This month I have made some significant changes in my portfolio.

- I will be adding a new P2P platform from this month called OMLP2P

- I have decided to stop my “unidentified risk” category investment in Lendenclub

I will cover the rationale in detail .Let me start with the current month allocation and performance stats

Portfolio Composition

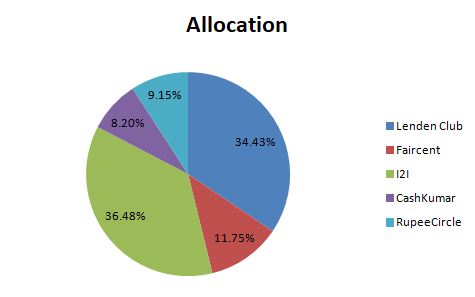

March Allocation

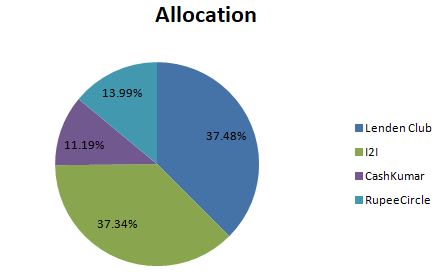

April Allocation

Portfolio Changes:

- I have stopped publishing Faircent performance as I am going to withdraw all my capital from it in the next few months and not going to evaluate it anymore

- No changes in I2I except the EMI are reinvested

- Fresh Inflows to Cashkumar and RupeeCircle.

- Will add OMLP2P in May

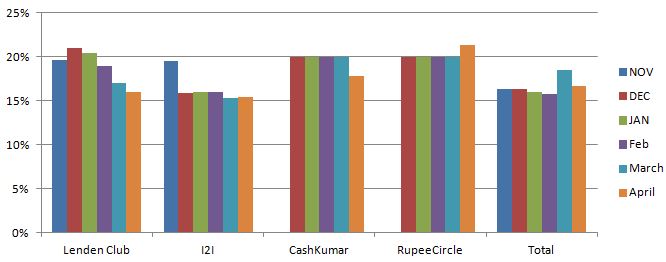

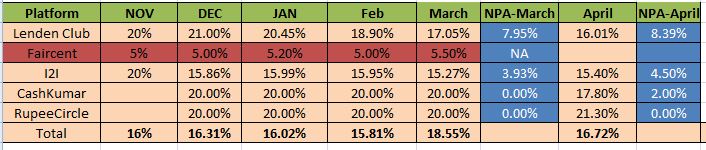

Portfolio Performance:

Performance Analysis:

- The positive aspect has been that rupee Circle is the only platform I have been investing in where till now I have not faced any delinquency.

- My Lenden performance has been steadily deteriorating . After a bit of evaluation I figured out the major reason for fall in performance was due to my exposure in “Unidentified Risk” Category loans.

On the surface these loans look quite lucrative with 48% return but if you try to do understand the payoff of this product you realize 48% is too low for the risk they expose your portfolio too considering the underwriting I have seen lately of Lenden . A small increase in the NPA can change the ROI.

Let’s say average 6% default rate is for loans with terms up to 90 days. Taking this into account, if a loan originator lends 100000 worth of loans, then after 90 days, it can be assumed that 6000 worth of them will have defaulted. Therefore, a loan originator will need to charge 6% per quarter in interest to make up for this default rate. Without compounding, that makes 24%. So if we combine this with the APR needed to cover Feesl costs, we are close to a 30% APR already. This figure is covering the default rate of the original amount.

Now if the EMI also have 6% default rate ,in 3 months almost 10% will be the default. which is equivalent to 40% default rate plus the fees

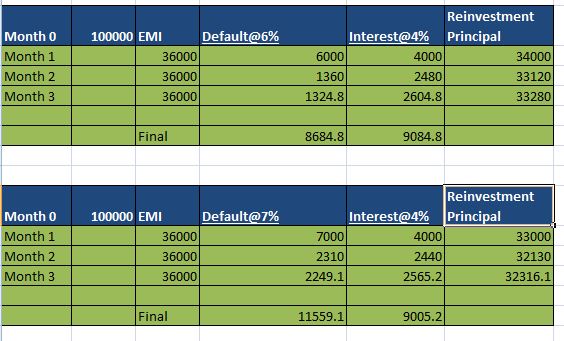

Below is a example at various level of default:

In one scenario we are making money while other losses after Fees

Basically even though your number of defaults are just 6%and 7% but due to the short nature of loans you have to take reinvestment risk of the whole capital . i.e for earning 32% (48% reducing rate) a year you have to invest atleast 4 times if you do not reinvest the capital.

Factoring in the Reinvestment makes a small default of 7% equivalent to 40% plus.

My portfolio was yielding pretty low for the recent the disbursal in “Unidentified Category”. I Can guess that is because Lendenclub is trying to onboard as many borrowers as possible and in the process underwriting is taking a hit.

I will stick to the longer term category for a while and see if my portfolio performance improves!.

One problem I will face is to find enough Loans but it’s better than making losses

- Another problem which has been plaguing me is the paucity of loans in the platforms. Not having enough loans means Either I wait for too long or end up put money in substandard loan.

To overcome this problem I am planning to invest in OMLP2P . The ROI range is around 22-30% with medium term tenor 12-36 and overall platform NPA seems quite low. They have disbursed close to 10Cr till now and have an NBFC-P2P license.The promoter is experienced in the lending business which is a positive.

Compared to Monexo and Finzy ROI is higher . Minimum ticket is 5000 which is on a higher side but is manageable for people who wish to create a decent size portfolio.

I can comment on my portfolio performance only after 3-4 months of investment.

Footnote:

I2I Account Referral Link(Use Code I2I50%DISCOUNT while paying to get 50% off,Mail me after registering to get further benefits)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

Mail me to get Cashkumar Referral

Hi Rohan,

Pls advise:

1.

“Let’s say average 6% default rate is for loans with terms up to 90 days. Taking this into account, if a loan originator lends 100000 worth of loans, then after 90 days, it can be assumed that 6000 worth of them will have defaulted. Therefore, a loan originator will need to charge 6% per quarter in interest to make up for this default rate. Without compounding, that makes 24%. So if we combine this with the APR needed to cover Feesl costs, we are close to a 30% APR already. This figure is covering the default rate of the original amount.”

In the above, is 6% the platform default? Or the default rate that an individual investor may face?

2.

“Now if the EMI also have 6% default rate ,in 3 months almost 10% will be the default. which is equivalent to 40% default rate plus the fees”

If point no.1 (in my comment) is about individual investor, then why do we need to account for EMI default separately here? Isn’t it already covered in the 6% (of point no.1)?

3.

“Factoring in the Reinvestment makes a small default of 7% equivalent to 40% plus.”

Pls explain how the figure of 40% was arrived at.

Finally, a suggestion. Do share your detailed feedback, with calculations, with the LDC team, so that all of us may continue earning good returns. If you have already done this, CHEERS!!

Regards,

Bhadresh

1).In the above, is 6% the platform default? Or the default rate that an individual investor may face?

Default Rate of the platform. I am just trying to figure out the default rate at which this loan become unviable.

I am talking about an investor who has invested in substantial number of loans and we can assume his NPA rate = platform rate

2). If point no.1 (in my comment) is about individual investor, then why do we need to account for EMI default separately here? Isn’t it already covered in the 6% (of point no.1)?

The Percentage figure which generally get on platform are annualized numbers. Let’s say you have just one 500 rs loan . and it gives 48% return (APR).

In terms of default again if platform has let’s say 5% default. what does it mean ,that in a year 5% of all loans will default.

let’s make it simple and assume we do not reinvest the EMI. How many times we have to reinvest the Principal : 4 Times!

So if platform has 5% default,everytime we reinvest we have that risk. So in a year 5*4 = 20% is the risk of losing principal.

Now with the EMI ,you reinvest in other principal which again has the same risk.

Technically platform risk is 5% because total default/ Total principal = 5% only but you need to churn the principal multiple times to get your 48%!!

3) “Factoring in the Reinvestment makes a small default of 7% equivalent to 40% plus.”

Pls explain how the figure of 40% was arrived at.

for a loan of 100 Rs for 3 months. first month at 7% default you lose 7. Second month you get EMI of 33 which you reinvest you lose 33%*7 =2.1 and 3 rd month again 2.1 = around 10% which is 40% plus annually.

These kind of loans are common in USA and UK called as paydayloan ,The APR is very high 200% plus to make for the risk.

Until Lenden improves the underwriting , I would be wary of this product !

Good Article. I’ve also invested in short term loans on LenDenClub. Let’s see how it performs. The only thing I am afraid by giving long term loan (upto 12 or 24 months) is that what if the p2p site owner closes their business (for whatever reason). I know they claim that there is an agreement between lender and borrower but still it will be hard to run behind borrowers to get emi / money back.

Well technically you will get money back, but as they wont pay for collection agents etc ,your NPA will definitely go up. That is one of the reason Its important to diversify across platform so that impact of one company going bust does not impact the total portfolio.

Also we need to look at some lead indicator like ,drop in number of available loans, platform performance etc which indicate that platform is going southward

Portfolio numbers at https://www.lendenclub.com/portfolio-performance/ lists default ratio of “UNIDENTIFIED” loans at 3% – this is half of the figure you mentioned @ 6%

I have just given an example ,how the 48% ROI looks high but is susceptible to slight change in default level.

My Default level is around 5% for unidentified .Obviously platform will take more conservative figure in NPA hence the low default risk.

The platform does less due diligence for unidentified risk category hence the default level can shoot up and thus people who are investing in this category need to be much more careful than others.

Ok thanks yes – I understand that you were giving an example, but I just wanted to check/confirm if your 6% figure was from personal experience? I am also seeing somewhere around 4-5% default rate(counting delays also as NPA conservatively) although I’m investing since last 3 months only in lenden. If the real NPA figure is actually around 5-6% like you are suggesting and as per my experience so far, I’m also considering stopping future investments in this specific category. Anyway, thanks a lot for the useful and insightful analysis, I really liked all the articles on your blog so far, keep them coming!