After a terrible June, the broad market recovered quite well this month. In July, the S&P 500 rose 8.1%, the Nikkei 225 advanced 6.1%, the Straits Time Index jumped 5%, and the Dow Jones Industrial Average and CAC 40 gained 5% each.

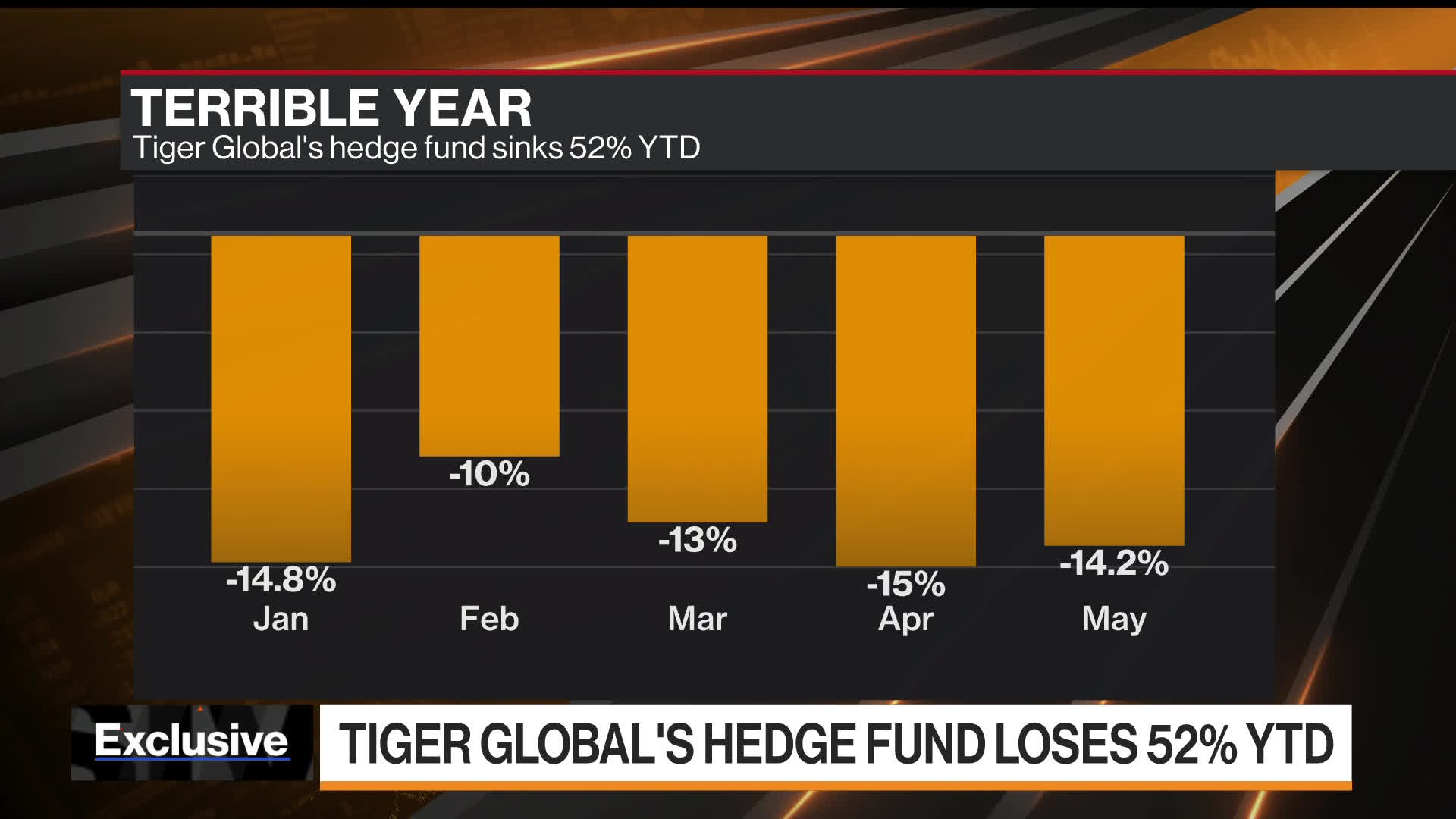

People assume that Venture capital funds are the sure-shot way to make money as it is run by smart fund managers but market behavior can be very hard to decipher. Tiger Global Management’s hedge fund made just 0.4% in July, bringing its loss this year to 49.8%, according to people familiar with the returns. The fund trailed the broader markets, with the S&P 500 advancing 9.1% and the tech-heavy Nasdaq Composite Index climbing 12%.

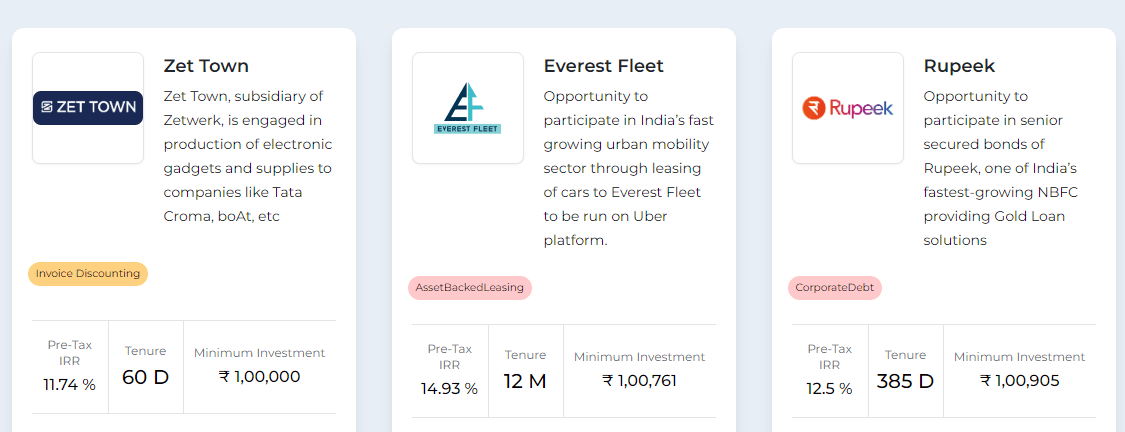

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 11-12%(Post-Tax) | 0% |

| Klubworks | 16-20%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 13-15%(Post Tax) | 0% |

| Growpital | 12%(Tax-Free) | New (6 Payments) |

| Leafround | 17-18% | New (3 Payments) |

- Received payment from Growpital

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

- Based on my discussion with other investors, Klub had listed around 70+ deals, of which 2 have been in delay.

- Invested in 1 Year Everest NCD on Jiraaf

- Investing in a New deal on Sustvest (covered below)

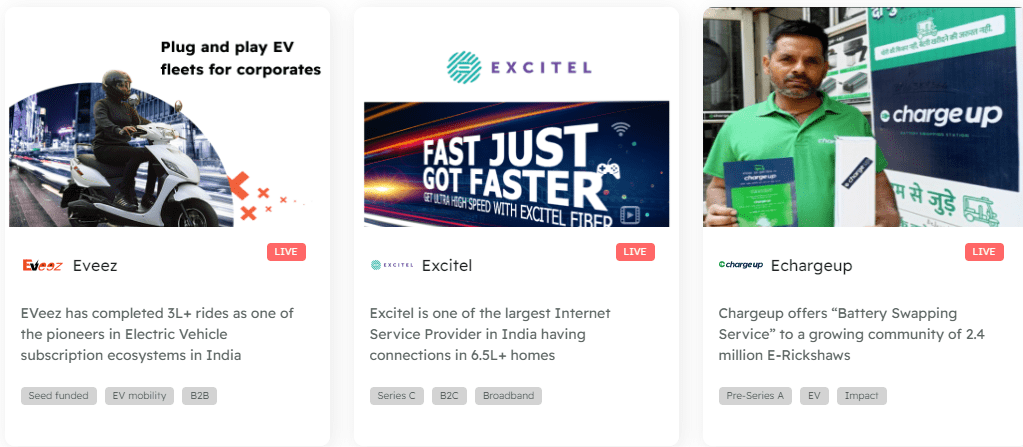

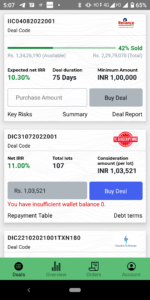

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 13% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Invested in Reliance Retail on Tradecred

- I have invested in Instakart on KredX.

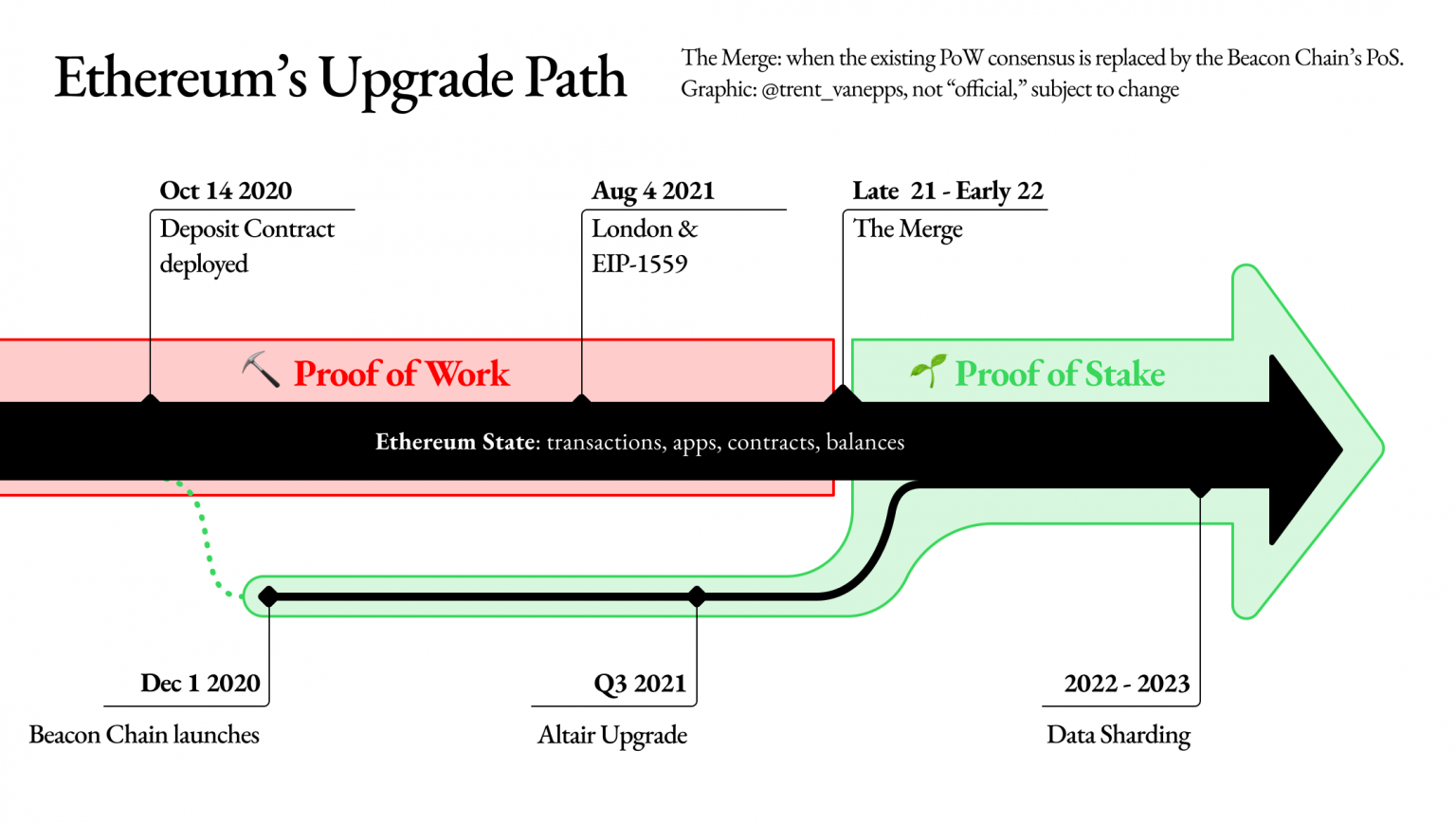

Crypto Investing

This month some large caps performed extremely well with Ethereum and Solana giving 50% plus returns. Some of the reasons which drove this are

- Ethereum Had its biggest conference – ETHCC. Vitalik mentioned Ethereum would be able to process 100k transactions per second by the end of its roadmap. They finally scheduled the Goerli testnet. This is the final step before The Merge

- Polygon has made some deals with large companies: Mercedes, Reddit, Disney, and Nothing ( company)

- Have added some capital to Iconomi for the long term which did well this month.

- Removed Exposure from Wazirx due to recent negative media coverage on the Binance deal

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -20% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 4% |

| Bitcoin Trading(Binance/CoinDCX/FTX) | 8% |

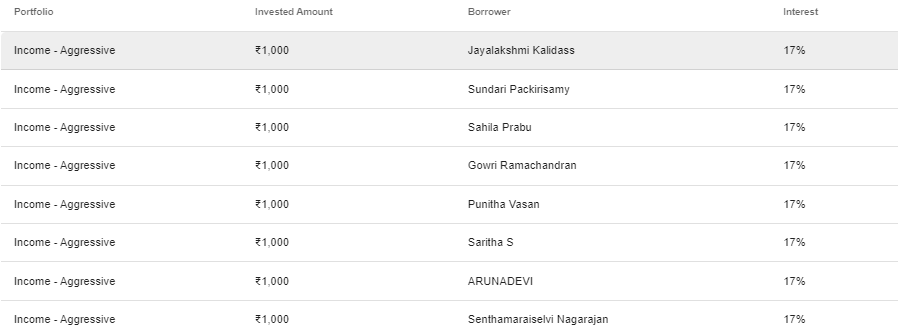

P2P Investment

Current allocation:

- India P2P – 30%

- 12Club – 5%

- I2IFunding- 35%

- Finzy-30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.85% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been positive till now. Will increase investment in a couple of months if there is consistency

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1.5% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- We will be soon covering how to seamlessly invest in European platforms using MCA

- Still exploring some interesting opportunities in Europe

Equity Market

The Indian market was on steroids last month. I was planning to invest in a staggered manner. Unfortunately, I could only invest 25% of the amount intended to add.

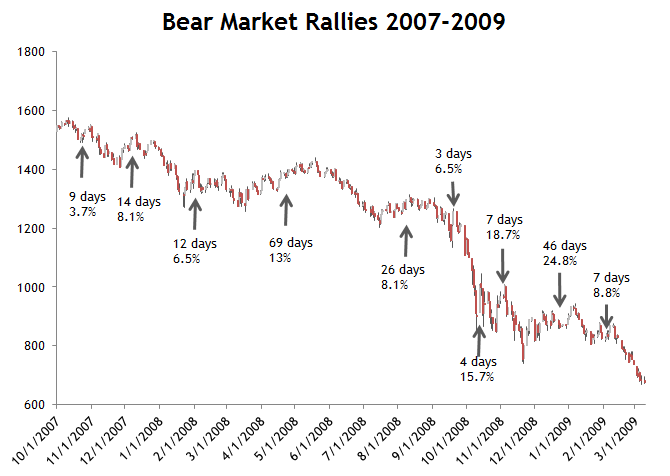

As bear market rallies go, this one isn’t breaking any records. Stocks have often soared in the midst of a bear market, only to sometimes give up those gains and fall further — something Wall Street has dubbed the bear market rally. I could be entirely wrong and the market could be higher but I don’t feel comfortable adding a lot to the equity market considering there are obvious problems globally and in India. Inflation, Sovereign crisis, and Energy Crisis to name a few.

Other Alternative Assets and Platform Updates

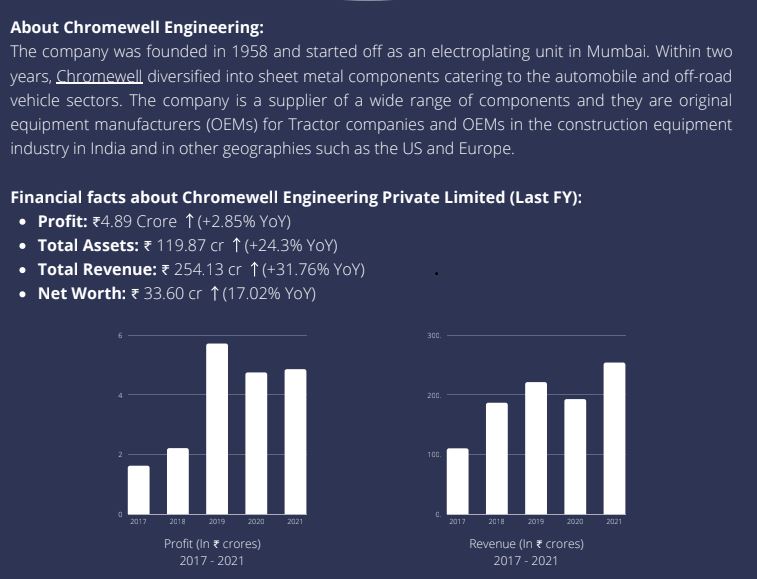

Sustvest Investment – There is an upcoming deal on Sustvest this week. The investment would be for Rooftop solar project Chromewell Engineering. The financials of the company are decent and the investment will yield 11.2% Tax Free with lockin of 8 months.

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 6.00 |

How is experience on Jiraaf and invoicetrades for invoice discounting deals?

experience on Jiraaf has been pretty good till now .Have invested in 8-10 invoices. Have not tried invoice trades yet. I think invoice trades is being run by ex falconsgrup team

Hi, Anyone having feedback about Falconsgrup NPA,s/defaults, please update

Hi,

I had previously invested in Falconsgrup,I dint face default but I am not very comfortable considering they do not disclose any information on the vendor