Alternative investments have been the talk of the town for a few years now. Since the COVID-19 pandemic, traditional investment markets globally have continued to remain volatile for a plethora of reasons. As a result, investors, both new and seasoned, have been looking for alternatives to traditional stocks, mutual funds, etc. And today, the world of alternative investments offers many innovative avenues for those looking to diversify and take risks.

Today, we are going to review one such alternative investment platform, BetterInvest, which lets investors access investments in the media and entertainment industry through exclusive invoice discounting deals. The platform serves as a bridge between the post-production financial needs of production houses and investors, like you and me, looking to diversify into alternatives.

What is BetterInvest?

BetterInvest is an innovative alternative investment platform that enables retail investors to participate in invoice discounting within the media and entertainment industry. Historically, the high-yield world of film financing was the exclusive playground of High-Net-Worth Individuals (HNIs) and production moguls due to the massive ticket sizes required. BetterInvest breaks this barrier, allowing individual investors to fund the “post-production” and “distribution” phases of movies and music. At the same time, the platform is addressing financing challenges faced by production houses, which are often required to cover huge post-production expenses without having much interest from hesitant banks and NBFCs.

Thus, on one hand, BetterInvest is giving Production Houses, TV Producers, YouTube and Social Media creators an opportunity to avail themselves of funding, while on the other, it is giving investors an opportunity to invest in invoice discounting for production houses earning returns as high as 18% p.a. over short investment horizons.

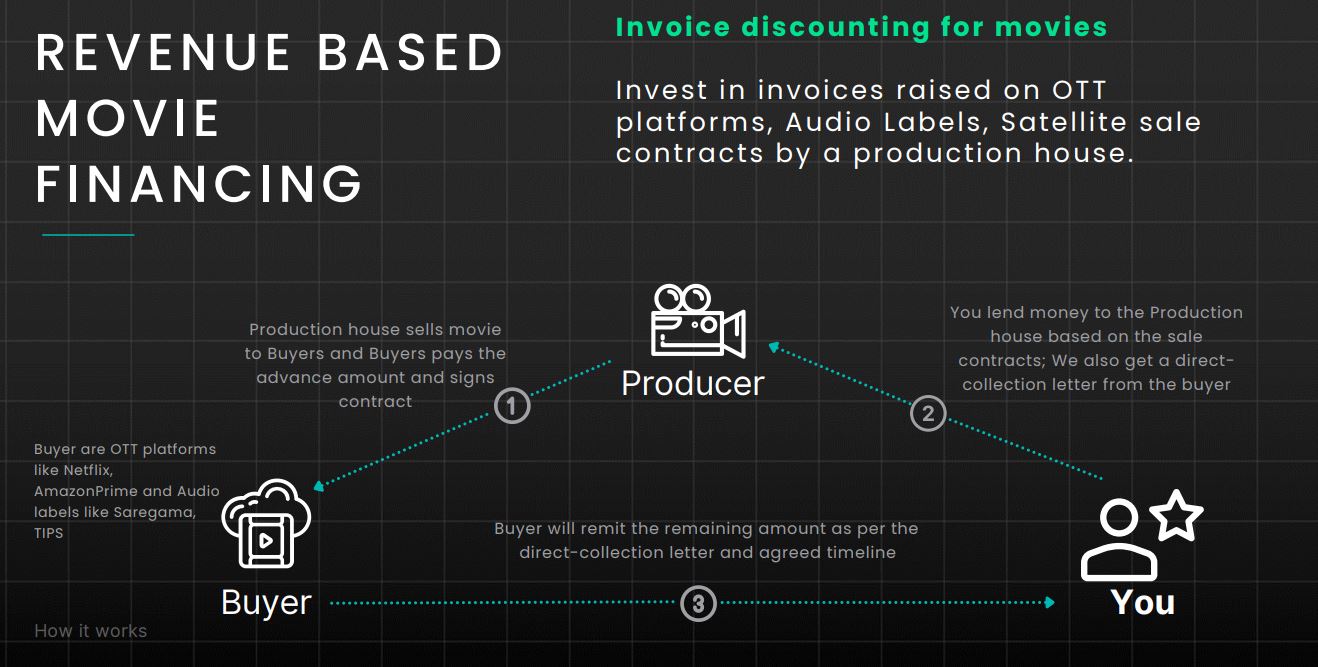

When a film is completed, it enters the post-production phase (editing, sound, VFX). During this stage or upon completion, production houses sell rights to “Buyers”, typically major OTT platforms (Netflix, Amazon Prime, Zee5) or Audio Labels (Saregama, T-Series, TIPS).

While a contract is signed, the actual payment from the OTT/Label often arrives 3 to 12 months later. BetterInvest allows investors to “discount” these invoices, providing the production house with immediate liquidity while investors earn a fixed return when the OTT rights holder pays the final bill.

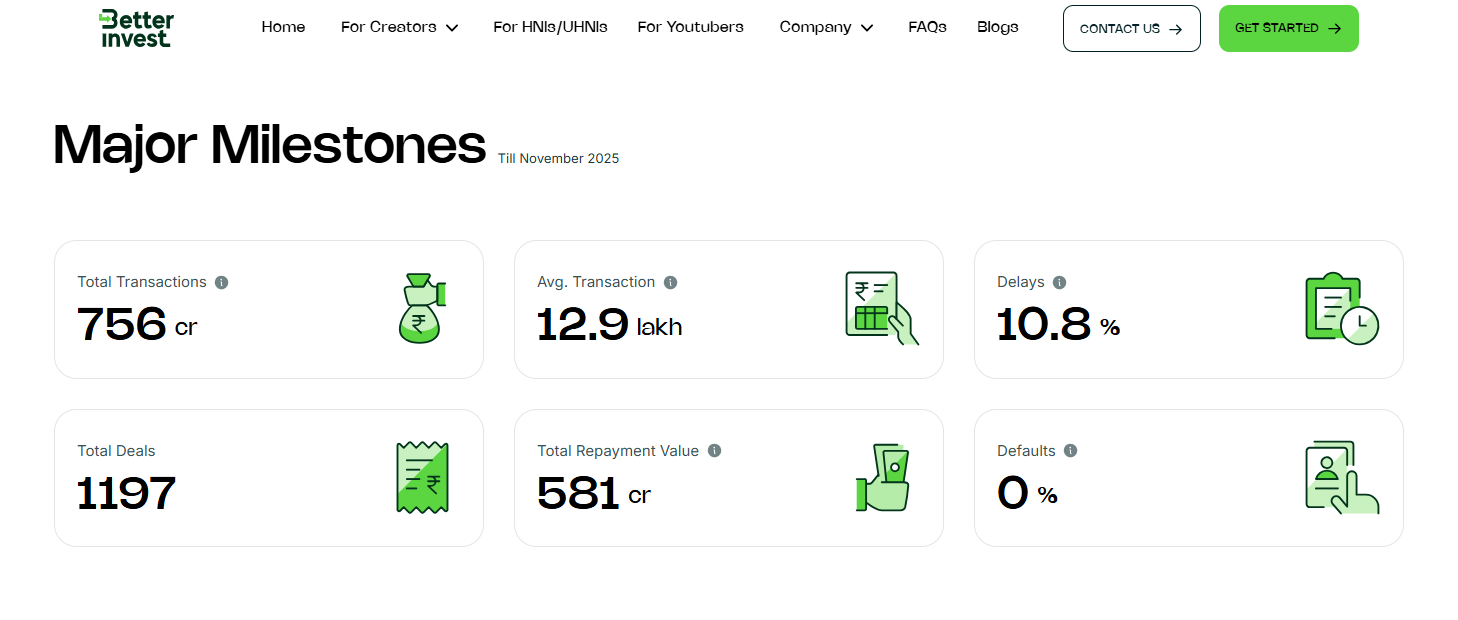

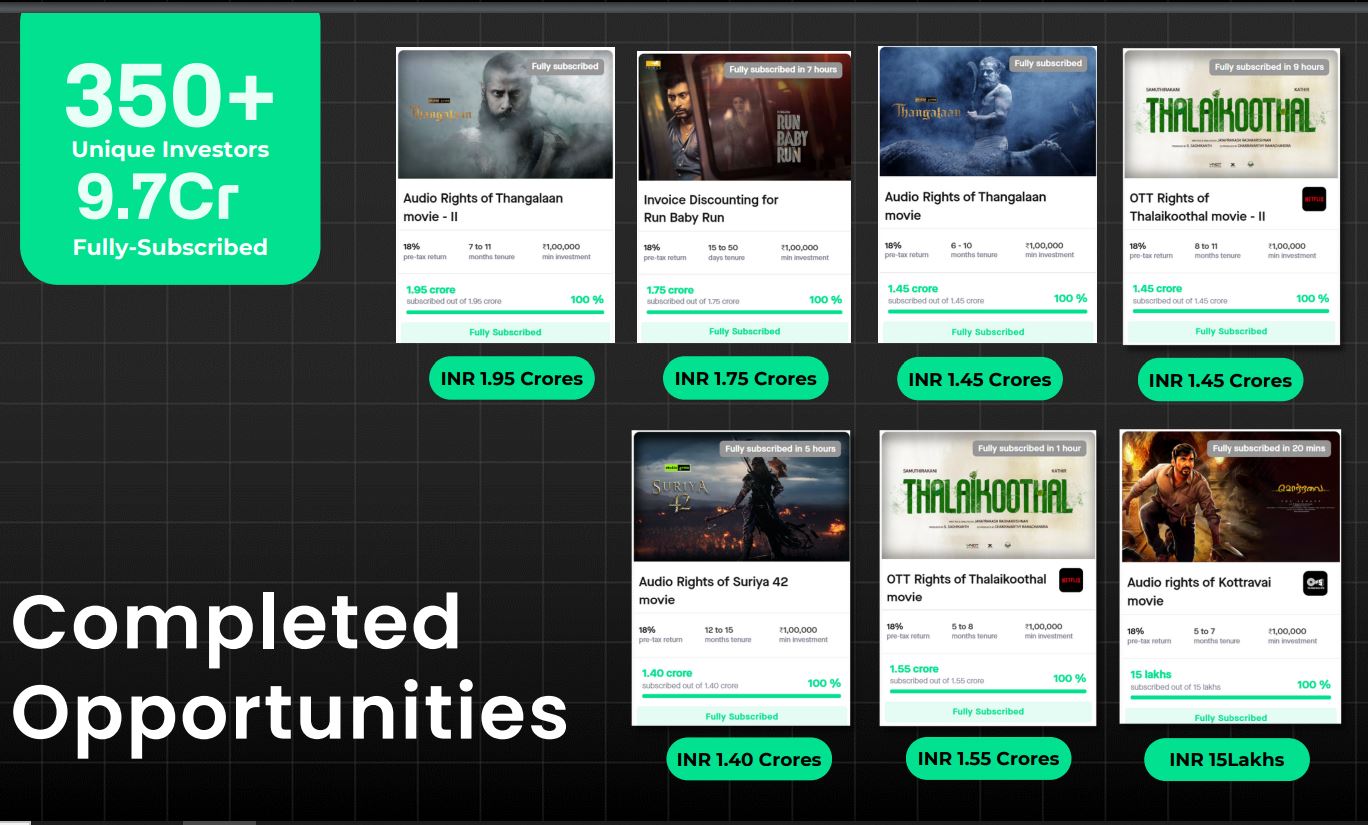

Over the years, BetterInvest has served over 5862 customers, with over INR 756 Crores in funding to more than 114 content producers.

Team Behind Betterinvest

BetterInvest was founded in 2021 by Pradeep Somu, Sedhumanikandan, and Sriram Anax in Chennai. BetterInvest Finadvisors Private Limited was registered in July 2020 as FABO Properties Private Limited, and the name was changed later with the launch of BetterInvest.

Co-founder and CEO Pradeep Somu is an alumnus of the prestigious Indian School of Business and is a qualified Chartered Accountant. Besides his strong educational background in finance, Pradeep has extensive experience in the entertainment space as well, having co-founded and run HeroTalkies, a Tamil OTT platform for the global audience in 2013, even prior to the launch of major OTT players such as Netflix, Hotstar, etc. Sethu Rajendran was a core team member at HeroTalkies and thereafter worked along with Pradeep on multiple ventures, including a short stint as political consultants. The team behind BetterInvest has combined their knowledge of finance and experience of the entertainment industry to bring together the platform offering revenue-based financing to content producers and discounting outright sale invoices to prospective investors. Back in 2022, BetterInvest had raised a pre-seed round of USD 350K from a group of Chennai-based angel investors.

What is Betterinvest Business Model?

BetterInvest follows revenue-based financing, also known as royalty-based financing, in the entertainment industry. It is a method of raising capital to meet business requirements from investors, who receive a share of the company’s gross revenue in exchange for the amount invested. Unlike most revenue-based financing opportunities, where returns can vary, here the model is similar to invoice discounting with fixed cash flow.

The COVID-19 pandemic has triggered a major shift in the entertainment industry. While back in the day, box office collection was the primary source of revenue, now, production houses have different streams of income, including from the sale of OTT rights and audio rights, among others. Production houses sell their OTT rights to buyers or OTT platforms, like Netflix, Amazon Prime, etc. This is primarily done through outright sale agreements, as against pay per view contracts, wherein the OTT platform is required to pay a predetermined amount to the production house to acquire the content, regardless of how it performs in box office collections. BetterInvest only lists investment opportunities arising from the discounting of such outright sale agreements. Thus, the future cash flow or revenue remains unaffected by the performance of the movie or show.

The buyer or OTT platform does its own due diligence before entering into a sale agreement, and usually pays some percentage of the total invoice in advance, while the remaining is paid within 30-90 days or so after the movie’s release. Now this is where BetterInvest comes in. Once the production house has an outright sale agreement, it comes to BetterInvest, which then does its own due diligence, and if everything is satisfactory, buys the invoice at a discounted price and offers the same for investors to invest in. Once the OTT platform pays the entire invoice amount, the investors receive the principal amount plus accrued interest, usually within a short-term horizon of 3 to 18 months.

Features of BetterInvest

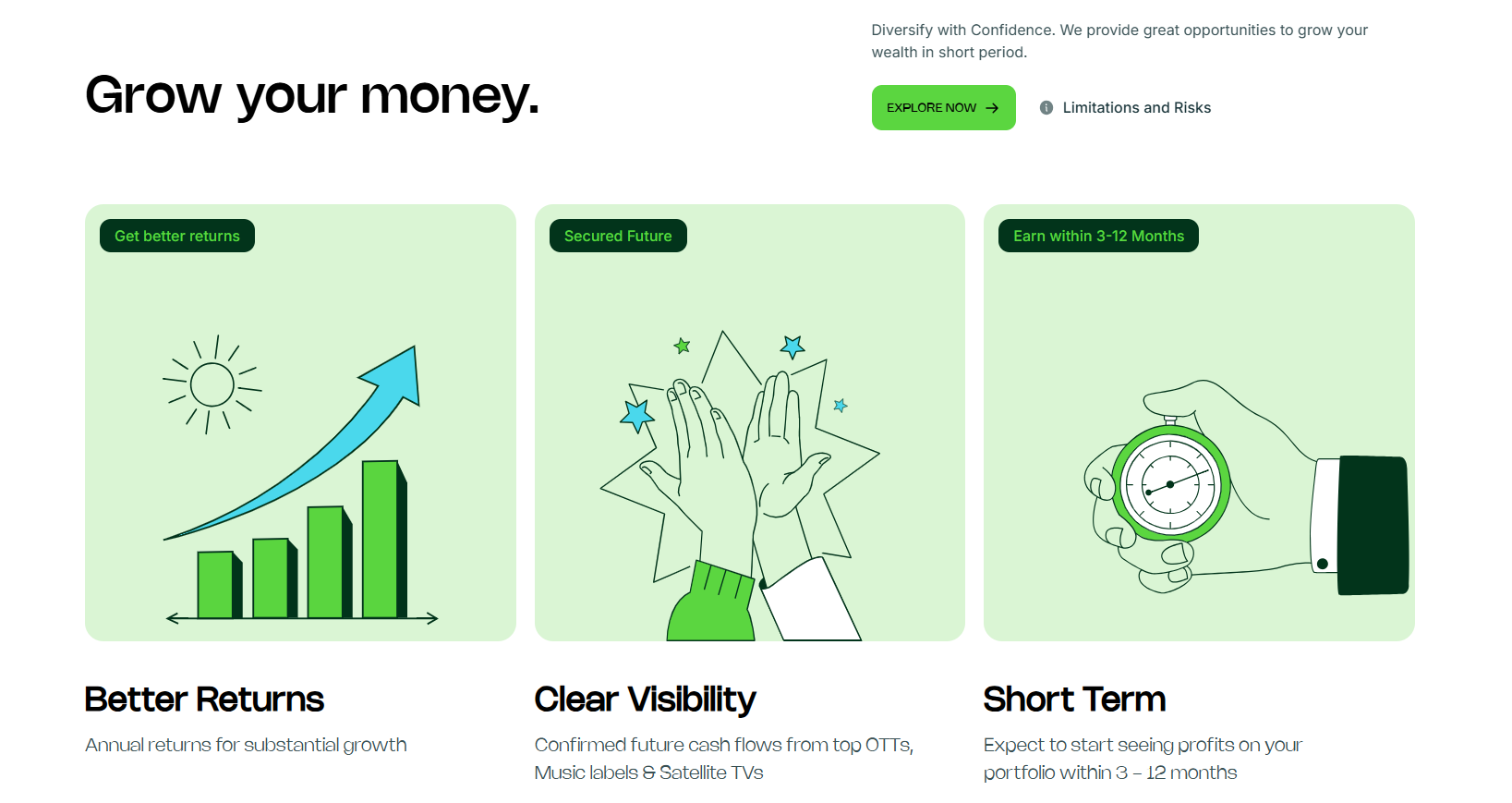

- You can achieve a high return on investment of up to 18% per annum.

- The investment is secured, and offers confirmed future cashflows from top OTTs and Music labels.

- You can receive returns in a short period of 3-18 months.

- The minimum investment amount required is INR 50,000.

How does Betterinvest Manage Risk?

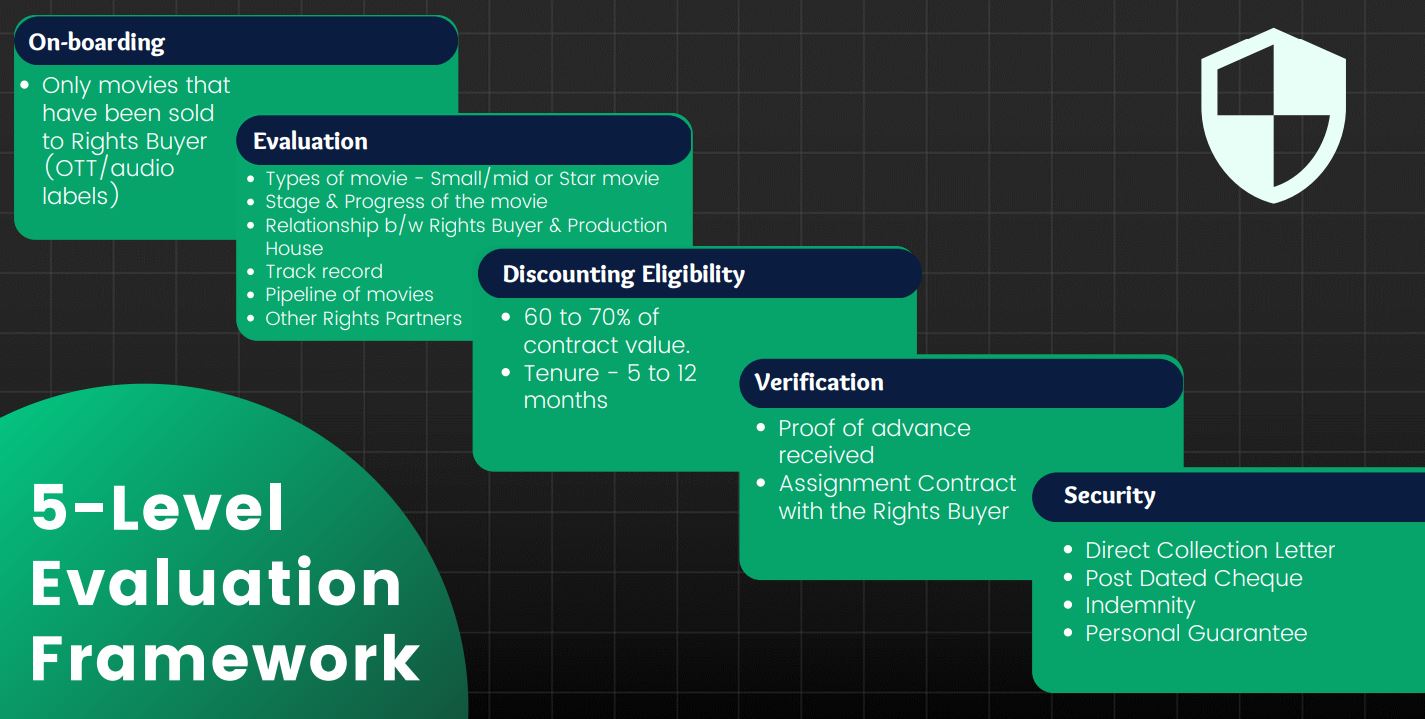

Betterinvest follows a 5 prong approach to evaluate deals

- Onboarding -They choose only movies that have been sold to Rights Buyers (OTT/audio labels)

- Evaluation – It is done on the below parameters

- Types of movies – Small/mid or Star movie

- Stage & Progress of the Movie

- Relationship b/w Rights Buyer & Production House

- Track record

- Pipeline of movies

- Other Rights Partner

- Discounting Eligibility: 60 to 70% of the contract value is discounted. Tenure – 5 to 12 months

- Verification – Proof of advance received, Assignment Contract with the Rights Buyer

- Security – Direct Collection Letter, Post Dated Cheque, Indemnity, and Personal Guarantee

To minimise the risk of default, BetterInvest takes the following precautions:

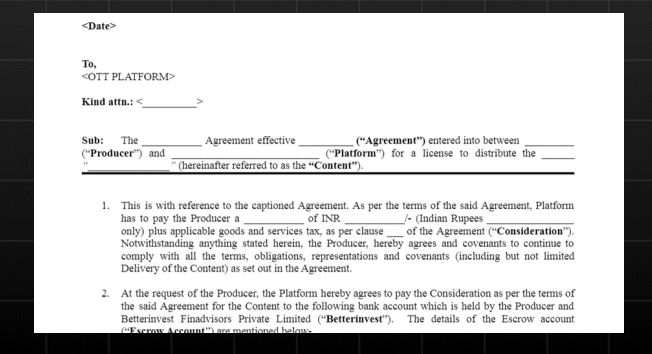

- Direct Agreements with Production House: BetterInvest acquires a Direct Collection Letter from the production house that the OTT buyer would directly pay the proceeds into the escrow account, which will be controlled by BetterInvest at all times. This ensures that the invoice amount is directly transferred to the investors through an escrow account.

- The platform collects Post-Dated Cheques and Indemnity Bonds from the production house to ensure compliance with financial obligations and to mitigate the risk of defaults.

- Due diligence: BetterInvest only offers deals that have an outright sales agreement between the production house and the rights buyer, to ensure that returns are not affected by performance. Besides, the platform conducts its own due diligence to reduce the risk of failure.

The platform mitigates the risk of default through a ‘lien on future cash flow’ from the production houses. In case of a default by an OTT platform, BetterInvest will take appropriate measures to recover the outstanding amount from the production house, as outlined in the Bill Discounting Agreement. Investors will receive accrued interest for any delays during the recovery process.

BetterInvest collects the following security documents from production houses:

- Post-Dated Cheques (PDCs)

- Indemnity Bonds

- Direct Collection Letters

- Personal guarantee

The platform boasts a track record of 0% default rate so far, however, there have been delays in repayments. 10.8% of the total number of deals on the platform have suffered from delayed repayments. BetterInvest’s website publishes a transparency report, where you can find details of all delayed projects, including the number of days of delay.

Products offered by Better Invest

Invest in Movie Rights

With BetterInvest, you can invest in secured movie rights and get an opportunity of earning high returns. First, you have to click on the ‘Explore Now’ button from the home page. Then, you will be redirected to the page with investment opportunities available in movie revenue-based financing.

You can click on ‘Get early access to invest in a particular movie, use the code TXRHTH and you can see all the details, such as minimum investment required, rate of returns, tenure of the investment, taxes, and deal size.

Invest in Audio Rights

Like movie rights, you can see the opportunities available to invest in audio rights on the ‘Explore Now’ page and all the details related to the opportunity.

How to Invest with Better Invest

Use TXRHTH while registering to get early Access to New Deals

You can start investing by following three simple steps after you register using the above link

Step 1: Go to your profile, enter your details, and complete the KYC process. A valid PAN Card and address proof (Aadhar) are required. In addition, your bank account details are needed after you invest in making the payout.

Step 2: Join the waitlist to invest in a particular opportunity. Only waitlisted users can invest.

Step 3: You can start investing when the opportunity is open.

While investing in a particular deal listed on BetterInvest, you will have to sign a discounting agreement, which is executed on stamp paper between BetterInvest, the production house, and the investor (that is, you). This agreement includes every detail, such as information about the invoice holder, underlying film or project, and assigned works, date of agreements, what rights have been assigned, invoice value, maturity date, etc.

BetterInvest Alternatives

Currently, Betterinvest is the only platform that offers revenue-based opportunities in the movie industry. However, there are a few platforms in India that offer different types of alternative investment options. Some of the alternatives you can consider with similar yields are as follows:

-

Grip Invest

Grip Invest is a platform that lists equipment leasing, inventory-based financing, and commercial real estate investing deals on it. It has a constant flow of new deals and has been one of the pioneers in this space in India. The minimum amount to invest is Rs.10000 and you can get an average IRR of 12-15%+ depending on which deals you invest in.

-

Leafround

Leafround lets you invest in assets that are then leased to Enterprises. They have multiple opportunities available to invest on the platform. The minimum investment is Rs.10000 and you can expect 20-25% IRR.

-

Jiraaf

This is a new but fast-growing alternative investment opportunity listing platform backed by Sequoia and other popular angel investors. Apart from invoice discounting, corporate debt, and other instruments, it also has equipment lease-based investment options on its platform. The minimum investment is slightly higher at Rs. 100000 per deal, but it might vary depending on the deals.

-

Altdrx

AltDRX is a platform focused on alternative investments, offering access to opportunities like fractional real estate, farmland, and other private-market assets that are usually hard for retail investors to participate in directly. The key appeal is its attempt to make alts more accessible, structured, and transparent, with curated deals, investment documentation, and periodic performance updates.

Pros of BetterInvest

- Secure: The platform is safe and secure. Your personal details are hosted on a secure cloud network, and all data transfers occur between Bia 256-bit SHA encrypted channels.

- No Extra Fees: The platform does not charge any fee from the investors. The fees are charged by the production houses, and the return on investment is credited to the investors after paying taxes.

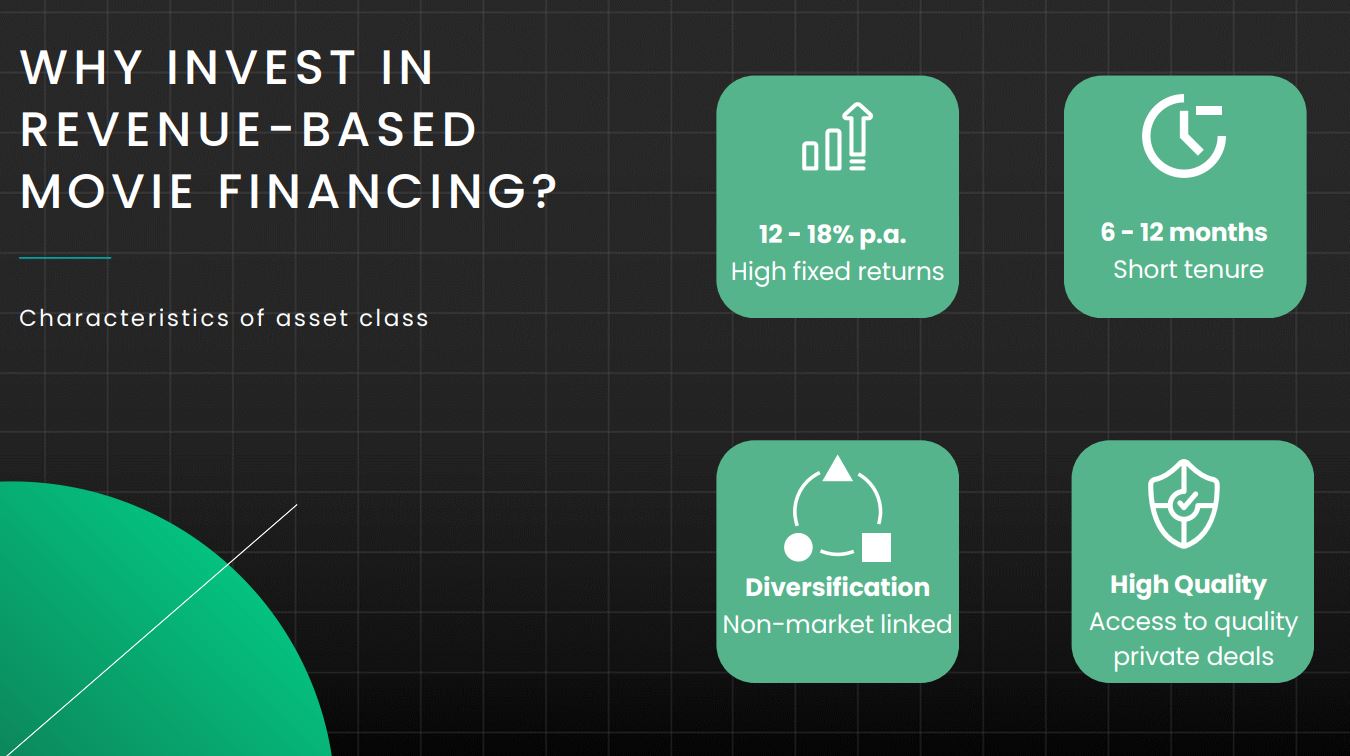

- Fixed Returns: Revenue-based movie financing offers 12-18% p.a. fixed returns. This can be a suitable option for investors seeking fixed returns on investment.

- Diversification: Revenue-based movie financing is not linked to the market and is a great way to diversify your portfolio.

- Short Tenure: You can earn a fixed return in a tenure of 6-12 months, which is higher than other fixed-return investment options.

Cons of Better Invest:

- Refund Policy: The amount invested cannot be refunded because once you invest, the amount is already financed to the production house.

- Returns: The returns on revenue-based financing are not guaranteed; the returns depend on the OTT content’s revenue. Though they are based on outright sale agreements, there can be delays and even defaults.

- New Concept: Revenue-based movie financing is a recent phenomenon, and there is less awareness and data available. Investors are still making educated guesses about the investment.

- Lack of Regulation: Investing in invoice discounting deals in the entertainment industry is an unregulated investment space.

Personal Experience of Investing on Betterinvest

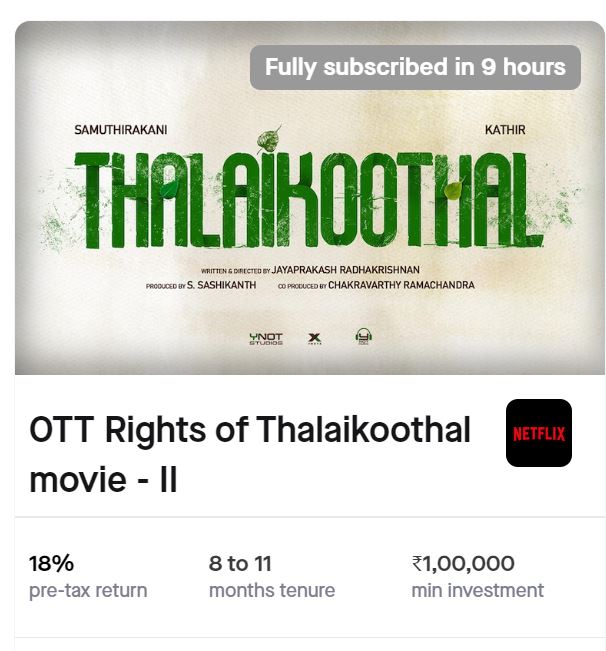

I have invested in 10 deals on Betterinvest. The investing experience was smooth. Details of some deals I invested in are below

- Hindi & Audio Rights of Nenu Student Sir! movie

- OTT right of Thalaikoothal movie – II

Conclusion

Use TXRHTH while registering to get early Access to New Deals

Revenue-based financing in movies offers an excellent opportunity to earn good returns quickly. However, an investor must know the risks associated with the investments. If you want to diversify your portfolio and invest in non-market-linked investments, BetterInvest can be a good option. Happy Investing. I have invested in a few deals and will update my portfolio performance in the upcoming review

Frequently Asked Questions

- Is BetterInvest Risky?

Revenue-based financing in movies is a great way to diversify your portfolio, as it offers opportunities to invest in instruments that are not market linked. However, there may be several kinds of risk while investing in revenue-based finance in movies, such as payment default of production house, delay in movie release, etc. BetterInvest mitigates this risk by signing a deal with the production hose to transfer the revenue directly from the OTT to the investors. Additionally, if there is a delay in the movie release, BetterInvest will charge interest for the delayed period from the movie houses and share it amongst the investors.

- How much return do you get from BetterInvest?

You can get up to 18% pre-tax returns on OTT and Music rights; the tenure depends on product to product which can be from 3 months to 18 months, and a TDS of 10% is applicable on the gains. For example, if you have invested Rs. 1,00,000 in movie rights and pre-tax returns are expected to be 18%, the amount you shall get:

Rs. 1,18,000 (with 18% returns) – 10% TDS (TDS is applicable on the returns and not the principal amount)

Rs.1,18,000- 1,800 = 1,16,200

- What is the minimum investment required for revenue-based financing in Movies?

You can invest as low as Rs. 50,000 with BetterInvest.

- What is revenue-based financing in movies?

It is lending money to movie production houses to fulfill their capital requirements based on their future cash flow.

- What will happen if the movie fails at the box office?

BetterInvest only curates movies that have an Outright Sale agreement with the buyers. Buyer (OTTs/Audio labels) pay the amount as per the signed

contract irrespective of the performance of the movie

- What if there is a delay in movie releases or collections?

A delay in the release of the movie will extend the tenure for repayment. In such instances, the platform will collect interest for a delayed period

- What happens if the Producer does not repay the Money?

BetterInvest receives a “Direct Collection Letter” from the Rights buyer (Netflix, TIPS, etc) agreeing to pay the remaining amount directly to investors through an Escrow. So we are not dependent upon the production house for collection

- Is a Direct Collection Letter a valid contract in case of default/dispute?

The Direct Collection Letter is considered one of the valid security documents under law. The letter will be signed by 3 parties – BetterInvest,

Production House & Rights Buyer – OTT/others in the letterhead of the Production House.

- Is there any risk of default from OTTs?

BetterInvest curates movies that are sold to leading OTTs with zero default history. OTT pays 10-40% of the invoice value to the

Production houses as advance, enhancing their commitment

- What are the perks I get apart from returns as an investor?

Apart from returns, investors also get perks such as movie merchandise, access to exclusive events, movie tickets, and vouchers.

- What is the investment tenure?

The investment tenure for revenue-based financing opportunities ranges from 1 to 18 months. The tenure varies from asset to asset, and the details can be checked from the asset details page.

- What happens if an opportunity fails to be fully subscribed?

If an investment opportunity fails to be fully subscribed, the investor’s amount is reimbursed to the investor’s bank account within ten working days without any charges.

- What will happen if there is a delay in the movie release?

The rights buyer releases the payment only after the release of the movie. In such a case, BetterInvest will charge interest for the delayed period from the movie houses and will share it amongst the investors.

Hi

Are all the returns shown on their website correct?

In one case they have shown the return as 18% but 6209 on rs 100000 in six months is just 12.4%.

Dasara OTT rights. Already fully subscribed.

Mukul

Hi Mukul,

It says 18% based on the below cashflow:

Tentative date

Expected returns

Sep 15, 2023

₹31,562

Oct 15, 2023

₹34,435

Nov 15, 2023

₹34,627

Dec 15, 2023

₹9,872

Total (pre-tax)

₹1,10,496

if you use XIRR formula with date, IRR will be close to 17%

The review says, there is zero default payment history from OTT platforms. Though this is a good track record, this does not guarantee about future payments. Just like the mutual funds. this is as riskier , as any other equity investments, though equity investments seem better regulated.

Production houses may collect the payments to meet their immediate capital requirements, but the OTT platforms should vest some form of collateral with the production houses, and can collect it against completion of payments to the investors. Else investors are left in a limbo in case of any defaults.

The OTT platform are paying advance around 30-40% to the production house, and the remaining after completion. This gap is where betterinvest is capitalizing

Did you get promised returns on your investments?

Hi Eva,

Yes I am getting return on time. There have been instances where payment have been delayed by few days for some people.

I like to think about Better Invest