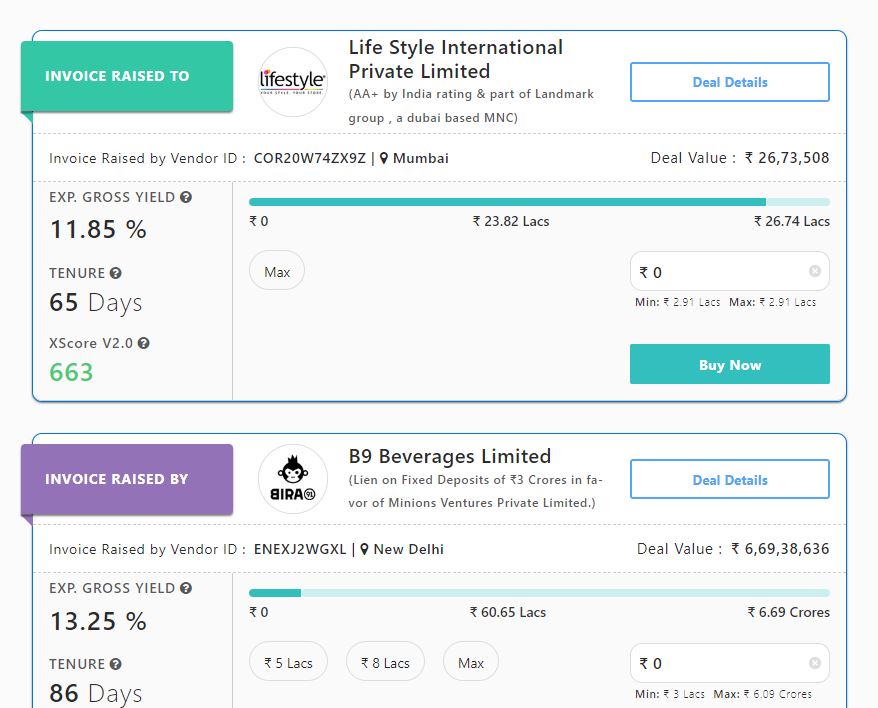

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations.

- Using Liquiloans to park short term capital

- Have done a Cocoblu deal on Kredx and Zetwerk on Tradecred

- Not adding any capital to cashkumar as deal flow is too slow at the moment.

Crypto Investing

Bitcoin and Ethereum have recovered this quarter from the lows but the rally has not been sustained. Currently looking to add crypto and put it in Cold wallet gradually.

P2P Investment

Current allocation:

- India P2P – 50%

- 12Club – 5%

- I2IFunding- 25%

- Finzy-15%

- Faircent Pool Loan -5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.75% |

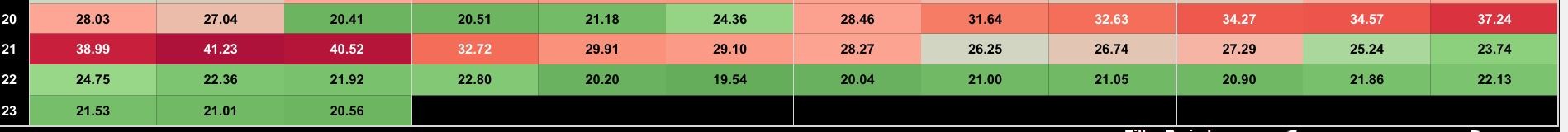

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistent for more than 8 months now. I have added capital to the aggressive plan only. They have added escrow feature that can make reinvestment easier

- Rupeecircle repayment is also dead now. Blacklisting both Lenden club and Rupeecircle

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

Equity Market

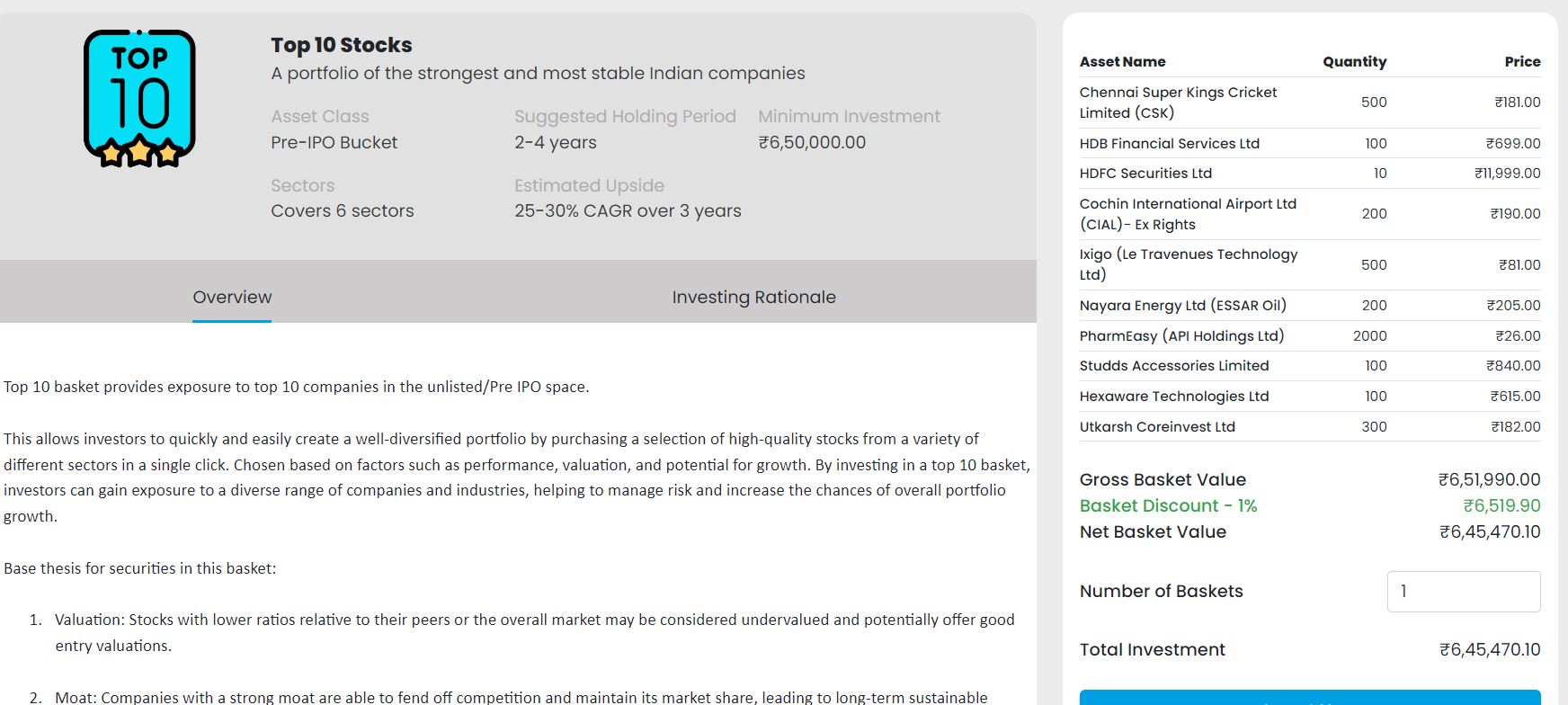

PreIPO Stocks

Altius provides comprehensive research on unlisted stocks with historical prices. This can be a good time to accumulate some quality stocks in the unlisted space. It is advisable to create a portfolio than take a concentrated bet

Listed Stocks

The P/E of Nifty has come down from 24 to 20 in the last 1 year as the market has been rangebound. At these levels, for someone with a long time frame perspective, it can be an opportunity to buy mutual funds in a staggered manner. In fact, in 2021 the PE was 40 at one time!

Other Alternative Investment Assets and Platform Updates

Growpital Investment – Growpital has been making good progress. Things look positive for now. Would be monitoring for a few more months before adding incremental capital.

Growpital(Promo code GROWRDIMES)

You can find the latest stats here –Growpital Performance

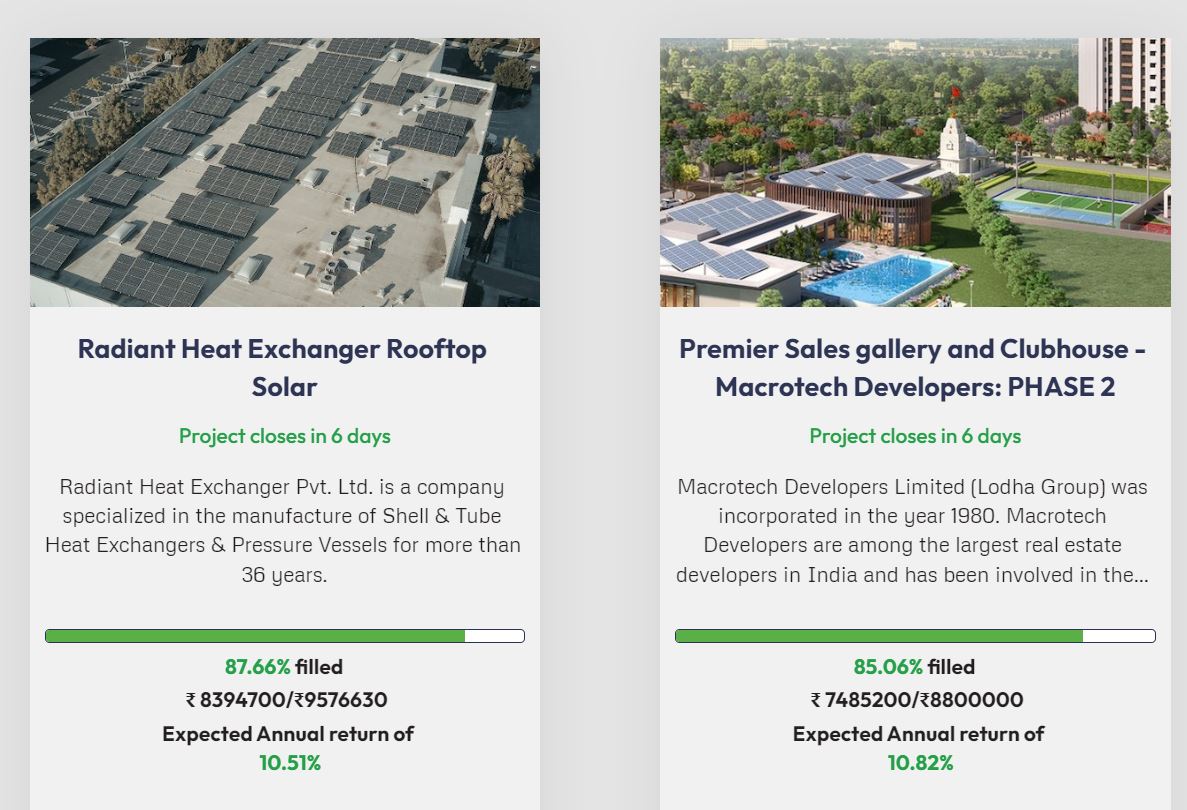

Sustvest Investment – There are 2 new opportunities on Sustvest offering upto 11% post-tax returns, My investments are performing well.

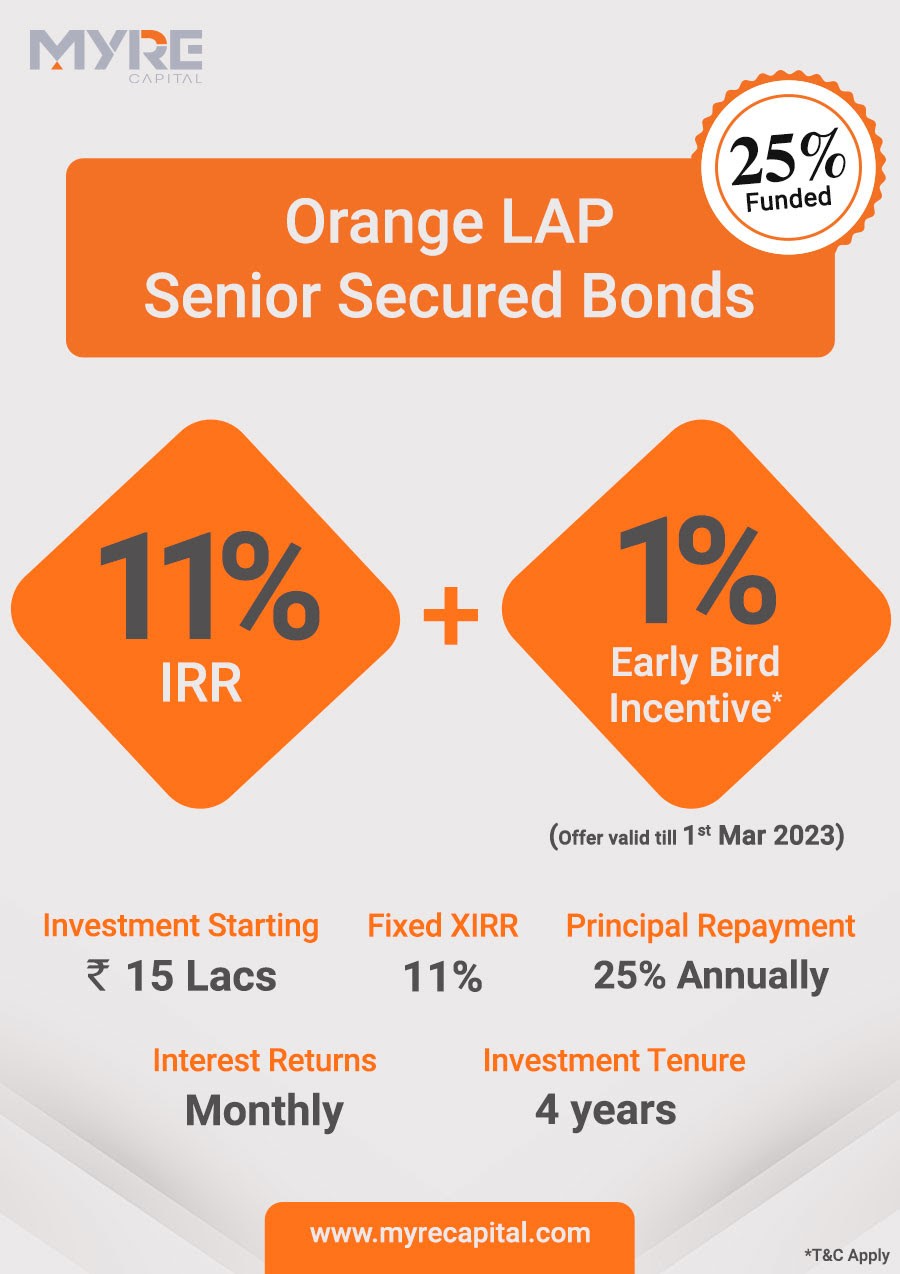

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received cash flow on time for a year now. There is a new NCD opportunity secured by Real Estate live on the platform

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 121.00 |

Thanks for sharing monthly updates.

About Rupeecircle, – is there anything lenders can do? Repayments have really just stopped for past 5-6 months. I had written to their customer care few months back, received response that they are connecting with borrowers. I dont think it moving at all in positive direction.

Thanks

I agree the response for them is poor and they haven’t taken any concrete actions till now. I guess we can try the RBI ombudsman route as they are not disclosing monthly portfolio performance also which they should do on their website and not giving complete picture of npa and recovery

How do you pay income tax or file return.

Which form do you use while filing return when you are investing in these diversified investment.

Please help .. Thanks

ITR3 should be filled if you want to add LLP and avail tax benefit.

You can drop a mail to info@randomdimes.com ,will connect you to the Tax specialist I work with

Kredx should be blacklisted as well for their Invoice discounting. Their Kredx Scoring is even poor and completely unreliable. I have invested in High Score (664) Dairy Power Limited deal and my money is stuck since 40 days now. Their cheques have bounced as well.

I agree that Kredx Score are not that great. I use kredx only for few repeat deals where I’m comfortable with enterprise

Kredx returns are never 12% also. They take a huge cut in the returns making it more like 11.50% everytime. I still prefer tradecred. But recently one of the deal they cancelled after 24 hrs and returned the money. Too much mushrooming of invoice discounting websites is not good.

Hi Ravindra,

I agree with you, off late many platforms are offering invoice discounting hence important to ensure there is no overlap of vendor or enterprise in our portfolio.

Also, Stick to more reliable brands in enterprise than going for yield

Some of my money was struck in cashkumar. They are not collecting, customer service will tell same story, they will collect soon.

Cashkumar, seems to have focussed on their partnership with an elastic run and is not running the p2p model, hence no deals and inadequate response from customer care