We recently reviewed The Policy Exchange, a platform that allows you to invest in Insurance policies and achieve a 12-14 % return on low-risk government bond assets.

The Policy Exchange brings a transformative approach to alternative investments by enabling investments in Pre-owned Life Insurance Policies. This innovative product offers assured returns and capital security, backed by AAA-rated securities and a transparent, regulated process.

Below is a detailed review of the platform

Many people had questions about the product. To answer these questions, we decided to interview Mr Naveen Gupta, the platform’s founder.

Here is the link to the Webinar.

We also requested that he answer some of the investor queries. Below are the answers he shared with us. Please do comment if you have any other questions!

What are the key Features of The Policy Exchange’s Investment Product?

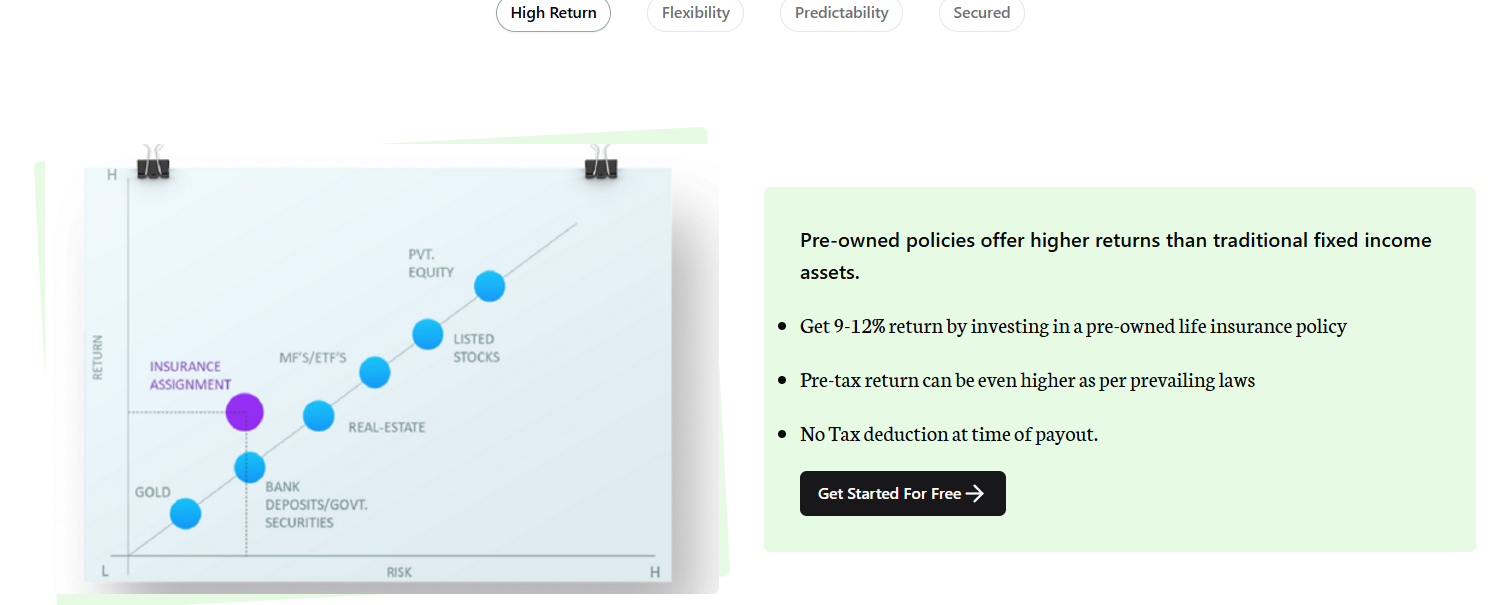

Unlike traditional investment options like fixed deposits or mutual funds, our product provides an assured IRR of approximately 9%-14%. This return is secured through AAA-rated instruments, combining the benefits of high yield and lower risk in the alternative investment space.

Primary Stakeholders in the Investment Process

- Original Policyholders: Individuals who hold lapsed policies they no longer wish to continue.

- Insurance Companies: Policies remain active under new investors, offering a way to sustain business from previously lapsed policies.

- Investors: New investors who purchase these policies at a discounted rate, assuming the premiums and gaining rights to policy benefits.

Leveraging Section 38 of the Insurance Act 1938, The Policy Exchange facilitates legal, beneficial transfers of policies, giving investors full rights upon Assignment.

Is the product regulated and what is Policy Exchange’s Role in this process?

Policies are governed by IRDAI regulations, ensuring compliance with industry standards. As a platform, The Policy Exchange identifies lapsed policies, handles their assignment to new investors, and serves as an intermediary. Once transferred, investors hold an irrevocable claim to policy benefits, with The Policy Exchange supporting the transition.

How is the Market Risk mitigated of the asset?

To protect against market fluctuations, all policy funds are transferred to a secure fixed-return investment, typically yielding around 6-7% at the time of assignment. This stabilizes returns and contributes to the expected IRR of 9-14%, providing investors with security from market volatility.

How is this product Taxed?

The tax implications depend on the original issuance date of the policy. For ULIP policies issued before 1st February 2021, gains are tax-exempt, whereas later issues are subject to LTCG tax at 12.5%.

Is there a risk if The Policy Exchange platform ceases operation in the future?

As a platform, The Policy Exchange only facilitates policy assignments and ensures convenient and smooth processing. The primary stakeholders (Policyholder, Investor, and Life Insurance company) directly interact to culminate the ownership and financial transactions, ensuring investor security even if our operations cease. The investor, as the policyholder, retains all policy benefits (including policy liquidation payout) directly with the insurance company.

Are there any other hidden charges?

Investors enjoy a transparent exit process with no hidden charges, receiving the full fund value at liquidation.

What is the Future Vision of the platform?

The Policy Exchange aims to expand its offerings, including options with potential equity-linked returns. Partnerships with additional insurance providers will increase product diversity, enhancing options for investors looking for stable, high-yield alternatives.

Frequently Asked Questions on Policy Exchange

Q: What rights do investors hold post-assignment?

Investors gain full rights to policy benefits, excluding only the death benefit, which remains tied to the original insured party.

Q: How does The Policy Exchange secure returns for market-dependent policies?

To stabilize returns, The Policy Exchange moves funds into fixed-income options upon assignment, yielding around 6–7%, independent of market fluctuations.

Q: Can all policies be assigned through ThePolicyExchange?

Yes, The Policy Exchange ’s standardizes policy assignments, applying them across insurers to maximize investor benefits.

Q: Are gains on assigned policies taxed?

Tax treatment depends on issuance date: pre-February 2021 policies are typically tax-exempt, while later issues may incur LTCG tax.

Q: Does an assigned policy provide life coverage?

This investment focuses solely on capital growth. Life coverage remains with the original policyholder.

Q: How do investors liquidate their policies?

Upon maturity or the end of the lock-in period, investors may contact The Policy Exchange or the insurance company directly for fund transfer.

Q: Will IRR change if markets fluctuate during policy assignment?

Minor IRR variations may occur, but fixed-income options stabilize returns, minimizing market impact.

Q: Could returns exceed the guaranteed rate?

Yes, if secure fund performance is strong, returns could exceed initial projections.

Q: Are there any deductions at liquidation?

No deductions apply at liquidation; investors receive the full fund value, underscoring ThePolicyExchange’s commitment to transparency.

Q. What is an Assignment?

Assignment is a process through which the owner of a policy can transfer its rights and benefits to another individual.

Q. Who can invest in a pre-owned policy?

Any individual can invest in a pre-owned policy.

Q. What is Premium Financing?

Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.

Q. What happens if one is not able to repay the loan amount?

If the loan amount is not repaid the lender can surrender the policy and recover the amount.

Q. What is the tax treatment of insurance proceeds?

The process from an insurance policy is tax-free provided the underlying policy is compliant with Section 10(10D) of the Income Tax act 1969.

Q. How much loan one can get against a policy?

This can vary depending upon the type of policy, generally, the loan amount is in the range of 50-90% of surrender value.

Q. Post assignment of policy does the life insured change?

No. The assignment is a process where the rights & benefits of the policy are completely transferred to the assignee. The life insured remains the same.

Q. Are the returns guaranteed?

The returns are assured in different ways e.g. for non-par policies, these are guaranteed while for participating policies these are linked with PAR fund performance. ULIP policy returns are linked with market performance and are usually much higher.

Q. What if I am not able to pay future premiums?

The policy will lapse, you can request for complete surrender as well however the return will be significantly lower.

Q. What will be the tax treatment if the investor is a company?

All institutional investors need to pay capital gains tax on the returns on these policies. However, the premium paid is a tax-deductible expense and hence, the tax benefit can be availed there.

Q. Are there options where one would pay only once?

Normally, the investment in a pre-owned or for that matter, any life insurance policy is a recurring event. However, there are certain policies where the premium payment term is over. Our investment advisors can guide you on various options for buying these instruments to maximize the returns.

Q. Can I invest in Unit Linked policies?

Yes, investment in ULIP is always an option, and generally, these policies provide better returns due to market linkage however as the underlying investment is equity there can be more volatility or drawdowns.

Q. What happens if unfortunately, the original policyholder dies?

In such an event, the nominee of the original policyholder files for a claim. The claim money, when approved by the insurance company, will first cover your original investment and the promised ROI till that date and the balance will be paid to the nominee of the deceased policyholder. Such is the construct of the contract between you and the original policyholder.

Q. What is the minimum amount of investment?

You can go through all the policies available on the portal and choose the one that suits your investment appetite. You should consider the amount of the upfront investment and the investment in the subsequent years.

Q. What is the average maturity or investment period?

It usually ranges from a minimum of 3 years and up to 12 years. The investment timeframe is an important criterion basis which you should choose a policy to invest in. Our investment advisors will guide you on the same.

Q. What is the average return?

As mentioned in the introduction of this investment class, the RoI is tax-free and ranges between 9-12%. In some rare cases, it may go up to 14-15% also.

Q. Can an investor invest in multiple policies?

Yes, it is always an option.

Q. Is there any limit to the amount that one can invest in pre-owned policies?

No, there is no specified limit by the regulator or the insurance company. However, the insurance companies may assess or underwrite your capacity to pay future premiums and assign a limit up to which the pre-owned policies can be assigned to you.

Hi,

Is investment in Policy exchange as safe as FD with banks?

is it ok to invest big amount? what could be risk?

i had invested in Aarzoo via Jiraff. lost principle amount. almost 1.5 year no proper action from Jiraff to recover amount. Hope similar issue can’t be with Policy Exachange. Please guide me, awaiting for response

Hi kamlesh,

The new ulip will be available from May , we will evaluate it in detail once they are live. i generally prefer approach of gradually scaling up to get more understanding of risk that we might have overlooked in the start !

thanks