This Month I have added one more platform called Lofty.Ai .It is an innovative platform that can help you to invest in tokenized real estate assets in the USA

I have also invested in assets on Wint Wealth, Jiraaf, and Klubworks this month.

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 18%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 13-15% | New |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay( Promo code FV48G4) | 14-16% | New( 4 payments ) |

| Growpital(Promo code GROWRDIMES) | 12% | New (2 Payment) |

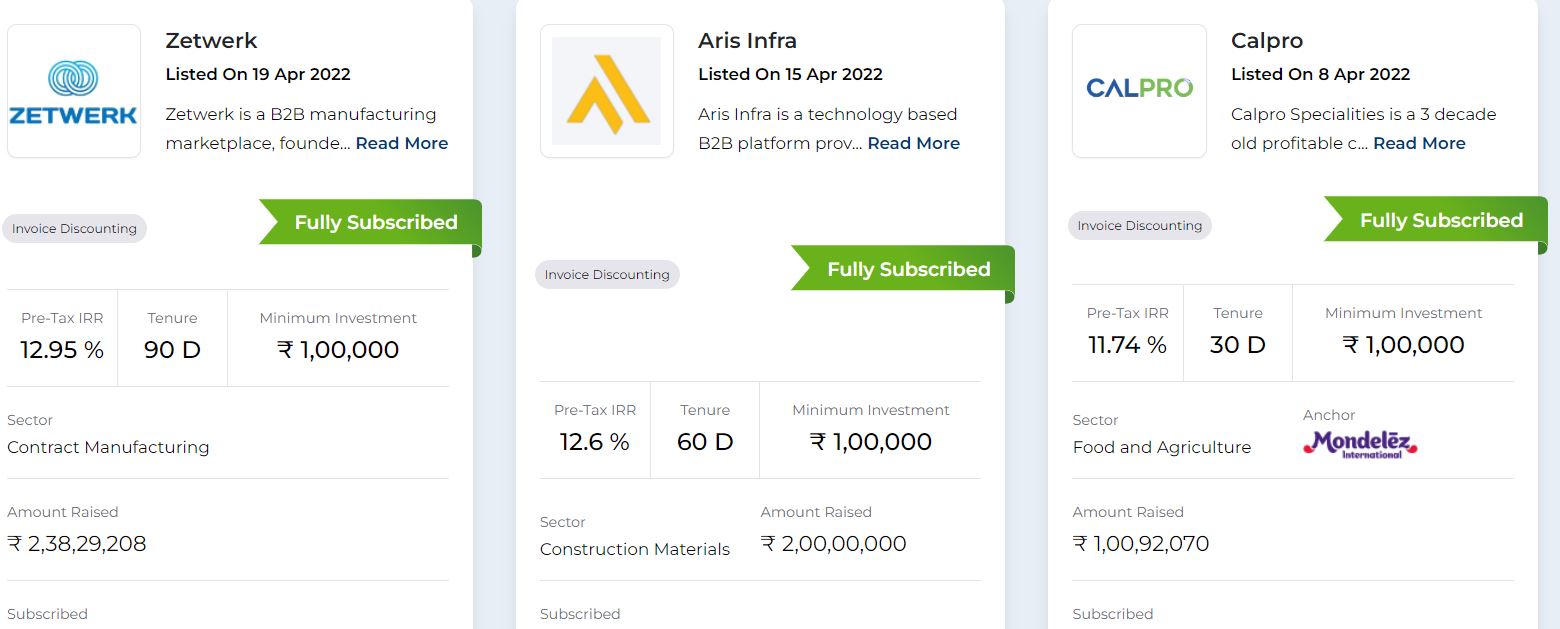

- Have invested in Zetwerk at 12.9% on Jiraaf

- Invested in the latest Legal Pay Interim Finance deals.4 Payouts on time!

- Invested in Aaryman NCD on Wealth Wint at 10.5%

- Received payment for Growpital

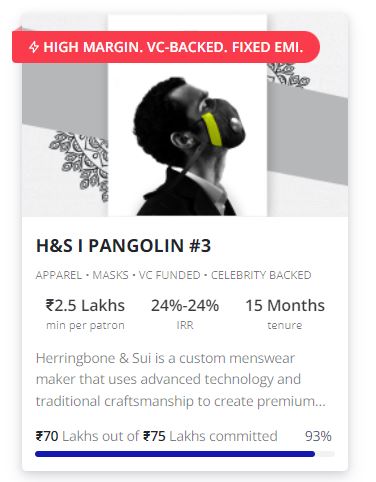

- Invested in Tagz on Klubworks

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

- GripInvest has started Equity Investment on the platform. Considering the minimum size it makes sense for people who can invest across 10-15 deals in a year’s time. Won’t recommend it for people looking to do only 1 Investment

- I have zero exposure to Hedonova now and no plans to Invest in the future as there is negative media coverage with serious allegations

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

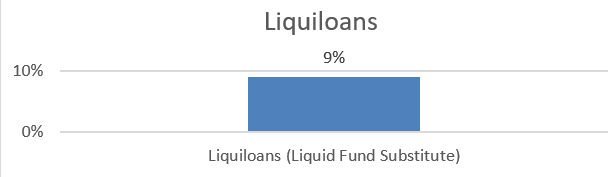

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| Faircent ( Only Pool Loans) | 12% | 0% |

Have added money to the 10%, 2-month lockin deal with Liquiloans

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Cashkumar Returns are on time

- I Invested in a Kredx deal this month. Will cover the platform’s pros and cons soon!

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- Euro has lost 10% to INR this year due to war-led issues. It might be a good time to top up European investment and make some additional returns if Euro strengthens in the long run.

- For all investment-related remittances please transfer money to the IBAN account from your Indian bank account and not other remittance services as per RBI FEMA guidelines!

- Have tested Lofty.AI with a small amount.

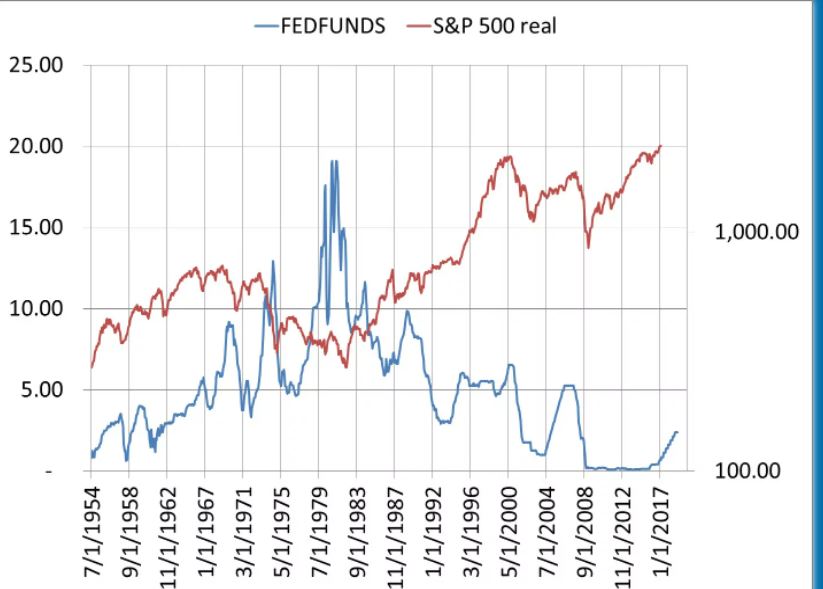

Equity Market

The equity market is showing a lot of weakness due to inflation-related issues. However, it could be a blessing to buy the dip if the market tumbles. The Repo rate hike is also adding to the woes. The stock market and the interest rates have an inverse relationship. Every time the central bank increases the repo rate, its immediate impact is seen on the stock markets. This means that following the hike in the repo rate prompts companies to also cut back on the spending on the expansion, which leads to a dip in growth and affects the profit and future cash flows, resulting in a fall in stock prices.

- Have added a small quantity of Large-Cap ETF

Crypto Lending Investing

| Platform | Returns | Capital Loss |

| Kucoin | 5-50% | Nil |

| Celsius Network | 12.00% | Nil |

| Youhodler | 12.50% | Nil |

| Vauld | 12.70% | Nil |

| Coindcx | 14%% | Nil |

- Coindcx is also offering a 14% return on USDT

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Exploring a few more options to spread platform risk

Crypto Investment

Cryptomarket has been rangebound for a while. I believe anyone investing in crypto should have the patience to bear with months of boring market, bouts of insane volatility, and resistance to FOMO in a bull market.

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 12% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 4% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 3% |

P2P Investment

Current allocation:

- India P2P – 15% (new)

- 12Club – 5%

- Rupeecircle- (stopped)

- I2IFunding- 40%

- Finzy-40%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks-backed loans, E-Rickshaw backed loans, education loans, NBFC backed loans(Mondeo etc) Group loans | 13.5% | 4.9% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- India P2P is the new addition. The platform looks promising as it has a physical lending model.

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- Completely stopped RupeeCircle

Other Alternative Assets and Platform Updates

IndiaP2P updates

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. I have received 4 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 4.00 |

Growpital Updates

- Portfolio bagged contracts worth INR ~30 Crores for ~5000 Metric Tonnes of volume take of farm produce.

- Portfolio size currently running at 850 Acres and presence in Rajasthan, Chattisgarh, and Karnataka

- 1000 acres in pipeline

- Raised ~1.8 Crores over Growpital Platform

- Signed MoUs for operational partnerships with Eeki Foods and Farmcult for managing hydroponic segments and Vertical Hydroponic segments of the portfolio.

- The portfolio will add Honey Farming and Mushroom cultivation in this quarter.

Upcide Update

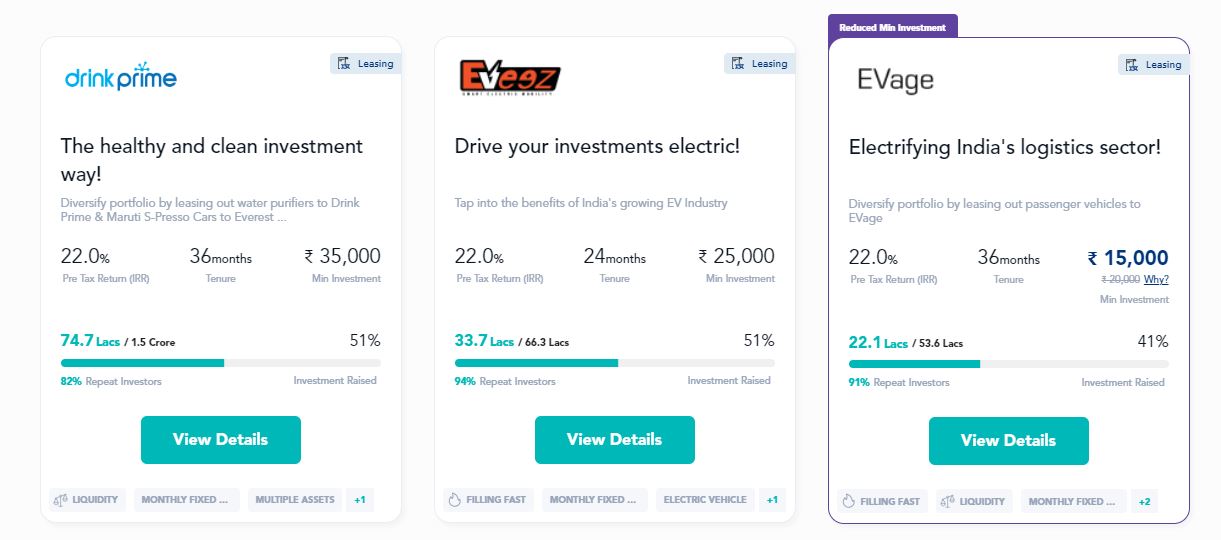

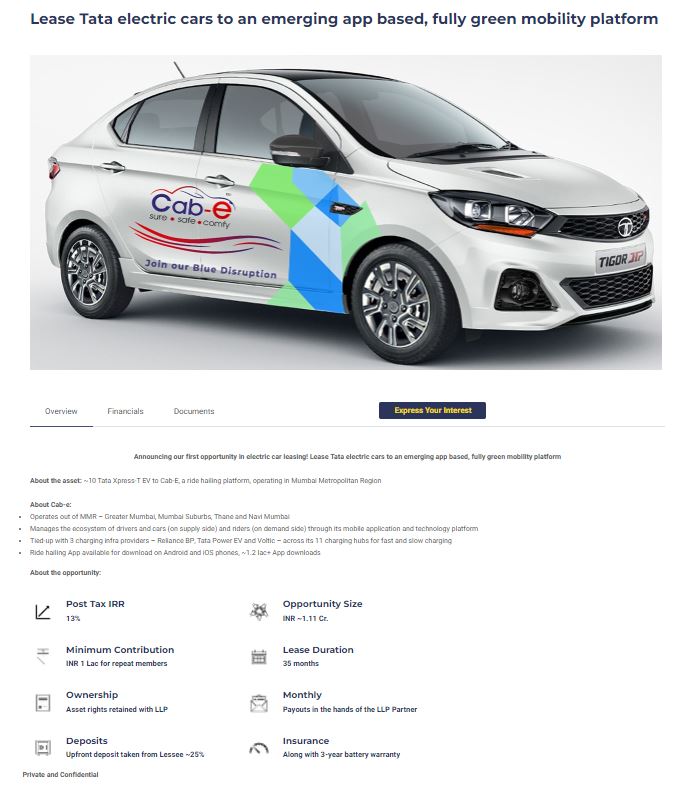

Upcide(access code RDIMES to get early access)is an asset-based investment platform that lists some great deals however the frequency is much lower than others. Those who are interested in asset leasing will appreciate the quality of assets ( eg Tata EV )

Hi, would you recommend removing money from Hedenova? Had put the same about ~4 months back?

Hi Sakshi,

I will strongly suggest redeeming. I had done the same in Feb(covered in Feb post). Considering the opaque nature of its structure and leadership, and negative media coverage I have again suggested everyoneto redeem in April post!

https://randomdimes.com/alternative-investment-portfolio-april-2022/

https://randomdimes.com/alternative-investment-portfolio-feb-2022/

Hello, first of all great work in covering alternative investments. I want to start investing in products that you have mentioned. Which products would you suggest to start with? Top 3 picks and then I will start investing in remaining ones with time. If you can suggest to start with, will be of great help.

Hi Riken,

Thanks for your comment. The top products depend on each person’s risk appetite and capital deployment plan.

Based on my experience a good starting point could be Jiraaf,Klub and Liquiloans. We can have a small call if you would like to know my experience with them

how about Falcon Invoice Discounting Platfrom

I have tried it a couple of times but I am still not very confident as they do not disclose complete deal details.