“Mutual Funds Sahi Hai” , the omnipresent tagline these days has become a buzzword these days if you watch TV or read newspaper. In one of the advertisement the protagonist draws the analogy between Mutual Fund and Test match where the probability of making money increases with time we spend holding the mutual funds.

The Interesting thing to note is that he uses the word probability and not guarantee. The ad ends with a blink and miss disclosure that Mutual funds are subjected to market risk. What should an average investor make out of it. Is there a risk we are not cognizant of? Yes we certainly are ,because we do not know if the future will be like the past and if it is not then we could be a generation with negative return. Now the question is how do we address this issue.

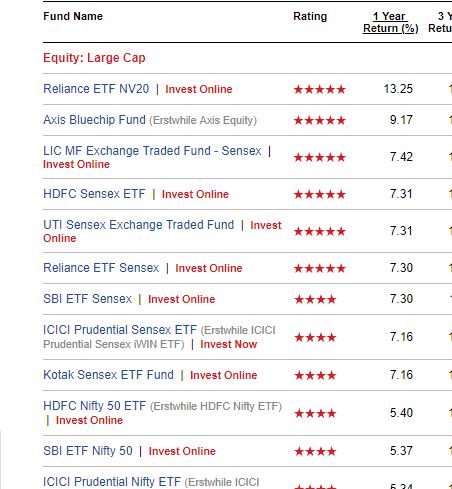

Lets start with check the last 1 year performance of the Large Cap Fund vis-a –vis Nifty 50.

Nifty 1 year return : 6%

Funds which gave more than 5% .Almost zero. You Can see all the top performing funds are ETF barring Axis Long Term Equity.

Its apparent Nifty outperformed most funds and technically bulk of investor lost to the Index and paid fees to the fund manager.

Isnt it unfair they get paid when you lose money too! Anyway that story for some other day.

Now we have established that Nifty 50 index is atleast as good as a large cap fund if not better. This means that we should buy the Index?

The answer is No!

Do you realize a big difference between Equity MF and Debt. Debt pays interest Equity MF does not. If the market doesn’t move at all you are losing opportunity cost in the form of foregone interest .So how do I get the best of both world.

The answer is Create a structured Product .Combination of Debt + Equity which will have all the upside of the Nifty but no downside.Sounds like a scam but no.Its possible and very easy to do it.

Lets say I have 100 rs to invest .How do I replicate my Nifty upside using options.

I buy an ATM call option. Lets check the price of 1 year Call option .Its around 7% for 10 months.You can purchase it using your broking account

Now I am left with 93 bucks. Where do I put it. I had published my annual return of 16.5% (P2P January Performance) through my P2P portfolio. Lets take a more conservative approach and assume 13% return. At 13% 93 buck become 103 in 10 months.

Now lets Compare the performance with holding Nifty 50 fund vs the hybrid product

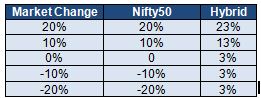

Scenario I:

Bullish on the market but do not want to risk capital. Buy 1 Call ,invest rest in P2P

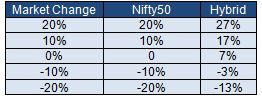

Scenario II:

Bullish on the market ,Can take some risk. Buy 1 Call, Sell Put

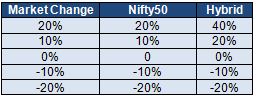

Scenario III:

Super Bullish on the market ,Willing to take full downside . Buy 2x Call,sell 1 Put

Even in the riskiest scenario 3 we are better off creating the hybrid product than buying a large cap Mutual fund.

I have taken conservative numbers where I am receiving 13% from P2P .In reality I can generate 15% plus returns and using it with options can outperform large cap mutual funds

Its also pragmatic to optimise your money to make the most of it than just do what everyone else is doing.

Referral Codes and Link for P2P Platform:

- RupeeCircle (use code PIND145 while registering to get portfolio analysis reports)

- I2I (use referral https://www.i2ifunding.com/referral/ud8cwng83/invest ,add I2I50%DISCOUNT code while registering to get 50% discount )

- Cashkumar (Mail me for referral)

- LendenClub (use code LDC11989)