Its much debated battle and people on both sides of the argument have their own rationales and logic.Real Estate being an illiquid asset makes it difficult to compare in a transparent and a fair way. I will try to do backtesting of real estate performance vis a vis stock market.

Real Estate data

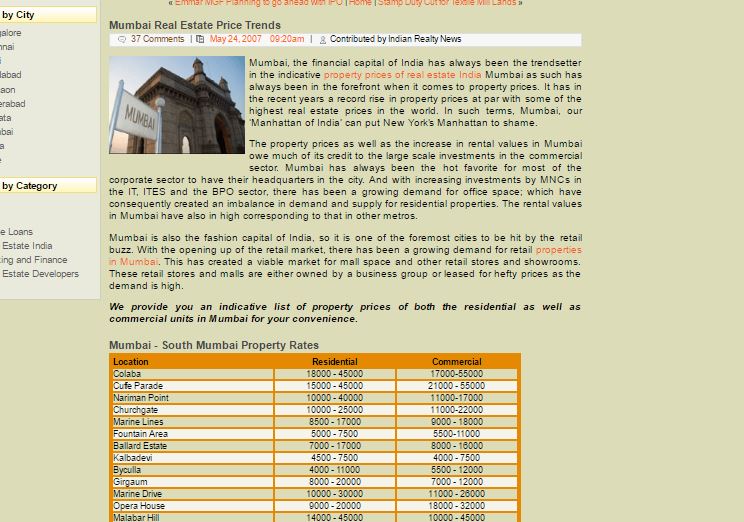

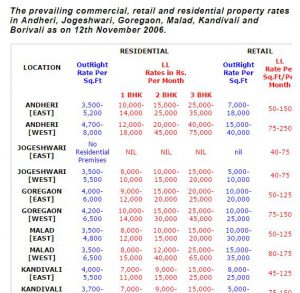

I got some residential property prices for Mumbai for 2007 from newspaper excerpt. I want to ensure I dont take word of mouth but rather rely on evidence.

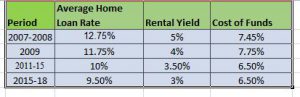

So From the old news articles I am able to get the approximate rent and real estate price in Mumbai during 2007 . I will compare price movement of 3-4 places.Now i need see how the home loan rates have changed . I will take SBI home loan rate historical record for that .

Assumptions:

- Will take average property and rent for the area

- Will assume rent growth is linear

- Person stays in property and immediate possession

Based on the Rents prevailing in 2007 and home loan rate I calculated rental yield and fund cost trend.

Cost of funds is the actual interest he had to pay which is the net of EMI he has to pay and rent which he saved thus an inflow

As we can see cost of fund has almost been same even though rates have gone down.As EMI and rent are both monthly cash flow we can net them to get a ball park figure. What inference we can draw from this ?

The home owner was able to borrow at an effective rate which is much lower than Home loan rate.

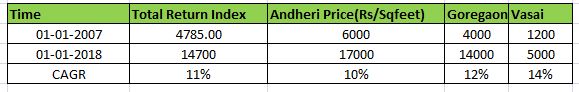

Lets compare CAGR for Real estate and Nifty Total Return Index over the period:

We can see prices for small underdeveloped places appreciated more compared to developed places

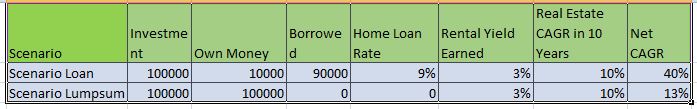

Now lets compare 2 scenario

- Person invest from own money

- Person borrows 90% money

*Tax benefit on interest is not factored which will also increase return

It is evident that in Real Estate we make more money if we borrow money and real estate appreciation rate is higher than

our cost of funds i.e Home Loan Rate – rental yield generated

Obviously we can lose money in the same way.Back of the hand calculation for real estate required return

Real Estate CAGR = Leverage *( Real Estate Return – Cost of Fund)

in this example = 10* (10*- (9%-3%) ) =40%

Final Verdict:

- As interest Rates are increasing we should be wary of the growing cost of fund.It could move to 7%+

- 10X leverage is very dangerous (high return high risk),Maybe 3X leverage is good enough

- Use optimum loan to maximize tax saving through interest also

- Try to look for underdeveloped property as they are like small cap ,give higher value in the long run.

- we need to subtract atleast 3% from stock market return to compare against Real Estate Return as we need to factor in rental yield we earn in real estate which is not possible in Stocks.

- You can not leverage in stock market as you can do in Real estate as cost of fund will be 11-12% because its unsecured lending.

- There are other factors like emotional value etc in owning house which cannot be quantified