While Tapinvest is an old platform, in our endeavor to understand various asset classes better, we engage with these platforms to do a deep dive into the products. We recently did a post on Altgraaf Invoice Discounting

Invoice Discounting is an emerging asset class in India, gaining popularity among investors looking for alternative investment opportunities. Many platforms offer these products, and understanding the underlying processes and risk management strategies is crucial.

TapInvest is a platform offering a range of fixed-income-generating investment opportunities, including invoice discounting. Register as an investor to get started, browse the available opportunities, and choose the ones that align with your investment goals.

In this article, we spoke with the team at TapInvest to better understand their Invoice Discounting process, the steps they’ve taken to manage risk, and how they’ve adapted to ensure a secure investment environment. Below are the key questions we posed to Tap Invest, along with the insightful answers they provided.

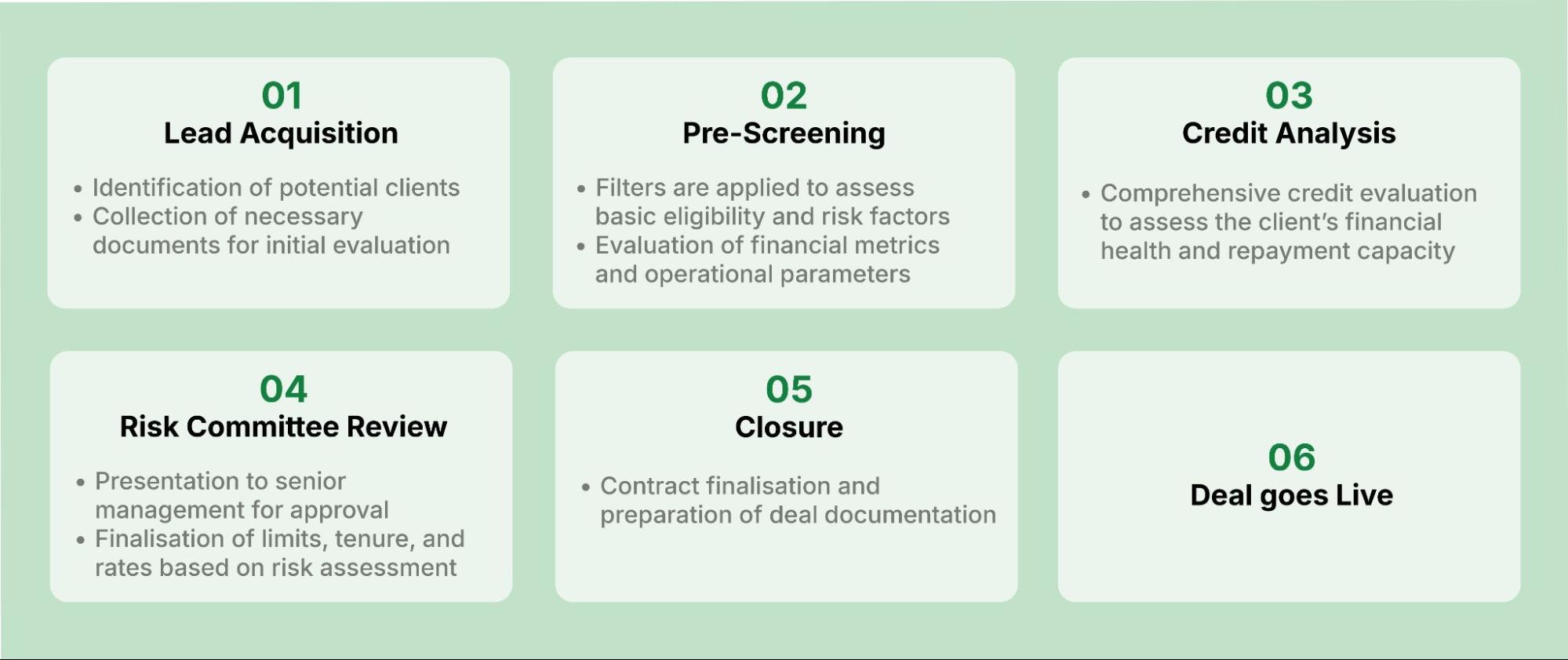

What is the lifecycle of the invoice discounting process on Tapinvest?

The invoice discounting process at Tap Invest typically takes 2-3 weeks. It begins with identifying potential clients, where the sales team collects necessary documents and performs an initial evaluation of eligibility and risk factors. This is followed by a detailed credit analysis to assess the client’s financial health and repayment capacity. Once the risk committee reviews and approves the proposal, the terms, including limits, tenure, and rates, are finalized based on the risk assessment. After contract finalization and deal documentation, the transaction goes live. Borrowers can then present invoices for discounting, gaining immediate liquidity for short durations ranging from 30 to 90 days.

Lifecycle of the Invoice Discounting Process

How does TapInvest onboard a new company for Invoice Discounting (ID)? What is the risk management process followed when listing an ID opportunity?

We follow a structured process focused on thorough credit evaluation and financial diligence to onboard a new company for Invoice Discounting (ID) and assess the associated risks. Here’s how it works:

Credit Assessment Memo (CAM)

We prepare a detailed CAM to evaluate the company’s financial health and performance. This includes:

- Year-on-Year (YoY) Analysis: Examining audited financial statements to assess revenue growth, gross margins, and trends in asset accumulation on the balance sheet.

- Month-on-Month (MoM) Trends: Monitoring recent performance to identify patterns or anomalies.

GST and Revenue Reconciliation

Revenue figures declared by the company are cross-verified against their GST filings. Any discrepancies are scrutinized to ensure accuracy and transparency.

Banking Turnover Analysis

We analyze banking transactions to confirm that at least 85% of reported revenue flows through the company’s bank accounts. This helps validate revenue authenticity and ensures the company has healthy cash inflows.

Financial Metrics Review

Key ratios and financial indicators are examined to understand the company’s solvency, liquidity, and overall economic stability.

Some borrowers raise funds across multiple platforms; how are the deals on your platform unique compared to others?

If “X” is raising funds through Tap Invest, we ensure the same invoice is not used on other platforms like Tyke or Altgraaf by generating a commercial CIBIL report for all clients. This report lists all existing credit facilities the entity has with financial institutions. We then review these details, including the sanction letters, to identify which invoices are covered under those facilities. Only invoices for customers not already utilized in those credit facilities are eligible for discounting through Tap Invest, ensuring no duplication.

We also undertake non-encumbrance of company invoices to ensure that discounted invoices are not already pledged or used as collateral elsewhere. This ensures the invoices are free of claims or disputes, providing security and transparency for our investors.

Example

Suppose “X” has a credit facility with another platform covering invoices for its distributor “A.” When “X” approaches Tap Invest, we review their commercial CIBIL report and sanction letter to confirm this. If the facility already covers “A’s” invoices, we exclude those and allow only invoices from other distributors, such as “B” and “C,” to be discounted on Tap Invest. This ensures no overlap or duplication of invoices across platforms.

How does Tapinvest monitor companies post-deal closure, and Is there any provision to manage risk before default?

The Credit and Investments teams play a crucial role in monitoring companies and managing risks throughout the lifecycle of a deal. Here’s how the process works:

1. Comprehensive Onboarding Process:

Before onboarding a company, we analyze its financial and operational parameters in-depth. This includes evaluating audited financials, banking transactions, revenue patterns, and overall risk exposure. Based on this detailed assessment, a credit limit is sanctioned, which serves as the basis for fundraising through the platform.

2. Ongoing Risk Monitoring:

Once a deal goes live on the platform, we implement a rigorous monthly risk monitoring process for all clients. This involves:

- Banking Analysis: Review the company’s banking transactions to verify cash inflows and ensure consistency with reported revenues.

- Profit and Loss (P&L) Review: Analyzing the monthly P&L statements to assess financial health and performance trends.

- Limit Reassessment: Evaluating whether the existing credit limit remains appropriate or if adjustments, such as reducing the limit, are necessary to mitigate risks.

3. Risk Committee Oversight:

The findings from the monthly risk monitoring are presented to the Risk Committee. This committee conducts a detailed review of each case and makes informed decisions regarding maintaining, reducing, or revising the credit limits to ensure proactive risk management.

This structured approach ensures that risks are continually assessed and mitigated, providing a robust mechanism to address potential issues well before they escalate into defaults.

What is the process in case a default happens?

In the event of a default, we work closely with borrowers to resolve issues promptly and recover repayments, ensuring a fair and efficient process. If these efforts are unsuccessful, we have robust mechanisms to safeguard our investors’ interests, including pursuing legal actions when necessary.

This approach reflects our unwavering commitment to protecting investors while maintaining a solution-driven, responsible recovery process.

What is a Structured Pool of Invoices or Insurance-Backed Invoices, and how is it different from Invoice Discounting?

Structured Pool of Invoices, in financial terms known as Pass-Through Certificates (PTCs), is a regulated product by the RBI. PTCs are securitized debt instruments that provide investors with a claim on the cash flows generated from a pool of underlying assets, such as trade receivables. These assets are pooled together, offering diversification and spreading the risk.

To facilitate the issuance of PTCs, an SPV (Special Purpose Vehicle) is created as a separate legal entity specifically for managing the transaction. The SPV’s sole purpose is to handle and execute the issuance of PTCs, ensuring the smooth operation of the process. A trustee is appointed to oversee the transactions, manage the funds, and provide regular reports to the concerned parties.

The security features backing these pools vary by deal and can include the following:

- Trade Credit Insurance (TCI): Protects the pool from non-payment risks by covering a percentage of the receivables in the event of default, reducing investor risk.

- First-Loss Default Guarantee (FLDG): This guarantee absorbs initial losses from defaults, providing investors with an added layer of security.

- Fixed Deposits: A portion of the funds may be reserved in fixed deposits to enhance investors’ financial security.

This contrasts with Invoice Discounting, which involves financing a single invoice, exposing investors to the credit risk of a specific borrower. While invoice discounting offers potentially higher returns, it lacks the layered security and diversification of structured pools, making the latter a more secure option for risk-averse investors.

Are there any risks in Invoice Discounting that remain uncovered?

All investments, whether in Equity, Mutual Funds, Bonds, Real Estate, Gold, or Fixed Deposits, come with their own risks, varying based on market conditions, economic factors, and specific investment characteristics. In the case of Invoice Discounting, while we implement thorough risk management processes and continuous monitoring, the risk of default or other unforeseen financial challenges can still arise, as with any financial product. Before committing to any investment, we strongly encourage investors to review all available information, including risk factors, terms, and potential returns.

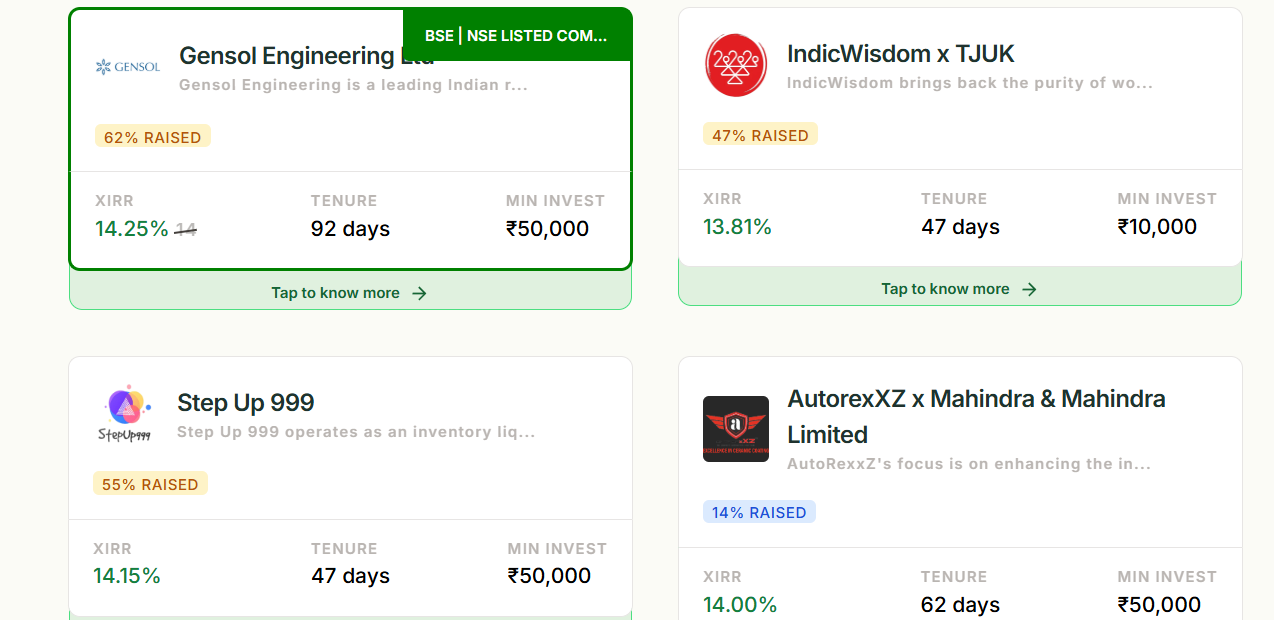

What kind of offerings are currently available on TapInvest?

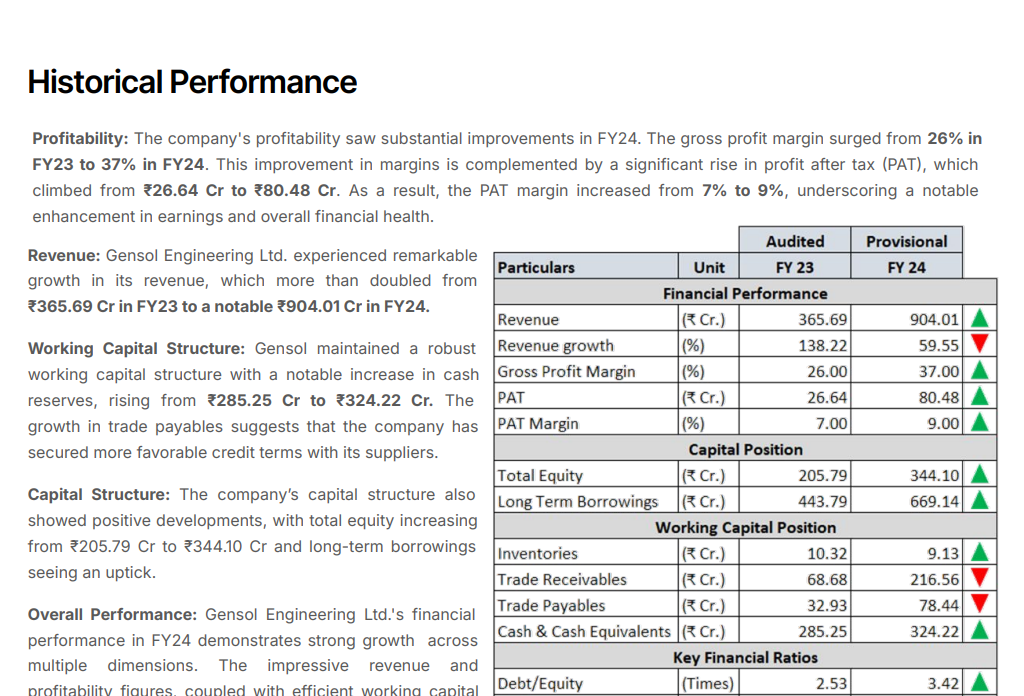

Tap Invest provides a variety of Invoice Discounting opportunities across multiple sectors. These include invoices from established listed companies like Gensol and are anchored on major corporations such as Walmart, ITC, and Amazon. The sectors covered include EV and renewables, textiles, FMCG, agritech, and logistics, offering investors a chance to diversify their portfolios in fast-growing industries.

Closing Remarks

Invoice Discounting is an emerging asset class in India with significant growth potential for retail investors. Platforms like Tap Invest are developing innovative products with solid risk management frameworks to safeguard investors. However, investors must conduct their due diligence before making investment decisions. We regularly provide updates on platforms like Tap Invest. We have been investing in multiple platforms and share our portfolio performance. You can check out list of all Invoice discounting platform on our website!