Diversification in the world of investment is the key. Equity may have a high potential for gains, but it also attracts volatility. On the contrary, corporate bonds, FD, and Government securities offer a stable and fixed source of income with capital security. Goldenpi is a platform made to invest in these products

This blog will explore Goldenpi, the platform for investing in fixed-income securities. Let’s delve into it and understand more about it.

What are Bonds?

These are investment tools issued by a company. When a company issues a bond, it seeks a loan from the investors for a predetermined period with a fixed coupon (interest) rate paid at fixed intervals. The principal amount and earned interest are returned to the investor when the bond matures.

The credit rating agencies rate corporate bonds to assess their creditworthiness. Higher-rated bonds are rated as AAA or AA, which shows a lower risk of default, and lower-rated bonds are classified as BB or B, indicating a higher risk.

What is GoldenPi?

GoldenPi is an online platform that was introduced for investing in bonds and debentures. Earlier, investments in bonds were limited to high-net-worth individuals (HNIs) and financial institutions because of high ticket size and accessibility limitations.

GoldenPi is a fintech company that noticed this market gap and introduced an online marketplace where retail investors with small ticket sizes could invest in bonds and debentures. GoldenPi is also a SEBI-licensed debt broker.

GoldenPi Founders

Abhijit Roy

He is the CEO & Co-Founder of GoldenPi. Roy holds an engineering degree from IIT Kharagpur and an MBA from IIM Calcutta. He aims to make bonds and debentures readily available to every Indian household.

Samir Baran Pratihar

He is the CTO & Co-Founder of GoldenPi. Pratihar is a technologist responsible for developing technology and products in GoldenPi. He has a track record of working in many MNCs, including ixia Communications and Juniper Networks, in computer networking and data communication.

He holds an engineering degree from Jadavpur University.

What is the GoldenPi Business Model

Collaborating with Companies

Golden Pi approaches bond issuers who want to launch their bonds for retail investors and lists their bonds on their platform.

Marketing

It also focuses on customer acquisition through various marketing campaigns and social media engagement.

Revenue Model

The company generates revenue from commissions from the bond issuers to list their bonds on GoldenPi’s platform.

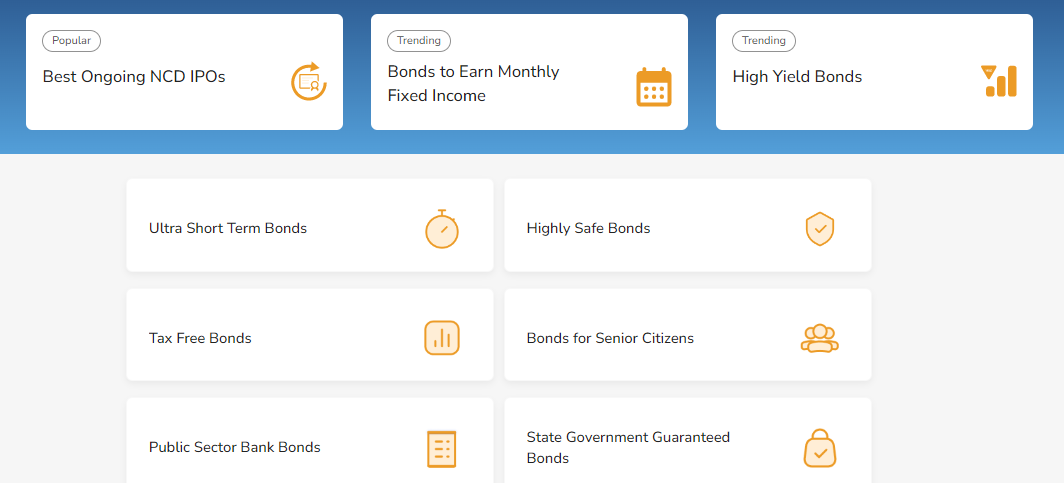

Type of Bonds on GoldenPi

Golden Pi offers a wide variety of bonds, which are listed below:

- Corporate Bonds and PSU Bonds

- Ultra Short-Term Bonds

- Highly Safe Bonds

- Tax-Free Bonds

- Bonds for Senior Citizens

- Public Sector Bank Bonds

- State Government Guaranteed Bonds

- Private Sector Bank Bonds

- Bonds to Earn Quarterly Fixed Income

- NBFC Bonds

- Public Sector Undertaking Bonds

- Bonds for Long-Term Investment

- Bonds for Short-Term Investment

- NRI Eligible Bonds

- Bonds at Discounted Price

- Fixed Deposits of top Corporates

- Sovereign Gold Bonds

- Government Securities

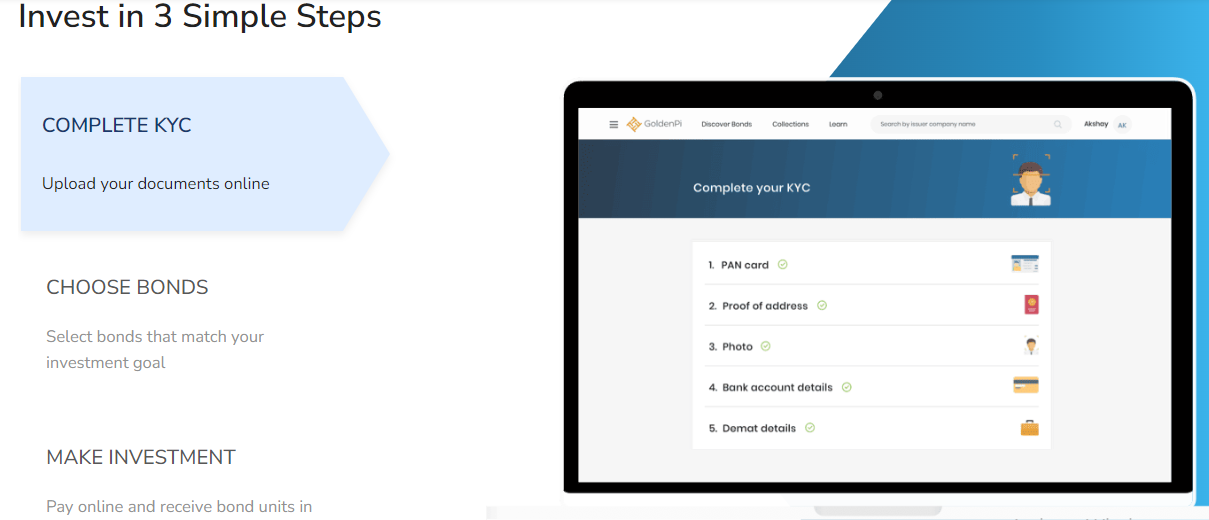

How To Invest With GoldenPi

You can easily start investing in GoldenPi by these three simple steps:

Step 1: Complete KYC

Upload all the required documents to GoldenPi’s official website.

Step 2: Choose Bonds

You can select from a variety of bond options on the investment page of the GoldenPi website and explore different varieties of bonds.

Step 3: Make Investment

Once you select bonds based on your financial goals and risk profile, you can simply invest in bonds and receive the units in your demat account.

GoldenPi Alternatives

AltiFi

AltiFi is a new-age investment platform that allows retail investors to invest in fixed-income securities. You can invest in bonds of growing companies in various sectors. The platform is backed by Northern Arc and is focused primarily on High Yield Microfinance companies.

Grip Invest

Grip Invest is an online investment platform that offers a variety of investment products such as corporate bonds, securitized debt instruments, Asset leasing, and invoices through regulated listed products.

TheFixedIncome

Fixed Income is a platform that allows you to buy various types of bonds. The platform is backed by the solid Tipsons Group which is one of the largest players in the bond market in India.

Read our report on High Yield Bonds in India

GoldenPi Funding

The company has raised multiple rounds of more than 10 Million USD in funding including the likes of Zerodha

Pros of GoldenPi

It offers investing in bonds, which have many benefits as compared to other investment avenues, such as:

-

Verified Platform

GoldePi is SEBI licenced debt broker and all the investment options available in the platform is verified and all the interest rates and issuer details are genuine.

-

Easy to Use

You can start investing in three easy steps through GoldenPi and explore the various options.

-

Bond Ratings

You can differentiate bonds based on their ratings. Credit rating agencies classify bonds based on their risks. A bond with less risk is typically rated as A or AAA, while bonds with higher risks are classified as B or BB. While investing, you can easily differentiate between these categories in GoldenPi.

- Diversified Investment Options

GoldenPi offers various investment options in the bonds and debt market that allow you to diversify your portfolio and reduce risk.

- Earn Fixed Returns

Bonds are a perfect investment option if you want to invest in fixed-income securities, as the coupon rate is predetermined. They are an ideal option for conservative investors seeking a stable return.

Cons of GoldenPi

-

Lack of Awareness

Even after the launch of various investment platforms such as GoldenPi, people are unaware of different investment options; hence, they need more knowledge about it.

-

Lack of Personalised Investment Advice

Golden Pi is an easy-to-use platform. However, it lacks personalized investment advice that investors may get from a financial advisor.

-

Limited Investment Options

Though Golden Pi has various debt instruments to invest from, apart from bonds and debentures, other options like securitized debt instruments are not available.

High Yield Bonds available in GoldenPi

Here are some of the high-yield bonds in GoldenPi with an interest rate of upto 15% p.a.

Conclusion

GoldenPi can be a good platform for investors looking to invest in fixed-income investment options or who are looking to diversify their portfolios and try their hands on bonds. However, considering the risks of corporate bonds will help you make better financial decisions. Happy investing!

Personal Experience of Investing through GoldenPi

I tried GoldenPi to try it and explore some fixed investment options. The platform is easy to use and has extensive bond offerings. The platform shows details of every bond listing, such as issuer details, credit ratings, interest rates, etc., which helped me make better investment decisions. The investment transaction was seamless, and I faced no issues using it.

I always compare bonds in other platforms like Alitfi, Grip, and Wintwealth before investing

Frequently Asked Questions

- Can I invest in mutual funds using GoldenPi?

No. You can only invest in bonds and debentures using GoldenPi.

- Can NRIs invest in bonds through GoldenPi?

Yes. GoldenPi has NRI-eligible bonds, and you can invest in them.

- Is it safe to invest through GoldenPi?

Yes. GoldenPi is a secure platform that uses encryption protocols and safeguards investors’ personal information.

- Does GoldenPi provide a guaranteed return on investment?

Return on investment depends on your selected investment, and the platform does not guarantee the underlying bonds.

If you are looking for other alternative investments check out the below list