When it comes to investing in Debt most people look into only 2 options:

- Fixed Deposit

- Debt Mutual Funds

Though these have their own advantages which I have covered earlier, one thing which they lack is liquidity . You end up paying either an exit fees or you have to wait till a stipulated period.

Other problem is It’s very hard to take advantage of a view when you are investing through a Debt mutual fund as you are not aware of the portfolio at any given time.

It makes sense to invest in Debt Funds to diversify across debts but you can add your own bond portfolio based on your analysis and save some expense ratio.

The rationale is when you are certain about some company why not just buy the bond directly if it is offering decent yield .Gradually you will understand the mechanics of the market and would be able to take credit and interest rate view.

You can buy bond at a particular yield and if the yield spikes you can average it or book profit if yield softens. Due to the liquidity you wont face problems in entering or exiting.

So how do we buy bonds. We can buy directly buy bonds from the broking platform.

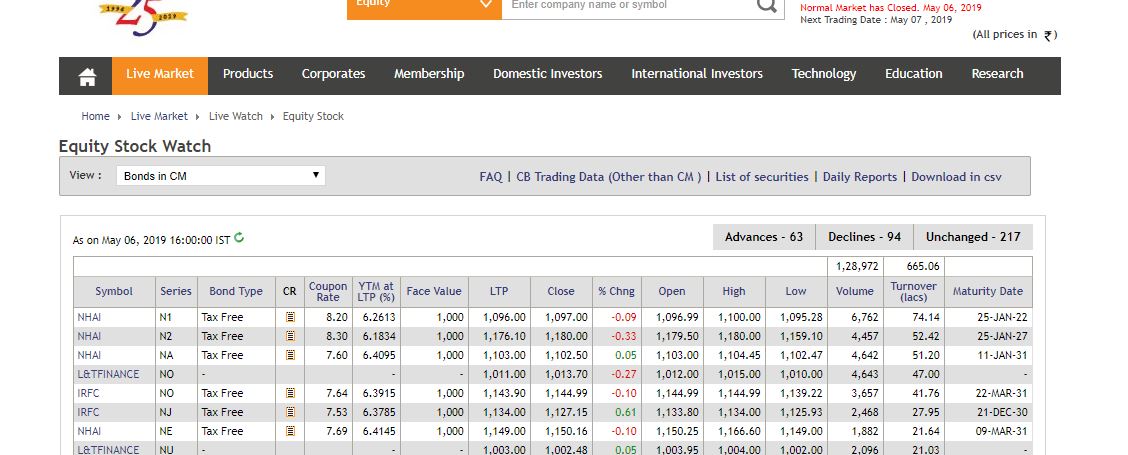

NSE publish details of the available bonds for trading everyday on it’s platform. It is available under live Market section

Various details are available for a bond:

- Coupon

- Maturity

- Volume

- Yield To Maturity (YTM)

We can check the tentative YTM from this page and select the bond we would like to evaluate. Let’s say we shortlisted Tata Capital 3 year bond.We can then do further drill down:

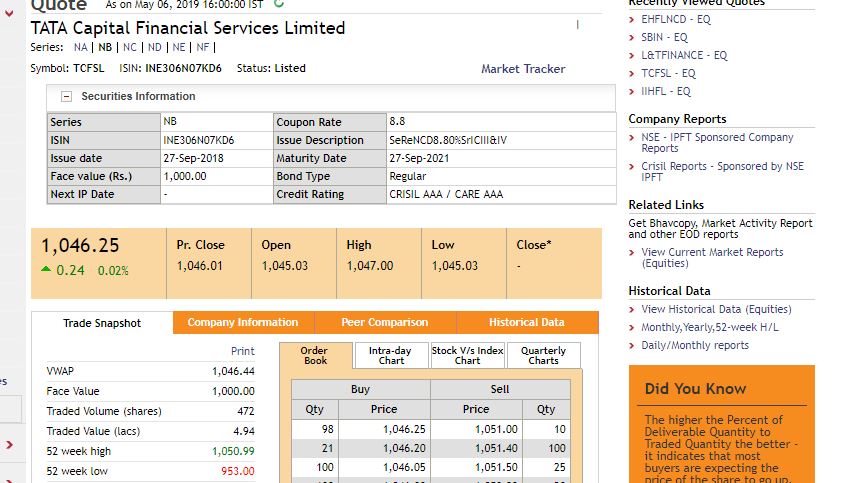

What all can we see:

- Coupon = 8.8%

- Maturity = 27 Sep 2021

- Category = Sr secondary (It means in case of default we have rights on company access over other lenders)

- Credit Rating =AAA

- Coupon Freq = 1 year( You can google the ISIN number to check these details)

Now comes the important part: PRICING.

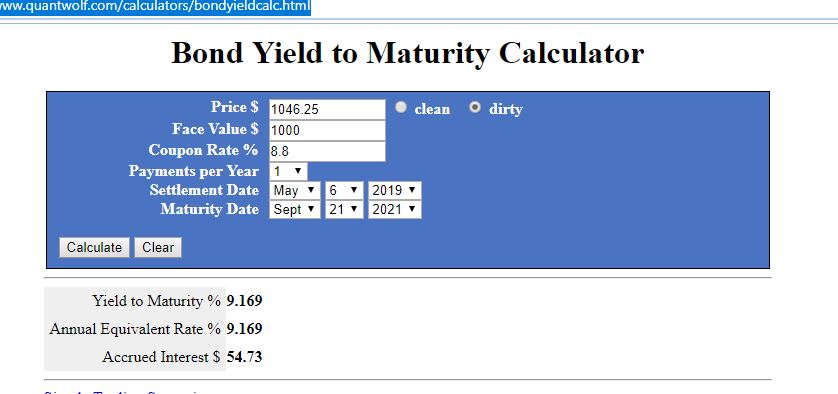

Bonds are priced by discounting of future cashflow . YTM is the number if we use to discount we will get the current price of the bond .

Bonds quoted in the NSE platform with dirty price. What does it mean?

It means that accrued interest from the last coupon date is added to the current price because the buyer will get the coupon not the seller.

Now how to check the current YTM. We also need to check the current yield( which will be higher than YTM if bond is trading at discount.

This is because in maturity bond pays back the principal ,if we buy in discount today we get more than the YTM but if we buy in premium we get less. So for people who are buying to trade this bond rather than hold it till maturity current yield gives better picture.

To Calculate YTM you can use this link:

http://www.quantwolf.com/calculators/bondyieldcalc.html

Based on the current price, the bond is trading at 9.16% yield which is better than most FD available in the market. People who are interested in buying this bond should do their own due diligence about the company which should include Fundamental analysis ,market news and sentiment analysis of the company.

The bond has 2.5 years of maturity thus will have small exposure to interest rate risk . We will get coupon as dividend which we have to reinvest.

Hey nice article,

I wanted to understand how/ where can I find whether the price is clean or dirty and how many interest payments in 1 year

Thnx in advance.

Price in NSE is always dirty( Bonds Traded in CM) which is also the price quoted in broking platform like zerodha. It would be Clean price + accrued interest. Just after coupon payment Clean = Dirty.

You can reverse calculate by putting in dirty price and calculating the yield which will match Published YTM on NSE

Hi ,you can google the ISIN of the bond you are interested in. Most often you will find information memorandum online readily available in various sites. it will have the details of coupon frequency also !