This month was quite eventful for the global economy keeping all asset classes volatile.UK’s economic decline has spiraled into a currency crisis, threatening to expose the fragility of global efforts to crush inflation. Events like Russia’s default in 1998 and, more recently, Greece’s debt crisis highlights that individual events can trigger wider financial turmoil.

Rates hikes in the US followed by India have also kept the equity market in turmoil. Crypto is still going through a long winter and the price of Bitcoin has been hovering below 20k USD. Interestingly Jamie Dimon CEO of JP Morgan, speaking at a US congressional hearing said “I’m a major sceptic on crypto tokens, which you call currency, like Bitcoin. They are decentralized Ponzi schemes.”

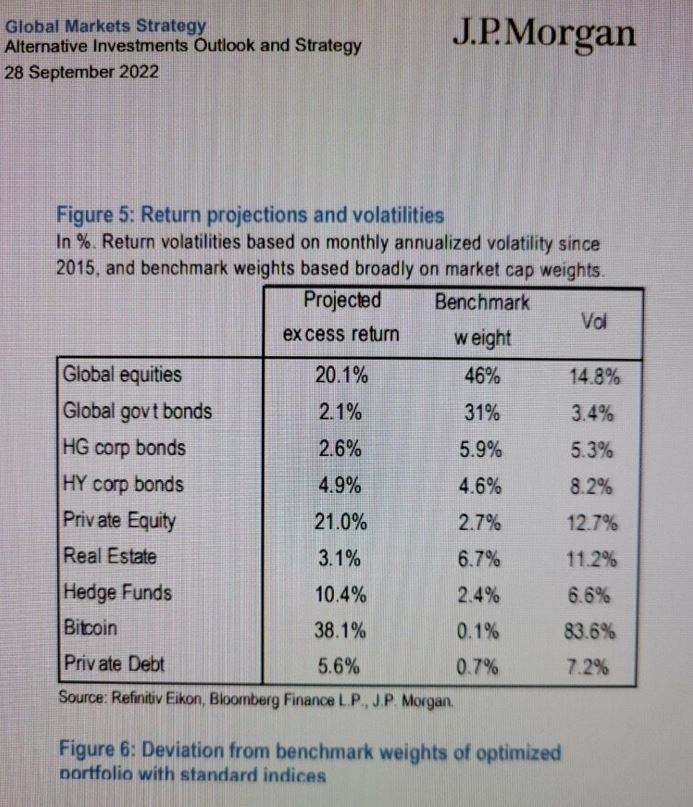

However, in a report published by JP Morgan, Bitcoin has a projected excess return rate of 38.1%, making it the asset with the highest expected excess return on the list.

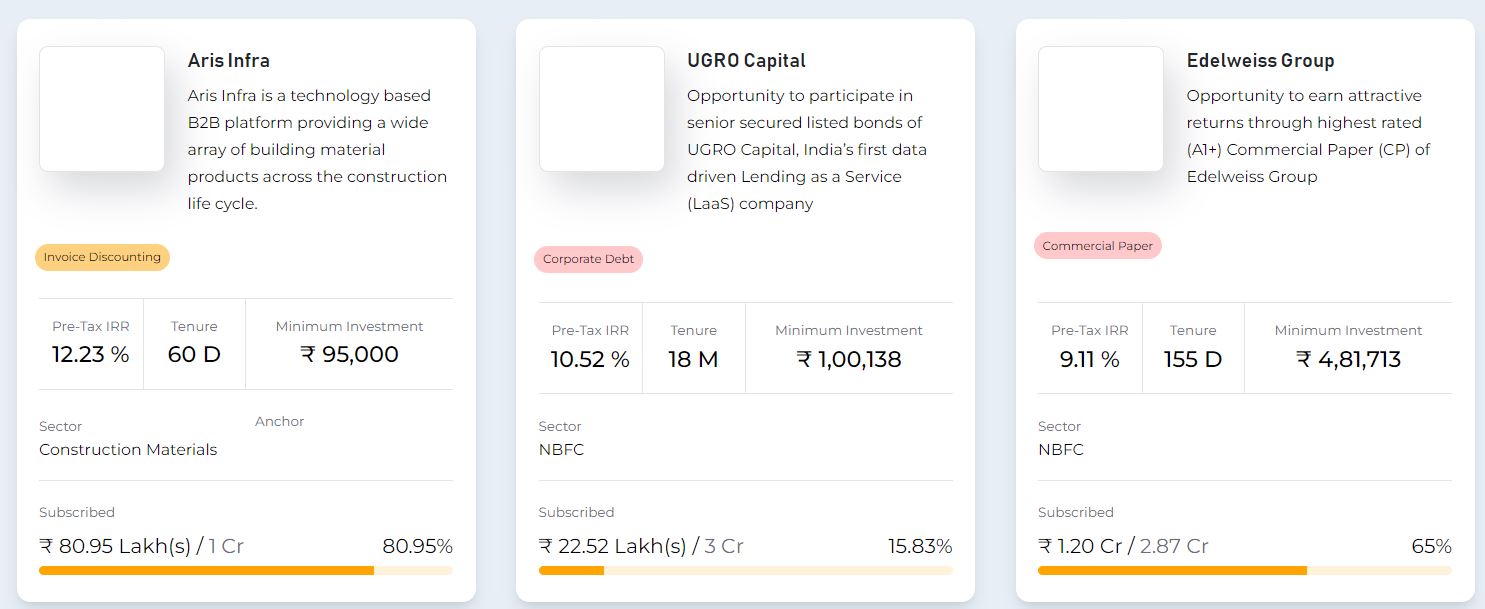

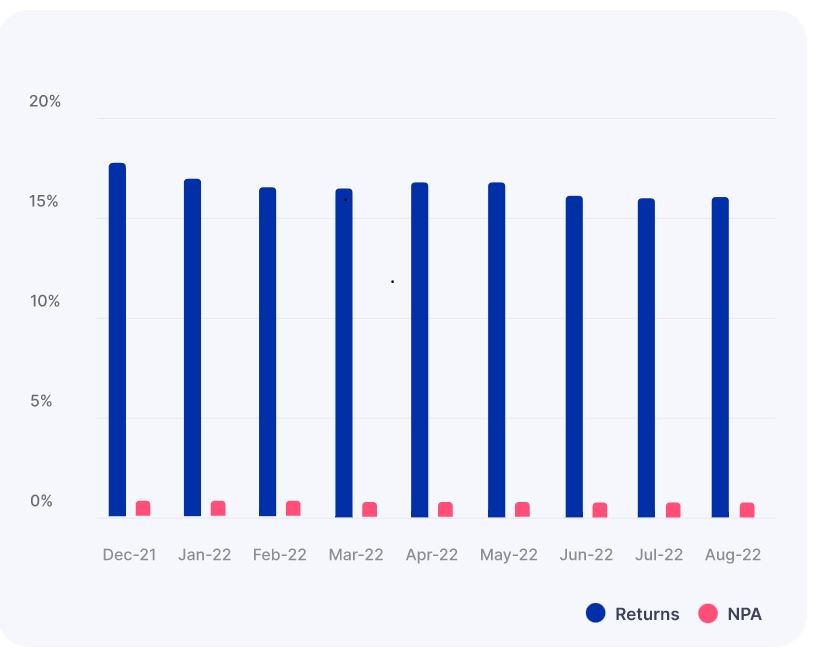

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 15-17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post-Tax) | 0% |

| Growpital | 12%(Tax-Free) | New (8 Payments) |

| Leafround | 17% | New (5 Payments) |

| Altifi | 12.50% | 0% |

- Received payment from Growpital on time

- All my cash flows in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

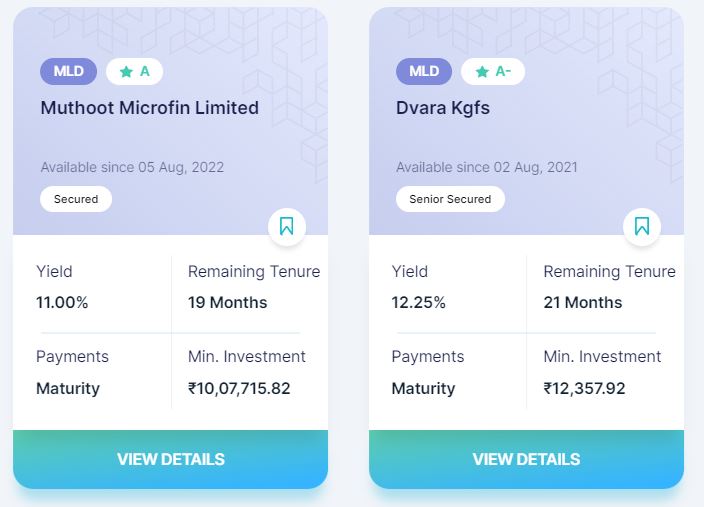

- Invested in Muthoot Finance MLD on Altifi yielding 11%

- Increased my allocation to Growpital this month

- Investing in Capsave on Wintwealth at 10% IRR for 15 months

- Investing in Ugro Capital on Jiraaf at 10.5% for 18 months

- There is a litigation finance opportunity in legal pay

- Adding a few more deals on Leafround this month

New Deals

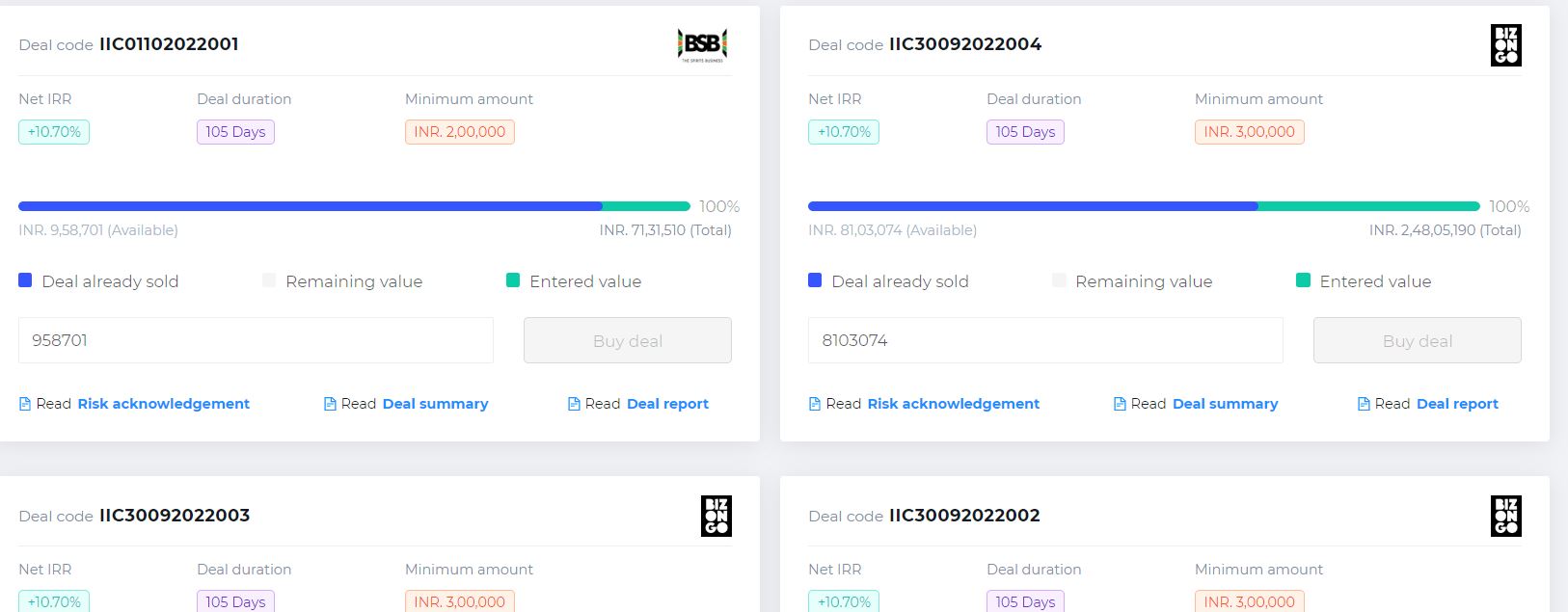

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Invested in Diptab Ventures on Tradecred. Investors should compare the net IRR between Kredx and Tradecred

- I have invested in Zetwerk on KredX for 13 % which is yet to mature.

Crypto Investing

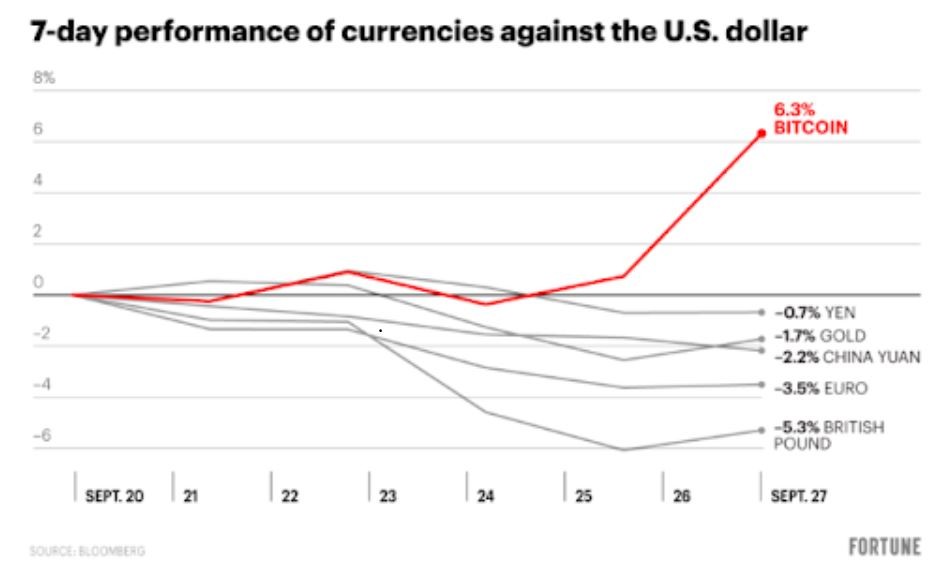

Crypto showed some resilience this month. Despite USD’s onslaught of stocks, commodities, and appreciation against other currencies, Bitcoin (BTC) reportedly has kept its value between the $19,000 and $20,000 mark.

Stanley Druckenmiller, a famous Billionaire Fund manager feels “central banks tightening up.” he thinks that crypto could play a big role in a Renaissance if people continue to lose trust in banks. The current currency crisis this week actually has led to Bitcoin’s outperformance

- Gradually adding SIP to Large cap crypto and some strategies on Iconomi

- Will add a larger amount if large-cap coins correct another 25-30% from the current level

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 5% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 8% |

| Bitcoin Trading(Binance/CoinDCX/FTX) | 5% |

P2P Investment

Current allocation:

- India P2P – 35%

- 12Club – 5%

- I2IFunding- 35%

- Finzy-25%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.85% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistently positive till now with negligible NPA. Have increased allocation and will continue to monitor

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- I have sent a mail to Rupeecircle to provide the status of my delinquent loans!

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 11.5% | 1% |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1.5% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- With the current crisis going on in Europe I feel its best to not increase allocation to Europe-based platforms

Equity Market

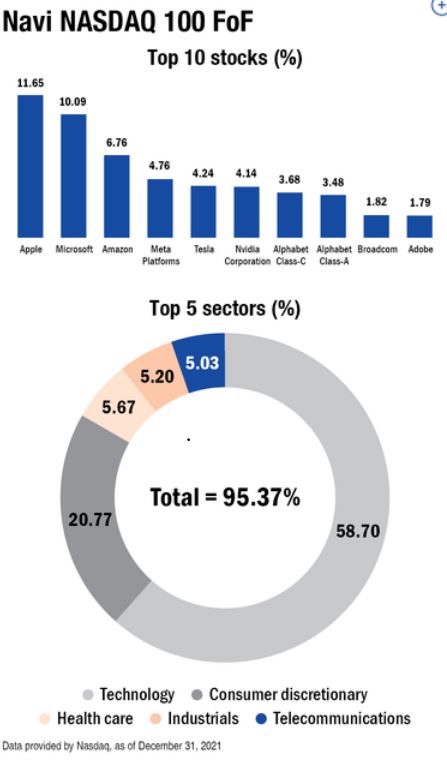

Nasdaq and S&P both have crashed and have fallen more than 25% from their highs. Indian market showed signs of weakness for the first time after a very long period. Considering the valuation I decided to invest in the US market through Index Fund

- Invested in Nasdaq 100 FOF operated by Navi Mutual fund

- Invested in NIFTY IT ETF considering it seems better priced than the rest of the market.

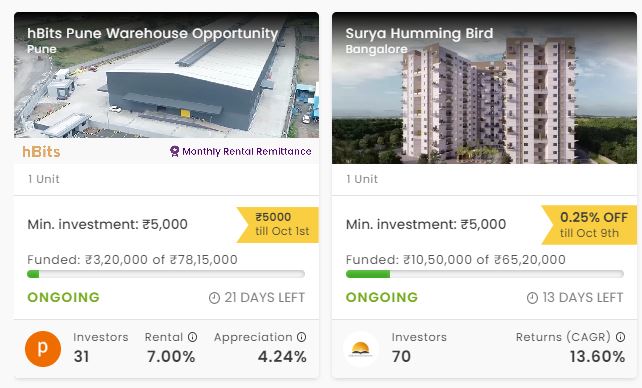

Other Alternative Assets and Platform Updates

Sustvest Investment – Have invested in a couple of opportunities to date on Sustvest. Will be monitoring payout consistency

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 8 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest.

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 8.00 |

What is your opinion regarding gayn capital based in chennai that deals in real estate fractional ownership investments just like myre capital? Minimum investment is 5 lacs.

Hi Ravish,

Thanks for enquiring about gayn. I have not used it so I can’t comment at the moment but will definetely explore and share my experience.

Thanks for your post,all of the above details are rightly said as i am following most of them as well.

Just to add one more point about CRE in grip, please mention that investment may start at 1lakh in any deal but over a period of 5 years you need to invest minimum of 25L across all the deals,please educate the terms and conditions for all the platforms for retail investors before they put in their hard earned money.

Hi,

Thanks for highlighting this. Yes, the total amount is INR 25 lakh over 5 years. It gives diversification over just 1 property of INR 25 lakh but investors should be mindful of this fact and factor it in while starting their investment journey.

Hi, Please write an article covering the taxation aspect especially on how to manage optimally. You can also share your approach on how you deal with these aspects. Thanks

Hi Shyam,

This is something I definitely want to cover. Would also like to share a template using which people can manage alt portfolios in one place.

Bro can you please make a video on your youtube channel on how to invest in lofty please and also about investing in Europe from India using contomobile actually I didn’t understand the whole concept . Remit bank persmission and all that so please make a video on it with complete tutorial on your channel. Hope you will do .

Hi Gaurav, Will do a video soon to cover international investments soon!

have you invested in US stocks in indmoney then make a detail video or page

I am using Vested and Stockal. I have Ind account but never used it for international. I will share my review once i do that.