Real Estate Debt Financing in India

The real estate sector in India has been a significant contributor to the country’s economy for a long period. Whether it’s residential, commercial, or other infrastructure projects, real estate development is a capital-heavy business that requires substantial financial backing. For this reason, debt financing has emerged as an essential mechanism for real estate developers to fund their projects. In this article, we will deeply understand debt financing for real estate projects, its importance in India, and alternative real estate investment options available to retail investors to invest in real estate projects.

Overview of the Indian Real Estate Sector

India’s real estate market has experienced exponential growth over the past few decades. The demand for residential housing, commercial spaces, and urban infrastructure continues to surge, driven by urbanization, increasing population, and rising incomes. The sector contributes roughly around 7% to India’s GDP and is expected to grow even further, reaching a market size of around USD 1 trillion by 2030.

The real estate market, however, is highly capital-intensive. Each real estate project requires stretches for a large period of time, from land acquisition to obtaining regulatory approvals, construction, and finally, sales. Since large sums of money are required at various stages of project development, real estate companies often look for external funding, which brings debt financing into the picture.

Why Debt Financing is Essential for the Real Estate Sector

Debt financing is one of the primary ways developers secure the capital they need to kick-start or complete projects. Unlike equity financing, where a developer might dilute ownership to raise capital, debt financing allows the developer to retain full ownership of the project while using borrowed funds to meet immediate cash flow requirements.

Some of the major reasons why debt financing is crucial for the real estate sector are as follows:

- Significant Capital Requirement: Real estate projects need massive financial inputs, often running into crores. Developers rarely have such substantial amounts on hand, making borrowing essential.

- Cash Flow Management: Real estate projects take years to complete. Financing through debt ensures that developers can manage their cash flow, meet construction costs, and pay vendors on time without depending on sales or other income.

- Flexible Repayment Terms: Debt financing typically comes with flexible repayment options, allowing developers to repay the loan over the project’s lifecycle, often after the project begins generating revenue.

- Leverage: Borrowing allows developers to take on more projects simultaneously, as they are not restricted to using their funds.

How Debt Works in the Real Estate Sector in India

In India, real estate debt financing primarily comes through various channels like banks, non-banking financial companies (NBFCs), private lenders, and a very tiny percentage through alternative platforms. The debt structuring process involves multiple steps, stakeholders, and collateral management. Here’s a deeper look at how the process works, including explanations of some key terminologies:

-

Types of Loans:

- Construction Loans: These loans are specifically designed for developers to fund the construction phase of a project. The disbursement is usually done in tranches, in line with the progress of the project, ensuring funds are released as the project meets certain milestones.

- Land Acquisition Loans: These loans help developers acquire land, which is the first major step in most real estate developments.

- Bridge Loans: Short-term loans designed to help developers manage gaps between different financial events, such as acquiring land or securing long-term financing.

-

Collateral and Charges

Real estate loans are generally secured loans, meaning they are backed by collateral, often the property or land being developed. The collateral serves as a safety net for the lender in case the borrower defaults. Below are some key concepts related to collateral:

-

- Charge: A charge is a legal right granted to the lender over the developer’s property. There are two main types of charges:

- First Charge: The lender with a first charge has the highest priority for repayment if the borrower defaults. This means they have the right to be paid before any other lenders.

- Second Charge: A second charge lender will only be repaid after the first charge lender has been fully compensated.

- Charge: A charge is a legal right granted to the lender over the developer’s property. There are two main types of charges:

-

Valuation

Before granting a loan, lenders usually require a valuation of the property or project. This involves an assessment of the land, construction, market conditions, and future income potential of the project. Valuation ensures the lender knows the worth of the asset they’re lending against.

-

Loan-to-Value (LTV) Ratio

The LTV ratio indicates the amount of the loan compared to the property’s market value. For example, if the property is worth ₹10 crore and the lender grants a loan of ₹6 crore, the LTV ratio is 60%. A lower LTV ratio means more security for the lender.

-

Trustees and Their Role

A trustee is a third-party institution that acts on behalf of lenders or investors in a debt financing transaction. Trustees are responsible for safeguarding the interests of the lenders. For example, if the developer defaults, the trustee can take legal action, enforce the charge on the property, and manage the process of repayment. Trustees play a vital role in syndicated loans or debt securities, where multiple lenders are involved.

-

Special Purpose Vehicle (SPV)

For large real estate projects, developers often set up a Special Purpose Vehicle (SPV). An SPV is a separate legal entity set up solely for a particular project. The main benefit of an SPV is that it isolates financial risk. If the parent company (the real estate developer) faces financial difficulties, the SPV remains unaffected as it is legally independent. This arrangement gives lenders more confidence as they know the assets and cash flows related to the project are separate from the parent company’s other operations or debts.

-

Debt Structuring and Repayment

The structuring of debt in real estate involves evaluating the project’s feasibility and risk. Lenders assess factors such as project location, demand, developer reputation, and regulatory hurdles. Once satisfied, they may offer flexible repayment options. These could be:

-

- Interest-only Loans: Where the developer only pays interest during the loan term and repays the principal at the end of the loan period.

- Bullet Payments: A large lump-sum payment made at the end of the loan term.

- Amortizing Loans: Loans where the developer pays both interest and principal in regular installments over the loan term.

Understanding these terms and mechanisms is essential for developers and investors alike. They define how loans are structured, secured, and repaid, ensuring both the lender’s and the developer’s interests are protected during the project’s life cycle.

Risks and Challenges in Real Estate Debt Financing

While debt financing offers a valuable resource for developers, it is not without risks. The real estate sector can face cyclical downturns, which can affect sales, delay project completion, or decrease the expected return on investment (ROI). If the developer fails to generate sufficient revenue, it becomes difficult to repay the loans, leading to defaults.

Moreover, the regulatory landscape in India is complex, and delays in obtaining approvals or changes in policies can impact project timelines and increase costs. In such scenarios, developers can find themselves burdened with debt that they are unable to repay.

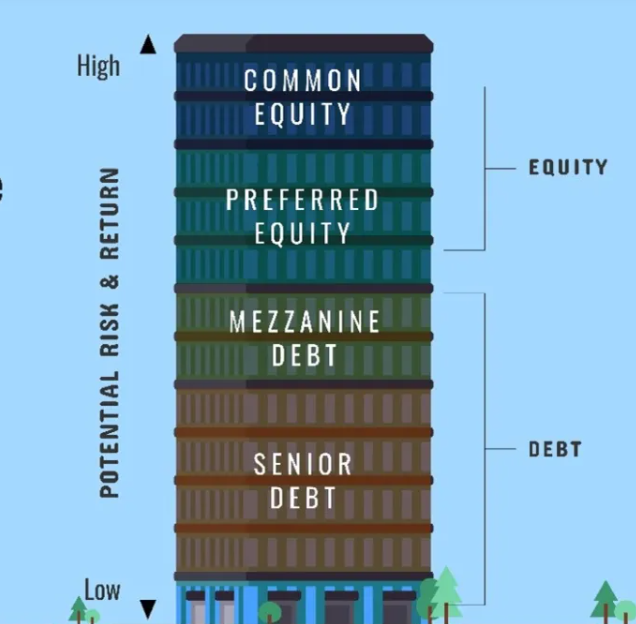

Real Estate Investment Capital Stack

Real estate development is a capital-intensive endeavor, demanding significant financial resources to initiate, execute, and complete projects. While developers leverage equity and cash flow from property sales—typically received through staggered payments—they also rely on external financing to cover the extensive development costs. This external capital often comes from financial institutions, high-net-worth individuals (HNIs), and retail investors.

Developers can raise funds either at the entity level or on a project-specific basis, employing different capital structures like equity, mezzanine, or debt. Each structure offers a unique risk-return profile for investors.

Equity

Equity financing involves raising capital by selling shares of the developer’s equity, either at the entity or project-specific SPV (Special Purpose Vehicle) level. Investors in equity gain ownership stakes, offering variable returns tied to project success without fixed interest obligations. However, equity financing dilutes ownership and control, making it less appealing to developers compared to debt.

Equity structures are often used in commercial real estate, particularly for large-scale developments like offices, retail, or warehouses. Major funds such as Blackstone and GIC frequently acquire stabilized assets or form joint ventures with top developers to finance significant projects like IT or office parks.

Mezzanine

Mezzanine financing is a hybrid structure that blends features of both debt and equity. Investors benefit from profit-sharing arrangements similar to equity but also enjoy a minimum assured return, offering more security than pure equity investments. Positioned between debt and equity in terms of risk and reward, mezzanine financing provides a balance of stable returns with upside potential.

Debt

Debt financing is the most common method developers use to fund projects. It offers fixed returns through regular interest payments and is typically secured by mortgaging the developer’s assets. Debt financing options vary, with developers borrowing from banks, non-banking financial companies (NBFCs), and private debt or Alternate Investment Funds (AIFs). Below are the distinct features of each:

- Bank Loans

Banks provide loans to developers, secured by the real estate project. These loans are restricted to project-specific use, limiting flexibility. Interest rates for bank loans depend on the developer’s creditworthiness, the project’s risk profile, and prevailing market conditions. In India, recent trends indicate interest rates for real estate projects typically range from 10% to 12% per annum. - NBFC Loans

NBFCs offer more flexible lending terms than traditional banks, including higher loan amounts, early-stage project funding, and broader end-use allowances. NBFCs are known for faster processing times, although they have recently adopted stricter criteria akin to traditional banks. Interest rates for NBFC loans start around 13% and can rise depending on the project’s risk profile. - Private Debt Funds or AIFs

Private debt funds and AIFs offer bespoke financing solutions, such as land acquisition funding, pre-approval financing, and top-up loans, with full flexibility on end-use. These funds undertake greater risk and therefore expect higher returns, with internal rate of return (IRR) targets ranging from 16% to 18%.

Alternative Investment Options in Real Estate for Retail Customers

In addition to traditional real estate investment and debt financing, there are now alternative platforms that allow retail investors to invest in real estate indirectly. These platforms provide new avenues for smaller investors to participate in real estate markets without the need to purchase property outright.

In the Equity investment space, many fractional real estate platforms are there such as

- Altdrx

- Hbits

- Propshare

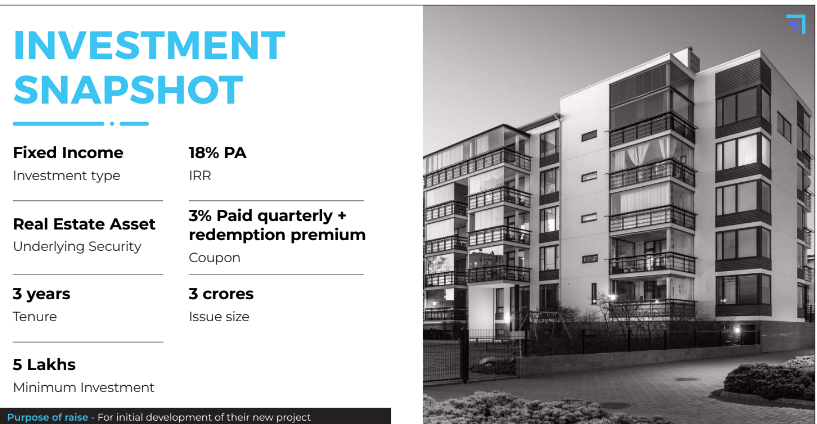

In Real Estate Debt financing below are the top platforms currently. We should focus only on Secured Debt and Mezzanine investment deals as unsecured debt platforms have very high risk!

Assetmonk

Assetmonk is a popular platform that offers fractional ownership in premium commercial and residential real estate projects. The platform allows retail investors to invest in real estate without the need to purchase an entire property. By pooling funds from multiple investors, Assetmonk enables users to own a portion of high-value real estate properties and earn rental income and capital appreciation in return. This model provides liquidity, low entry points, and attractive returns, making real estate investment more accessible to the average investor.

Read about Assetmonk in our review

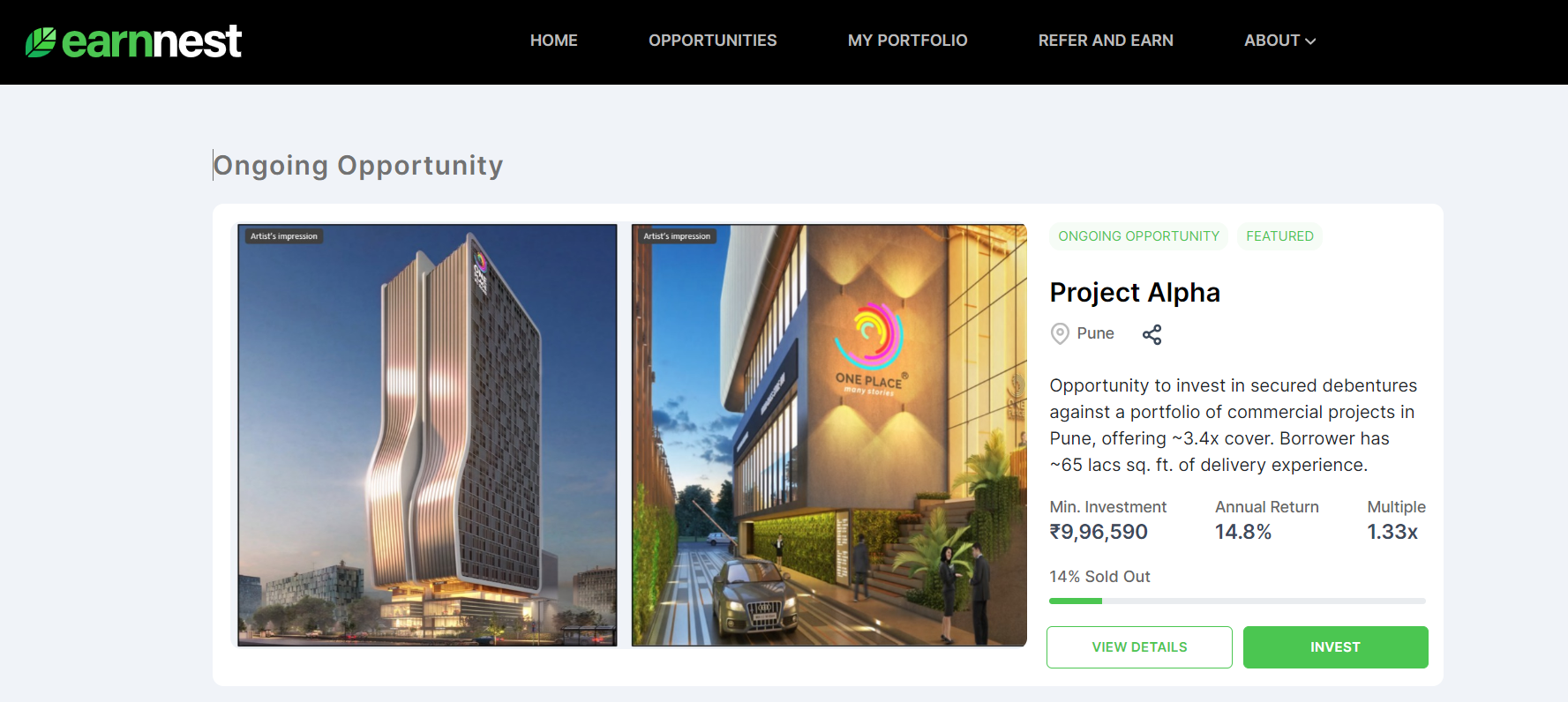

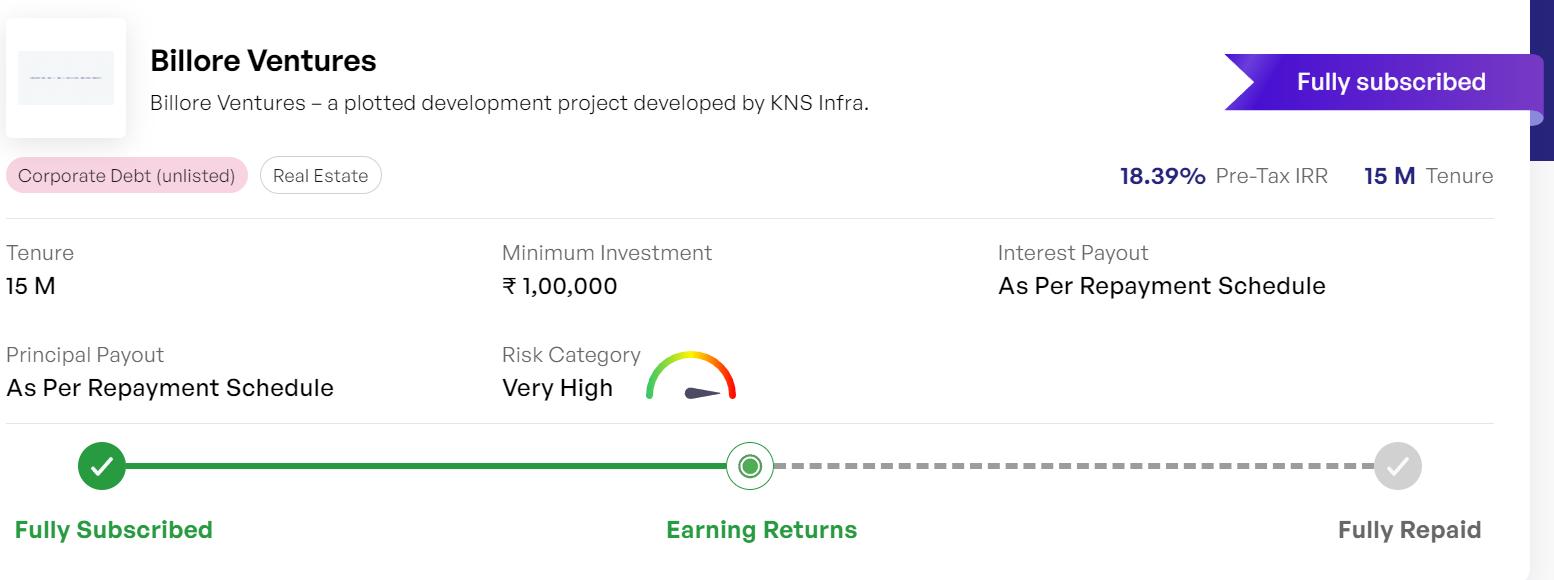

Earnnest

Earnnest is another innovative platform that focuses on real estate-backed debt investments. Through Earnnest, retail investors can lend money to real estate developers and earn fixed returns on their investments. These investments are often secured by the real estate project itself, providing a layer of security. With returns typically ranging from 10% to 15%, Earnnest offers an attractive alternative to traditional investment options such as fixed deposits or mutual funds.

Both platforms aim to democratize real estate investment by making it accessible to a wider audience, providing diversification, and reducing the financial commitment traditionally associated with property investment.

Read about Earnnest in our review

Altgraaf

Altgraaf is one of the largest alternative investment platforms in India. They have done more than INR 4,000 Cr of deals to date. It has different types of products including invoice discounting, Asset Leasing and Real Estate NCD. They provide secured bonds with 16-18% returns.

Read about Altgraaf in our review

Conclusion

Real estate debt financing plays a critical role in driving the growth of the Indian real estate sector. By offering developers the capital they need to build and complete projects, it helps fuel the country’s urbanization and infrastructure development. At the same time, innovative platforms like Assetmonk and Earnnest are opening up new avenues for retail investors, allowing them to participate in real estate without the need for large capital investments.

Whether you are a developer seeking funding or an investor looking for opportunities, the real estate debt market offers a range of options to suit different needs and risk profiles. As India’s real estate market continues to evolve, debt financing will remain a key enabler, supporting both large-scale developments and retail investment opportunities.