Ironically while the covid period was one of the most testing time for majority of people as they lost wages and jobs some people made lot of profit in these times

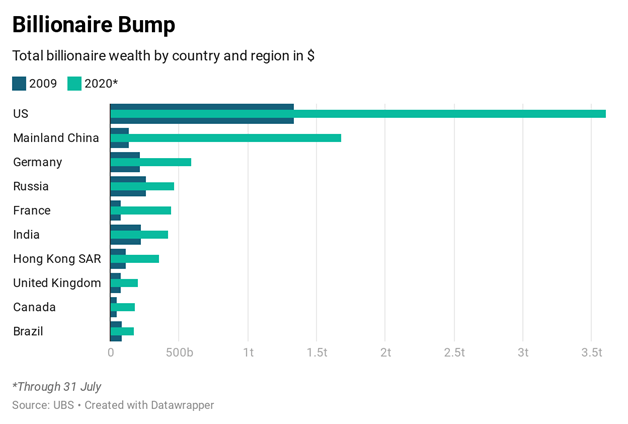

More than 16 million cases of COVID-19 were confirmed between April and July of this year, there were nearly 630,000 related deaths, and the world’s richest people got about $2 trillion richer.

Global billionaires managed to increase their collective wealth by 27.5% during the four-month period, to $10.2 trillion, according to a recent recent

News of the windfall for this elite club of roughly 2,000 members comes alongside indications of trillions of dollars in lost wages, and warnings that hundreds of millions of people will be pushed into extreme poverty this year as a result of the pandemic.

That dissonance has raised concerns about so much money finding its way into the portfolios of the already wealthy rather than funding services that could help the vulnerable during a crisis. It also points to broader potential implications for our ability to reset the global economy in a more just and sustainable way

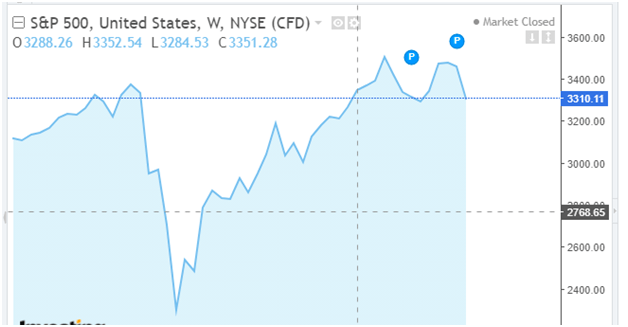

Much of the financial gain for billionaires resulted from approaching the initial impact of the pandemic on asset prices – including sharp stock market decline – as an investment opportunity . As assets like stocks suddenly got much cheaper, the wealthy were able to accumulate significantly more of them before they regained value.

Most people do not have the same type of access to equity markets as the wealthy, who employ bankers and advisers to manage their money – if they have any access at all. In the US, for example, while the wealthiest 1% of the population owned $14 trillion in stocks as of the second quarter of this year, the bottom 50% owned just $160 billion in stocks.

This highlights the fact how important it is to know ways to invest when assets are cheap. Many times when asset crashes it happens along with loss in income etc. People who are able to manage this complex problem get access to once in a lifetime opportunity to invest .

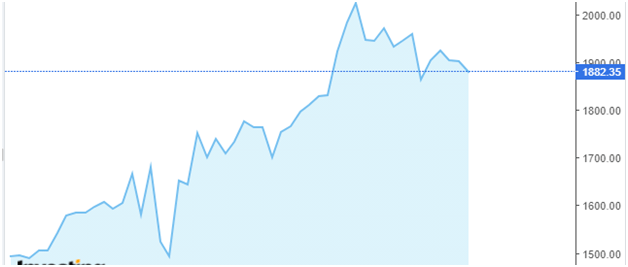

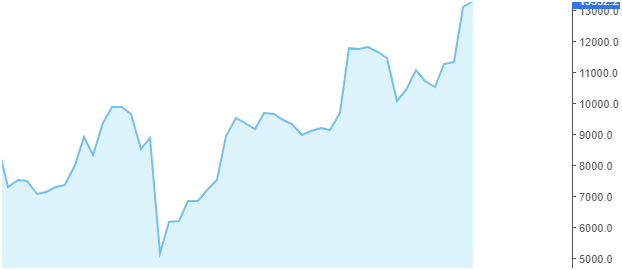

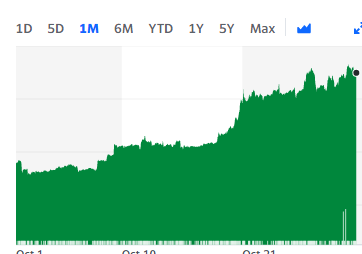

Look at the recovery from crash to current date the performance of various assets.

Global Stocks- 50% Return from Crash

Gold -35% from crash level

Bitcoin :180% Return from crash

The crux of the matter is that there are no bad assets but just bad timing. Lot of people say market timing is useless but if we take a step back and see from April 1- July 30 Market gave 50% while from 2012 -2016 it took 4 years to get the same returns!

Tactical allocation is as much important as strategic allocation!

My Portfolio Performance

Bitcoin continued to lead crypto asset price movements over the past month, reaching over $14,000 , a level not seen since June 2019

Despite Bitcoin’s strength, traditional assets suffered under the weight of the pandemic’s record numbers and uncertainty surrounding both the election and Brexit negotiations. The risk-off mood benefitted the dollar and weighed on gold. The euro also felt itself under added pressure from a commitment from the ECB to implement additional monetary stimulus at their next meeting – this helped stem the tide for lockdown-hit European stocks, but the same couldn’t be said for many other markets. This despite estimate-beating US tech earnings and record-breaking US GDP readings (but with economic activity still depressed relative to pre-pandemic levels).

With few viable hedges available for a play on a Democratic clean sweep, and most prediction markets suggesting that is the likely result, expect wild volatility next week as results roll in from across the US – even if the results aren’t unexpected.

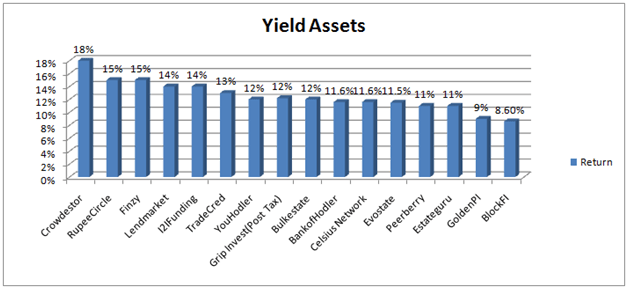

Yield Generation Platform Performance (Annualized)

My performance across all yield generation assets have now stabilized in the range of 8.5%-15%. Among all the assets Celsius Network in stable liquid account , Crowdestor in International Investment and Rupee Circle (referral code PIND145 ) in P2P have performed the best

My crypto portfolio performance has been less stellar this quarter except bitcoin!

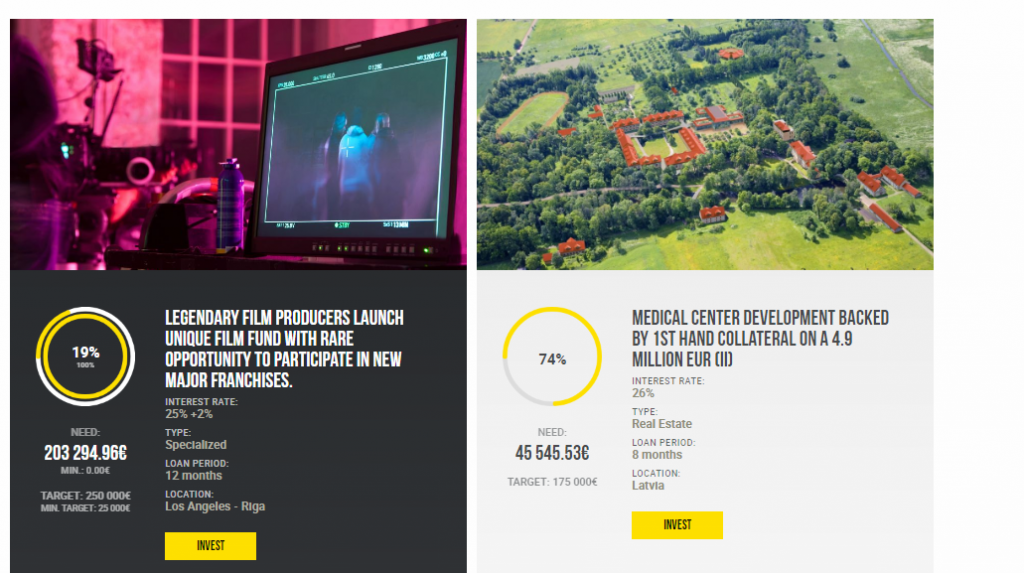

International Investment Porfolio

My International investment portfolio has continued to give stable return with Zero NPA as yet.RealT has been a new addition to cover USA rental properties

| Platform | Return | Current NPA |

| Crowdestor | 18% | – |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate | 11% | – |

| Bulkestate | 12% | – |

| Lendermarket | 13% | |

| RealT US High Yield Property | 11% | Rental yield |

Crowdestor has been the best in terms of yield and most interesting deals (equity in movie etc)while EstateGuru has the safest business model for this month too.

Equity/REIT Portfolio

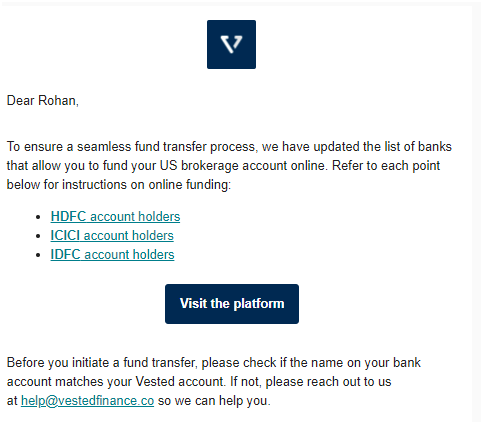

Good news for international stock investors. Now you can transfer online money to your Stockal and vested account!

This means whenever the rupee strengthens or when global market crashes you can capitalize on the opportunity and quickly buy ETF and Stocks!

Crypto Interest Account

Celsius Network and Youholder are the top performer with yield close to 12%.More details in the below post.Now Youhodler also provides 12% interest on Eurobased Stable coin

| Platform | Return |

| Celsius Network | 11.55% |

| BlockFi | 8.6% |

| Youholder | 12.00% |

| BankofHodler(now vauld) | 11.6% |

*for new users who want to buy crypto and transfer to other platforms I recommend using DCX discount link( as Wazirx has increased the withdrawal fees.

*Existing users who have binance linked to Wazirx Can transfer to binance for withdrawal at nominal fees

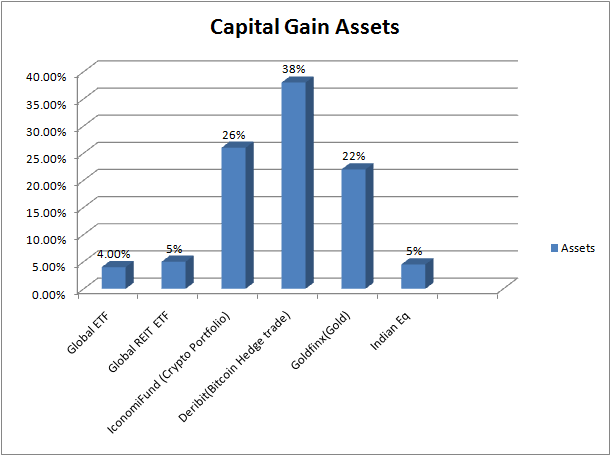

Crypto Investment Platform

My portfolio in Iconomi has underperformed my bitcoin portfolio as bitcoin has been on fire. The reason for bitcoin outperformance is

- Lot of new institutional Investors(Square,Paypal etc)

- Bitcoin being considered a new safe haven like gold

I wont be surprised if bitcoin becomes 3x in next 3-4 years!

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 26% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 38.00% |

In my Crypto hedge I made money in the underlying while had some MTM losses in my call option ,overall the profit were reduced by a few percentage

GoldFinX

On October 22nd, GIX was listed on 3rd exchange of this year. This time it was the highly-rated Bitmart.

There are two trading pairs:

- GiX/USDT https://www.bitmart.com/trade/en?symbol=GIX_USDT

- GiX/BTC https://www.bitmart.com/trade/en?symbol=GIX_BTC

Two Factors aregoing to propel the next rally in Goldfinx:

- Phase 2 of gold run when inflation start going out of control

- More and more adaptation of blockchain in near future

If gold goes up 30% from current level in next 3 years we can expect the goldfinx coin to double in value!

People who have made good returns this month in Bitcoin can use it to buy GIX

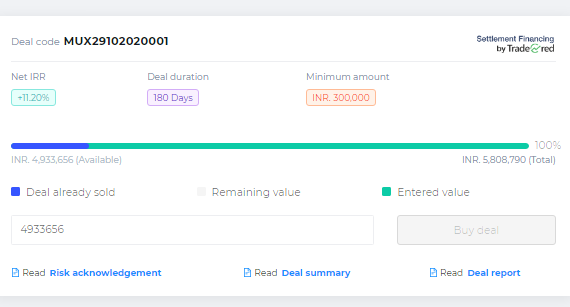

TradeCred

I have now completed more than 2 years on TradeCred and I have been very pleased with performance. My net yield is close to 13% with zero delinquency

Some Interesting Invoices this month: Settlement Finace deal at 11.2% for 180 days .Settlement finance has much lower risk as these are daily invoices of creditcard/POS ATM to be paid by banks

The best way is to invest in companies for which you can find out information online. Invest in vendor which are not new on the platform.

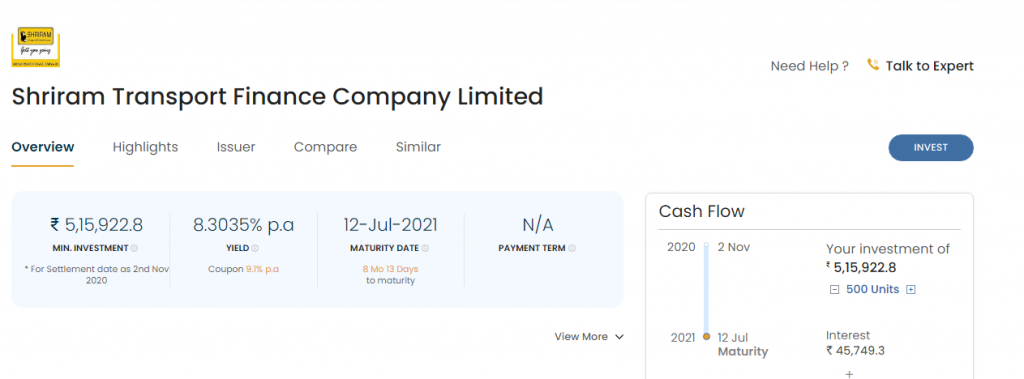

Corporate Bonds–Golden PI

Short Term bonds make more sense now as we are already at very low interest rate enviroment and people can wait few months to lock in long dated yields unless very attractive bond .Shri Ram Transport Bond for 8 months is a good option with yield over 8.3%

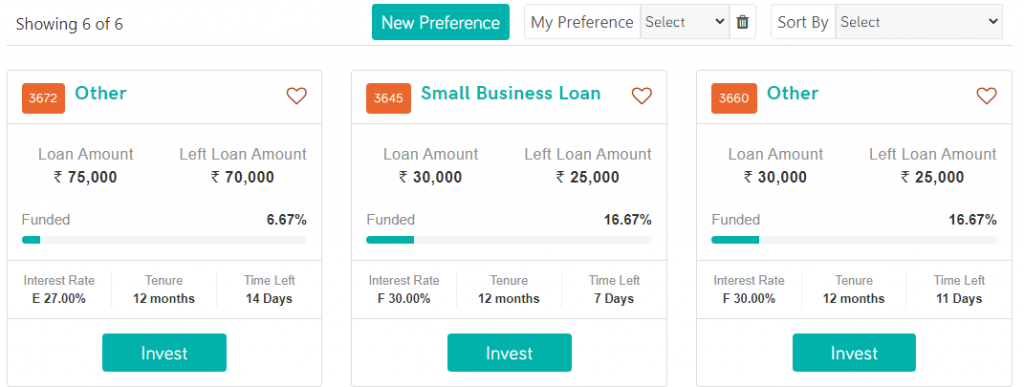

P2P Lending India

The repayment has started trickling in for most of my P2P platform. I expect things to improve further in the next couple of months. For the time being I am redeploying money in the following category:

| Platform | Loans Selected | Expected Yield | NPA Expected |

| I2IFunding | E-Rickshaw backed loans,educationloan,NBFC backed loans etc’,group loans | 20% | 3% |

| Rupee Circle | Small business/salariedloans to people with own house and low EMI to Earning Ration | 25-30% | 5% |

| FINZY | Prime Borrowers,High Salary ,A category | 12% | 1% |

| Faircent(Onlypool Loans/Education loans) | credit pool loan | 12% | 1% |

| Platform | Return | NPA |

| I2IFunding | 14% | 5% |

| Rupee Circle | 16% | 4.80% |

| FINZY | 14.00% | 3% |

| Faircent(Onlypool Loans/Education Credit Pool loans) | 12% | 1% |

| FinancePeer | 13% | 5% |

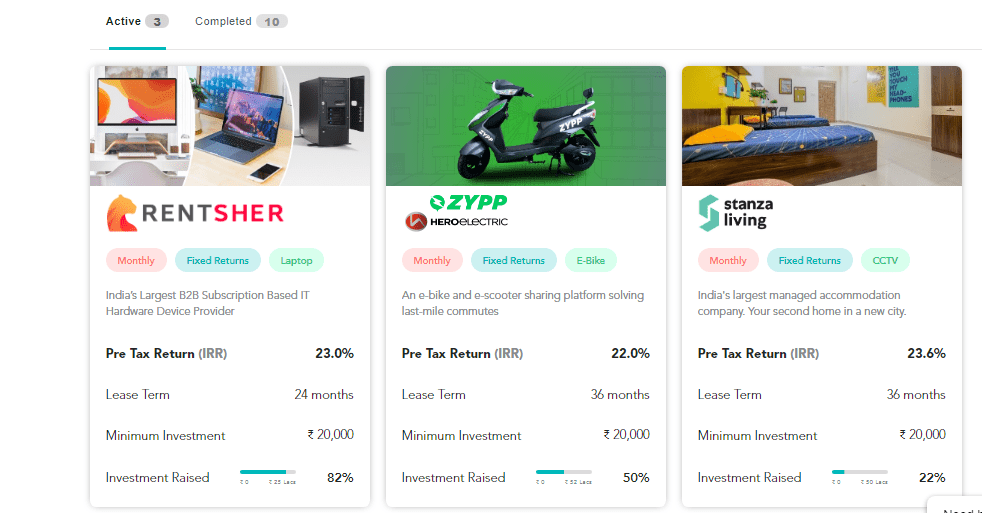

Equipment Lease Investing:GripInvest

My first investment on GripInvest has been performing good with no delay in cashflow till date(4 months). If the performance stays consistent I will be adding more assets to my portfolio

| Platform | Return |

| GRIP Invest | 12%(Tax Free) |

Grip Invest has now multiple assets to choose from

- laptops

- Bikes

- Furniture etc

Other Investment: Long Term

legal finance deal on AxiaFunder:20%+ Expected

Venture Capital on Seedrs. 20% Expected

Indian Fractional Real Estate(exploring)

I tried 3 P2P i.e. cashkumar, financepeer & Rupeecircle. Out of 3 only rupeecircle is performing well. On other tow platforms, I have lost money. It seems these platforms doesn’t carry out thorough check especially financepeer. Cashkumar response is very poor. They don’t update regularly once the loan turns NPA.

True ! initially 48% ROI on cashkumar seemed too good. but the NPA started piling up 4-5 months after using the platform. Same goes true for Lenden. I suggest Finzy for low risk and medium returns!

I tried 3 P2P i.e. cashkumar, financepeer & Rupeecircle. Out of 3 only rupeecircle is performing well. On other two platforms, I have lost money. It seems these platforms doesn’t carry out thorough check especially financepeer. Cashkumar response is very poor. They don’t update regularly once the loan turns NPA.

True! Initially 48% ROI seemed very attractive but NPA soon piled up. Finzy is another option in low risk and medium returns!

Hi

Nice article on many topics

Hi Rohan, Thanks again for sharing monthly analysis. Just curious that on tradecred I see 11.00% IRR for same deal code. Would you know about it.

The IRR vary depending on the tenor as well as credit worthiness of the company as well as how urgently the vendor requires the money.

DCX referred above also gives option to lend crypto.. Is it good option to use DCX for lending?

It is but i am wary of keeping lot of money on exchange for long term. For short term it’s good!