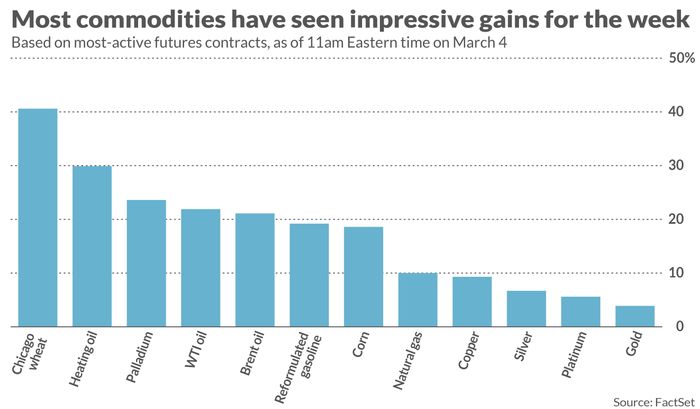

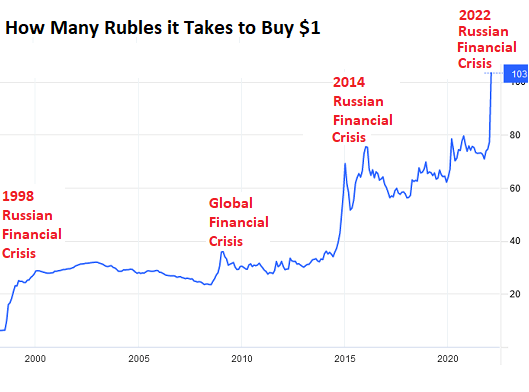

This year is turning out to be a crazy volatile ride for most investors. The ongoing Ukraine crisis had a detrimental impact on the global equity market but was instrumental in driving the commodity and crypto prices up.

This market behavior really highlights the need to have a diversified portfolio not just across assets but also across geographies. The sudden crash in Ruble is a testament to this.

My Alternative Investment Portfolio Performance

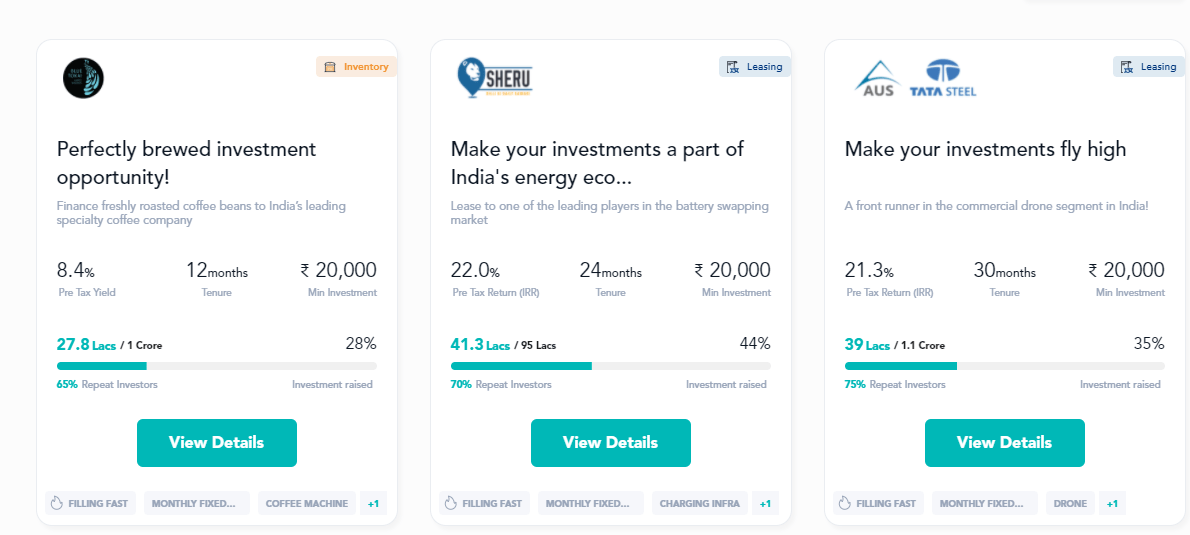

This Month I made few new Investments in – Jiraaf and IndiaP2P

Jiraaf investment were in few high yield opportunities and IndiaP2P for testing the new product. I ramped up my Jiraaf investment considerably fast as the risk to reward on most of its deals is generally attractive.

This month Fixed Income Assets have been consistent performer. I have Increased my investment in Jiraaf and Liquiloans, while reduced in Hedonova.

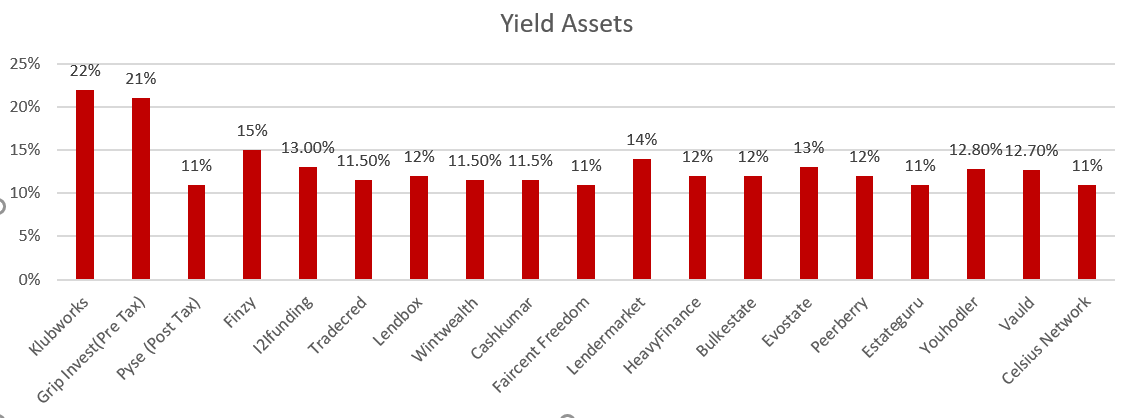

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 20%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | New |

| Pyse | 10-11%(Post-Tax) | New |

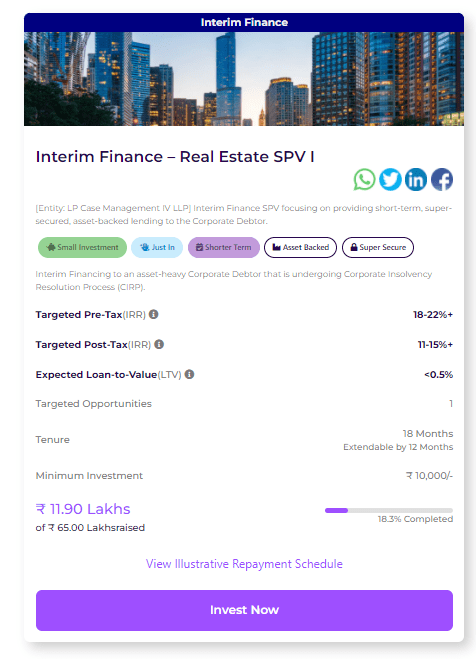

| Legalpay( Promo code FV48G4) | 14-16% | New |

| Growpital(Promo code GROWRDIMES) | 12% | New |

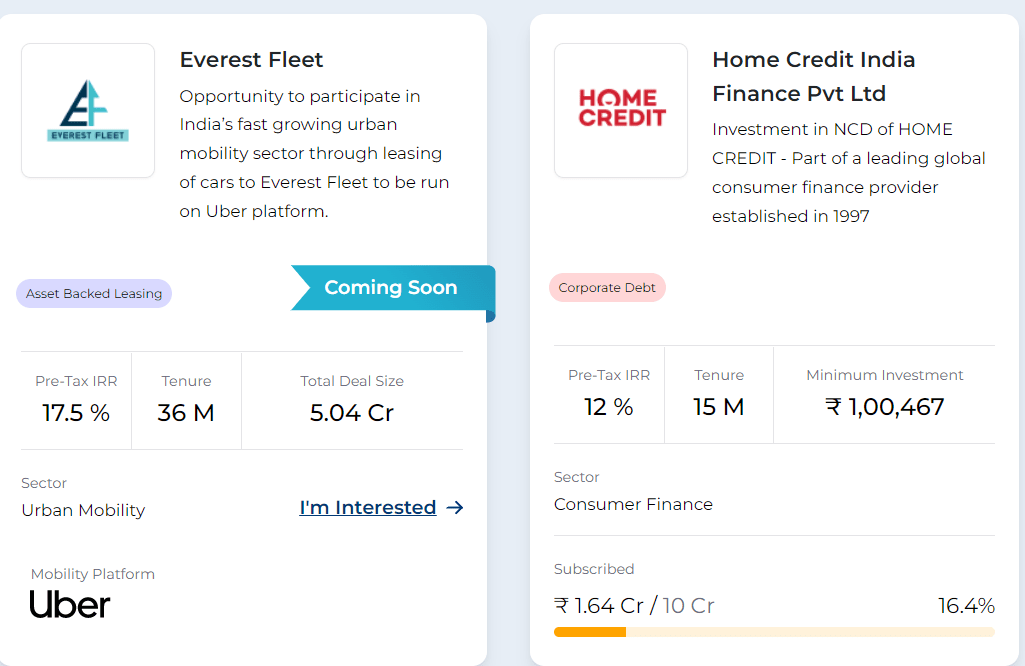

- Have invested in Home Credit bond (12% IRR) and 1K Kirana Invoice(15% IRR) on Jiraaf

- Invested in the latest Legal Pay Interim Finance deals.2 Payouts on time!

- Wealth Wint Issue for Slice is live.

- My Tijori investment in Klubworks is complete with a 20% IRR

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| IndiaP2P | 16% | New |

- Have added more investment to Liquiloans. Will be investing in the stock market using this capital in case of any correction.

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Cashkumar Returns are on time

- Have bought Infosys deal on Tradecred

- Just Added money to IndiaP2P

Global Alternative Hedge Fund- Hedonova

| Platform | Cumulative Returns |

| Hedonova | NA |

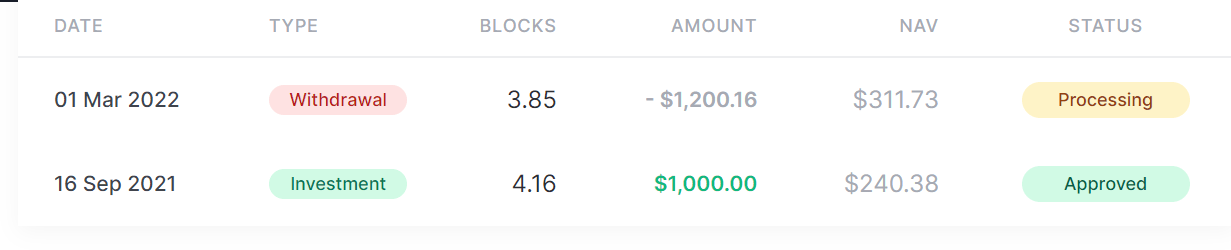

I have just redeemed money successfully from Hedonova. The platform does not seem transparent and looks very risky to invest

- Reason for Redemption- I am waiting for a full audit of Hedonova assets. As the fund is heavily invested in startups/NFT, an independent audit is extremely important to get an assurance of fair value.There is currently no transparency.

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(Stopped) | 13% | 5.5% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- For all investment-related remittances please transfer money to the IBAN account from your Indian bank account and not other remittance services as per RBI FEMA guidelines!

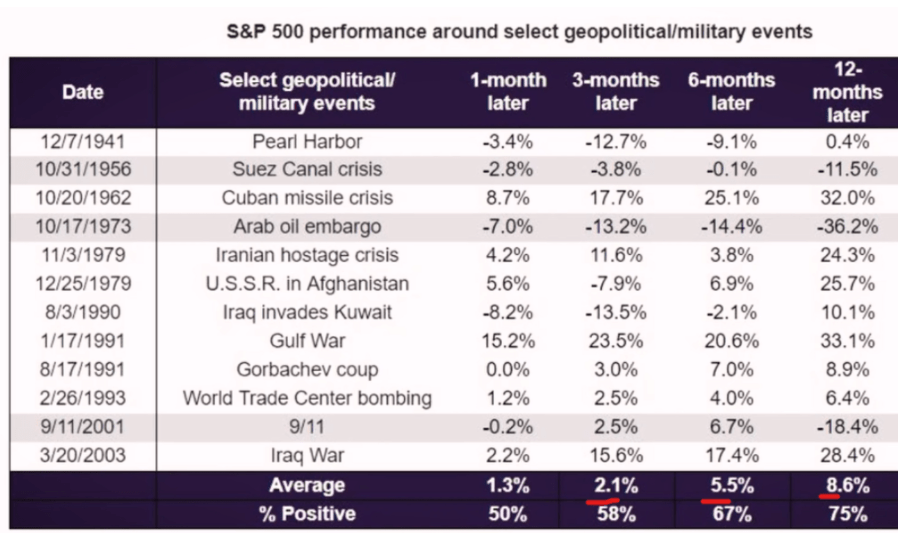

Equity Market

The market has been very volatile due to the current war. However, if we go by history overall, the average S&P 500 performance after War charged events has been surprisingly positive; 1 month +1.3%, 3 months later 2.1%, 6 months later 5.5%, and 8.6% 12 months later.

Now although executing an “Invest when there is blood on the streets” strategy seems like it gets great returns, it also requires nerves of steel and the optionality of not requiring access to the funds for at least 10 to 20 years just to be safe.

- This is the first month after a long period I am buying Equity ETF

- Valuation is not super cheap but small systematic investments can be made at this level.

Crypto Lending Investing

| Platform | Returns | Capital Loss |

| Kucoin | 5-50% | Nil |

| Celsius Network | 12.00% | Nil |

| Youhodler | 12.50% | Nil |

| Vauld | 12.70% | Nil |

| Coindcx | 14%% | Nil |

- Coindcx is also offering a 14% return on USDT (use code )

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Youhodler Paxg (Gold-backed coin) offering 8.2% yield over gold returns

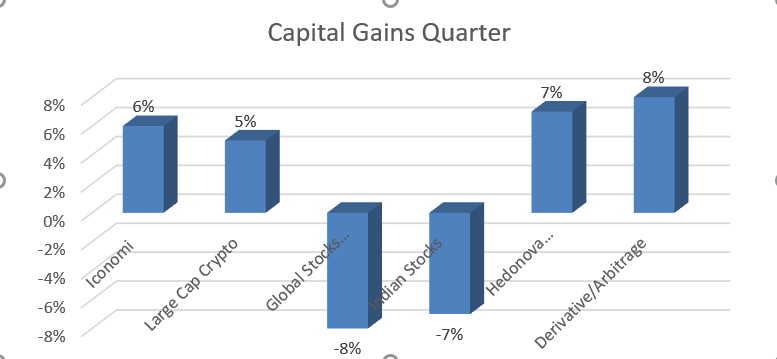

Crypto Investment

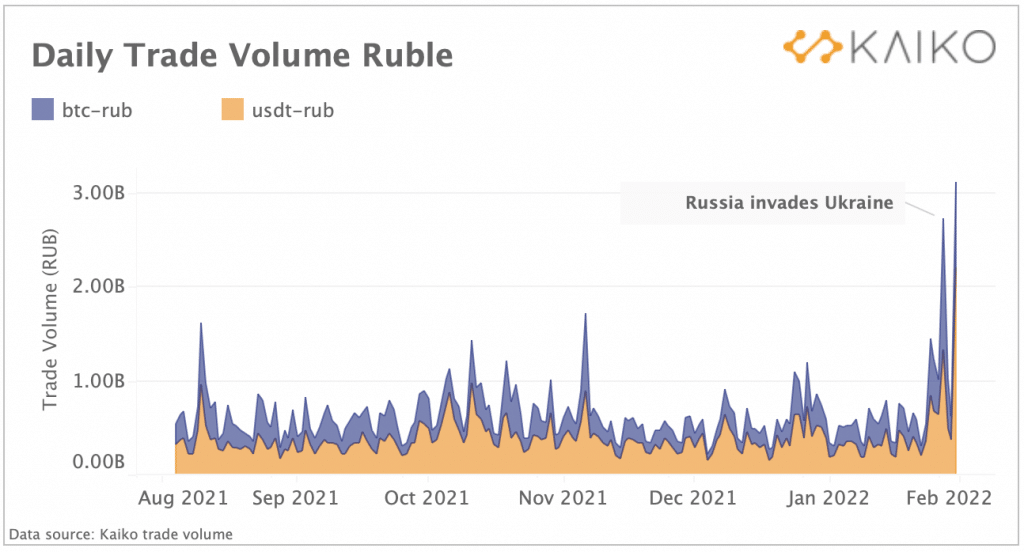

Bitcoin jumped 14.5 percent intraday, its best day in a year after Russians started buying crypto due to ongoing sanctions. The market is still far from its all ATH level

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 15% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 6% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 5% |

- I had made a few investments in ICONOMI( Diversitas, Carus-AR) last month which have given good returns in the recent up move!

P2P Investment

Current allocation:

- Rupeecircle- 5%(stopped)

- I2IFunding- 30%

- Finzy-35%

- Faircent-30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks-backed loans, E-Rickshaw backed loans, education loans, NBFC backed loans(Mondeo etc) Group loans | 13.5% | 4.9% |

| RupeeCircle | Stopped | ||

| FINZY | Prime Borrowers, High Salary ,A category | 14.2% | 3.5% |

| Faircent ( Only Pool Loans) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- Have been investing in Urban Clap Loans on I2IFunding

- Systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- Completely stopped RupeeCircle

Other Alternative Assets

Options Trading as an Asset Class: I have been contemplating finding good options traders/Algo Traders who can help investors get high double-digit returns on the capital. Idea is that lot of securities that are lying idle in demat can be used to generate additional returns.

For most retail investors trading is not feasible due to time constraints. The skills and psychological conditioning are also not easy to develop. Over the next quarter will evaluate strategies of top traders who are willing to collaborate with investors.

Hi Have you got the audit report for Hedonova, or when is it expected

Hi Divyank,

They have not yet shared the audit report. I will follow-up again this month !

i cant invest in Hedendova for some reason never get the call

I have paused Hedonova at the moment. Waiting for Audit report before resuming

Did you find any good algo traders or platform for algo trading?

Hi Arun,

I did find a couple of them but I wanted to wait considering the market volatility these days. it would make sense to at least get started during more favourable conditions.

Hedonova is actually a Ponzi scheme. Read https://rattibha.com/thread/1524985342570266626?lang=en

I had invested 3000 USD with them and asked to withdraw my entire capital when I saw this report. They promised to send my money in 30 days, which they claim is the minimum time they need for processing redemptions. After a month I asked again on Twitter and got promptly blocked.

I would also advise staying away from legalpay. Hedonova is an investor in this firm, and that’s a major red flag.

I had shared media link in April portfolio update and decided to keep zero exposure in future

https://randomdimes.com/alternative-investment-portfolio-april-2022/