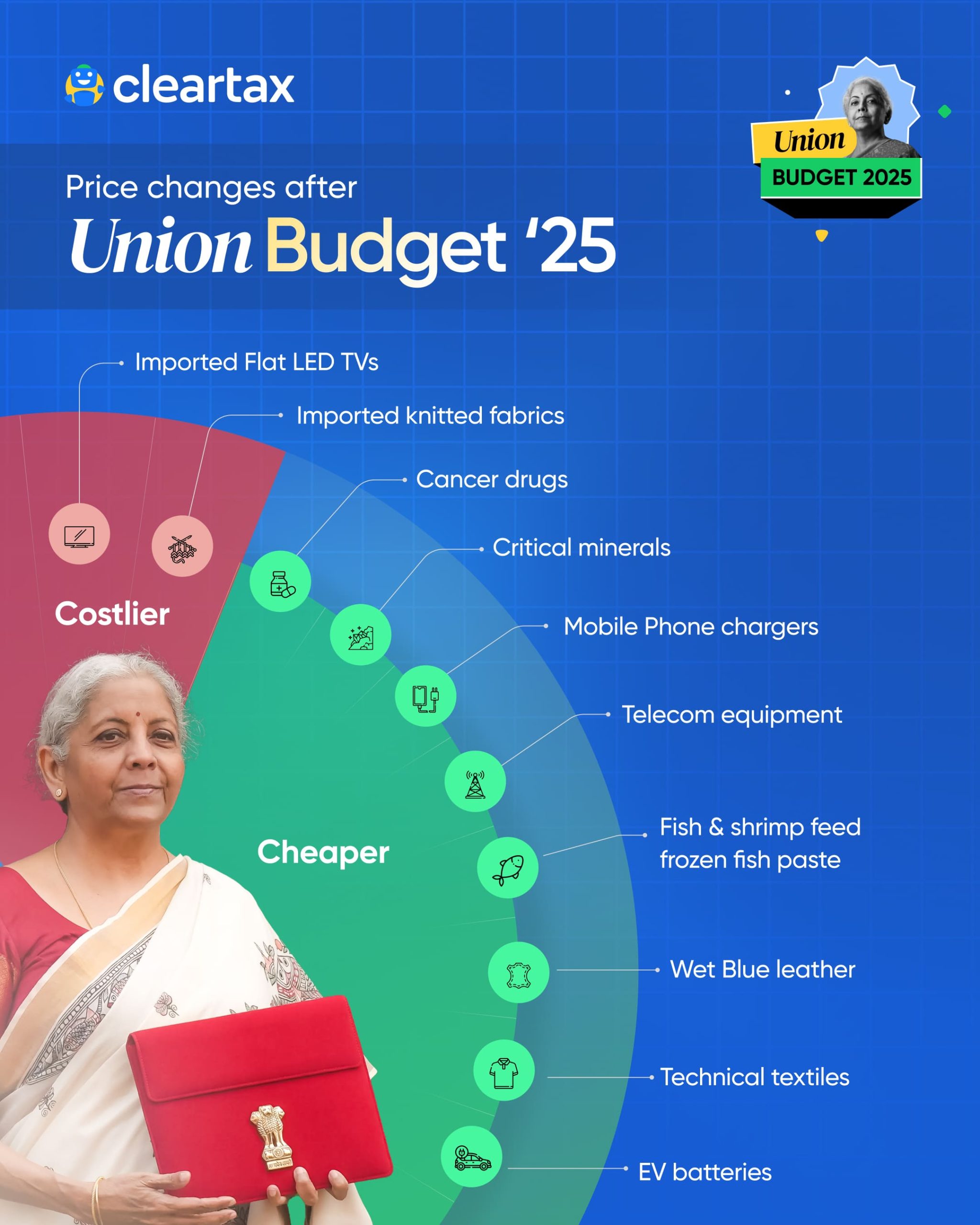

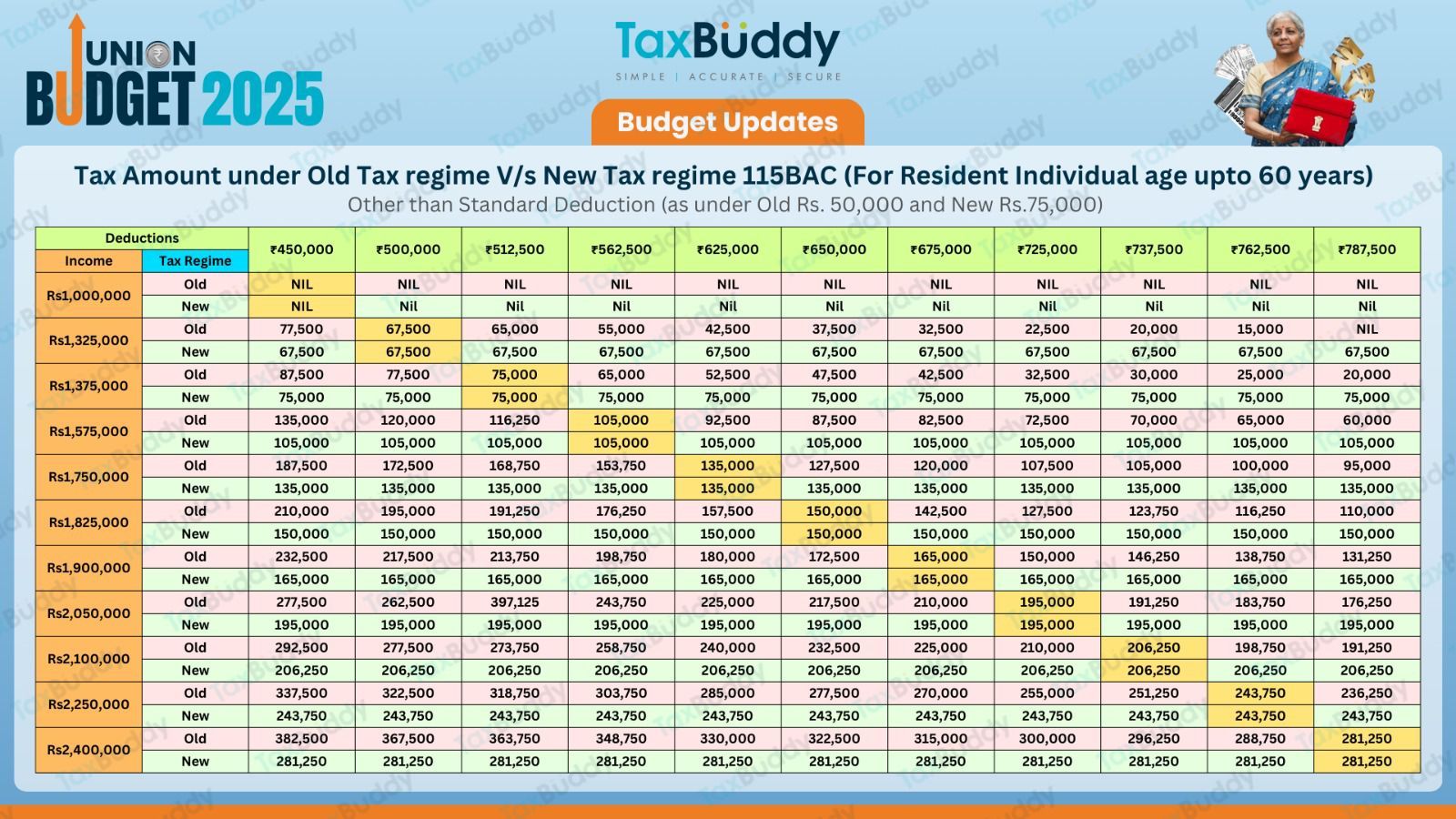

The budget for 2025 proved to be a relief for many people as tax liability for most will go down. Below is the amount of deduction you will need if you stay in the old tax regime. It means if you have INR 8 Lakh+ deductions then it makes sense to stick to the old regime.

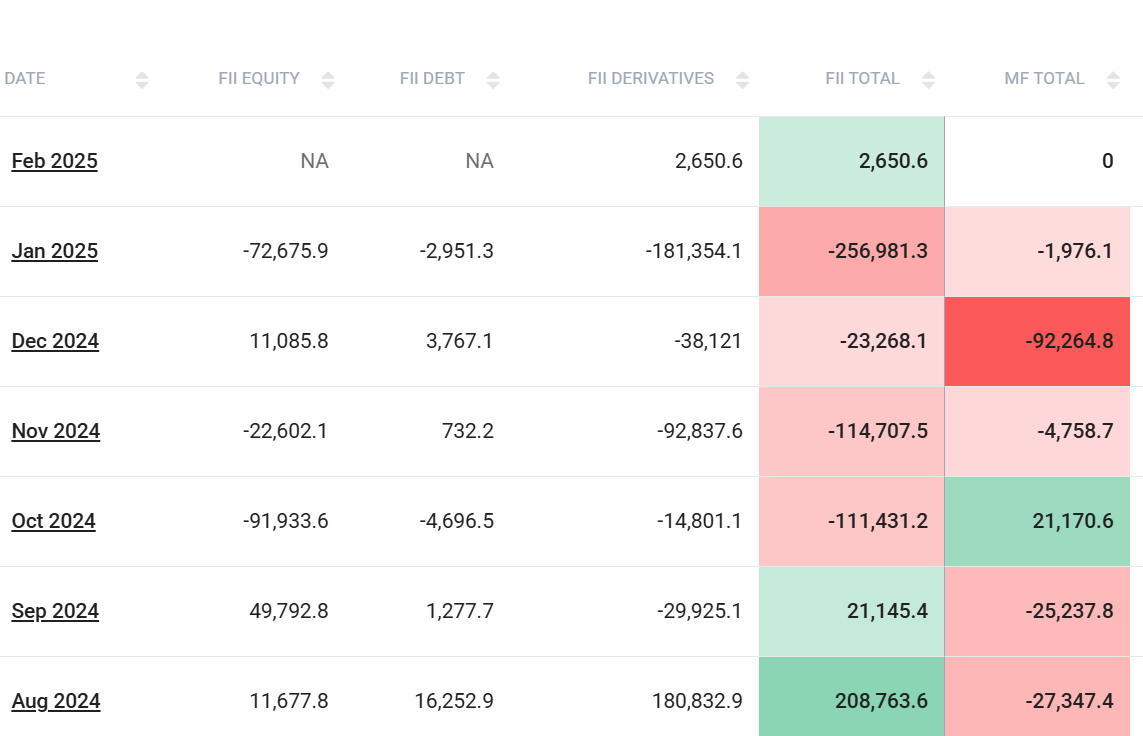

FII outflow from India

One pressing challenge is the significant outflow of Foreign Institutional Investments (FII) in recent months. Global risk aversion, coupled with tightening monetary policies in developed economies, has led to a shift of capital towards safer assets. This exodus has weighed heavily on the Indian equity markets, causing volatility and putting pressure on the rupee. FIIs, who were net sellers in 2024, continue to pull funds in search of higher yields and a more stable global macroeconomic environment. The weakening of the rupee has added fuel to this fire.

The sheer number of retail and DII buyers have cushioned this blow but in a way this inflow has provided liquidity to FII who were invested in India for last many years. However such events create opportunity and after a long time, equity is at an attractive level.

GDP Growth Under Pressure

India’s GDP growth, which was among the fastest in the world post-COVID recovery, has shown signs of deceleration. The latest estimates indicate a decline in growth projections, attributed to slowing global demand, subdued exports, and domestic consumption pressures. High interest rates, implemented to tame inflation, are dampening private investments and consumer spending. Additionally, the manufacturing sector is struggling due to weak external demand, contributing to the overall slowdown.

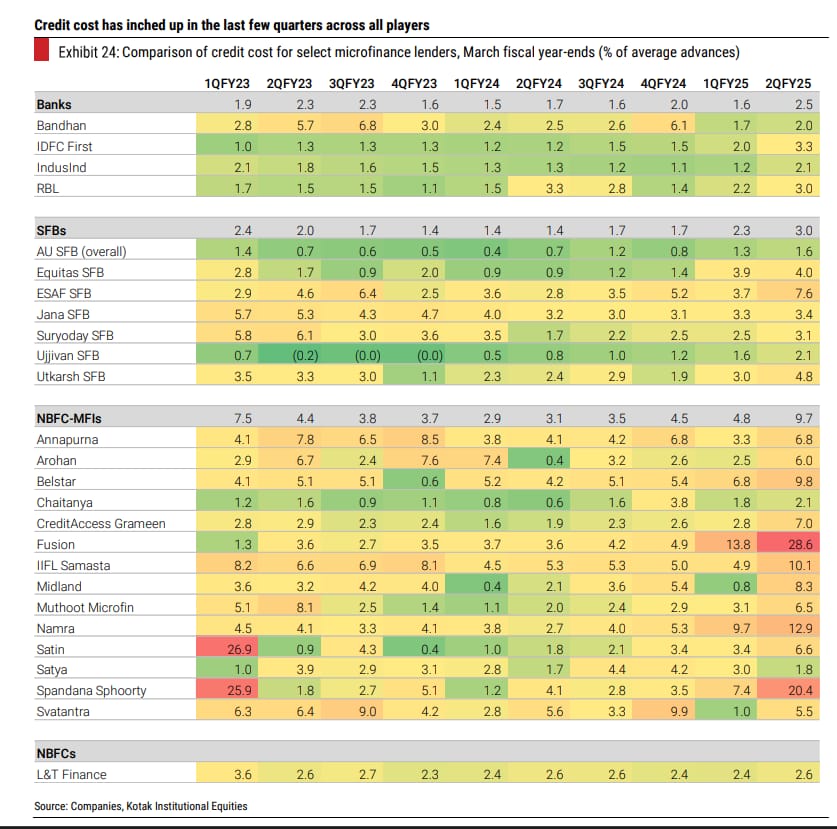

Microfinance and Rising NPAs

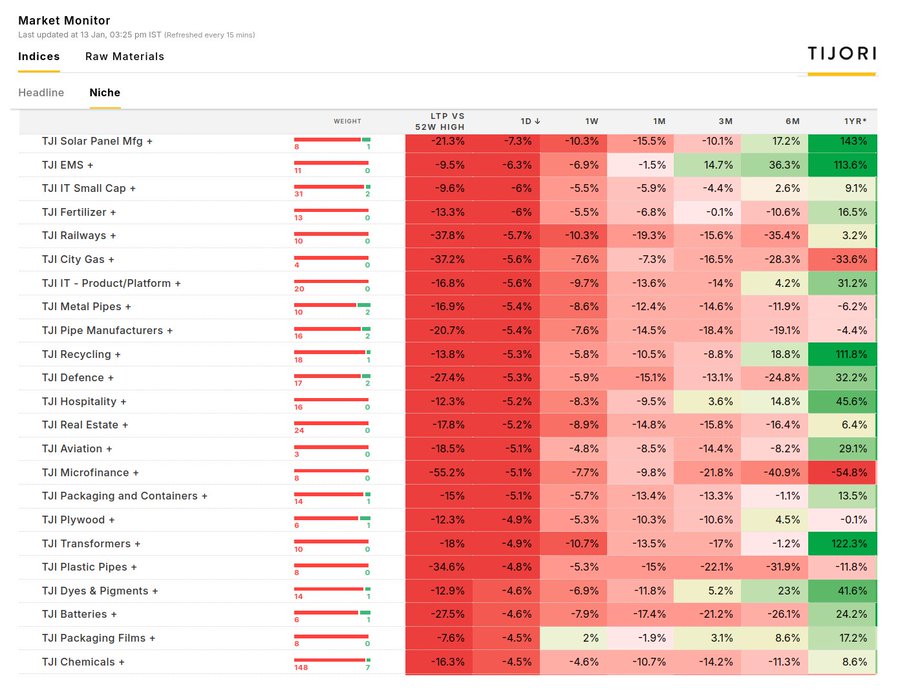

The microfinance sector, which plays a crucial role in financial inclusion, is facing a surge in Non-Performing Assets (NPAs). With inflationary pressures eroding disposable incomes, repayment capacities among borrowers—particularly in rural and semi-urban areas—have been hit hard. Borrowers dependent on agriculture or small-scale businesses are feeling the brunt of erratic monsoons and rising costs, pushing default rates higher. This has forced microfinance institutions (MFIs) to tighten credit policies, potentially stifling credit flow to the most vulnerable segments of the population.

Many of the bonds on online platforms have microfinance issuers hence it is important to exercise caution for further investment in such bonds. Do look at the latest financial reports of these companies. Look at the stock analyst reports to understand in detail the situation

New Alternate Investment Platform- Aspero<>Randomdimes

Many new Bond platforms have come up in the last couple of years. This makes it difficult for investors to choose the best bonds and yields as sometimes the same bonds are listed across different platforms. The reason for this difference is that most of the platforms do not originate the transaction, they just buy the bonds from large players like Yubi and Northern Arc.

Now each platform has its own cost and profit margin hence they markup the price. We at Randomdimes.com allow our readers to access these bonds directly from Aspero ( Yubi Entity ). Through this method, the investors can achieve higher yields than other platforms. As we do not have any marketing cost, we are able to directly allow Aspero to show its bond. The yields are higher if you register through this. It is even more than what you will find in Aspero if you go directly there.

We will also start showing market intelligence on the current Yield of Unlisted bonds and connect you with the platform who are offering these.

Altifi offers unlisted NCD to selected investors but won’t be available publically, you need to connect with the Altifi RM after registering here.

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital SEBI Order Update

- Betterinvest Delay

- Tradecred Delay

- Trucap Bond Downgrade

Growpital SEBI Outcome

The Growpital Fiasco has become a never-ending saga of rescheduling dates and timelines by the regulators for one reason or another. In spite of SAT’s order to release the escrow cash to investors, no plan has been created till now. Investors are losing interest in the money lying in the escrow. Even now an immediate resolution looks unlikely.

The next hearing is scheduled for 3rd Feb 2025. It is quite likely that it will rescheduled or will not have any conclusive plan laid out in the meeting,

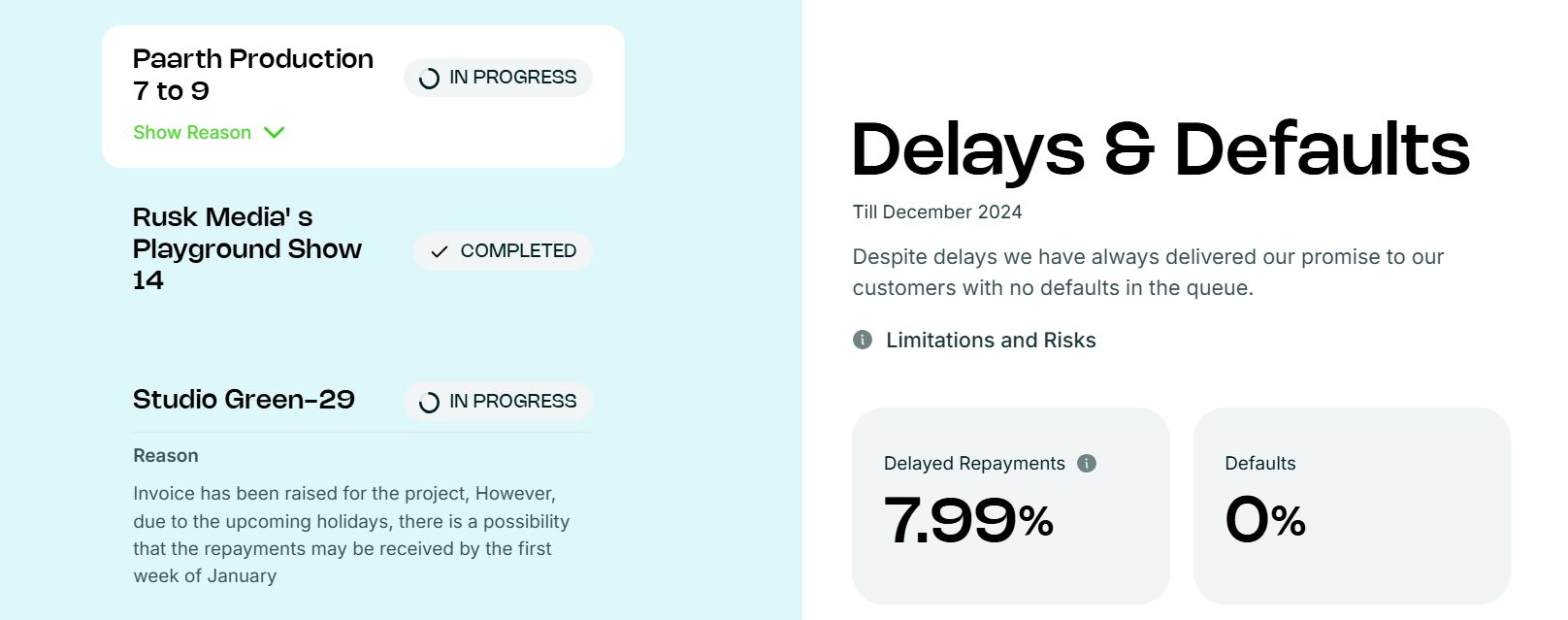

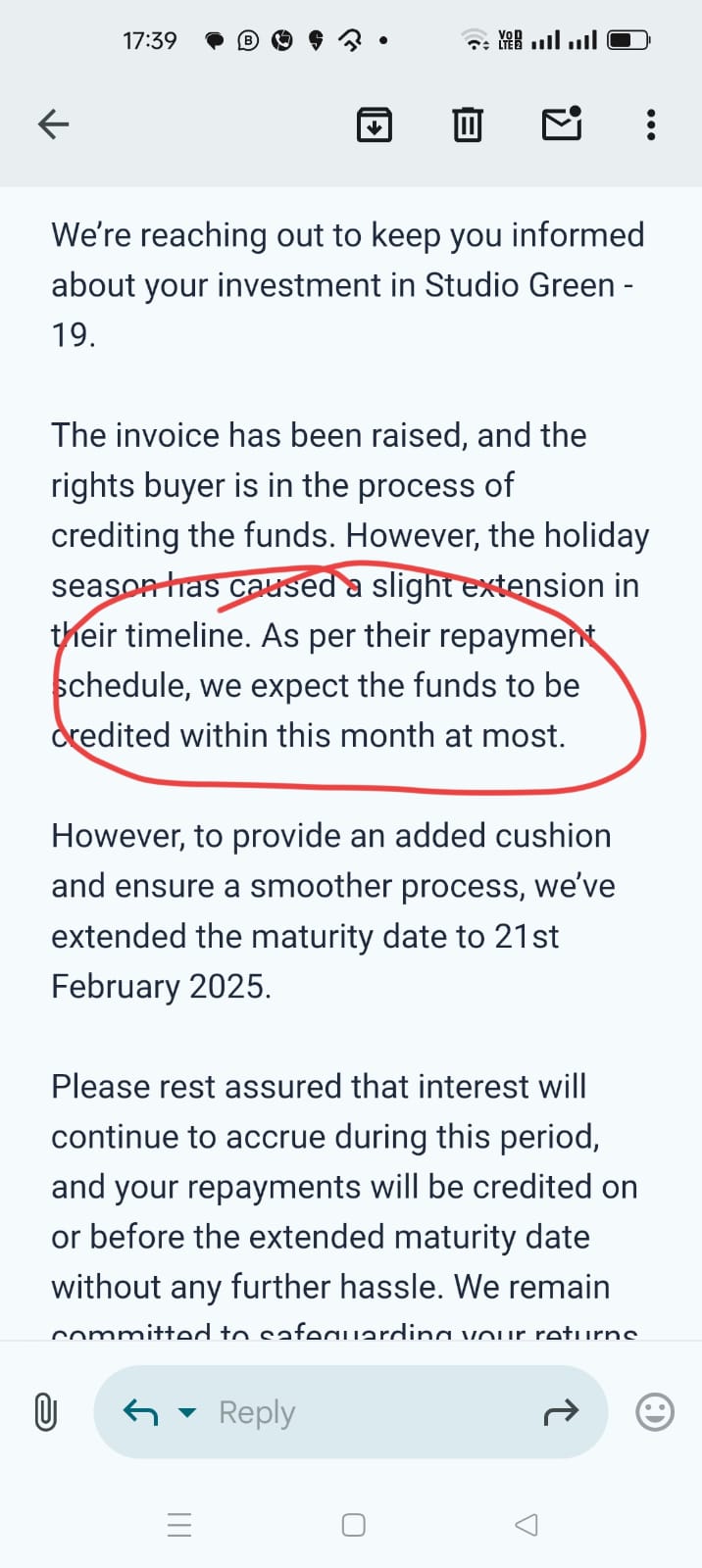

Betterinvest Delay

Studio 9 repayment has been delayed. Betterinvest has communicated that it would be processed by February End. It is common in media invoicing that repayment gets stretched due to various circumstances such as movie delays, post-production work, etc. Betterinvest has created a transparency report segment where they update the status of various delays on their website

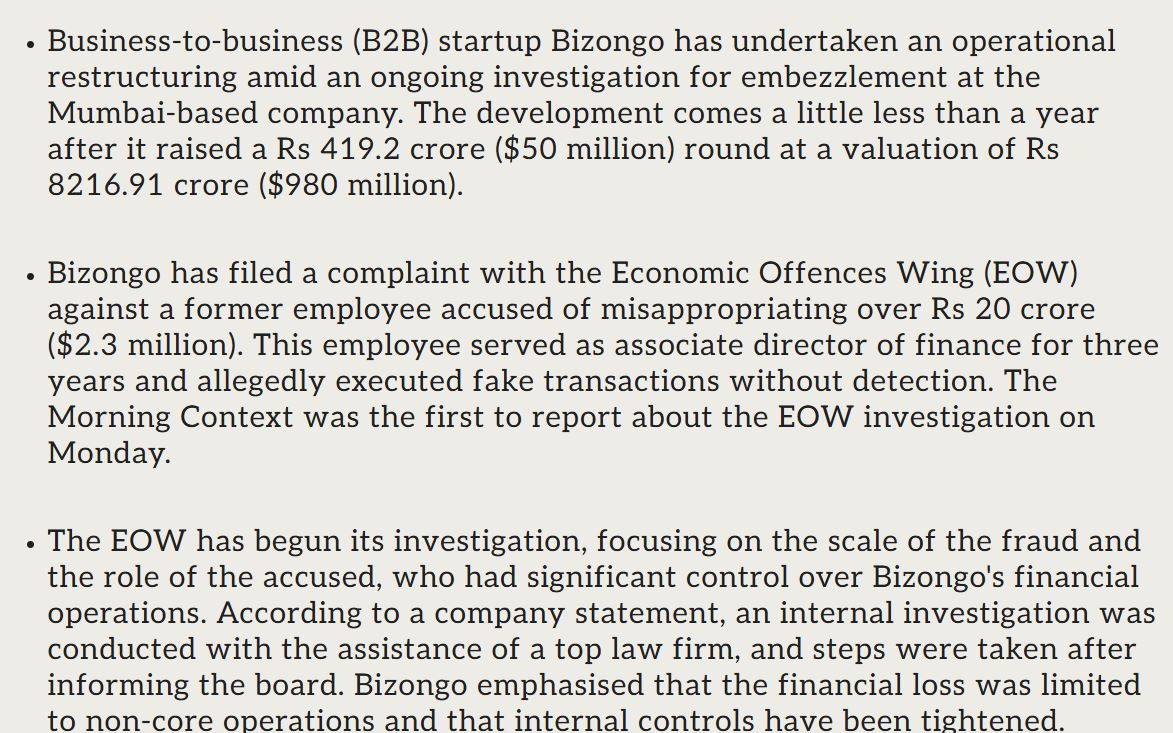

Tradecred Bizongo Delay

Repayment of the Bizongo deal on Tradecred has been delayed. We reached out to the team of Tradecred. They highlighted that Bizongo funding is underway and should be completed in the next 45 days and the invoices along with the accrued interest would be paid within 60 days.

Notably, there was an internal fraud in Bizongo to the tune of INR 20 cr due to which they have done corporate restructuring and hired many people and senior-level

Trucap Bond Downgrade

Recently one of the popular MFI companies – Trucap Finance had to face a debt downgrade. It was one of the popular bonds listed on many platforms.

Fortunately, only 10% of my principal is pending now for payment. A default might not happen but the current NPA problem being faced by microfinance institutions has impacted their capital-raising capability. Investors should do higher due diligence before investing in unsecured loans and MFI companies’ debt.

Trucap finance stock is down 80% from the top in 1 year as many people feel they might not survive!

Alternative Investment Portfolio Updates

This month we covered the Randomdimes<> Aspero collaboration and its benefit to investors. You cn use the randomdimes registration link to avail best prices.

Apart from that we reviewed Monytics, the revamped version of Lendpartnerz.They have added new products along with Invoice discounting.

Tapinvest has also launched Ultra to cater to investors that have much larger capital to deploy and looking for differentiated opportunities apart from invoice discounting such as unlisted shares.

AltDRX Referral Opportunity

The AltDRX 1.5% referral bonus is still available for all Randomdimes investors of ALTDRX who refer someone from their network. This means if you have invested in Altdrx and would like to refer someone through Randomdimes, Altdrx will provide a 1.5% referral bonus without any cap on the number of investors you can refer!

Telegram channel for *the Latest Alternative Investment News

Medium Term Investment

Some of the top high-yield opportunities for this month

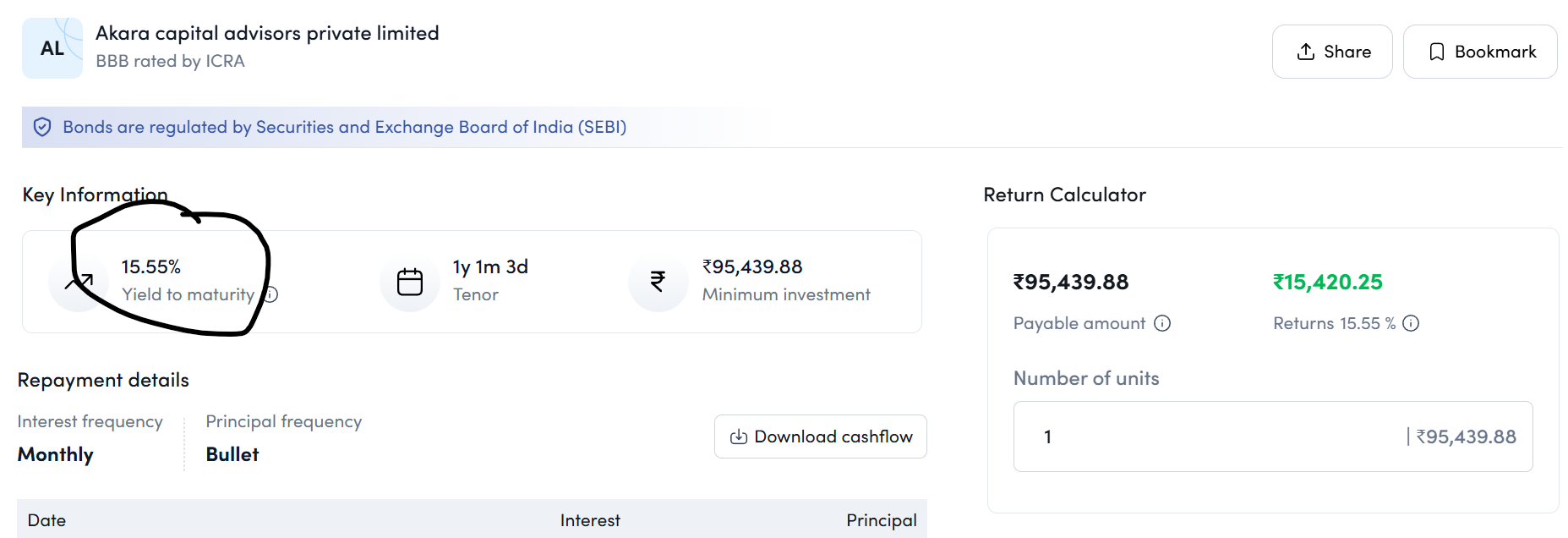

- Randomdimes<>Aspero – 15.55% Akara

- Policy Exchange – 13.75% IRR 2026 policy

- Betterinvest – 16.5%

- Afinue -15% post-tax 3 Assets combo (Battery+ Robotics+ Dispenser) , use Promo code MR630878 for early access

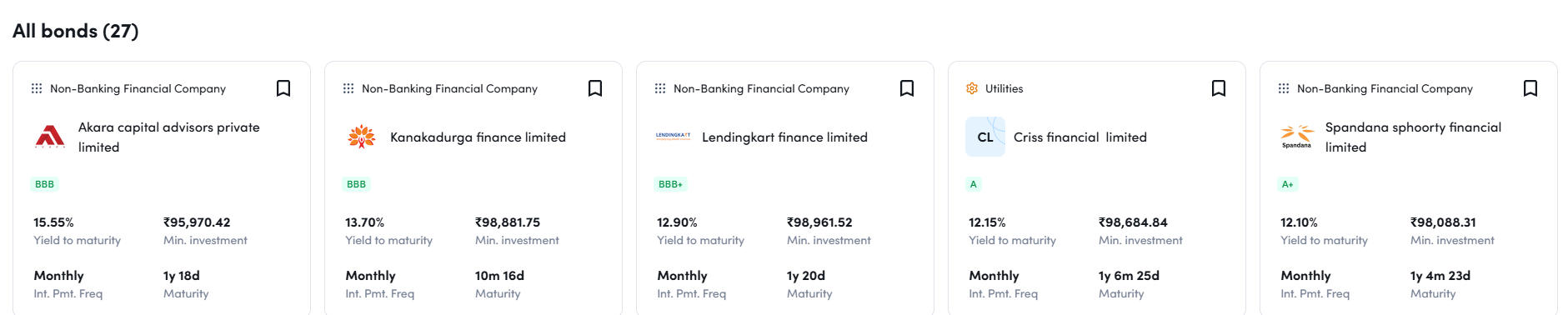

Below is the list of bonds currently Offered on Randomdimes<>Aspero.

Aspero Randomdimes Page

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- Principal-protected structured products available on Incred

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

- Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 3 Invoice deals on Tapinvest

- Invested in 1 deal on Tradecred

- Lendzpartnerz has rebranded itself as Monytics now

Crypto Investing

This has been a phenomenal time for crypto, mostly Bitcoin as it has crossed 100,000 USD for the first time. In the latest Fed meeting, chair Jerome Powell indicated that banks can serve crypto clients — provided they manage the risks effectively. This is positive for the asset class as it will allow it to reach new investors.

Trump launched his own meme coin,$Trump that rallied to 15$ billion market cap in a day. It then dropped 63 percent in value in the next 10 days. The coin is down from $14.9 billion as of January 20 to $5.5 billion in 10 days. Many fortunes we made and lost in this mania. One Trader turned USD 1.1 million into USD 23 million within minutes by getting early.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 40%

- I2IFunding- 30%

- Lendbox -30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13.70% | 5.1% |

| Lendbox Per Annum | Low Risk Short Duration only | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category i.e Urban Clap Loans

- As substantial exposure of Indiap2p was in the microfinance borrower category, the performance of Indiap2p has declined due to the current NPA problem.

Equity Market

PreIPO Stocks

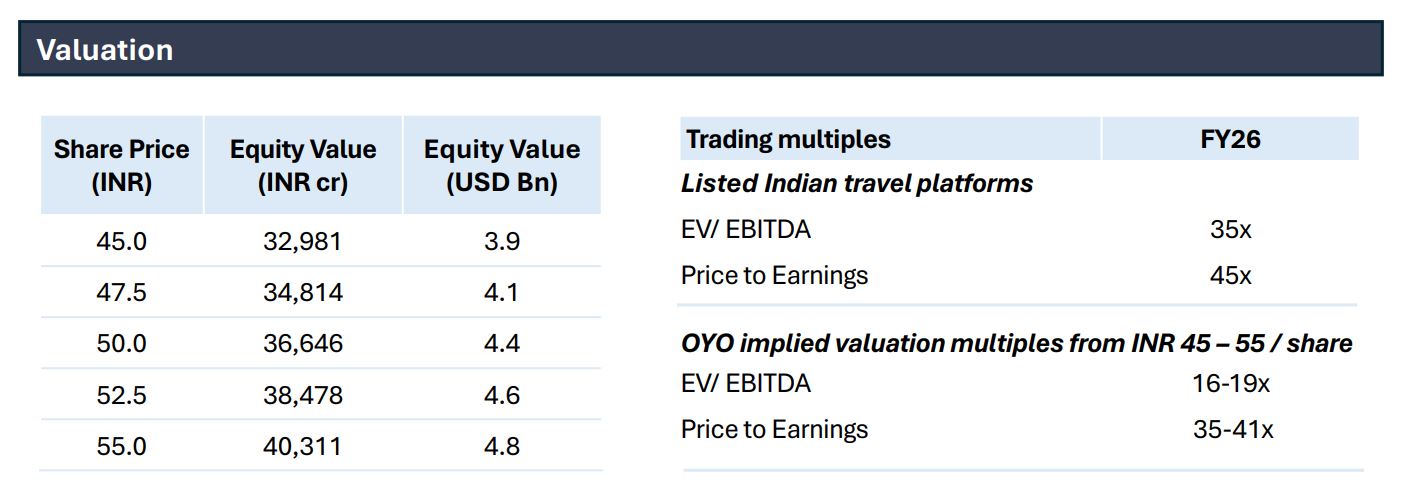

A lot of investors have been enquiring about OYO. We feel the demand for Oyo is lesser among larger investors and retail investors are more keen to invest hence we would be waiting for some time before investing.

We hope to invest in a few more opportunities and will share their details for others to evaluate.

Listed Stocks

Listed Equity has been under a lot of pressure for a few months now. However, we see this as an opportunity to add some sectors and stocks that look more attractive now.

Any investment made now can go further go down but that will give the opportunity to average it and improve returns in the long run.

OptionTrading

January was pretty good for trading and we were able to achieve close to 3% this month. The volatility levels were elevated without any significant movement and nondirectional trades benefitted. We have started covering some top traders and firms on youtube.

We have covered some trading-related articles on our blog. We will soon be reviewing online courses on trading that can help budding traders learn

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.