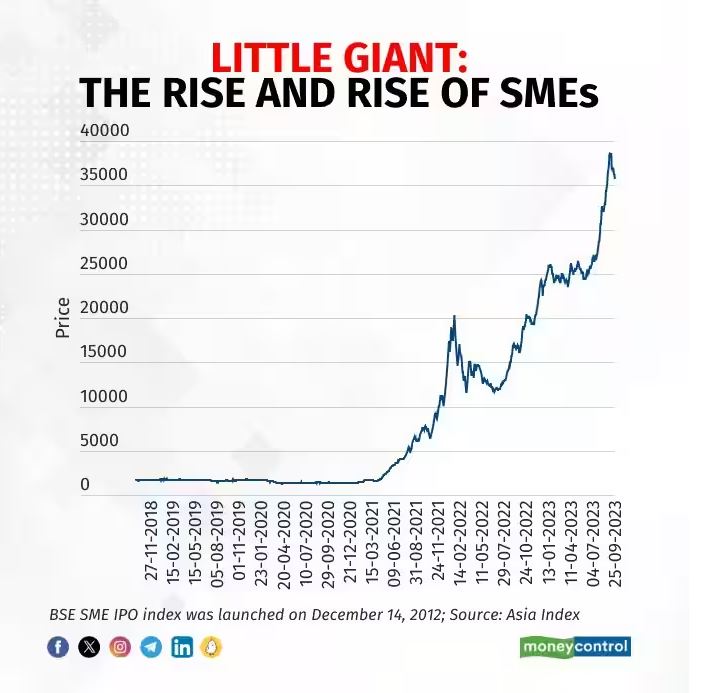

One of the lead indicators to predict that the market is in greed mode can be seen through the performance of the BSE SME platform,

The popularity of frenzy around SME stocks has reached such an extent in 2023 that they have seen an average of 67 times subscriptions. Some of them saw 713 times subscriptions, led by retail investors who applied for over 1,000 times their allocated quota in some cases, data collated by Prime Database shows.

The data shows 107-odd SME stocks listed in 2023 so far have returned an average of 77 percent. Some stocks have delivered four times gains in just 4-5 months. Only 19 of these names are sitting on losses.

While India’s major equity gauges have hit all-time highs, the 63-member SME IPO Index continues to outperform, surging almost 1900% from 2019 compared to only 60% gain for the BSE Index.

Telegram channel for the Latest Alternative Investment News

Alternative Investment Portfolio Performance

This month we focussed on generating returns through Trading strategies along with adding various alternative investments. The reason for options trading to generate yield is

- You don’t need to deploy cash, you can pledge your existing stocks and mutual funds to trade. It’s like zero-cost funding for your business

- You can generate returns in any market conditions, hence a bull market is not required.

- You can generate cash flow which can be deployed in long-term assets.

My performance for the current year has been approx 15% in the last 6 Months. I use a combination of :

- Intraday Option strategies using algo

- Position strategies manually.

It is very critical to understand that options trading is fraught with risk and people should always start with paper money and gradually deploy real cash as it takes a lot of effort to master the psychology not just the strategy.

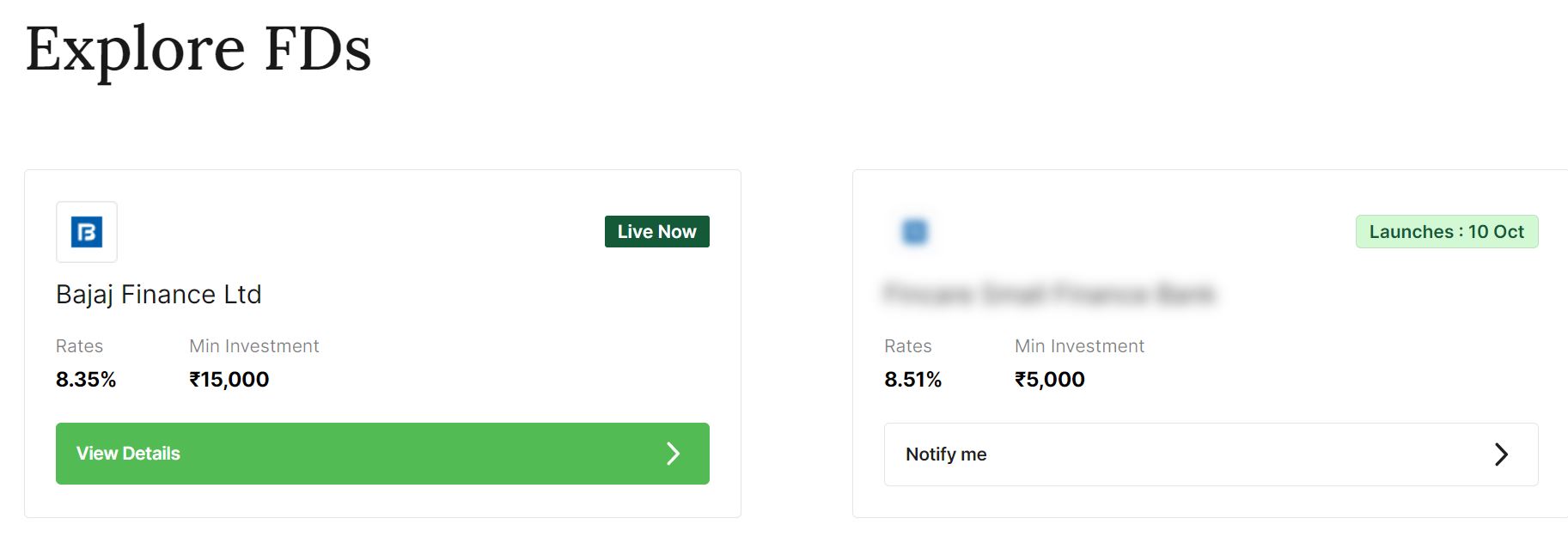

I also explored Wintwealth FD. It’s a great platform for people looking to explore fixed deposits. Wint Wealth does the due diligence for the FDs backed by strong issuers.

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 13% | 0% |

| Klubworks | 15-17% | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Sustvest | 10-11%(Post-Tax) | 0% |

| Afinue (Upcide ) | 13%(Post Tax) | 0% |

| Growpital | 14%(Tax Free) | 0% |

| Leafround | 15-18% | 0% |

| Altifi | 12.50% | 0% |

| Better Invest | 16-18.00% | 0% |

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are per schedule.

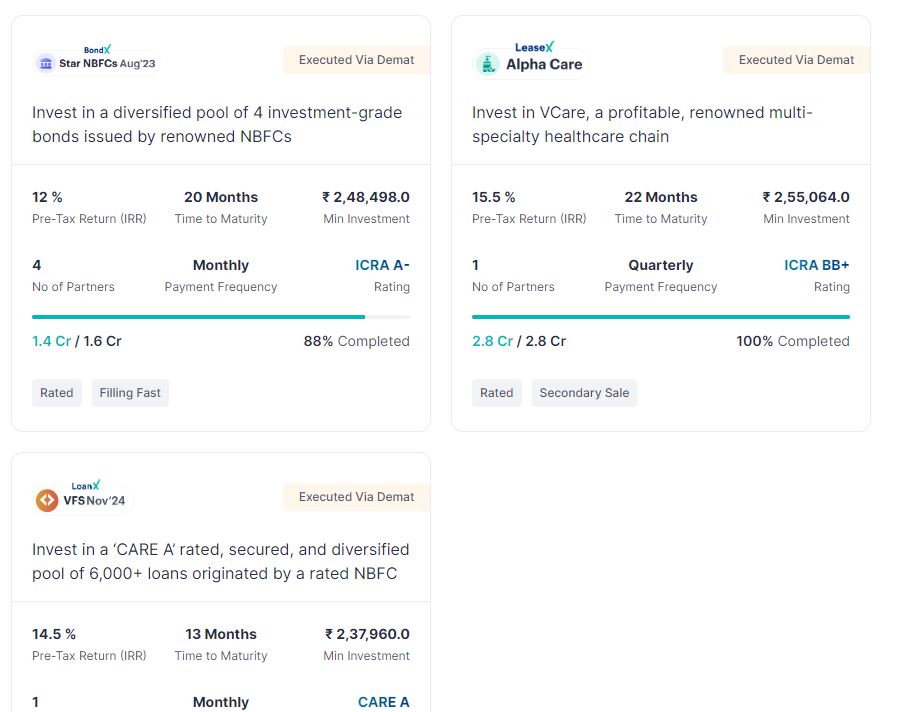

- Invested in VFS capital SDI deal on Grip offering 14.5% for 13 months.

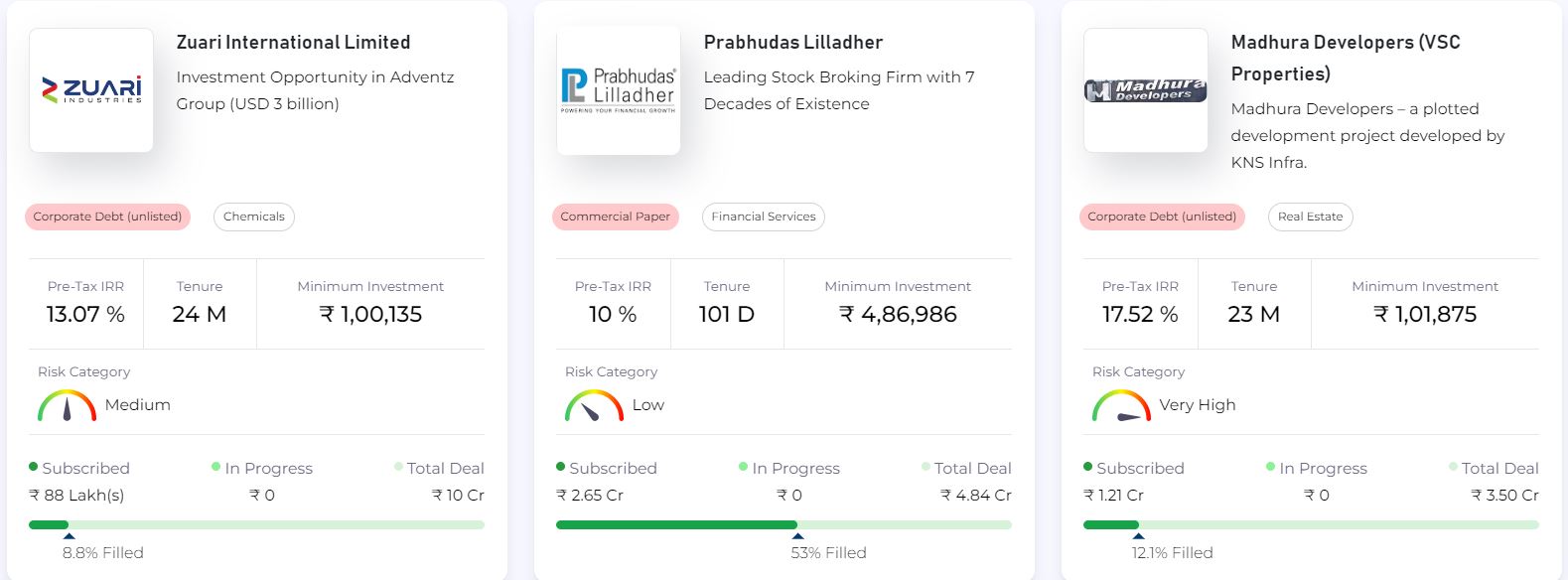

- Invested in 13% Leasing deal on Afinue (use code MR630878) as they provide detailed analysis of deals that is helpful in evaluating

- Invested in a Few Invoices on Leafround ( Boat, Heromotocorp)

- Received my Jiraaf NCD payments as per the schedule

- Received my Stashfin repayment on time in Altifi.I am also an investor in Satya Microcapital.

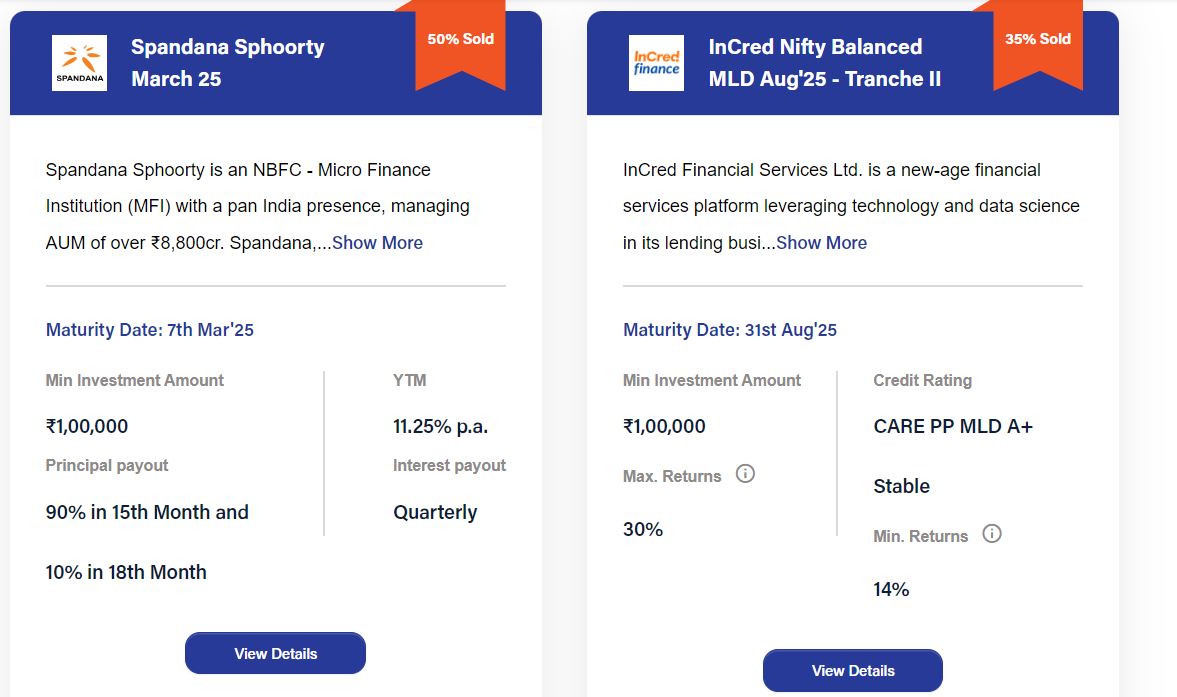

- Second tranche of Incred Money is also live

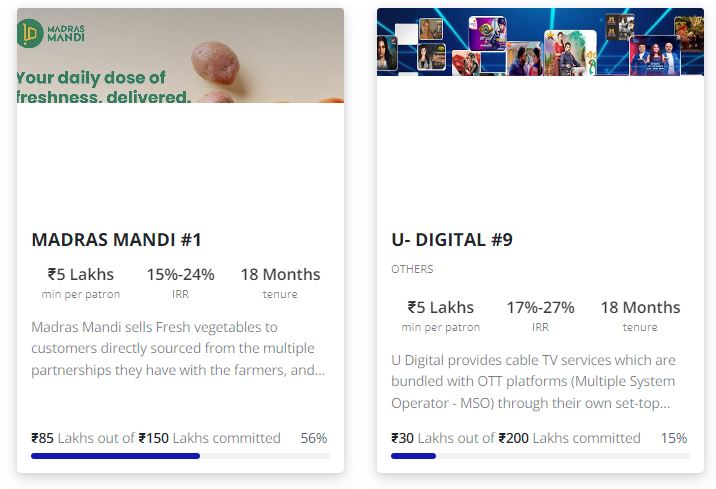

- Participating in the live Madras Mandi deal on Klub as it is a profitable company and the deal tenure is short.

- Betterinvest also has a new deal offering 18% IRR for 6 months that I intend to participate in.

Randomdimes Youtube

New Deals

| Platform | Returns | NPA |

| Liquiloans | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Lendzpartnerz | 14.0% | 0% |

| KredX | 12% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.75%

- Using Liquiloans/Per Annum to Park Short-term Capital. Liquiloans has recently come up with a 12% plan

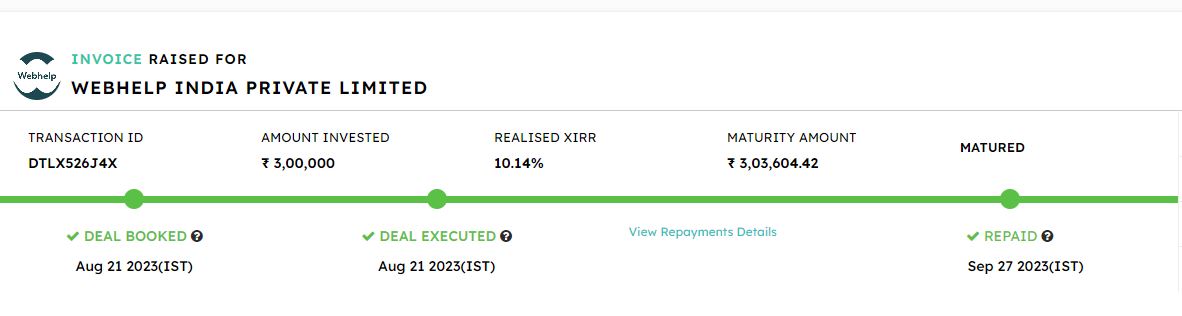

- Received returns from Webhelp on Kredx

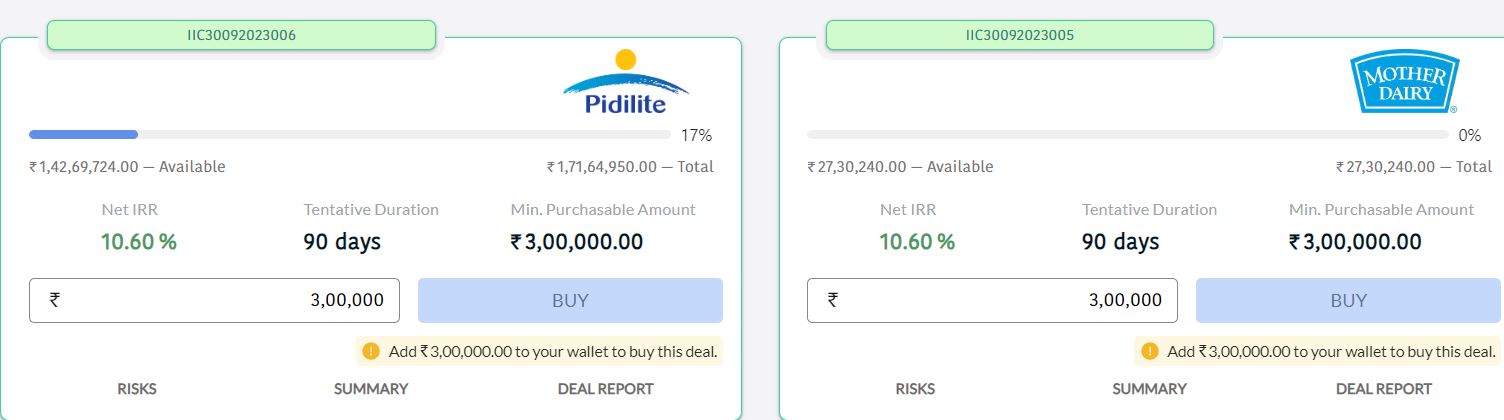

- Tradcred has launched some good deals such as Mother Dairy and Pidilite

- Have invested in 4 deals to date on Lenderpartnerz

Crypto Investing

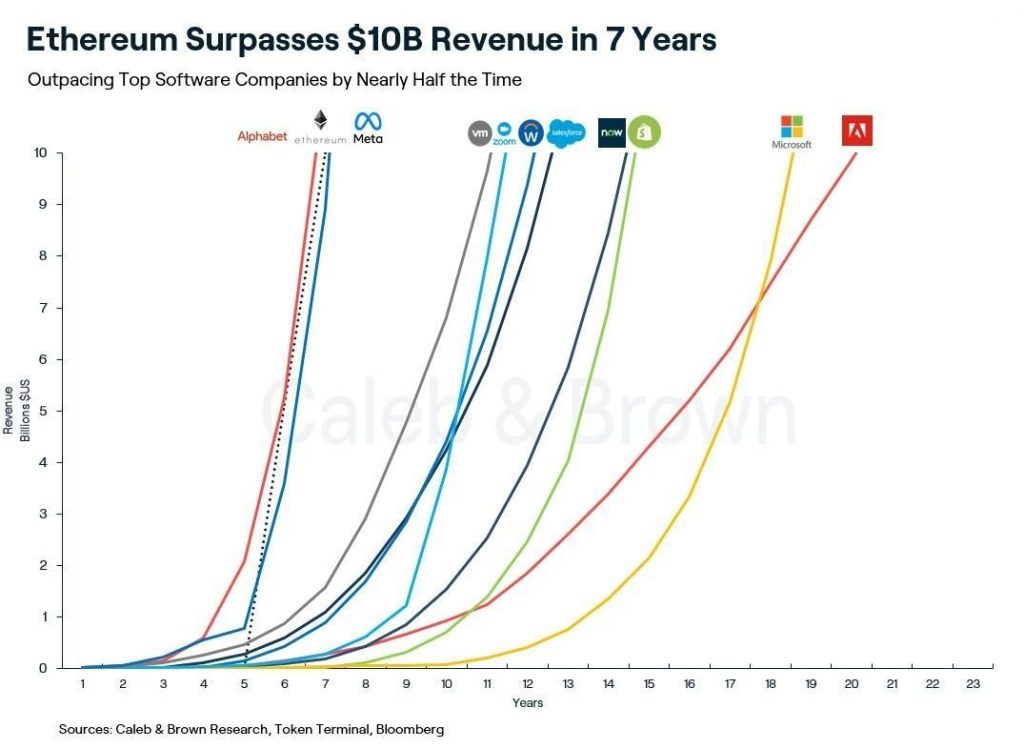

Ethereum, the leading smart contract platform, has reached over $10 billion in cumulative revenue since its launch in 2015. This growth rate outpaces many of the largest software companies in history.

It took Ethereum around 7.5 years to reach $10 billion in annual revenue, faster than Meta (formerly Facebook), which reached that milestone in a little over 7.5 years, and Microsoft, which took 19 years.

Ethereum reached the $10 billion revenue milestone through fees collected on transactions and other activities on its network. This includes payments for using decentralized finance apps, minting and trading NFTs, sending cryptocurrency payments, and more.

However, prices of the crypto have not gone up much in the last month. This is not unusual for crypto where winter can last for 2-3 years followed by explosive rallies.

You can buy Hardware Wallets on Etherbit

P2P Investment

Current allocation:

- India P2P – 55%

- 12Club – 5%

- I2IFunding- 15%

- Finzy-10%

- Faircent Pool Loan -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Paused) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.8% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club | Only Minimum amount | 12% | 0% |

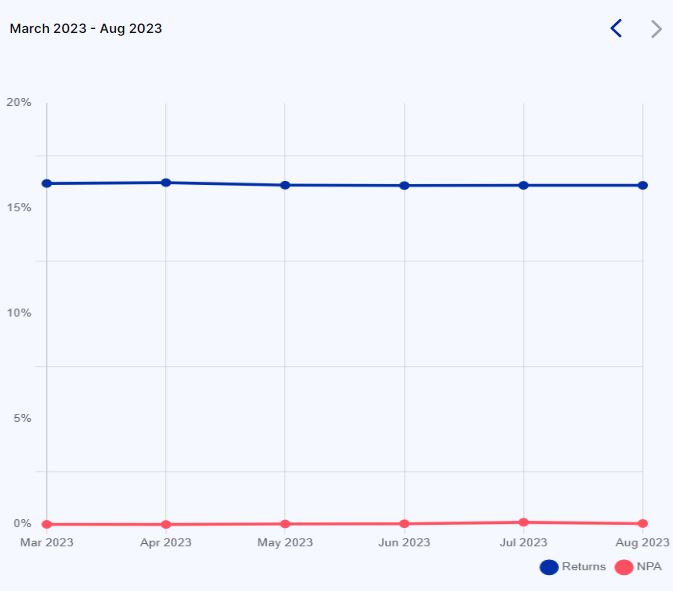

- I have completed 1 year of using IndiaP2P with steady performance. I am steadily increasing my capital on this platform.

- I2Ifunding and Finzy have a very low volume of loans and I haven’t added any new capital in the last 5 months.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

Equity Market

PreIPO Stocks

Homegrown solar panel maker Waaree Energies Ltd has filed a draft red herring prospectus with the Securities and Exchange Board of India (Sebi) for an initial public offering (IPO).

The offer comprises a fresh issue of equity shares worth Rs1,350 crore and an offer for sale of up to 4.01 million shares by existing shareholders and promoters. The stock of the company is in demand in unlisted markets as people expect a strong IPO listing. Altius Investech offers quotes for Waaree.

Listed Stocks

The Indian market has been in slight correction mode after the stellar rally. Overall Indian economy has shown more resilience than global markets, but the valuations are still not very cheap and India can be impacted by the global economy. However, some pockets have shown better valuation than others such as large banks like Kotak and HDFC. REITs/INVITS are another category that are at attractive yields.

Other Alternative Investment Assets and Platform Updates

-Alyf is an upcoming platform that provides fractional ownership of holiday homes in tourist destinations. Interested people can register and get a call from their team.

Growpital Investment – The performance of the platform has been satisfactory till now as the payments have been on time to date. It would be great if more investors could share their farm visit experience.

Growpital(Promo code GROWRDIMES)

Leasify Investment – Leasify has recently listed a Sharepal Leasing Deal offering 20% IRR for 1 year. I will be soon doing an interview with the founder.

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. It is now called Yiedlwisex. I have been exploring other real estate platforms like Alyf. Will be doing a comprehensive post on the real estate options investors have.

We have a challenge with Big Spoon on Grip, one of the owners has migrated abroad and the cash flow situation is not great! Will be my first NPA in Grip.Not sure if you are impacted

Hi Vaibhav, Had shared the Grip mail in the last month review. Will share any new communication. I had invested in big spoon in earlier tranche which was repaid last year.

I hope they will be able to cover the loss through sale of assets ! They have been quite proactive in resolution

Hello, How is you investment going on with Afinue (upside). Are and getting timely repayment and whether you have increased you investment on this platform??.

I don’t know but someone told me that deals are not genuine and repayment are delayed

Hi Tarun, I have increased by exposure to Afinue (Upcide). I find their due diligence process comprehensive and the assets have good secondary market .

The post tax returns are also good.