Investing in the direct stock market can be a daunting task, especially for beginners. With thousands of stocks to choose from, it’s crucial to have the right tools at your disposal to make informed decisions. That’s where a stock screener comes into play. In this article, we’ll explore the best stock screeners in India and understand why using them is essential for investors of all levels.

What are Stock Screeners?

Imagine you’re in a hypermarket with countless products on the shelves. You want to find the perfect snack, but you don’t have all day to check every item. This is where stock screeners come in.

Stock screeners are like magical shopping assistants for the stock market. Instead of sifting through thousands of stocks one by one, you tell the stock screener what you’re looking for. You give it a list of things you want in a stock, like low prices, high profits, or big dividends.

The stock screener quickly goes through all the stocks and picks out the ones that match your list. It’s like having a super-fast robot that finds the snacks you love in the supermarket in just seconds.

Why Use a Stock Screener?

Before diving into the list of top stock screeners in India, let’s first understand why using a stock screener is vital for investors:

Efficient Filtering

Stock screeners are like digital sieves that help sift through the vast sea of stocks. They allow you to set specific criteria, such as market capitalization, price-to-earnings ratio, dividend yield, and more. By doing so, you can quickly narrow down your options and focus on stocks that meet your investment goals.

Time-Saving

Manually researching and analyzing individual stocks can be incredibly time-consuming. Stock screeners automate this process, allowing you to evaluate numerous stocks in a matter of seconds. This time-saving feature is invaluable, especially for active traders who need to make quick decisions.

Objective Analysis

Stock screeners provide an objective and data-driven approach to stock selection. They eliminate emotional biases that can cloud your judgment, ensuring that your investment choices are based on hard facts and figures.

Risk Management

By using stock screeners, you can identify potential risks in your investment portfolio. Whether it’s a high debt-to-equity ratio or a declining trend in earnings, these tools help you spot red flags early, enabling you to make more informed investment decisions.

Now that we understand the importance of stock screeners, let’s delve into the top five best stock screeners in India. Do note that, I have tried to compile the information of all the screeners based on publicly available information and may or may not have used them personally.

-

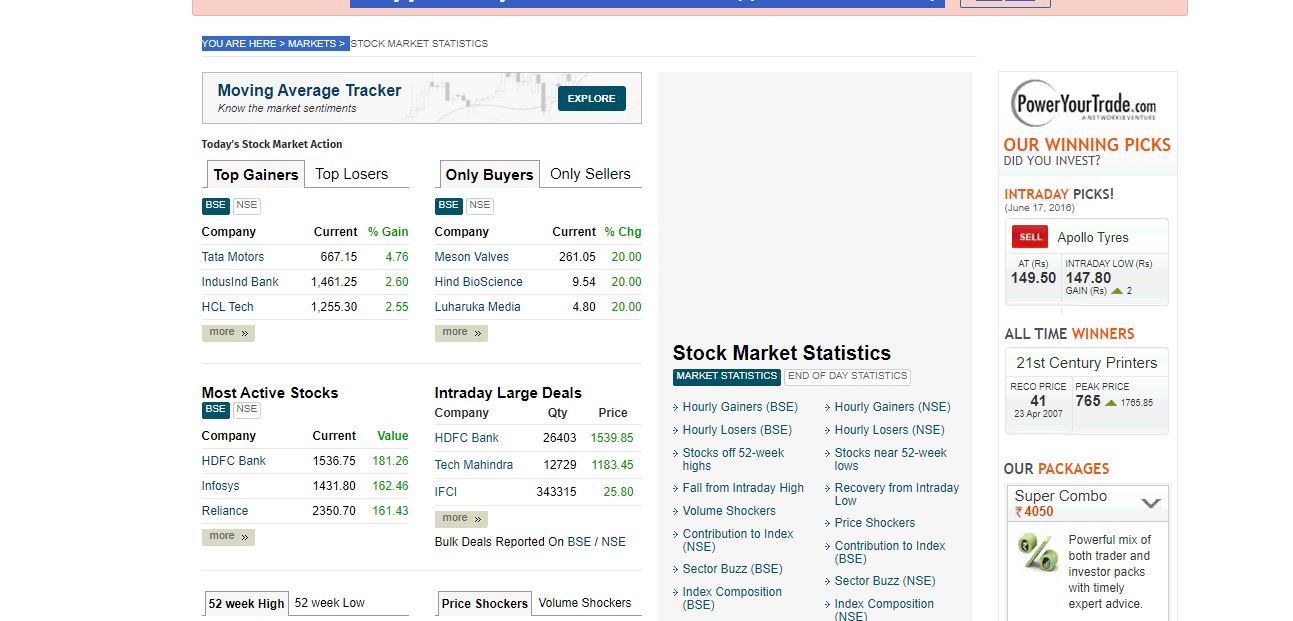

MoneyControl Stock Screener

MoneyControl is a highly trusted name in the Indian financial space, and their stock screener lives up to their reputation. Here’s what makes it stand out:

User-Friendly Interface: MoneyControl’s stock screener boasts a user-friendly interface that caters to both beginners and experienced investors. You can access a wide range of filters, including financial ratios, technical indicators, and news sentiment.

Comprehensive Data: The screener provides comprehensive financial data on Indian stocks. You can screen based on market capitalization, industry, P/E ratio, and more. It also offers historical data, allowing you to assess a stock’s performance over time.

Customizable Alerts: MoneyControl’s stock screener lets you set up alerts based on your screening criteria. This feature ensures that you stay informed about stock movements without constantly monitoring the market.

-

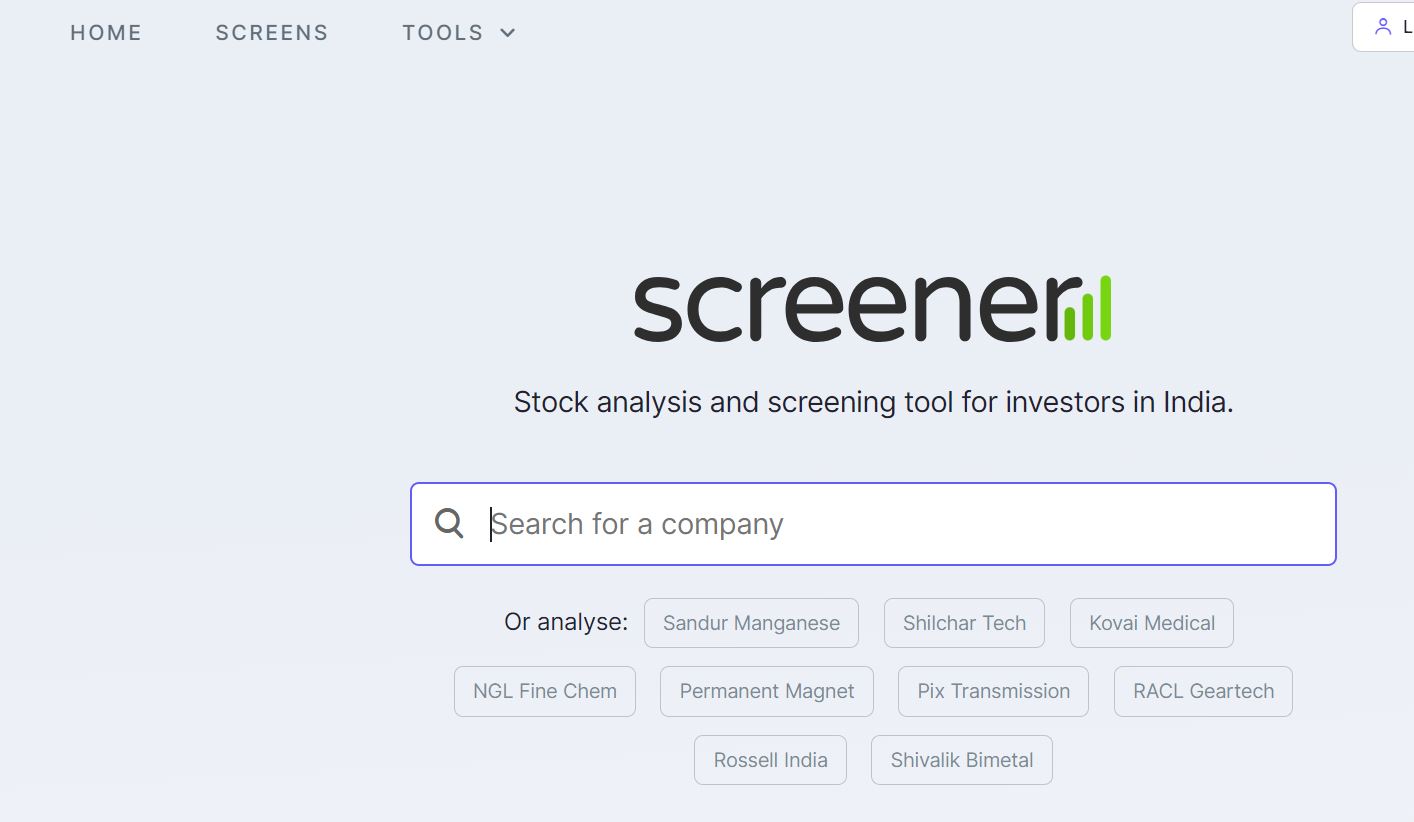

Screener.in

Screener.in is one of the most popular stock screeners in India. Here’s why it’s highly regarded:

Focus on Fundamental Analysis: If you prioritize fundamental analysis in your stock selection process, Screener.in is your go-to tool. It offers an array of fundamental metrics, including debt levels, profit margins, and return ratios.

In-Depth Company Information: For each stock, you can access detailed financial statements, including balance sheets, income statements, and cash flow statements. This level of transparency is invaluable for in-depth research.

Free to Use: Screener.in provides most of its features for free, making it accessible to investors with different budgets. They do have a premium plan which comes at Rs.4999/year offering additional requirements.

Stock Comparison: You can easily compare multiple stocks side by side, enabling you to make more informed decisions.

-

StockEdge Screener

StockEdge is a comprehensive stock market analytics and research platform that offers a powerful stock screener. Here’s what sets it apart:

Technical Analysis Tools: StockEdge is not just a fundamental screener but also a technical analysis powerhouse. It provides a wide range of technical indicators and charting tools to help traders make informed decisions.

News Integration: The platform integrates news feeds and market updates, ensuring that you have access to the latest information that could impact your investments.

Learning Resources: StockEdge offers a plethora of learning resources, including webinars, tutorials, and e-books, making it an excellent choice for those looking to enhance their trading skills.

Market Sentiment Analysis: StockEdge provides sentiment analysis tools that can help you gauge market sentiment around specific stocks or sectors.

-

Investello Screener

Investello is a relatively newer entrant in the Indian stock screener scene but has gained popularity due to its unique features:

AI-Driven Scanning: Investello employs artificial intelligence to scan and analyze stocks. It provides sentiment analysis and ranks stocks based on their potential for future growth.

Backtesting: The platform allows you to backtest your investment strategies, giving you insights into how they would have performed in the past. This feature is invaluable for refining your trading approach.

Portfolio Tracking: Investello also offers portfolio tracking, making it a one-stop solution for both screening and managing your investments.

Integrated Brokerage Accounts: You can connect your brokerage accounts to Investello for seamless tracking and execution of your trades.

-

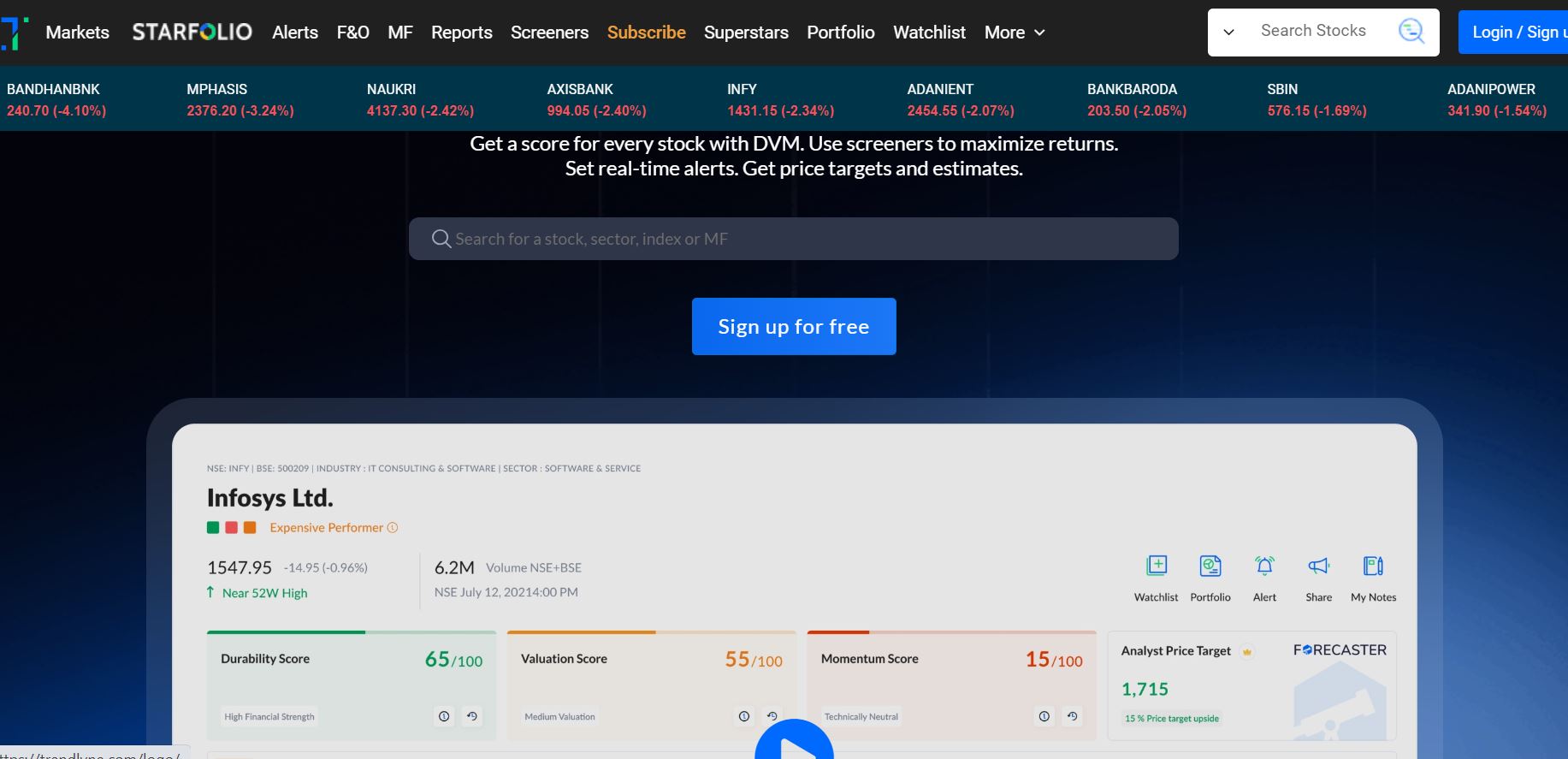

Trendlyne Screener

Trendlyne is known for its focus on data accuracy and reliability. Here’s what makes it one of the best stock screeners in India:

Data Accuracy: Trendlyne places a strong emphasis on data accuracy, ensuring that you can rely on the information provided for your investment decisions.

Advanced Filters: The screener offers advanced filters that cater to various investment strategies, whether you’re a value investor, a growth investor, or a trader looking for short-term opportunities.

Earnings Call Transcripts: Trendlyne includes earnings call transcripts, allowing you to gain insights directly from the company’s management about their future plans and performance outlook.

Dividend Tracking: If you’re a dividend-focused investor, Trendlyne provides tools to track and analyze dividend payments from your portfolio stocks.

Conclusion

In the world of stock market investing, having the right tools is crucial for success. Stock screeners serve as indispensable tools for investors, helping them filter through the vast array of stocks and make data-driven decisions. Whether you’re a beginner or a seasoned investor, using a stock screener can significantly enhance your investment strategy.

The top stock screeners in India, including MoneyControl Stock Screener, Screener.in, StockEdge, Investello, and Trendlyne, offer a range of features to cater to different investment styles and preferences. From fundamental analysis to technical indicators, these tools provide a holistic approach to stock screening.

Ultimately, the choice of a stock screener depends on your specific investment goals and the type of analysis you prefer. Consider trying out a few of these options to see which one aligns best with your needs and preferences. By incorporating a stock screener into your investment process, you can make more informed and potentially profitable decisions in the dynamic world of Indian stock markets. Whether you’re seeking value stocks, growth opportunities, or simply want to manage risk more effectively, these stock screeners are your key to success in the Indian stock market.

If you want explore investments beyond stocks check out the top Alternative Investments with up to 25% IRR