Metals have re-emerged as a serious asset class in global portfolios. What was once treated in India mainly as gold jewellery or a crisis hedge has evolved into a multi-metal investment universe spanning gold, silver, copper, platinum, palladium, and the companies that mine them.

Over the last market cycle, metals delivered equity-like returns, often when equities struggled. At the same time, structural changes — such as the unavailability of Sovereign Gold Bonds (SGBs) — have forced Indian investors to rethink how they access this asset class.

This article is a complete, end-to-end guide covering:

-

Performance of metals vs other assets

-

Indian ETFs and mutual funds (with AUM context)

-

Global metal ETFs (gold, silver, copper, platinum, palladium)

-

Mining company ETFs and how they differ from metal ETFs

-

Metal futures in India (MCX) and globally (COMEX/LME)

-

Dollar (USD) exposure benefit for Indian investors

-

ETF execution risks: price vs NAV vs iNAV

-

Practical portfolio construction frameworks

1. Why metals deserve a place in portfolios

Metals play three distinct roles that equities and bonds cannot fully replicate:

-

Monetary hedge

Gold performs well when real interest rates fall, and confidence in fiat currencies weakens. -

Cyclical growth exposure

Copper, silver, and platinum benefit from industrial demand, infrastructure spending, and energy transition. -

Crisis diversification

During financial stress, metals often outperform risk assets.

Crucially, metals are supply-constrained assets. You cannot quickly increase gold or copper supply when prices rise, which leads to sharp cyclical moves.

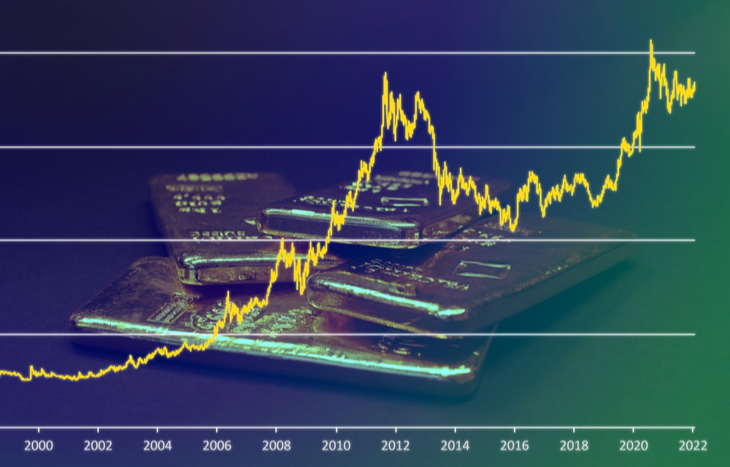

2. Performance comparison: metals vs other assets

Indicative performance snapshot (recent cycle)

| Asset / Metal | Approx. Return | Nature of Asset |

|---|---|---|

| Gold | ~60–70% | Monetary hedge |

| Silver | ~100–150% | High-beta precious + industrial |

| Platinum | ~80–120% | Auto + industrial |

| Palladium | ~60–80% | Supply-constrained |

| Copper | ~35–50% | Global growth & electrification |

| Gold mining ETFs | Often > gold | Operating leverage |

| Indian equities | Low single digits | Valuation compression |

| INR vs USD | ~3–5% depreciation | Currency tailwind |

Key insight:

Mining equities and global ETFs often outperform physical metal exposure, especially when currency effects are included.

3. Sovereign Gold Bonds (SGBs): no longer relevant

For years, SGBs were the most tax-efficient way to own gold in India. Today:

-

No fresh issuances

-

Secondary market liquidity is weak

-

Large bid–ask spreads and pricing distortions

Conclusion

SGBs are no longer relevant for fresh allocation

ETFs and mutual funds are now the primary vehicles.

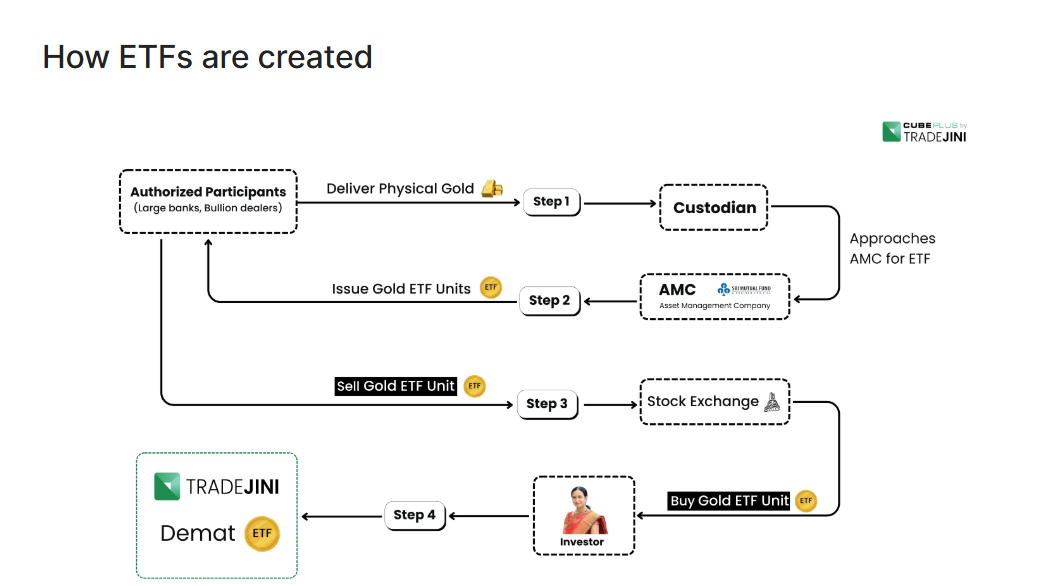

4. Metal ETFs vs Mining ETFs (critical distinction)

This distinction is frequently misunderstood.

Metal ETFs

-

Track the price of the metal

-

Usually physically backed

-

No earnings or cash flows

-

Lower volatility than miners

Mining ETFs

-

Invest in companies that mine metals

-

Returns depend on:

-

Metal prices

-

Cost structures

-

Capital discipline

-

Balance sheets

-

-

Much higher volatility

-

Can outperform sharply in bull cycles

Think of mining ETFs as leveraged metal exposure with equity risk.

5. Indian-listed metal ETFs (commodity exposure)

Gold ETFs in India (physical backing)

| ETF | Approx. AUM (₹ Cr) | TER (%)* | Liquidity |

|---|---|---|---|

| Nippon India Gold ETF (Gold BeES) | 10,000+ | ~0.79 | Very High |

| SBI Gold ETF | 6,000+ | ~0.80 | High |

| HDFC Gold ETF | 5,000+ | ~0.59 | High |

| Kotak Gold ETF | 3,000+ | ~0.55 | Moderate–High |

Long-term gold exposure, SIPs, portfolio hedge.

Silver ETFs in India (physical backing)

| ETF | Approx. AUM (₹ Cr) | TER (%)* | Liquidity |

|---|---|---|---|

| Nippon India Silver ETF | 6,000+ | ~0.79 | High |

| HDFC Silver ETF | 4,000+ | ~0.59 | High |

| Kotak Silver ETF | 2,500+ | ~0.59 | Moderate |

| Aditya Birla Silver ETF | 2,000+ | ~0.59 | Moderate |

They behave like a high-beta asset.

Volatility in metal ETFs is driven by the underlying metal price, not the fund house.

A Kotak or Nippon silver ETF will move almost identically over time.

Investors should compare TER, liquidity, and tracking error, not “risk labels”.

Metal sector ETFs in India (equity, NOT commodity)

| ETF Type | What you own | Risk |

|---|---|---|

| Nifty Metal ETFs | Steel & mining companies | Equity + business cycle |

These track company profits, not metal prices.

6. Indian mutual funds investing in metals

Indian mutual funds mainly offer metal exposure via fund-of-fund structures.

Gold mutual funds / Gold savings funds

| Fund Type | Structure | Suitable for |

|---|---|---|

| Gold ETF FoF | Invests in gold ETFs | SIP investors |

| Gold Savings Fund | Gold + debt | Slightly lower volatility |

Trade-off:

Higher expense ratios vs ETFs, but easier automation.

7. Global metal ETFs (commodity exposure)

Global markets provide far broader metal coverage. To invest in Global ETFs, investors need to set up an account with a platform that has a global brokerage tie-up. Platforms that I have used for global investing

Global gold ETFs

| ETF | Approx. AUM (USD) | Structure |

|---|---|---|

| GLD | ~140B | Physical gold |

| IAU | ~70B | Physical gold |

| GLDM | ~30B | Physical gold (low cost) |

Global silver ETFs

| ETF | Approx. AUM (USD) |

|---|---|

| SLV | ~35B |

| SIVR | ~5B |

Copper exposure

| Product | Structure | Notes |

|---|---|---|

| Sprott Physical Copper Trust | Physical trust | No futures roll risk |

Copper is a global growth and electrification trade.

Platinum ETFs

| ETF | Approx. AUM (USD) |

|---|---|

| PPLT | ~3B |

| PLTM | <1B |

Palladium ETFs

| ETF | Approx. AUM (USD) | Risk |

|---|---|---|

| PALL | ~2B | Extremely volatile |

Multi-metal basket ETF

| ETF | Metals Included |

|---|---|

| GLTR | Gold, Silver, Platinum, Palladium |

8. Global mining & metals equity ETFs (leveraged exposure)

Mining ETFs often outperform metals in bull cycles.

Gold mining ETFs

| ETF | Exposure |

|---|---|

| GDX | Large gold miners |

| GDXJ | Junior gold miners |

| RING | Global gold miners |

Silver & precious metal miners

| ETF | Focus |

|---|---|

| SLVP | Silver-heavy miners |

| GBUG | Active gold & silver miners |

Broad metals & mining

| ETF | Exposure |

|---|---|

| PICK | Global metals & mining companies |

| XME | US metals & mining stocks |

Copper & base metal miners

| ETF | Exposure |

|---|---|

| COPX / COPP | Copper mining companies |

| ICOP | Copper & base metals |

⚠️ Mining ETFs = equity risk + metal cycles

They fall harder during downturns.

9. Metal futures in India & globally (MCX, COMEX, LME)

ETFs are ideal for investors. Futures are primarily trading and hedging instruments.

Metals traded on MCX (India)

| Metal | Contract Type | Typical Use |

|---|---|---|

| Gold | Gold / Gold Mini / Gold Guinea | Trading, hedging |

| Silver | Silver / Silver Mini | High-beta trading |

| Copper | Copper futures | Industrial & macro |

| Zinc | Zinc futures | Manufacturing hedge |

| Aluminium | Aluminium futures | Industrial |

| Lead | Lead futures | Manufacturing |

Key characteristics

-

INR-denominated

-

Margin-based (leverage)

-

Daily mark-to-market settlement

-

Physically deliverable (rarely used)

Global metal futures

| Exchange | Major Contracts |

|---|---|

| COMEX | Gold, Silver, Copper |

| LME | Copper, Aluminium, Zinc, Nickel, Lead |

| NYMEX | Platinum, Palladium |

These markets drive global price discovery.

Futures vs ETFs — critical differences

| Feature | Futures | ETFs |

|---|---|---|

| Leverage | High | None |

| Risk | Very high (MTM losses) | Limited to capital |

| Time horizon | Short-term | Medium–long term |

| Roll cost | Yes | Indirect |

| Skill required | High | Moderate |

Key rule:

Futures are not buy-and-hold instruments.

10. ETF price vs NAV vs iNAV (execution discipline)

This is where many investors lose 1–3% instantly.

NAV

-

End-of-day intrinsic value

iNAV

-

Real-time fair value

-

Based on live metal prices

-

Best reference during trading hours

Market price

-

Actual traded price

-

Can deviate due to liquidity or demand–supply imbalance

Best practices

-

Always check iNAV

-

Use limit orders

-

Avoid panic buying

-

Extra caution for silver and low-AUM ETFs

11. Dollar (USD) advantage of global investing

Global ETFs add a currency layer.

Total return =

Asset return (USD) + USD-INR movement

Example:

-

Gold ETF return: 10% (USD)

-

INR depreciation: 4%

-

Total INR return ≈ 14%

This currency convexity is a structural benefit for Indian portfolios.

12. Risk framework

| Risk | Applies to |

|---|---|

| No yield | All metal ETFs |

| High volatility | Silver, miners |

| Liquidity risk | Platinum, palladium |

| Equity risk | Mining ETFs |

| Currency risk | Global ETFs |

| Margin risk | Futures |

13. Portfolio construction framework

Conservative

-

5–10% Gold ETF

-

Optional 1–2% Silver

Balanced

-

Gold + Silver

-

Small allocation to global miners

Aggressive/tactical

-

Add copper or platinum

-

Mining ETFs and futures (with strict sizing)

Final takeaway

-

SGBs are no longer relevant

-

ETFs have replaced them

-

Metal ETFs ≠ Mining ETFs ≠ Futures

-

Global ETFs add USD alpha

-

Execution (iNAV) matters more than entry timing

Metals reward discipline, correct structure, and patience — not headline chasing.

Check out alternative Investing Information on randomdimes.com