On the other hand, the Ruble has become the best performing currency after a sudden rally encouraged by Russia’s plan to make “non-friendly” countries pay for their oil in the Ruble.

My Alternative Investment Portfolio Performance

This Month I got cashflow from some of my new investments – Growpital and Legalpay

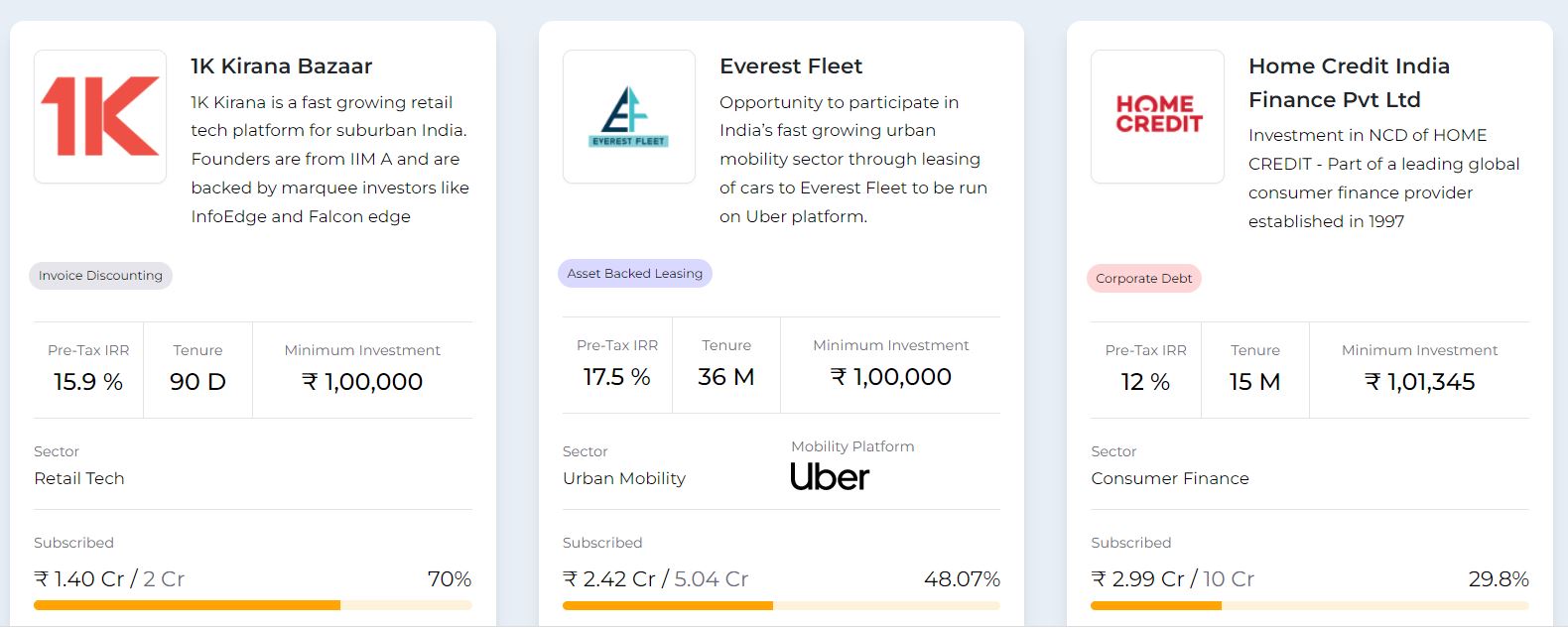

I invested in multiple opportunities on Jiraaf (12-15% IRR )this month along with increasing my stake in liquiloans 10% offer which was available in March.

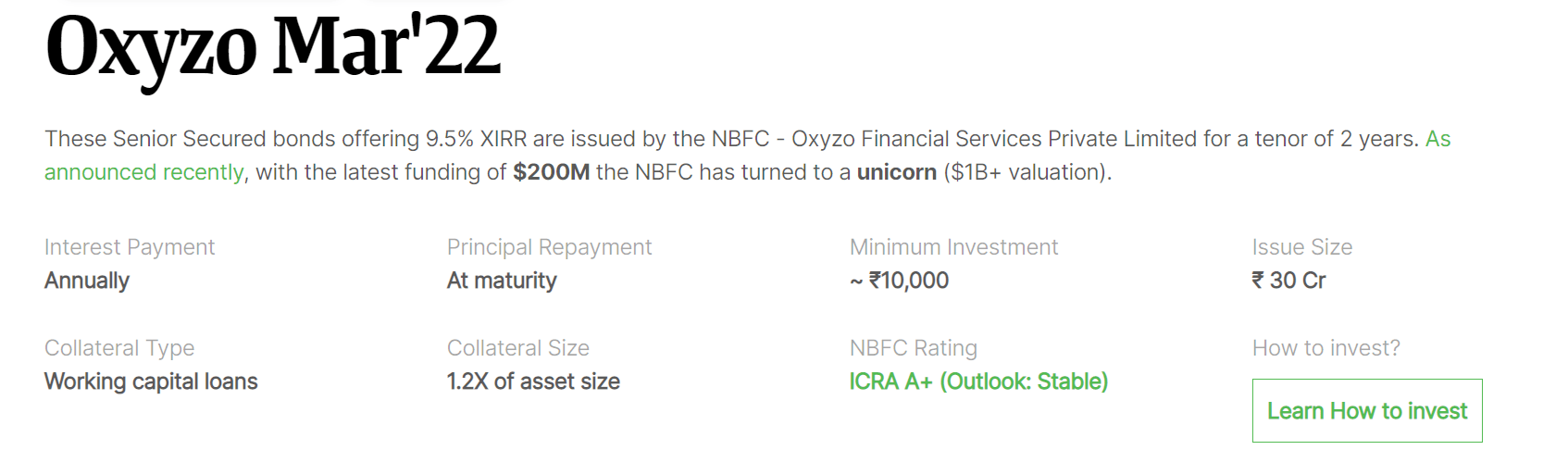

I also subscribed to Oxyzo NCD through Wintwealth.In other updates,My Option portfolio did well in March with almost 5%+ return due to falling volatility.

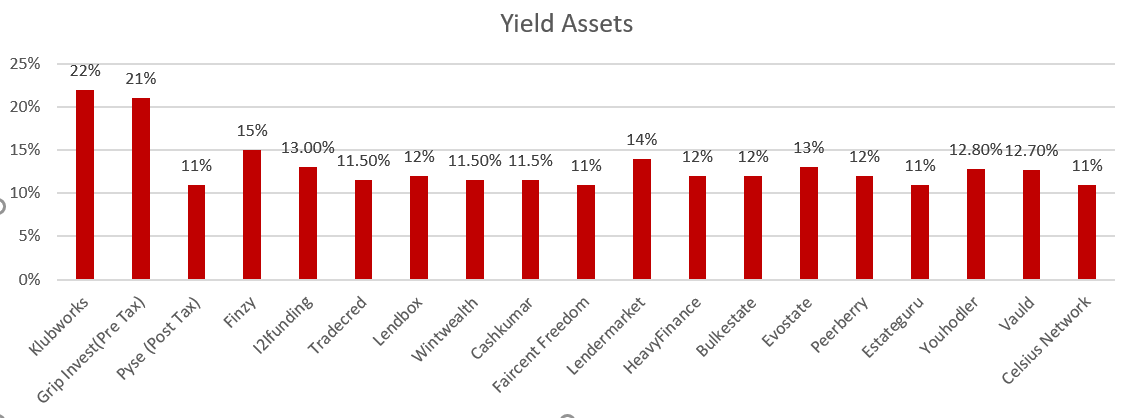

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 20%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 13-15% | New |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay( Promo code FV48G4) | 14-16% | New( 2 payments ) |

| Growpital(Promo code GROWRDIMES) | 12% | New (1 Payment) |

- Have invested in Clairco (11.54 % IRR) and 1K Kirana Invoice(15.39% IRR) on Jiraaf

- Invested in the latest Legal Pay Interim Finance deals.2 Payouts on time!

- Invested in Oxyzo NCD on Wealth Wint

- Received in payment for Growpital

- Klub had a few 20% IRR + deals this month

- Hedonova stopped till review of Audit Report (Some red Flags)

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| IndiaP2P | 16% | New |

- Have added money to the 10%, 2-month lockin deal with Liquiloans

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Cashkumar Returns are on time

- Just Added money to IndiaP2P last month

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(Stopped) | 13% | 5.5% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- For all investment-related remittances please transfer money to the IBAN account from your Indian bank account and not other remittance services as per RBI FEMA guidelines!

- Evaluating a few tokenized real estate investment international platforms

Equity Market

The equity market has shown good recovery but the market is not very cheap hence only a systematic investment makes sense at the current level rather than a huge lump sum.

China Market-Earlier this month, SEC named five Chinese companies listed in New York as the first of as many as 270 to face delisting if they do not provide audit documents, investors spooked. KraneShares CSI China Internet ETF (KWEB) lost around 10 percent of its value on each of the following three days. Soon a speech by Chinese vice-premier Liu He, promising to introduce “policies that are favorable to the market”, brought money flooding back and KWEB reacted by shooting up 40 percent in one day.

China’s market has shown a lot of volatility but a massive crash can be a valuable opportunity for long-term investors.

- My Investment in the Indian market last month when the market cracked have gone up 9-11%

- I had bought some China ETF. It can be bought through Vested, Stockal and Winvesta, etc

Crypto Lending Investing

| Platform | Returns | Capital Loss |

| Kucoin | 5-50% | Nil |

| Celsius Network | 12.00% | Nil |

| Youhodler | 12.50% | Nil |

| Vauld | 12.70% | Nil |

| Coindcx | 14%% | Nil |

- Coindcx is also offering a 14% return on USDT

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Exploring a few more options to spread platform risk

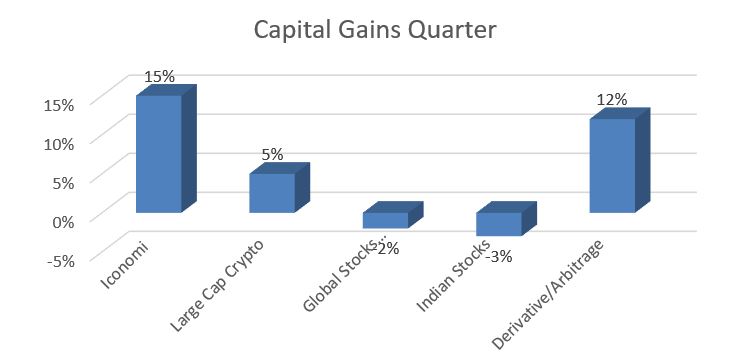

Crypto Investment

Along with the capital gains charge, the finance ministry announced a 1% tax deductible at source, or TDS, on all digital-asset transfers above a certain size, starting July 1.If this is implemented ,it might bring an end to crypto trading in Indian platforms!

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 20% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 5% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 6% |

- My strategy to top up investments in ICONOMI during Feb Crypto crash has given decent returns.

P2P Investment

Current allocation:

- Rupeecircle- 5%(stopped)

- I2IFunding- 30%

- Finzy-35%

- Faircent-30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks-backed loans, E-Rickshaw backed loans, education loans, NBFC backed loans(Mondeo etc) Group loans | 13.5% | 4.9% |

| RupeeCircle | Stopped | ||

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| Faircent ( Only Pool Loans) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- Completely stopped RupeeCircle

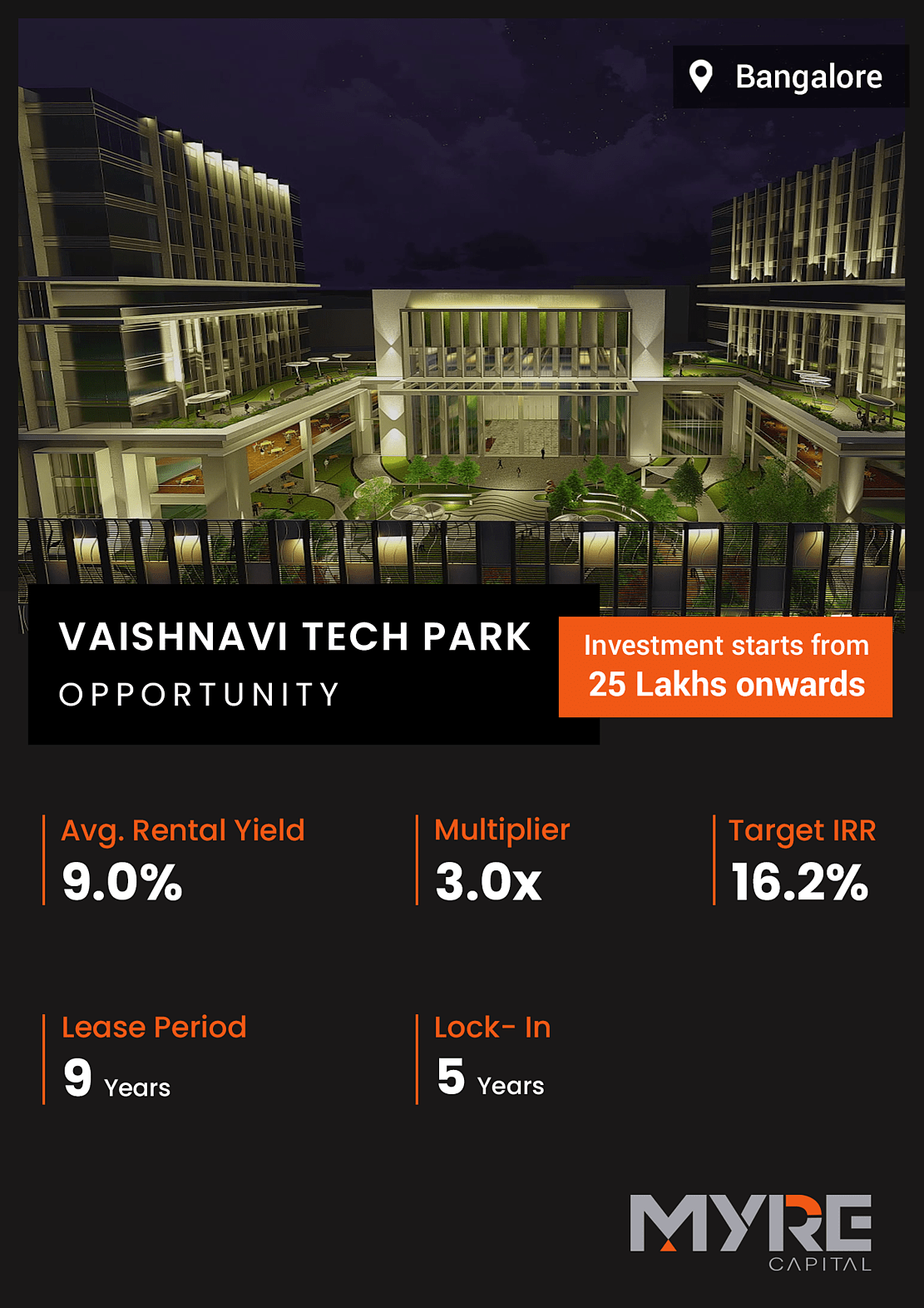

Other Alternative Assets

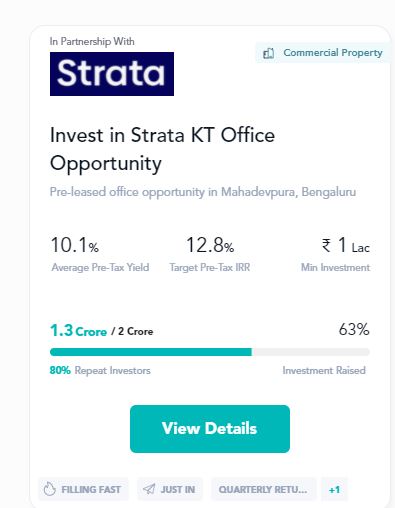

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. I have received 3 cashlfow on time. There is currently one new opportunity on the platform live. People who are interested in lower minimum (INR 1 lakh) can invest in the Strata Real Estate on Grip Invest

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 3.00 |

Growpital Investment Update- I have received first payment from the platform. Recently platform shared the current development.

- Farm Project Portfolios are running over 850+ acres of farms.

- Bagged deals for volume take off of:

– 500 MT Cumin

– 1500 MT Wheat

– 2500 MT Tender Coconut

– 2000 MTs of Other fram produce - The volume take off will secure ~INR 30 Crores worth of revenue stream in the portfolios.

- Will soon be including hydroponics, Indoor Vertical farms, Goat farming, fish farming in our portfolio with service contracts giving fixed returns.

- 1800+ Acres of new active farmlands are ready to be invested upon.

Rohan what’s the take on Hedonova. Should we invest it it ?

Even though the fund is giving good returns i have decided to wait for audit before investing again!

For all investment-related remittances please transfer money to the IBAN account from your Indian bank account and not other remittance services as per RBI FEMA guidelines!.

I did not understand above line clearly. Can we still use Winvesta Multi Currency Account ?

or we should mandatory to use Contomobile Account , Paysera Account only?

Please share the information.

Hi , Winvesta multicurrency account is an IBAN account and you can use it for foreign investment. However, you need to transfer USD the first time from an Indian bank account using a remittance service offered by them like DBS remit.

Hi,

In respect of investments in Hedonova, the NAV is calculated by a third party, a custodial firm called Northern Trust. Do you have any further details like the audit report you have mentioned in your post? I would also like to go through the same. Thanks in advance.

Hi Chirag, I had the exact apprehension hence I withdrew money as highlighted in Feb report. I will only being investing again once the audit report and methodology is shared.

Will update you if they share it .

Hi Rohan,

Wanted to check if there is any update on Hedonova from your end. Further, earnestly waiting for your blog on monthly performance update for April 2022.

Not planning to invest. Il suggest the same to others. Fund seems dubious! check out april update

https://randomdimes.com/alternative-investment-portfolio-april-2022/

Rohan,

How do you keep track of all the investment. I personally find it challenging to keep track of so many options. Plus we need to remember the passwords of different platforms. It would be great if you share some sort of info on how to keep track of the different investments

Hi, I have prepared a basic excel with the amount allocated to each asset and approx interest. Whenever I get cash flow I plan based on the best available options at that moment.

I Keep separate amount in Liquid fund,liquiloans,saving for emergency

Any reasons you stopped investing in KredX, 12% club, Lendbox interest-only loans or CRED mint?

Kredx – I invest in a few selected deals

12% club – Avoid due to Bharat pe fiasco ,also not confident on lendenclub ,their partner

Lendbox – I prefer per annum and settlement finance more

Cred Mint- i directly invest through Liquiloans hence no need to use Credmint

I’ve seen in Liquiloans, that the liquid scheme (D.Adv scheme) doesn’t provide a 9% yield as that of mint (even 7.25% if liquidated within 12m).

This could be balanced as Liquiloan’s min inv is 50k while that of mint is 1L.

It’s just for further diversification as my current liquid portfolio consists of per annum Flexi and a liquid fund.

Thanks for the answer BTW 🙂

Hi Zac , I Invested in the 10% offer on liquiloans which was available in March! you can add per annum too