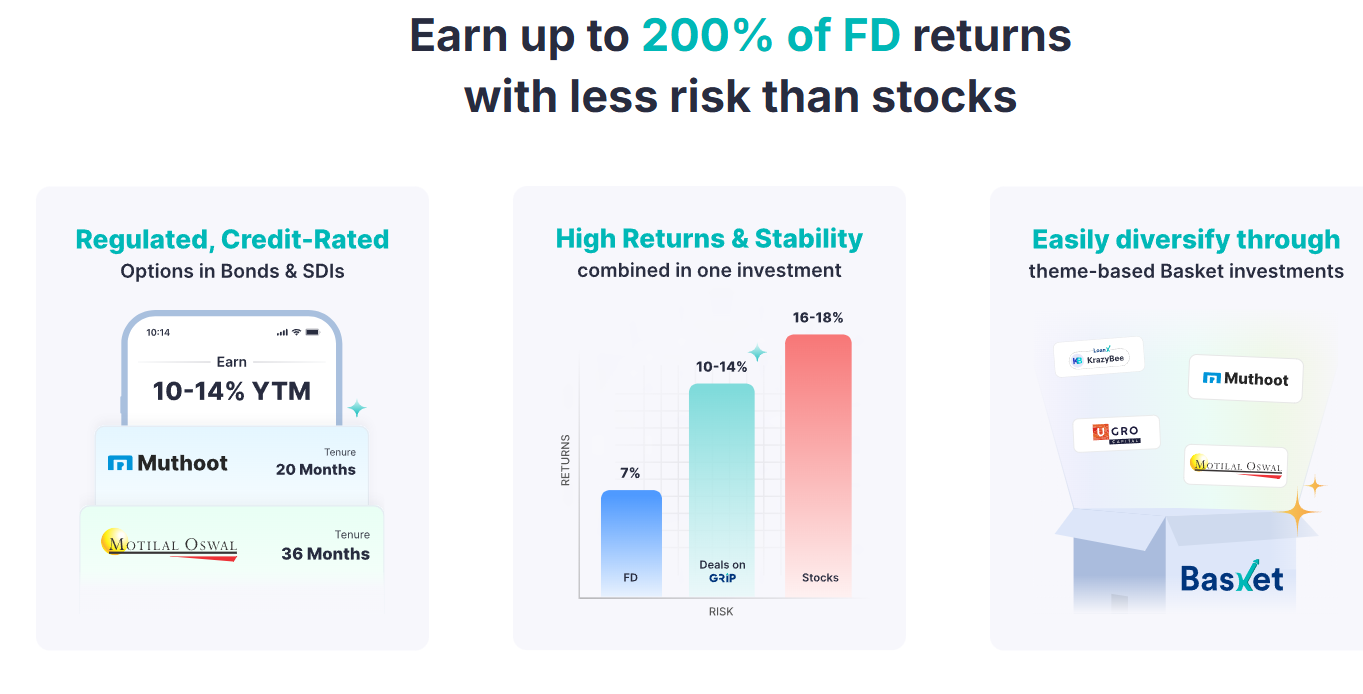

Over the last five years, Grip Invest has become one of the most talked-about platforms in India’s alternative fixed-income investing space. From fractional leasing and securitized debt instruments (SDIs) to corporate bonds and now the new Infinite feature, Grip has continuously introduced innovative products that go beyond traditional FDs and mutual funds.

But with higher yields come higher risks. And while marketing headlines talk about “democratizing debt investing,” it’s crucial to understand how Grip works, where it fits in your portfolio, and whether it really delivers the promised returns.

In this comprehensive 2025 Grip Invest review, I’ll cover:

-

What Grip Invest is and the products it offers.

-

How Infinite, their latest innovation, works (and whether it’s worth using).

-

My experience using Grip for over 5 years.

-

Independent feedback from other investors.

-

A performance, risk, and tax analysis.

-

A comparison of Grip vs FDs, REITs, P2P lending, and AIFs.

-

FAQs that most new investors ask.

By the end, you’ll have a clear idea of whether Grip deserves a spot in your fixed-income portfolio.

What is Grip Invest?

Grip Invest is a SEBI-registered fixed income investment platform launched in 2020. It allows retail investors to access products that were earlier limited to institutions and HNIs. The idea is simple: instead of only investing in FDs or debt mutual funds, retail investors can now participate in high-yield, asset-backed opportunities curated by Grip.

Core Product Categories

-

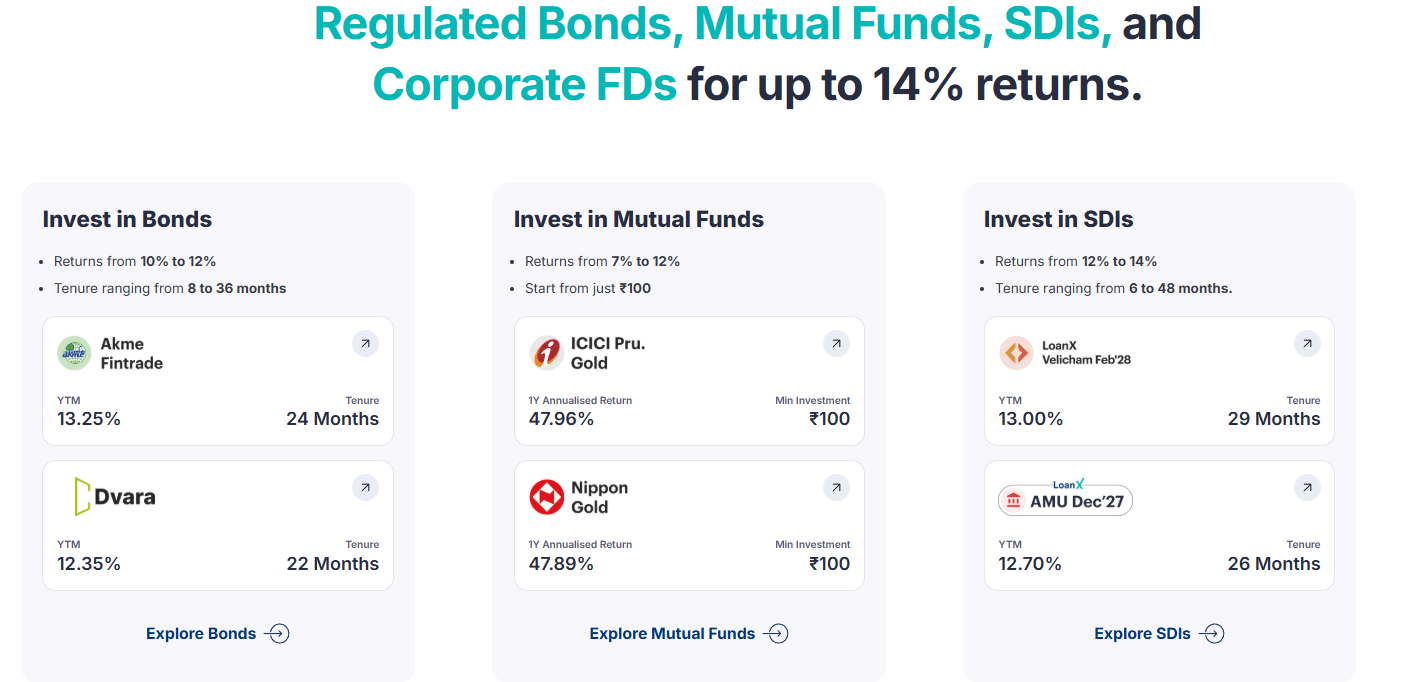

Corporate Bonds: Debt issued by companies, offering fixed coupons.

-

Securitized Debt Instruments (SDIs): Pools of receivables (like loans or leases) structured into securities.

-

LeaseX / Fractional Asset Leasing: Investors buy assets (EVs, equipment, logistics assets) leased to companies for fixed rentals.

-

Infinite: Their new reinvestment tool that automatically channels monthly payouts from Bonds/SDIs into debt mutual funds.

Minimum Investment

Most deals start at ₹10,000, much lower than traditional private debt or AIFs (₹1 crore). This accessibility is Grip’s biggest USP.

Grip’s Products Explained

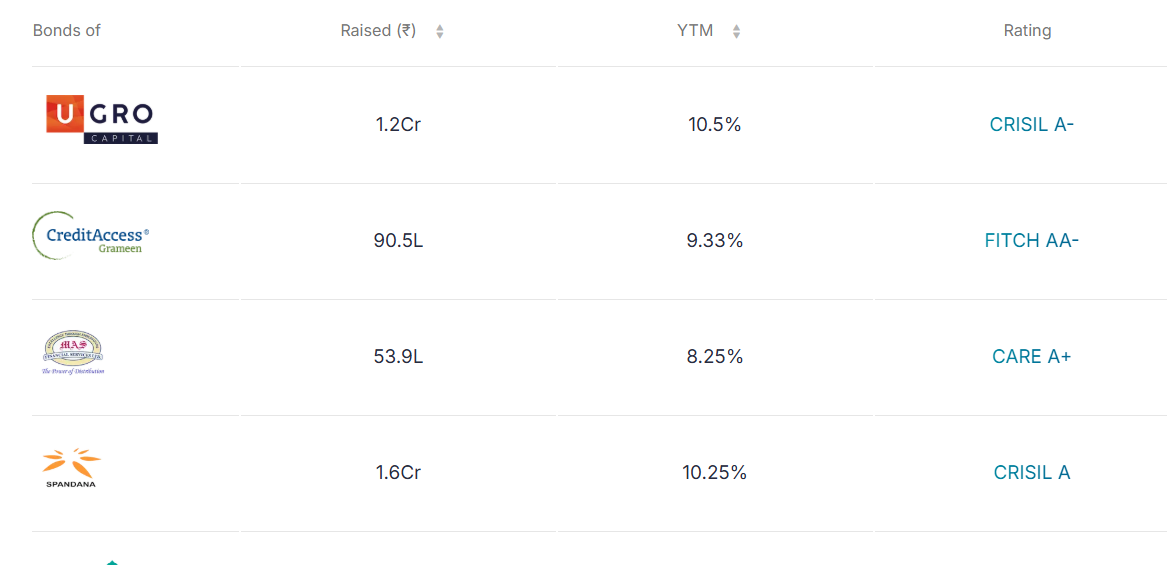

a) Corporate Bonds

-

Fixed coupon returns (7–12% typical).

-

Tradable on exchanges (but liquidity varies).

-

Risks: credit downgrade, default.

-

Best for investors who want relatively familiar debt instruments.

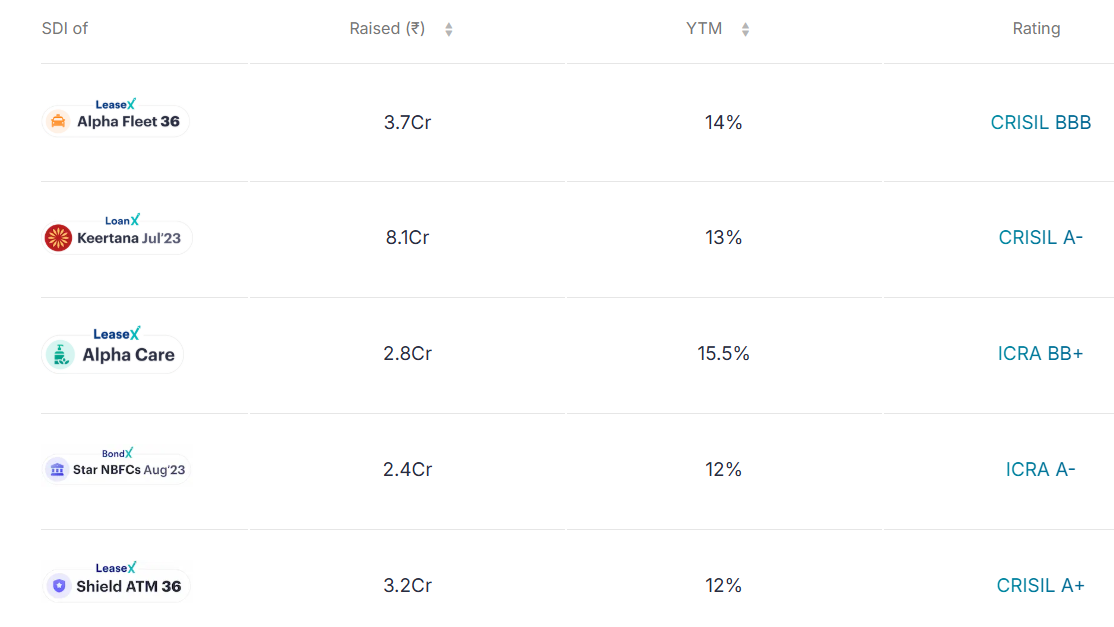

b) Securitized Debt Instruments (SDIs)

-

Pools of loans or receivables packaged into securities.

-

Yields are higher (8–14%).

-

Payouts are usually monthly, but prepayments can occur.

-

Risks: borrower defaults, pool quality, and illiquidity.

-

Requires trust in Grip’s due diligence.

c) LeaseX / Fractional Leasing

-

You invest in tangible assets (EV fleets, medical equipment, logistics assets) leased to companies.

-

Monthly rental income yields 10–12%+.

-

Risks: lessee defaults, repossession delays, sector concentration.

d) Infinite (New in 2025)

-

Automates reinvestment of monthly payouts into a chosen debt mutual fund SIP.

-

Claims to boost effective returns by ~30% vs leaving payouts idle.

-

We’ll deep dive into Infinite separately below.

Grip Invest: Founders & Leadership Team

Understanding the people behind a platform is just as important as analyzing its products. Grip Invest has a strong founder-led leadership team with a blend of finance, operations, and fintech expertise.

-

Nikhil Aggarwal (Founder & Group CEO) – The primary face of Grip, Nikhil has driven the platform since its launch in 2020 with the vision of democratizing access to alternative yield products for Indian retail investors.

-

Vivek Gulati (Co-founder & COO) – Vivek oversees operations and platform scaling. His background in finance and operations has helped Grip build processes around deal sourcing and investor servicing.

-

Aashish Jindal (Co-founder) – Focuses on growth and partnerships, helping expand Grip’s product suite from leasing into SDIs, corporate bonds, and Infinite.

-

Vaibhav Laddha (CEO, Investment Platform) – Elevated in 2024 to lead Grip Invest’s core platform operations, ensuring institutional rigor and product expansion while Nikhil focuses on group strategy.

Evolution of the Team & Platform

-

2020–2021: Launch with fractional leasing deals, small ticket sizes.

-

2022–2023: Expansion into SDIs, corporate bonds, and partnerships with NBFCs.

-

2024: Introduction of secondary marketplace and broader investor base.

-

2025: Launch of Infinite, strengthening Grip’s positioning as a full-stack alternative fixed-income platform.

This blend of founder vision + professional leadership has enabled Grip to scale rapidly while continuously innovating. But, as with any startup, investor trust depends on how effectively the team manages credit risks and delivers transparency during challenging market cycles.

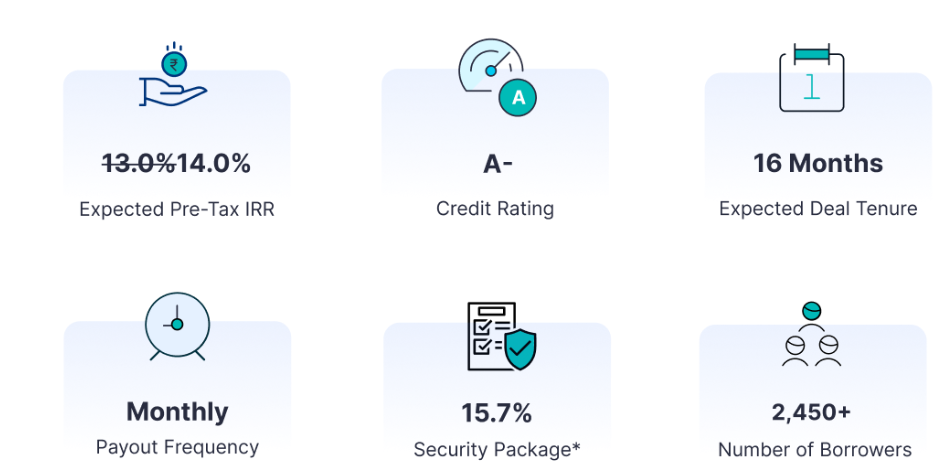

Deep Dive: Grip Infinite

Infinite is marketed as an “auto-compounding tool” for Bond/SDI payouts.

How It Works

-

You invest in an eligible Bond/SDI.

-

Monthly coupon payments are redirected to a chosen debt MF SIP.

-

The SIP adjusts for variations in coupon/prepayments.

-

When the Bond/SDI matures, the SIP stops automatically.

Example

-

Without Infinite: ₹88,500 in an SDI → ₹94,500 after 1 year (11.6% YTM).

-

With Infinite (assuming 9% MF return): ~₹98,500 (12% return).

Pros

-

Convenience: no manual reinvestment.

-

Compounding effect.

-

Flexibility: can stop or exit MF anytime.

-

Adjusts for payout fluctuations automatically.

Cons

-

Not all deals are eligible.

-

Uses regular plans of debt MFs (higher expense ratio vs direct).

-

Debt MF returns are not guaranteed; they could underperform.

-

For small tickets, coupon < ₹100, forcing manual top-ups.

-

Taxation complexity (interest + MF gains).

Infinite is useful for larger investments where compounding adds up. For smaller deals, the benefit may be marginal.

Grip Marketplace: What It Is & How It Works

What is Grip Marketplace?

Grip Marketplace is the platform’s secondary trading venue where existing investors can buy or sell their Grip-issued bonds, SDIs, or lease assets before maturity. It aims to provide some liquidity to what are otherwise relatively illiquid investments.

How It Works

-

Once a bond/SDI is listed on the marketplace, any investor on Grip can place buy or sell orders at prevailing yields or prices.

-

Grip acts as the facilitator, matching buyers and sellers.

-

Sellers may have to accept discounts (i.e., yield premium) depending on market rates, credit spreads, or time remaining to maturity.

-

Buyers will pay a premium if the deal is favorable (lower yield or stronger credit).

-

Orders are typically for whole units (not fractional trades).

-

Marketplace availability depends on whether the issuer/asset allows secondary trade under the terms.

Pros & Cons of the Marketplace

| Pros | Cons / Cautions |

|---|---|

| Offers exit options before maturity | Low volume/liquidity; may take time to find a matching order |

| Enables price discovery for Grip assets | Sellers may get less than expected due to yield repricing |

| Helps reduce lock-in risk | Buyers assume whatever credit/duration risk remains |

In practice, many investors may find the marketplace useful in limited cases (urgent need to exit, favorable pricing). It’s not a guaranteed exit, but a strategic tool.

Is Grip Invest regulated?

Yes, the products on Grip Invest are regulated

- Corporate Bonds & SDIs are regulated under SEBI and issued via SEBI-registered debenture trustees and arrangers.

- LeaseX / Leasing deals are structured through SEBI-registered debenture trustees who manage investor rights.

- Infinite (Debt MF SIPs) is routed into SEBI-regulated mutual funds.

-

Compliance Checks:

-

Each deal has a trustee, escrow account, and legal contracts to safeguard investor funds.

-

KYC is mandatory under SEBI and RBI guidelines.

-

Grip itself is a platform (tech + distribution) and not a regulator-licensed NBFC. But the products you invest in are issued through SEBI-compliant structures, and money flow is handled via trustees/escrows.

Risks with Grip Invest

While Grip markets itself as safe, there are real risks:

-

Credit Risk – Bonds/SDIs depend on issuers/borrowers paying on time.

-

Liquidity Risk – Unlike FDs or listed bonds, early exit is tough.

-

Platform Risk – Grip is still a startup; investors rely on its vetting.

-

Tax Risk – Post-tax returns may shrink significantly.

-

Market Risk in Infinite – Debt mutual funds are not risk-free.

Grip vs Alternatives: Comparison

| Product | Yield (2025) | Risk | Liquidity | Min Ticket | Who It Suits |

|---|---|---|---|---|---|

| Grip Bonds / SDIs | 8–14% | Medium-High | Low | ₹10k | Yield seekers are comfortable with risk |

| Grip Infinite | 9–12% effective | Medium | Moderate | ₹10k | Investors who want automation & compounding |

| LeaseX | 10–12% | Medium | Low | ₹20k+ | Investors who like asset-backed rentals |

| Debt MFs | 5–9% | Medium | High | ₹500 | Core debt allocation |

| FDs | 6–7% | Low | High | ₹1k | Safe, conservative investors |

| REITs | 6–8% | Low-Medium | High | 1 unit | Those wanting listed yield + real estate play |

| P2P Lending | 12–16% | High | Medium | ₹5k | Aggressive alt investors |

| AIF Cat II Debt | 12–14% | Medium | Low | ₹1cr+ | HNIs/UHNIs only |

Taxation of Grip Products

-

Bonds / SDIs / Lease Rentals: Coupon/rental taxed as Income from Other Sources (slab rate).

-

Debt MFs via Infinite:

-

STCG (<3 yrs): slab rate.

-

LTCG (>3 yrs): 20% with indexation.

-

-

No special tax treatment – so effective post-tax IRR is usually 2–3% lower than headline.

Independent Feedback Roundup

-

ALT Investor: Highlights Infinite’s convenience, but downplays risks (subsidiary of Grip).

-

Holistic Investment: Warns about risks, emphasizes due diligence.

-

CrowdSquare: Notes mixed user reviews; transparency but occasional delays.

-

Reddit: Users say real post-tax yields may be just 1–2% above FDs; caution about defaults.

Having read all, I’d say Grip is legit and useful, but only if you size your allocation carefully.

Who Should Use Grip Invest?

Grip is not for everyone. It suits:

-

Investors willing to lock money for 1–3 years.

-

Those seeking yields above FDs but below equity risk.

-

Retail investors are experimenting with alternative assets.

-

HNIs who want diversification into private credit.

It does not suit:

-

Ultra-conservative investors who value liquidity.

-

People are expecting guaranteed FD-like safety.

-

Investors who cannot handle complex taxation.

Is Grip Invest Safe?

My 5 years of experience have been excellent in terms of performance. The IRR has been north of 10% post-tax without any delay. My overall experience can be captured through.

- My Personal Grip Invest 5-year review

- Details of My Grip Invest Portfolio

My Personal Grip Invest 5-year Review

5 Year Review of my Investment on Grip Invest, which I started in 2020 when I was one of the first investors on the platform. Over a period of time, I have invested in multiple deals and also know people who have done the same. The platform has since then done close to INR 2300 Cr of issuance. I have added Grip Invest (get early access benefits using the link ) to my other alternative investment portfolio

I have been happy with the way they have navigated macroeconomic challenges and the risks they managed.

Details of My Grip Invest Portfolio

I invested in the following products on Gripinvest

- Securitized Debt Investment of – Everest fleet, Keertana, Dvara, AGS ATM

- Bonds – Navi, SatinCare, Ugro, Satin

I also invested in early products like leasing to companies such as Bigspoon. Total Investment was more than INR 25 lakhs across 3-4 accounts. Net IRR is 12.7%

Delays -1 ( AGS Transact ATM), which was smoothly handled by Grip Invest

AGS Transact Lease Default (2025 Update)

One of the most high-profile delays on Grip was the ATM leasing deal with AGS Transact Technologies Ltd. While it initially raised investor concerns, Grip managed a favorable resolution compared to typical corporate defaults.

Deal Summary

| Metric | Value |

|---|---|

| Investment Type | ATM Leasing (SDI) |

| Originator | Connect Residuary Pvt Ltd |

| Underlying Asset | 163 ATMs leased to AGS Transact |

| Asset Sale | Sold to a private bank for ₹3.37 Cr + taxes |

| Trustee NOC Issued | 20th June 2025 |

| Current Status | Sale accepted, awaiting payment release from bank |

Investor Recovery Update

| Metric | Value |

|---|---|

| Investment Amount | ₹2,78,401 |

| Lease Rent + Expected Sale Value | ₹2,82,406 |

| % of Investment Amount Repaid | 101.79% |

| % of Total Expected Lease Return | 88.48% |

Notes:

-

Percentages vary slightly by investor ticket size.

-

The remaining ~20 ATMs are still unsold; Grip is exploring additional recoveries.

-

Payment pending the bank’s legal & compliance checks.

Takeaway:

Despite initial worries of default, investors are expected to recover more than principal but less than originally projected returns. Compared to typical corporate leasing defaults, this resolution was relatively swift (within months).

How to Invest in Grip Invest?

To start, add a MaxButton via the Block Settings on the right.

I follow the points below to analyze investment opportunities with Grip Invest

- Google information about the company, like the latest funding, promoters, and growth prospects

- Check the financials to see if it has adequate liquidity, good cash flows, and an uptrend in growth.

- Prefer shorter tenor investment

- If you are investing from an account with a lower tax rate, you can choose to invest INR 2.5 Lakhs and get a pre-tax return directly.

Conclusion

Grip Invest has grown into a credible player in India’s fixed-income space. Products like Bonds, SDIs, and LeaseX add yield opportunities for retail investors, while Infinite is an innovative twist that automates reinvestment. My 5-year experience has been good, with most cash flow on time. Of course, the risk is higher than a bank FD, but considering the return, it is worth putting a small part of your portfolio. You can check out monthly portfolio reviews on randomdimes.com. They have now created SEBI/RBI-regulated products, which adds a lot of comfort in the fact that they have a long-term vision.

But remember: these are not FDs. They carry credit and liquidity risk, and post-tax returns are lower than headline numbers.

My advice?

-

Allocate only 5–10% of your debt portfolio here.

-

Use Infinite if you’re investing larger amounts (to benefit from compounding).

-

Monitor deals carefully and diversify across issuers.

Grip is a good supplementary platform, not a replacement for your core debt allocation.

Frequently Asked Questions FAQ on GRIP

- Who can invest in GripInvest?

Grip provides investment options for individuals who are at least 18 years of age and possess a valid PAN and Aadhaar card. These investment options offer benefits such as a 20%+ IRR, pre-agreed rental income, and ownership of the asset. Before listing investment options, Grip follows strict due diligence and risk mitigation processes. However, investors should be aware that returns are not guaranteed and exercise discretion when investing.

- Can NRI Invest in GRIP?

Yes, NRI can invest in GRIP from the NRO account. While they are able to accept investment amounts from NRO accounts, they are currently unable to receive investments from NRE accounts due to distinct compliance obligations from the RBI. Nonetheless, they plan to extend our services in the future, which would allow them to receive investments from either account.

- What is the minimum amount for investment in Grip?

GRIP allows one to invest from INR 10,000; however, each asset class may have a different minimum requirement, which would be highlighted in asset details

- What is LeaseX on Grip Invest?

LeaseX is an investment opportunity for lease financing that takes the form of a Securitized Debt Instrument (SDI). This fixed-income instrument is designed to be traded and issued in accordance with SEBI regulations. Grip offers lease rentals backed SDIs through LeaseX, which are rated by credit rating agencies and listed on the National Stock Exchange (NSE) in a dematerialized form. Investors receive fixed monthly payouts linked to rental payments made by either a single or a diverse pool of leasing partners. To minimize risk, all cash flows are managed by a SEBI-registered trust that employs an escrow mechanism to protect receivables. Additionally, the rentals are supported by a bank guarantee.

- Is Grip Invest safe?

Grip is SEBI-registered, but the investments themselves carry credit and liquidity risk.

- What is Grip Infinite?

A tool that auto-reinvests monthly payouts into debt MF SIPs for compounding.

- How do SDIs differ from Bonds?

Bonds are direct debt issued by companies; SDIs are pools of receivables.

- How are Grip investments taxed?

Interest/rentals taxed at slab rate; debt MF gains taxed as STCG/LTCG.

I would like to challenge the basic premise of this article as it is misleading investors. Any retunr received (principle + interest) is treated as salary earned by investor (treated as partner in LLP) for pre tax deals. as a result, one will lose principle if you fall in 30% tax bracket. Would like to be challenged but initial understanding basis annual tax document shared by Grip + clarification provided by relationship manager suggest this.

Hi Amit,

I agree the Pre taxation issue I had to face recently. As 90% of my exposure on GRip was post tax it dint bother much.

Now GRIPinvest has changed the structure and made it a listed product rather than LLP.

For pre tax investment I feel Leafround is better as they bifurcate between Principal and Interest and tax is paid only on interest.

https://randomdimes.com/leafround-review-lease-equipments-and-earn-upto-25-irr/

do you still invest with grip? As you mentioned, with the changed structure do you still find the returns favourable?

Hi Gautam,

Yes I do invest on Grip, If you are in 30% tax bracket the new structure has no impact. Post tax returns are higher. Also i like the securitization product as it is embedded diversification !