This month I have completed 1.5 years investing in P2P lending platforms. Overall the experience has been good. There were some hiccups though in the form of selecting good platforms,choosing category of loans but with experience you learn from your mistakes. Today I will compare my latest portfolio performance with the other asset classes for 1 year period

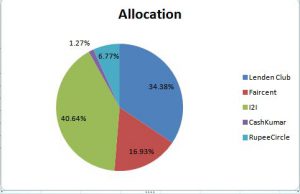

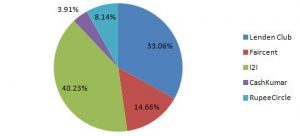

Portfolio Composition

January allocation

February Allocation

Portfolio Changes: I am still in the process of unwinding my Faircent exposure .

I move my Faircent EMI to lenden .it is a good strategy as I am able to put staggered investment in Lenden on various dates thus my cash inflows also become staggered across dates and makes it easy to reinvest

I2I portfolio is pretty much constant. Due to less number of loans in the platform I target 3-4 good loans every month.As loans are long dated the cashflow inflow is manageable

I am increasing my RupeeCircle and cashkumar portfolio as I have not faced any defaults uptill now

The portfolio allocation of I2I and Lendenclub is not reducing much because of the compounding effect of the interest generated from the past investment.

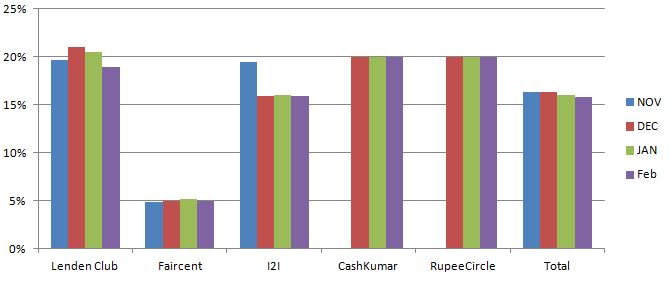

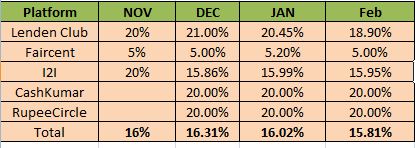

Calculating Portfolio Performance: I consider loans delayed by more than 45 Days past due date as NPA. I use XIRR method to calculate returns as it is the most accurate. My post on calculation methodology ( Lenden ROI calculation )

I dont have any NPA Cashkumar and RupeeCircle in till now(new portfolio ).

Portfolio returns have been stable .Had I not invested in Faircent and rather divided that money in other platforms my ROI would have been 18% plus.I have kept Rupeecircle and Cashkumar investment as 20% even though actual return is higher because I expect some delays as time passes thus I am provisioning for them.

Comparison with other asset classes

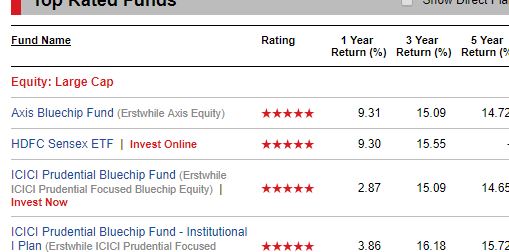

One year performance of my P2P portfolio has dwarfed the best performing equity and bond funds. Even the sharpe ratio has been excellent. It means my portfolio has delivered superior consistent return.

Axis Large cap delivered 9.3% .What are the chances of all the mutual fund you bought Axis .More than 30-40 Funds were not even able to deliver positive returns.

Gilt Fund delivered 10%. its a very good return for a bond fund but this is primarily because interest rates came down from the highs this year. Even the best bond traders could not have predicted it

This shows the unpredictability in a diversified P2P portfolio is far less than an equity or Gilt fund

It would be unfair to say that P2P is better than equity or debt investment because equity returns are always subjected to short term volatility and people who have a short term horizon should refrain from such investments.

I would say it is good to have P2P investments as a part of your portfolio when you are looking for high returns with manageable risk and decent liquidity.

Points to note

- If somebody is just starting to invest I would not recommend calculating XIRR because your interest income is too low and slight delay of emi etc can change the return drastically.Better gauge at starting will be to check the amount in delay and subtract that much percentage from the portfolio published ROI.

- In Lenden I use only Insta Loans using autodebit as I invest only 500 per loan and want to diversify as much as possible .I do not check individual loan as my rationale is if platform is underwriting properly with sufficient diversification my NPA will match with platform’s i.e if platform has 10% default my portfolio will also have 10% which is very good for 48% ROI loans

- I prefer investing in a SIP fashion(Systematic Investment Plan). If I have a monthly budget of 10000 I will calculate how much I need to replenish in I2I and rupeecircle so that I can make my escrow balance a multiple of 5000 for further investment. Then what is left after that I put it in other 2 platforms depending on where I want to increase allocation.

eg : if amount to invest 25000

Let’s say I2I escrow balance :2000

I need 3000 minimum to make it multiple of 5000

So I will invest 3000 or 8000

Same with Rupee circle.

Now the amount which is Left will be divided between cashkumar and Lenden depending on 2 factors a) where I want to increase exposure b) how much is available in escrow of the platform( In lenden you may end with up large cash inflow and do not want to increase it further which may cause delay in disbursement)

Strategy Going Forward:

- Move all Faircent EMI to Lendenclub(better risk adjusted Return)

- Keep growing investment corpus in RupeeCircle (use code PIND145 while registering to get portfolio analysis reports)

- Increase investment in I2I (use referral https://www.i2ifunding.com/referral/ud8cwng83/invest ,add I2I50%DISCOUNT code while registering to get 50% discount )

- Increase investment in cashkumar( positives are:short term loans(<6 months), overall good platform performance with low npa, high interest) Mail me for referral !

- Use Statistical analysis to determine if there is a pattern in default

People who wish to construct a P2P portfolio can email me.

Hi Rohan!

Thanks for all the knowledge you are sharing, and also all the learnings you are imparting.

WRT the following point in ‘Points to note’:

“In Lenden I use only Insta Loans using autodebit as I invest only 500 per loan and want to diversify as much as possible .I do not check individual loan as my rationale is if platform is underwriting properly with sufficient diversification my NPA will match with platform’s i.e if platform has 10% default my portfolio will also have 10% which is very good for 48% ROI loans”

Does this mean you do not bother about the borrower’s profile while lending (Insta loan), since amount is small? If yes, how successful has been this strategy? What is the % of NPA/defaults in your Lenden Club portfolio using this strategy?

Regards,

Bhadresh

Yes Bhadresh , I do not evaluate borrower in Insta Loan .If i can invest in 1000 plus loans , I can say with a high confidence that any luck based bad npa impact would be less and my exposure will only be on the platform underwriting skill.

Till Now I have a NPA around 6% for Insta Loan which I consider decent because of the high ROI. If my NPA start crossing 10% that will definitely raise a red flag and I would revisit my strategy

Thanks for sharing all the information. Can you write an article on how should one get started if we were to get into p2p lending? I also know that we have 10 lakh limit on p2p lending.

sure I will do that. Alternately you can drop me a mail and I will guide you.

Thanks