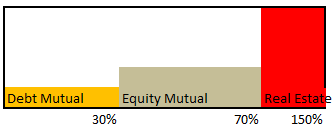

Most retail investors invest in stocks , bonds and real estate as a part of their asset allocation.Though stocks and real estate are one of the primary driver of growing economy it leaves the allocation of a common man in the mercy of market movement and Real estate prices which by nature are very volatile.Most common portfolio I have seen is :

- Equity Mutual Funds

- Debt Mutual Funds

- Flat ( for which EMI is being paid)

Lot of people argue that everything tanks to zero they will still have a home to live in, which is not a great argument as failing to may EMI will cause forfeiture of possession!

For instance if someone has 30 lakh corpus generally 10 Lakh is invested in Debt ,20 lakh in equity and they have a flat worth approx 50 lakhs for which they pay EMI

This is an example of leveraged portfolio. People keep changing the weight of equity and debt but the elephant in the room is the Flat.

They are paying around 9% per annum on 150% of their networth which is equivalent to 13.5% of their networth . Every year the real estate does not move up they lose 13.5% of their networth !!

It’s alarming but people do not realize because they cannot see profit and loss on real estate as it does not have any mark to market value.

Also people have inflow of salary etc which makes them overlook the loss!

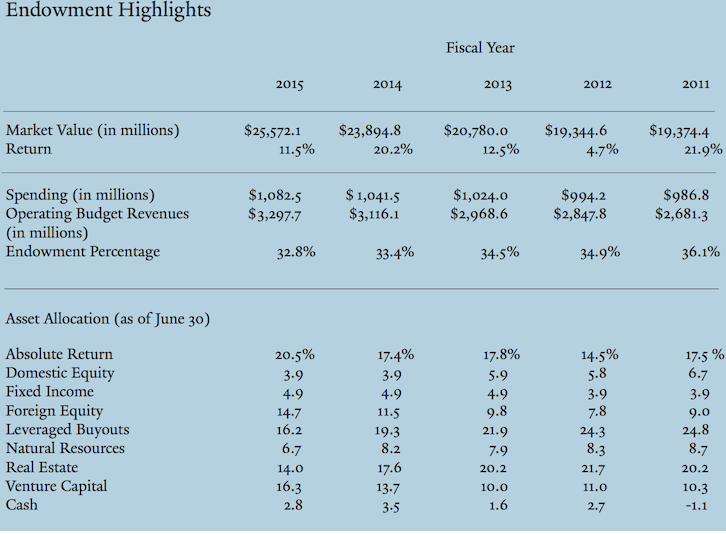

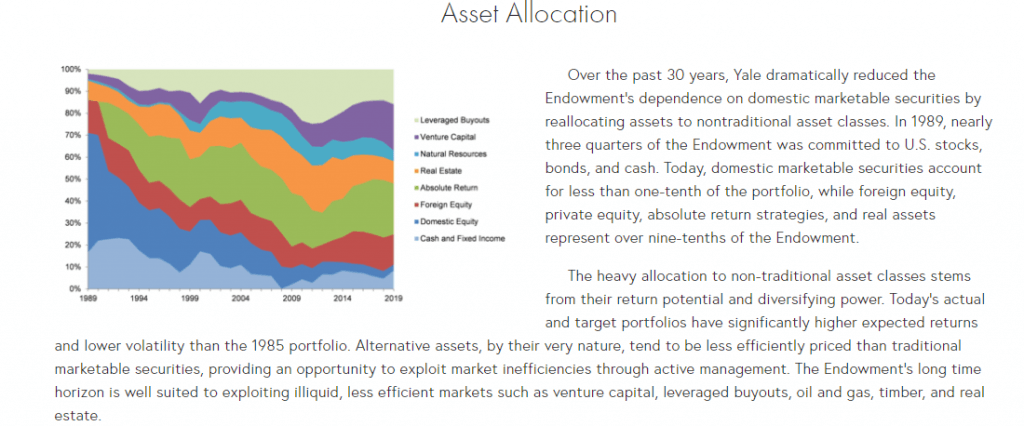

Now let’s see asset allocation of some top University of the world (Yale)

Endowments invest like many other institutional players as well as ultra Rich. They target income to fund their operations/lifestyles indefinitely and overall growth in the corpus.

If you could get a predictable return from your investment then you can tie rest of your networth to long term assets without worrying about volatility. Once you build a large enough financial corpus, small percentages make a big difference.

Yale University also boasts one of the nation’s largest endowments led by David F. Swensen, PhD. Yale University has more ~$30 billion endowment fund which it invest across multiple asset classes.

US Endowment Funds have consistently achieved superior investment returns. This is especially the case for the “Super Endowments” of Harvard and Yale. They have achieved an average 20 year annualised return of 11.5 per cent, 5.4 per cent greater than the returns of a traditional 60/40 global equity/ bond portfolio . US Endowment Funds have diverse portfolios with exposure to multiple asset classes including significant exposure to alternative asset classes.

Yale’s endowment returned 11.4% per annum over the 20 years ending June 30, 2019, exceeding broad market results for domestic stocks, which returned 6.4% annually, and for domestic bonds, which returned 4.9% annually. Relative to the estimated 6.5% average return of college and university endowments, over the past 20 years Yale’s investment performance added $28.6 billion of value in the form of increased spending and enhanced endowment value. During the 20-year period, the endowment grew from $7.2 billion to $30.3 billion.

I find it amazing that Yale’s domestic equity and fixed income only account for less than 10% of their overall portfolio. Most of us won’t have such diversification because we don’t have the resources or the expertise in investing in so many different asset classes. But I do strongly recommend following a asset allocation proper that incorporates real estate and alternatives as part of your net worth.

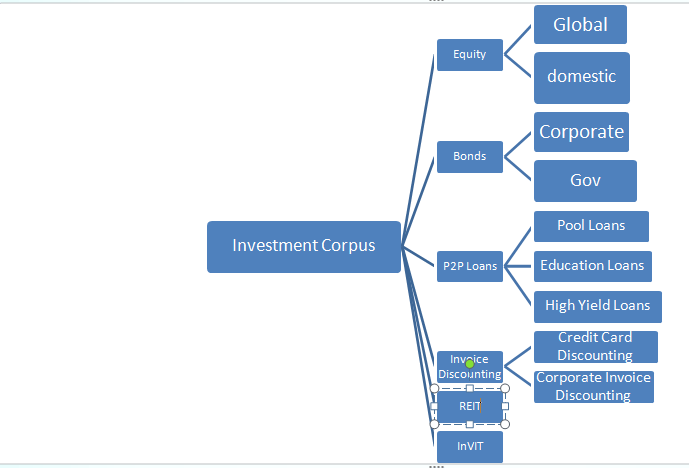

How can a Retail Investor Allocate?

We got an overview of how wealthy institutions and high net worth individuals invest their money so the rest of us can make better investment decisions. Many time people have a very negative view of alternative investments from people who’ve never invested in alternatives before. It’s as if we automatically attack what we don’t understand. You should keep an open mind with a focus on learning new things.We need to assess each alternative for it’s pros and cons and then invest after under understanding the details!. There’s a reason why the rich are rich and tend to stay rich!

With the advent of better technology lot of asset classes which were not available few years back are now within reach of most people. If we make asset allocation as basis for our investment decision we can invest more prudently and not over-allocate towards property just because our primary home tends to be so much more valuable than all our other investments. I keep looking for newer assets and platform which can provide decent and sustainable returns.

Footnotes:

For alternate investment you can use these links

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com