Cryptocurrencies have been in a tumultuous ride. A question which comes to all new investor’s mind is ;what are these cryptocurrencies actually? and do they have any use case or is it just like a casino.

No one knows the correct answer but we can draw an anology to the Dotcom bubble of the 2000.

Irrational exuberance was the reason behind the dotcom bubble. Anything related to internet sold like cupcakes.

On November 9, 2000, Pets.com, a much-hyped company that had backing from Amazon.com, went out of business only nine months after completing its IPO. By that time, most Internet stocks had declined in value by 75% from their highs, wiping out $1.755 trillion in value.

It doesnt mean all companies were bad.Amazon was also born in that era. Same is true with cryptocurrencies. Most of the crypto will fail but a few will eventually be there 10 years down the line.It’s about separating grains from the chaff.

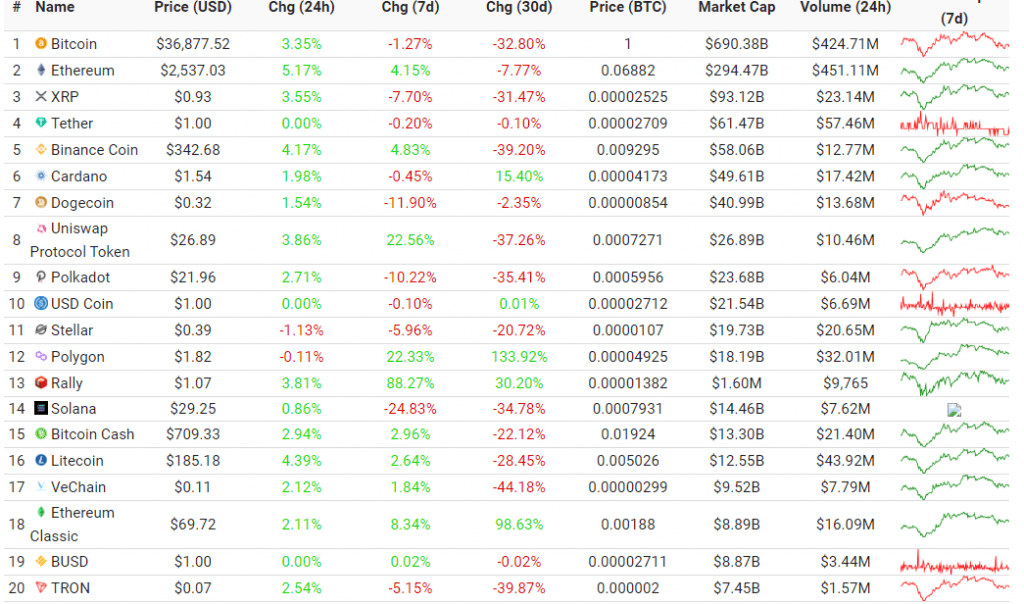

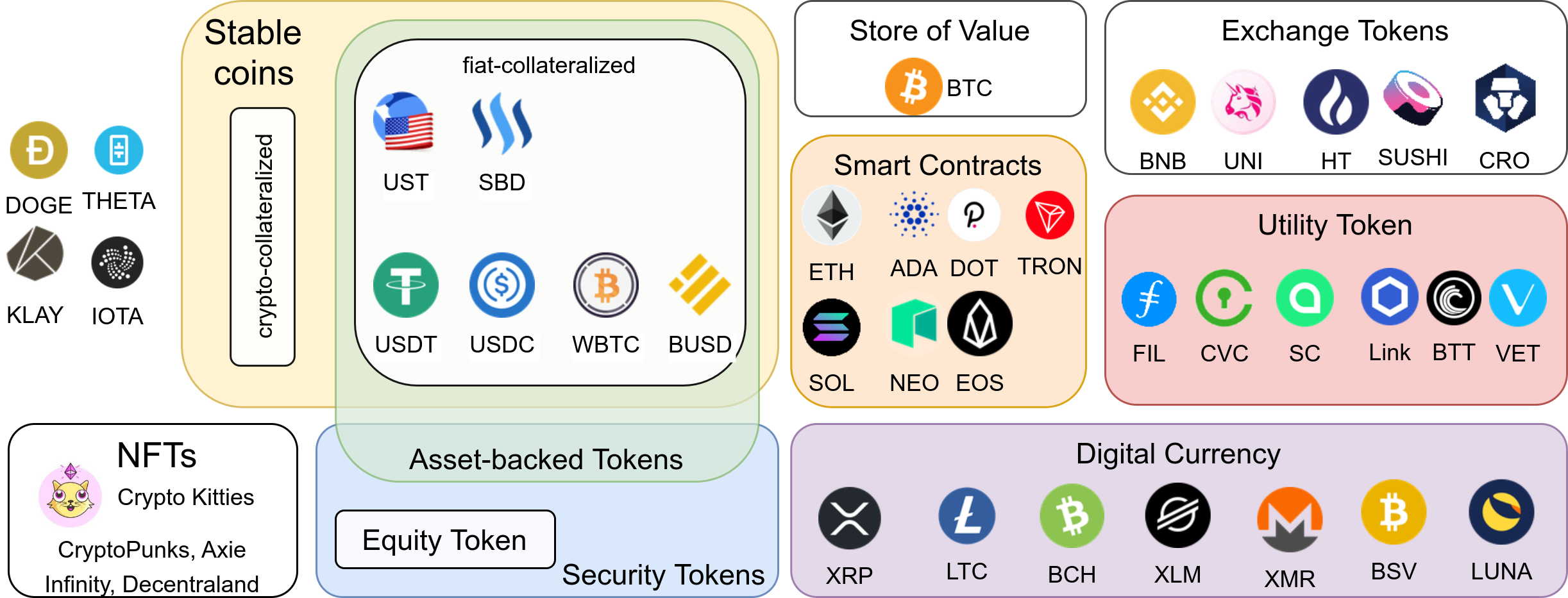

Introduction to top 20 Crypto currencies

I had covered a brief introduction to Crypto earlier.

Bitcoin

Needs no Introduction .King of Crypto .Bitcoin is a decentralized digital currency, without a central bank or single administrator. It’s USP is that its a limited resource. Lot of people are claiming it can usurp gold as an inflation hedge.

Ethereum

Ether is the cryptocurrency built on top of the open source Ethereum blockchain. It acts as an infrastructure for most decentralized applications. Introduces smart contracts, which are like programs with specific procedures that, once deployed, no one can change.

Ripple

Ripple is the name of the company and network behind the XRP cryptocurrency.XRP is the native cryptocurrency for products developed by Ripple Labs. Its products are used for payment settlement, asset exchange, and remittance systems that work more like SWIFT . XRP is pre-mined and uses a less complicated method of mining as compared to Bitcoin

Tether (USDT)

A centralized stablecoin tied to the dollar

Binance Coin

It is a native coin of the Binance cryptocurrency exchange . It has been built on the Ethereum blockchain using the ERC20 token standard. The BNB coin can be used for paying the listing fee, exchange fee, trading fee, or any other charges that a user may incur on the exchange.

Cardano

Similar to Ethereum, Cardano is a smart contract platform however, Cardano offers scalability and security through layered architecture. Cardano’s approach is unique in the space itself since it is built on scientific philosophy and peer-reviewed academic research. Those who hold the cryptocurrency ADA have the right to vote on any proposed changes in the software.

Dogecoin

Well it started as a joke and Elon made it a joke on us with his tweeting power.

Uniswap

It is a decentralized exchange protocol built on Ethereum. To be more precise, it is an automated liquidity protocol. There is no order book or any centralized party required to make trades. Uniswap allows users to trade without intermediaries, with a high degree of decentralization and censorship-resistance.

Polkadot

Polkadot describes itself as a next-gen blockchain protocol that connects several specialized blockchains into one unified system/network. Their main aim is to return control to the people, as opposed to giant conglomerates.Promotes interoperability. By connecting all these different blockchains, Polkadot promotes unprecedented interoperability between these diverse ecosystems.

Stellar

Stellar is a decentralized protocol on open-source code to transfer digital currency to fiat money domestically and across borders. The Stellar blockchain’s cryptocurrency is called the lumen, a token that trades under the symbol XLM.

Polygon

Formerly known as Matic Network, Polygon is an interoperability and scaling framework for building Ethereum-compatible blockchains.It seeks to address some of Ethereum’s major limitations—including its throughput, poor user experience (high speed and delayed transactions), and lack of community governance—using a novel sidechain solution.

Rally

Rally is an open network that enables creators to launch vibrant and independent economies with their communities powered by the ethereum blockchain.It offers anyone with an online community the ability to launch their own coin without the complexity of coding on the ethereum blockchain

Solana

Another blockchain aimed at providing super-high-speed transactions. It claims to process 50k transactions per second and be perfect for deploying scalable crypto applications.

Bitcoin cash

It is Fork of Bitcoin (so a copy with some differences). It tries to lower transaction fees and increase scalability but has been surpassed technology-wise by many other coins aiming to do just the same.

Litecoin

Bitcoin’s cousin, with faster transactions and lower fees

Vechain

VeChain is a blockchain platform designed to enhance supply chain management and business processes. Its goal is to streamline these processes and information flow for complex supply chains through the use of distributed ledger technology (DLT).

Ethereum classic

In terms of basic functionalities, ETC and ETH are the same.Ethereum Classic’s primary differentiating factor is its incompatibility with updates on the ETH blockchain. In this sense, ETC serves as an unaltered historical record of the Ethereum network.

Tron

Tron is a blockchain-based decentralized platform that aims to build a free, global digital content entertainment system . It works with distributed storage technology, and allows easy and cost-effective sharing of digital content

Investing in Cryptocurrencies

As it is evident most of the blockchain products are still evolving and it will take years before they can replace existing system if at all. Most projects will fail. Then why should someone invest in Crypto

Why to Invest in Cryptocurrencies?

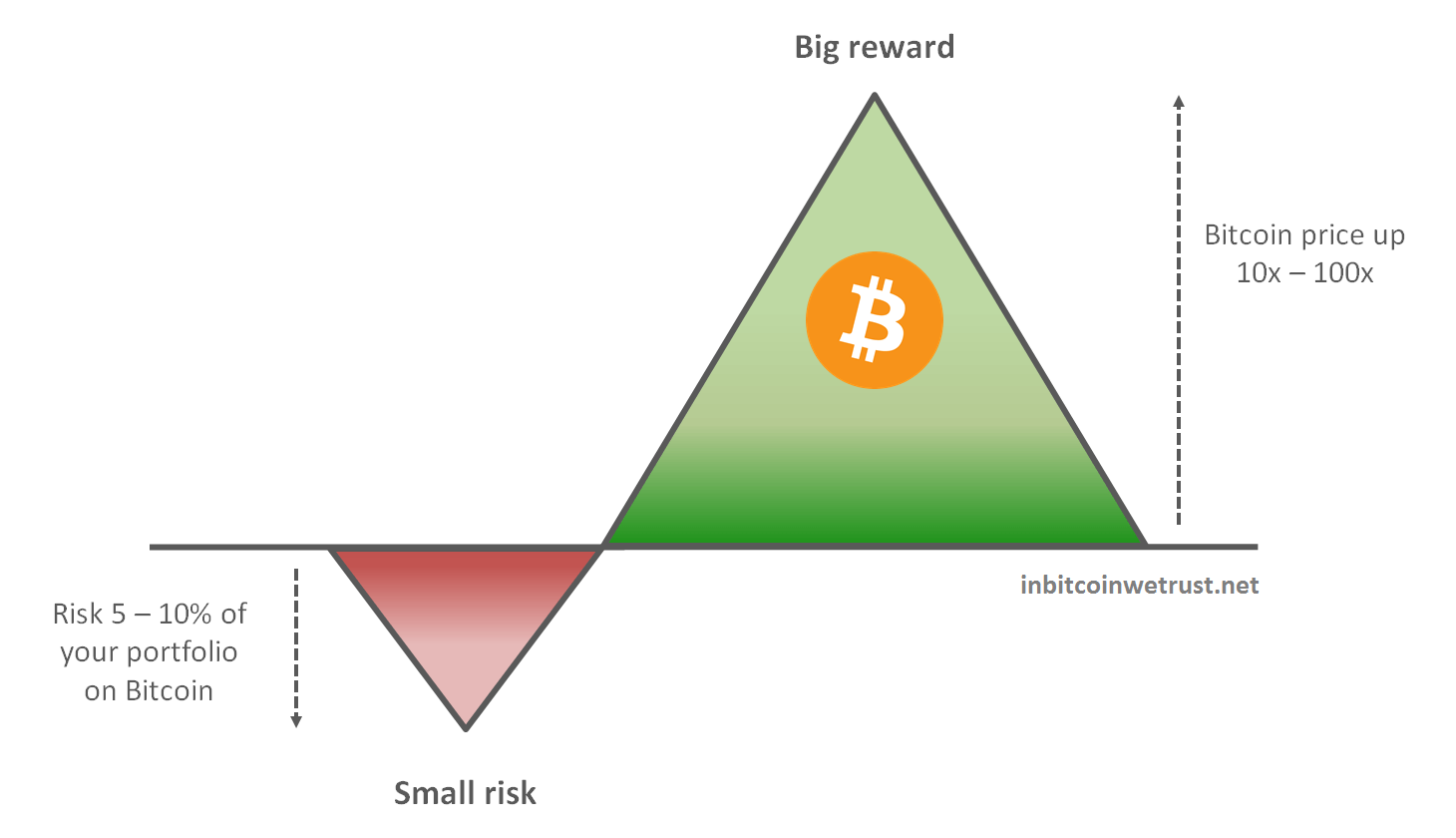

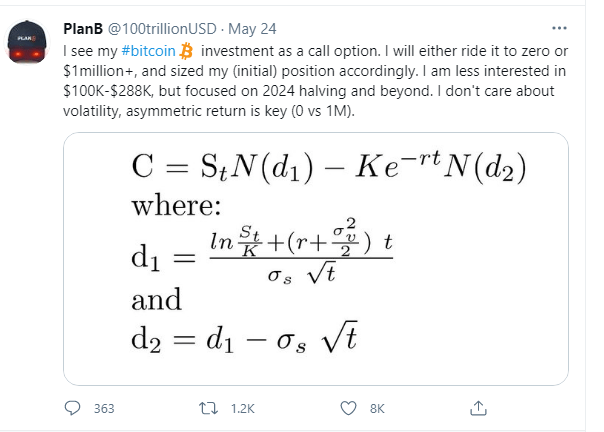

One of the fundamental reason to invest it to understand that underlying techonology can be disruptive like internet and It would not be very smart to completely distance yourself from it. Another reason to Invest is to realize crypto is an assymetric bet

You can lose only 100% of Investment but make 1000% return on the upside.

How much to Invest in Cryptocurrencies?

This is a tricky question as it depends on risk appetite of investor but I suggest to not put more than you can lose.

Also adjust your exposure periodically.

Eg : Initial Exposure to crypto is 2%. It gives 5X return.Now your allocation is 10%. So you need to cut down allocation to make it in line with your risk appetite. 2 benefits of this

- You have already recovered more than you invested.

- You are less susceptible to volatility

How to Invest?

You can buy Crypto using INR on

Buy Tether and transfer to Binance to buy smaller coins if you want.

To generate yield on your crypto use

- Celsius Network -12% Return (get 40 dollar bonus) (Download on mobile) Alternatively you can use the code 133908fe3e

- BlockFi– 8.6% Return(get 20 dollar bonus)

- Vauld -12.8% Return(get 10 dollar bonus)

- Youhodler –12.7%

- KuCoin – 10-60% Yield

Iconomi Platform provides opportunity to have a managed crypto fund of altcoins. You do not have to research all the coins on your own.

Add hedges when market is overheated using Deribit

Conculsion

Cryptocurrencies are still in nascent stages with lot of uncertainty such as technology scaling, Government bans etc but nevertheless it worth trying albeit with a responsible amount . You should invest the amount which does make you lose your sleep over daily prices fluctuation.