Now my Alternate Investment Portfolio is composed of 3 assets:

- P2P invest ( approx Return 15-16%)

- Invoice Discounting (12-13%)

- Settlement Finance( 11-12% approx)

Each has it’s own advantage in offering better liquidity or better return. The good part is all these 3 asset classes have low correlation with broad market and provide some stability to overall portfolio in volatile times like these days!

This month I have made certain changes in the portfolio as the size has become big and some platform do not offer enough loans to provide meaningful investment opportunity.

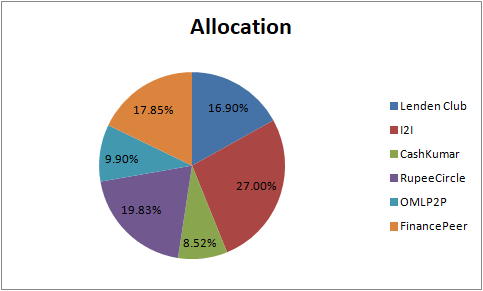

Portfolio Composition

Portfolio Changes:

- 3 Platforms have consistent supply of new loans: I2IFunding , RupeeCircle and FinancePeer.(I intend to make these primary platforms)

- In I2I I have decent exposure thus I am investing fresh capital in RupeeCircle and FinancePeer for next couple of months.

- I am only reinvesting EMI in these 3: LendenClub, OMLP2P and Cashkumar. Primary reason is that number of borrowers are too few to invest more money

- I allocate a fixed monthly amount for my P2P portfolio in the same way people do it for mutual funds.

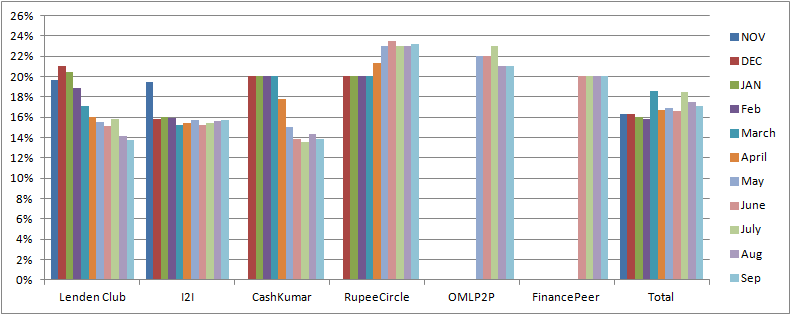

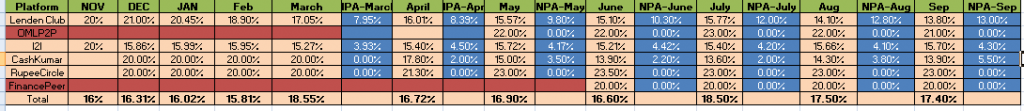

Portfolio Performance

Performance Analysis:

Key Points from this month’s performance are:

- LendenClub: I am not very happy with LendenClub performance mostly in the InstaLoan category where default rate is pretty high. I Have stopped Auto Invest and now only invest in repeat borrowers and few high risk category loans.

- I2IFunding : I have made I2IFunding as my defacto platform for government employees( Municipality, Jal Board etc) and ultra safe borrower( A, B and C).Performance has been consistent

- RupeeCircle :Strong performance continues with just one delay till now! . I am concentrating on people with decent salary, High account balance and low EMI to salary ratio

- FinancePeer : Education Loan investment has been pretty successful with zero defaults till now

- OMLP2P : very Few borrowers this month so no changes in investment

- Cashkumar: Yield has gone down due to cash lying idle in the escrow. I might reduce my portfolio exposure if situation does not change

- I am attaching Financepeer Education Loan Brochure pdf

- People who want to be put in broadcast for FinancePeer Loan may add this number : 8419975005

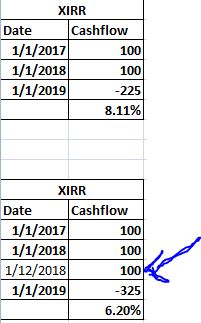

Calculating P2P return using XIRR vs EIV method

XIRR is the popular method and superior to NAR (Net Annualized Return) method which does not take into account cash lying in escrow account.I generally use XIRR method to calculate the returns of P2P but in some situation EIV(Equivalent Investment Value) might be more apt.

XIRR method:

This method equates the present value of cash flows and presents a better picture on the returns but a major limitation is that it leaves out future cash flows. The XIRR method accounts for all cash flows into and out of the Account. While this method is most suited for most investors I can show certain situations which can be problematic.

The difference between the 2 is that in second case we had a big cashflow (Dec’18). We have not received interest for that but it shows in the cashflow thus our overall ROI dips. This is quite common for people who have recently started investment and the new cashflow is substantial.

For people with decent old investment this might be not a problem/

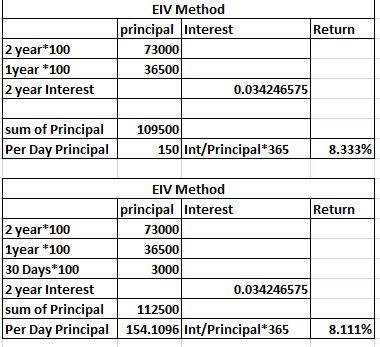

Equivalent Investment Value Method

EIV works on a simple principle that an amount Y invested for X days is equivalent to Y*X amount invested for one day. For example, ₹ 10,000 invested for 10 days is equivalent to ₹ 1,00,000 invested for 1 day. Applying the principle on the account transactions of a P2P lender, the EIV is calculated as follows:

EIV = (∑YiXi)/X1

where,

Yi=Invested Amount (positive) or Withdrawn amount (negative)

Xi=Number of days since the investment to today

X1=Number of days since first investment

Return on Investment = [(Interest + Late Fees – NPAs)*100]/EIV

In this method as the last cashflow was only for 30 days hence it’s impact is less in the second case unlike in XIRR.

People can choose either method depending on which suits their portfolio more

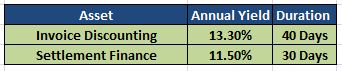

Invoice Discounting and Settlement Finance Performance:

I keep rolling my invoice discount investments. Currently I am invested In Amazon and Flipkart

I have also invested in Settlement Finance which has daily settlement against Aadhar ATM invoice using TradeCred.

While In Invoice Discounting I invest in short duration invoices of Bluechip companies, in settlement Finance credit card or Aadhar Payment invoice which is paid T+1 day is financed for a day hence it’s an ultra short invoicing.

My current Portfolio yield and duration:

Footnote:

For alternate investment you can use these links

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com

Hi Rohan,

“People who want to be put in broadcast for FinancePeer Loan may add this number : 8419975005”

Pls elaborate on what this is about.

Thank you.

Regards,

Bhadresh

Hi Bhadresh. You may ping on whatsapp account associated with the published number. You will be added to the broadcast list which will ping you details of new loans available on the platform!

Thank you.