June has been one of the worst months for crypto! In the first 6 months we’ve seen several “big name” projects get crushed:

- Terra ($60B peak market cap)

- Celsius ($1B+ crypto exchange)

- BlockFi ($4B+ crypto exchange)

- 3 Arrows Capital ($3B+ hedge fund)

Those are multi-billion dollar projects that lost almost all of their value overnight. This is the crypto 2008 financial crisis. It has resemblance to how banks like Bear Stearns and Lehman Brothers collapsed suddenly!

Sam Bankman-Fried bailed out Voyager and the embattled exchange BlockFi, the crypto entrepreneur has visibly emerged as a savior of the tumbling sector striking similarity with what J.P. Morgan did during a 1907 financial crisis! FTX’s CEO is now choosing winners and losers in the crypto bear market. The move is not unlike when JP Morgan stepped in to save the traditional financial system during the bank panic of 1907

During the panic of 1893, after intense speculation and consolidation in the emerging railroad and banking industries, Morgan lent the Federal Treasury $65 million in gold to re-up its dwindling reserves and firm up faith in the banking system. Then, amid the financial crisis of 1907, Morgan pledged his own capital and led a coalition of wealthy financiers to backstop failing banks, stock exchanges, and trust companies. Historians think Morgan’s actions prevented a much deeper recession when the federal government had little ability to manage economic crises.

Alternative Investment Portfolio Performance

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 11-12%(Post-Tax) | 0% |

| Klubworks | 20%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post Tax) | 0% |

| Growpital | 12%(Tax-Free) | New (5 Payments) |

| Leafround | 17% | New (2 Payments) |

- Investing in new deals on Leafround this month

- Completed Legalpay deal full repayment with 27% Pre Tax IRR ( Details later in the post)

- Received payment for Growpital

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

- Invested in Aris Infra for 3rd Time on Jiraaf

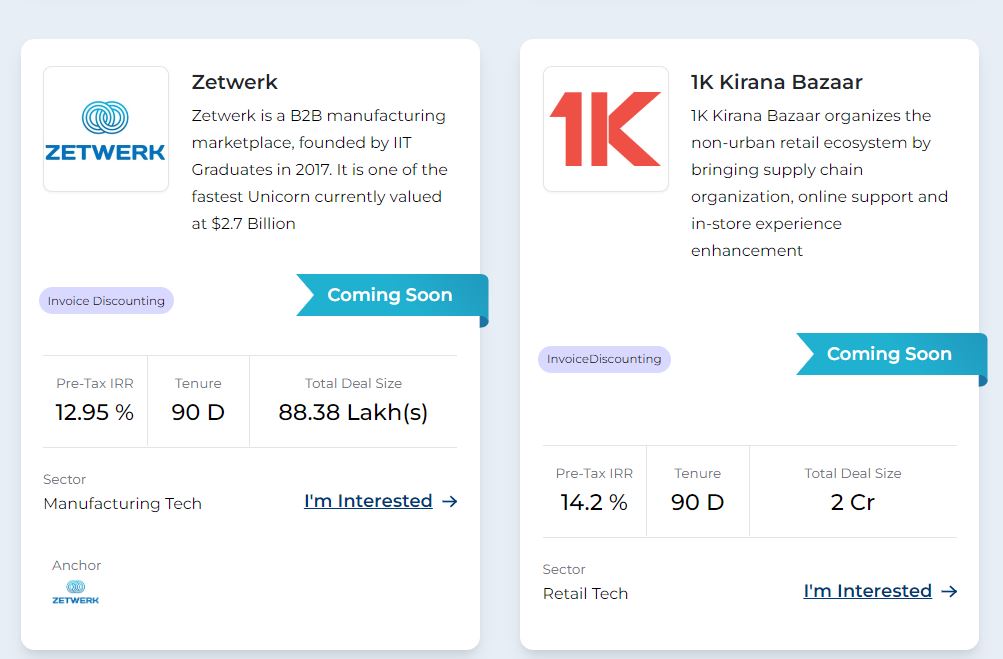

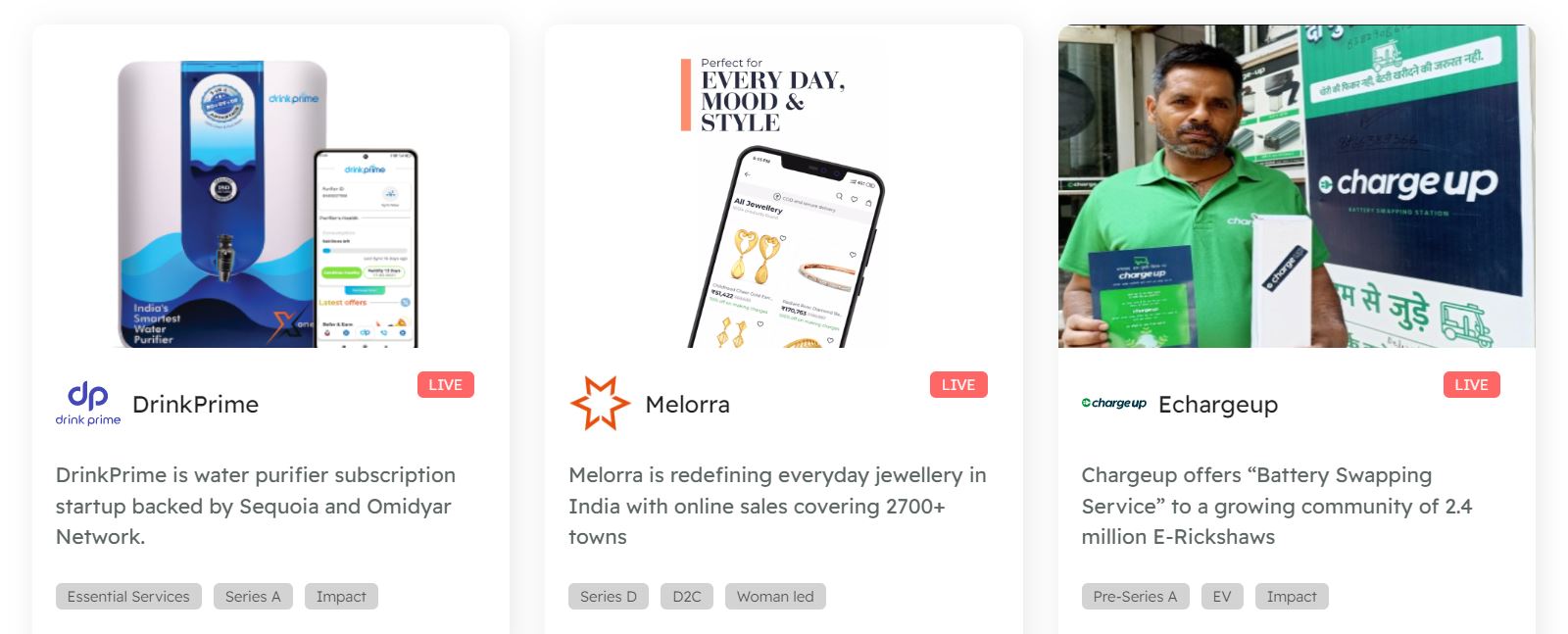

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 13% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- 10% IRR deal available on Liquiloans for 4 Months Holding Period

- Due to RBI guidelines on BNPL cards I think there would be less availability of Loans on Lendbox due to no new loans in per annum

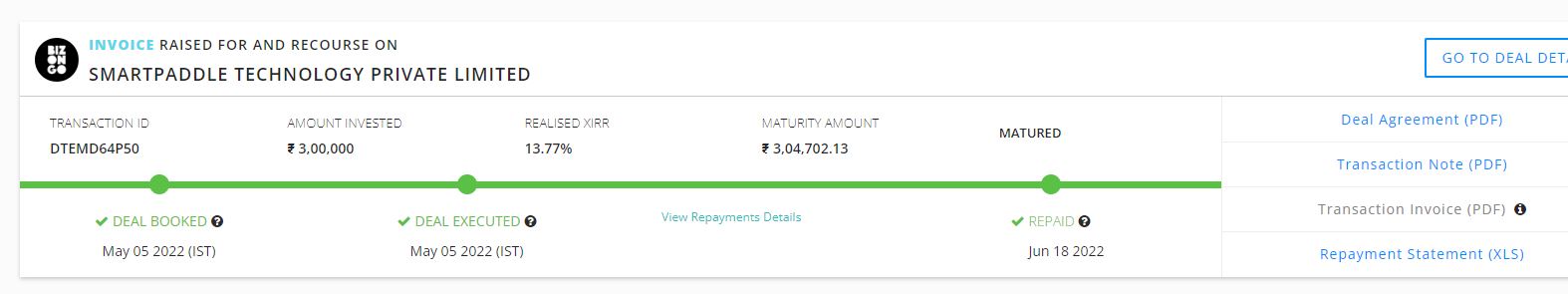

- I got KredX repayment for Smartpaddle on time and have invested again in the same deal.

Crypto Investing

- Luckily in my last month’s post, I had mentioned (screenshot below) taking out money from lending protocols, and the next week saw major liquidation issued in top lenders. Still, I ended up having some 125 USD stuck in Celsius. I am not going to keep any money in any lending protocol as the market is too volatile and risky at the moment

My May Review comment

- I am gradually adding large cap crypto in a staggered manner. It is a highly risky investment and I expect more volatility in the next few weeks.

- Have added some more capital to Iconomi for the long term.

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -25% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 5% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX/FTX) | 6% |

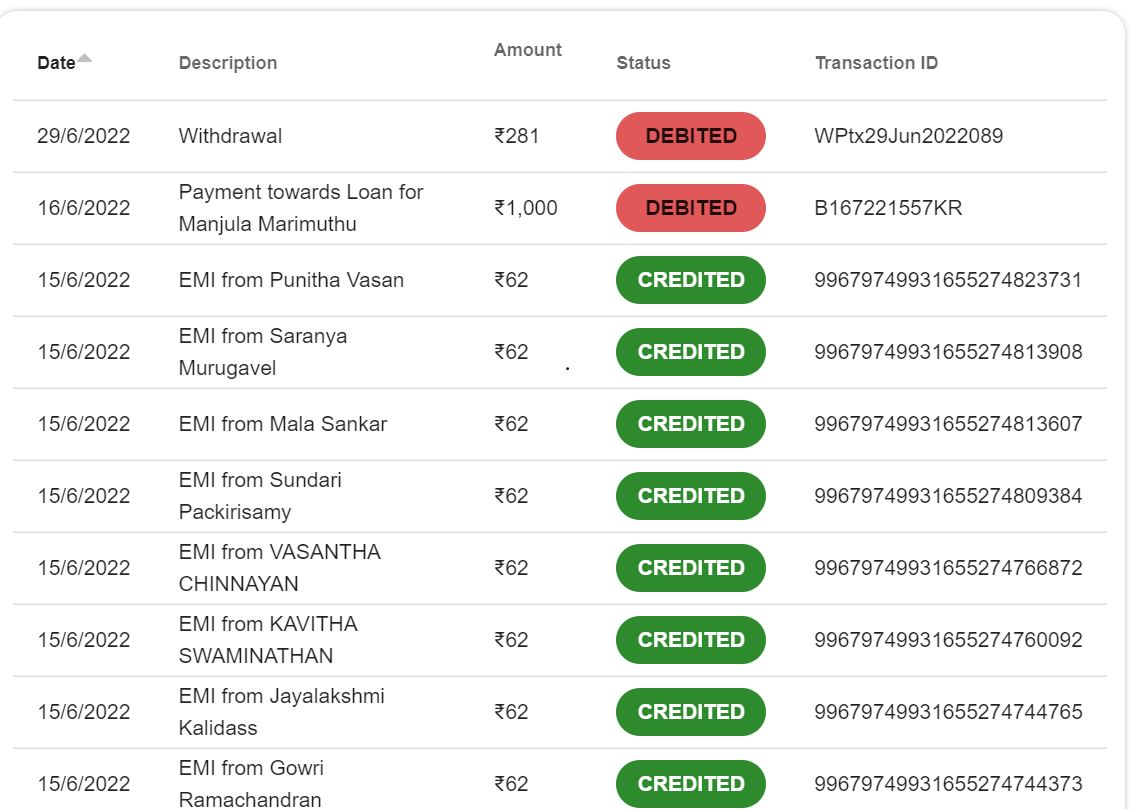

P2P Investment

Current allocation:

- India P2P – 30%

- 12Club – 5%

- Rupeecircle- (stopped)

- I2IFunding- 35%

- Finzy-30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks-backed loans, E-Rickshaw backed loans, education loans, NBFC backed loans(Mondeo etc) Group loans | 13.5% | 4.9% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- Increasing allocation to IndiaP2P. Women borrowers seem to be a good asset class and the performance of the platform looks good.No delinquency to date. Gradually increasing allocation

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- We will be soon covering how to seamlessly invest in European platforms using MCA

- I am in the process of evaluating a couple of more platforms with good risk-adjusted returns.

- Peerberry and Lendermarket have some loans stuck in Ukraine

Equity Market

The Indian market has corrected significantly from its All-time High but it does not mean that the Indian stock market is very cheap. It is still one of the most expensive markets if we use the P/E ratio as a factor to evaluate. At this point, I will choose to invest in a gradual manner rather than going all in.

Other Alternative Assets and Platform Updates

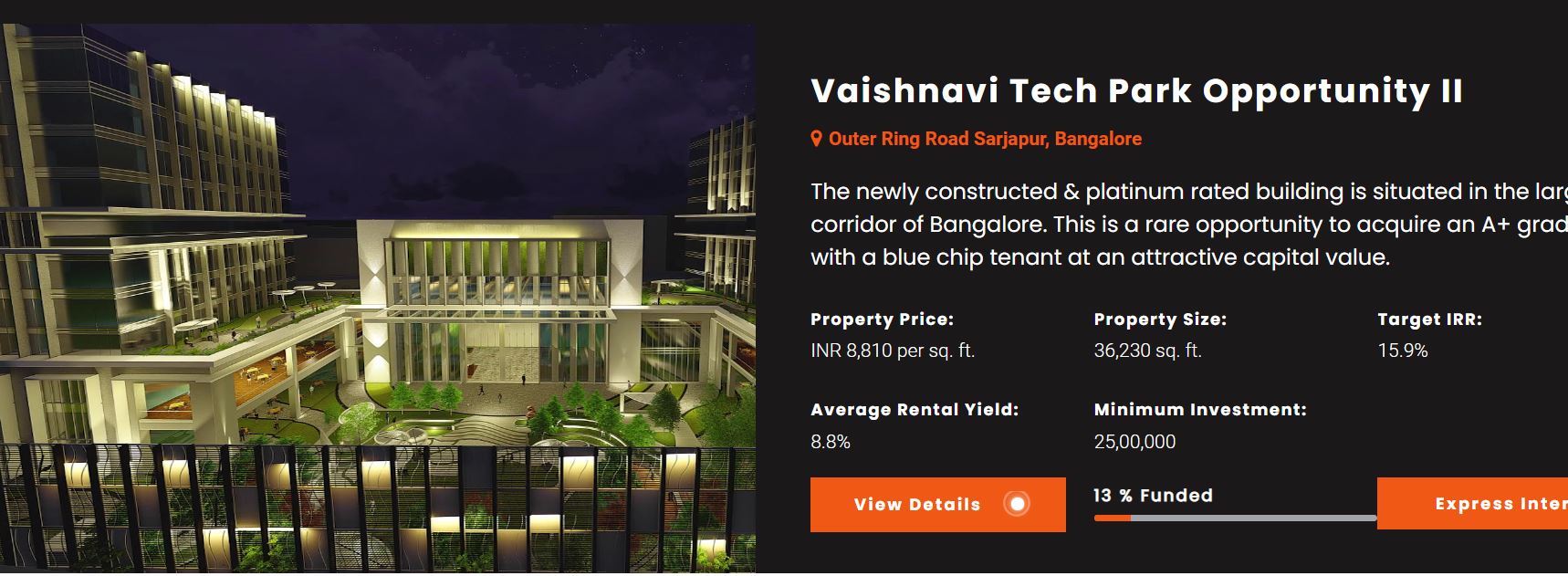

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 6 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest. New Vaishnav Park Opportunity is live. again

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 6.00 |

My May Review comment

My May Review comment

Any update on Hedonova?

Hi Kandarp,

I had mentioned in feb that I have taken out all my investments and in the subsequent monthly posts I had highlighted that I intend to have no future exposure as I am not very confident about it and hence would not want to risk the capital

How do you go about with filing taxes with these many platforms? Is there an recommended way than requesting statements from each platform, and then trying to make sense how much to pay for each platform?

Hi, For most it’s income from other sources, while for others that have tax benefits you get the SPV details from their website which you need to your ITR3. Unless the asset is tax-free at your hand it is mostly taxed at your marginal tax rate!

For Growpital, How did you download SPV?

They will share SPV details with the payout details once there are gains for realization .I got my SPV details today!

How do you track all your investments and returns with so many platforms? Please do a detailed post sharing net worth tracking, investment tracking, etc.

Sure, will cover how i manage all investments. Planning to share an excel with community also which can help

Hey,

I am following your alternative investment monthly report from May-22 onwards and you give such deep and good explanation.

I am already investing in Jiraaf and grip invest. Now, I am planning to further invest in leafround, India P2P.

Further, I want your advise can I invest in legalpay?? Also, any other platform which I can use to invest?

Thanks sir.

Hi Tarun, Great to know that you found the posts helpful.

I prefer the resolution financing deals as they have more defined timelines. The first investment turned out really well. I am planning to gradually add some amount to subsequent offerings.

Waiting for alternate investment monthly report for the month of July-2022

yes Sir,Will be sharing on Sunday